This version of the form is not currently in use and is provided for reference only. Download this version of

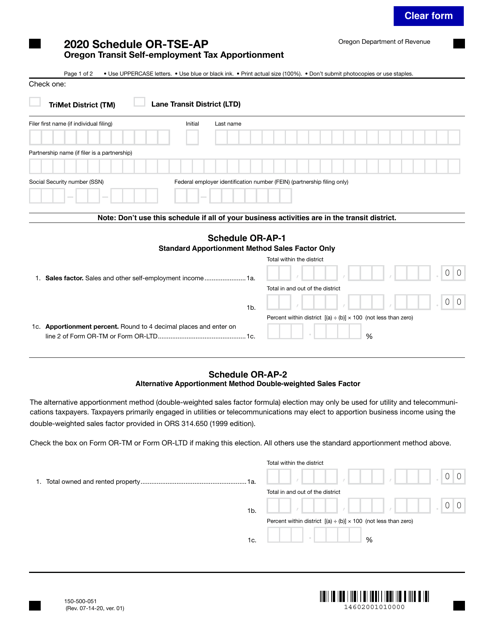

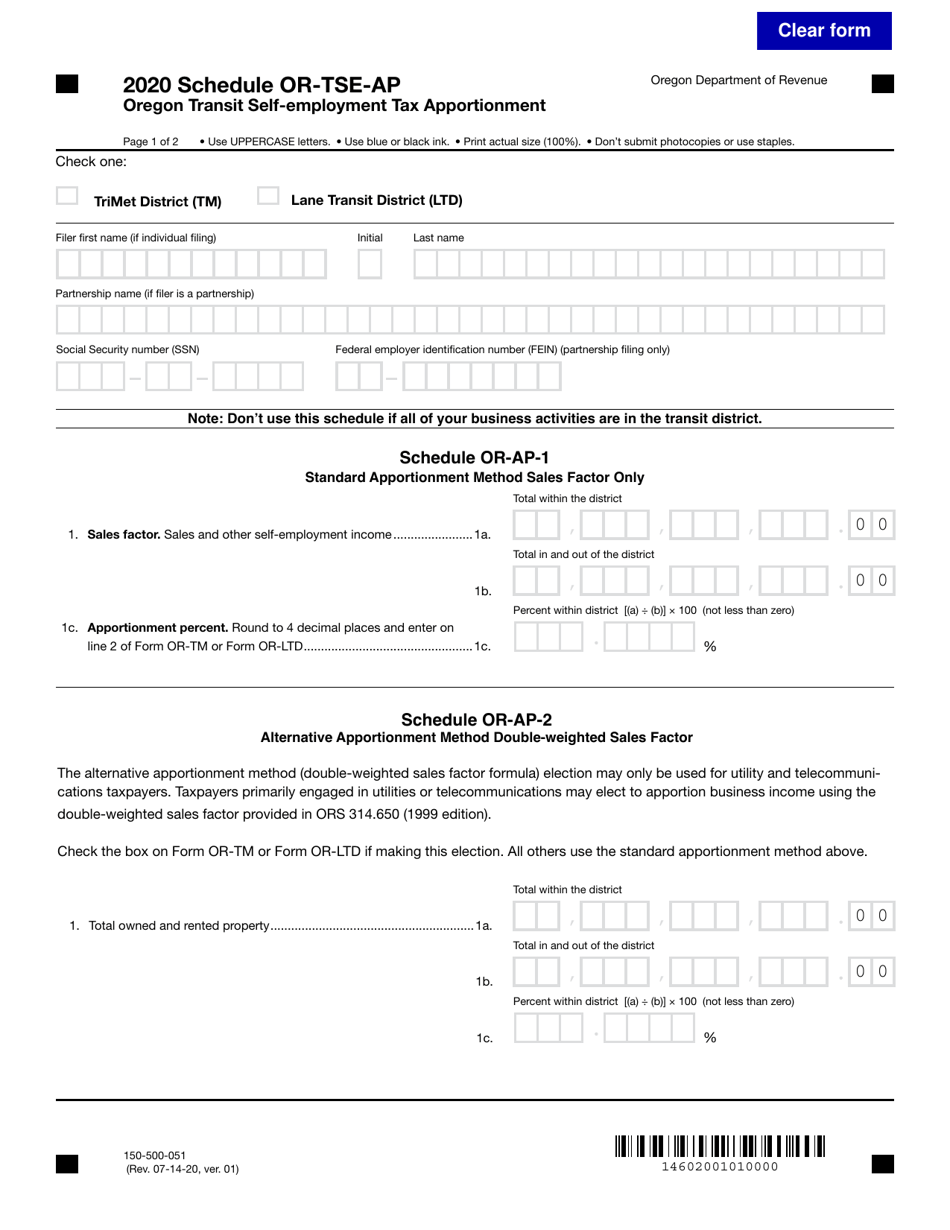

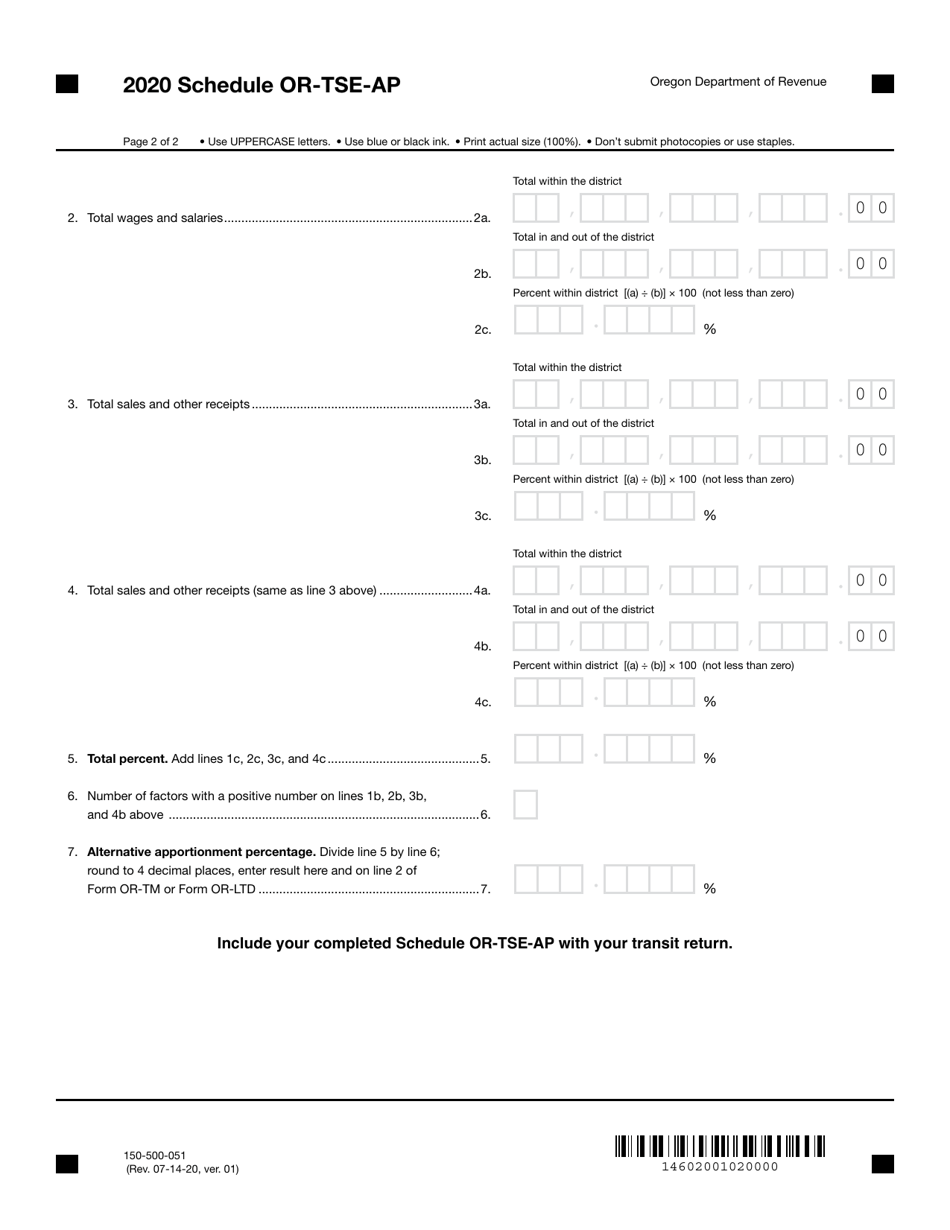

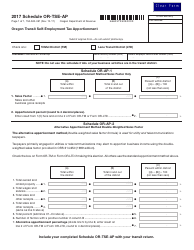

Form 150-500-051 Schedule OR-TSE-AP

for the current year.

Form 150-500-051 Schedule OR-TSE-AP Oregon Transit Self-employment Tax Apportionment - Oregon

What Is Form 150-500-051 Schedule OR-TSE-AP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-500-051?

A: Form 150-500-051 is the Oregon Transit Self-employment Tax Apportionment - Oregon.

Q: What is the purpose of Form 150-500-051?

A: The purpose of Form 150-500-051 is to apportion the transit self-employment tax owed to the state of Oregon.

Q: Who needs to file Form 150-500-051?

A: Individuals who are self-employed and owe transit self-employment tax to the state of Oregon need to file Form 150-500-051.

Q: What is transit self-employment tax?

A: Transit self-employment tax is a tax imposed on the net earnings of self-employed individuals in order to fund public transportation.

Q: What does apportionment mean?

A: Apportionment is the process of dividing or allocating something, in this case, the transit self-employment tax, among different entities or jurisdictions.

Q: Are there any special requirements for filing Form 150-500-051?

A: Yes, you must meet certain criteria to file this form, such as being a self-employed individual and owing transit self-employment tax to the state of Oregon.

Q: Is Form 150-500-051 for residents of Oregon only?

A: Yes, Form 150-500-051 is specifically for individuals who owe transit self-employment tax to the state of Oregon.

Q: When is the deadline for filing Form 150-500-051?

A: The deadline for filing Form 150-500-051 is typically the same as the deadline for filing your annual state tax return, which is generally April 15th.

Q: What should I do if I have additional questions about Form 150-500-051?

A: If you have additional questions about Form 150-500-051, you can contact the Oregon Department of Revenue for further assistance.

Form Details:

- Released on July 14, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-500-051 Schedule OR-TSE-AP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.