This version of the form is not currently in use and is provided for reference only. Download this version of

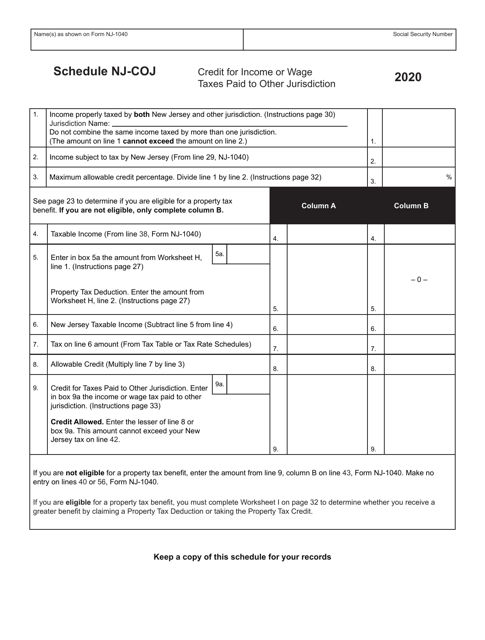

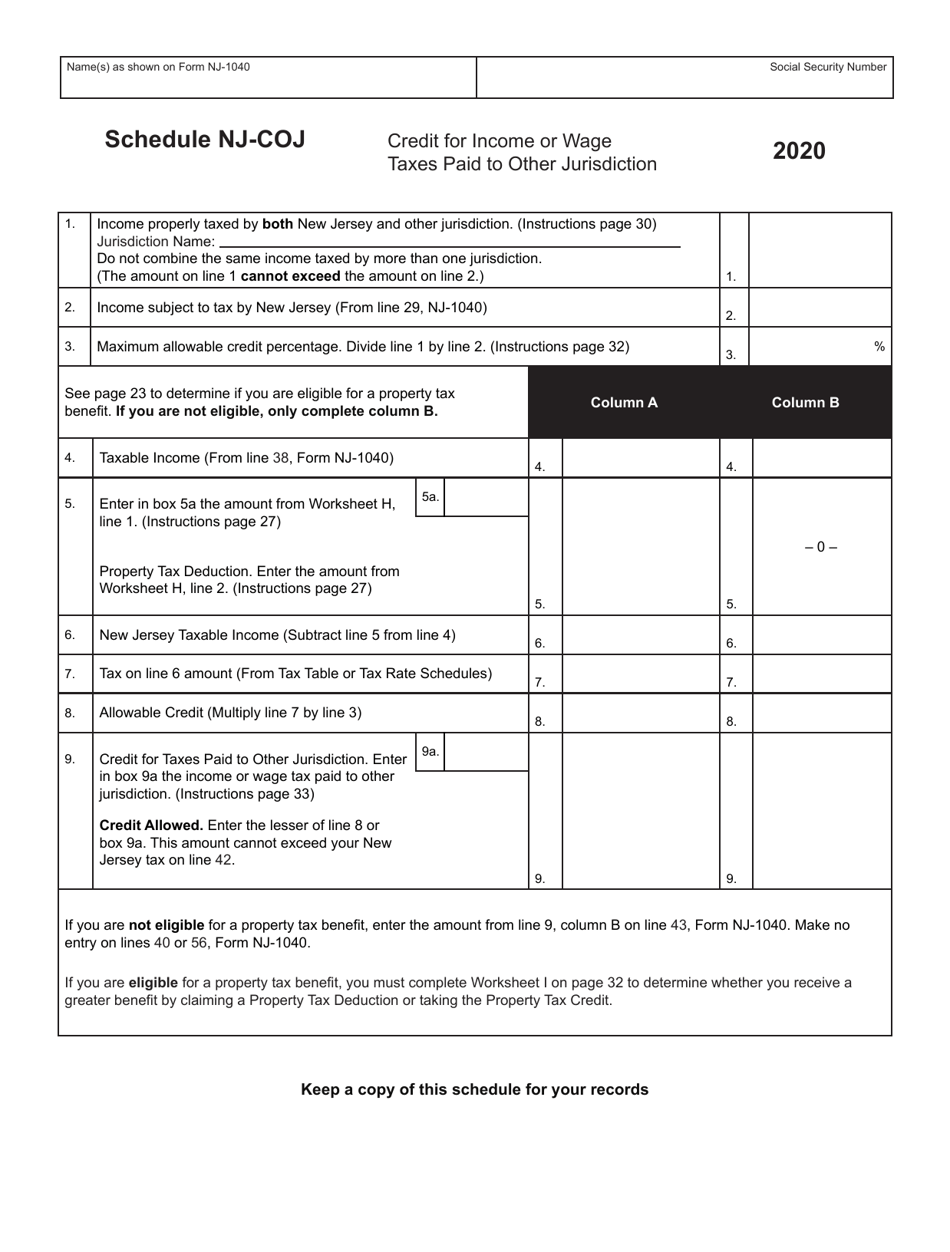

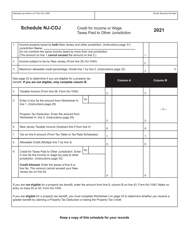

Schedule NJ-COJ

for the current year.

Schedule NJ-COJ Credit for Income or Wage Taxes Paid to Other Jurisdiction - New Jersey

What Is Schedule NJ-COJ?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a NJ-COJ Credit?

A: NJ-COJ Credit refers to the credit given to taxpayers in New Jersey for income or wage taxes paid to another jurisdiction.

Q: Who is eligible for the NJ-COJ Credit?

A: Taxpayers who are residents of New Jersey and have paid income or wage taxes to another jurisdiction are eligible for the NJ-COJ Credit.

Q: How does the NJ-COJ Credit work?

A: The NJ-COJ Credit reduces the amount of New Jersey tax owed by the taxpayer. It allows the taxpayer to claim a credit for the income or wage tax paid to another jurisdiction.

Q: How do I claim the NJ-COJ Credit?

A: To claim the NJ-COJ Credit, you need to file a Schedule NJ-COJ with your New Jersey tax return. The schedule requires you to provide details of the income or wage taxes paid to the other jurisdiction.

Q: Is there a limit to the NJ-COJ Credit?

A: Yes, there is a limit to the NJ-COJ Credit. The credit cannot exceed the amount of New Jersey tax liability on the income or wages subject to tax in both New Jersey and the other jurisdiction.

Q: Can I claim the NJ-COJ Credit for taxes paid to any jurisdiction?

A: No, the NJ-COJ Credit can only be claimed for income or wage taxes paid to jurisdictions that have a reciprocity agreement with New Jersey.

Q: Is the NJ-COJ Credit refundable?

A: No, the NJ-COJ Credit is not refundable. It can only be used to offset New Jersey tax liability.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NJ-COJ by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.