This version of the form is not currently in use and is provided for reference only. Download this version of

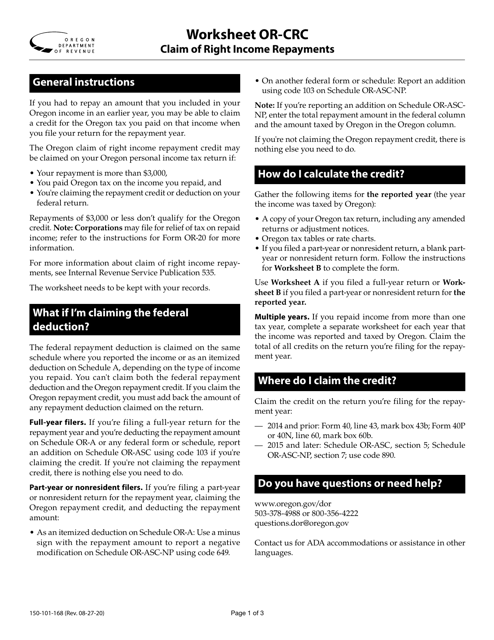

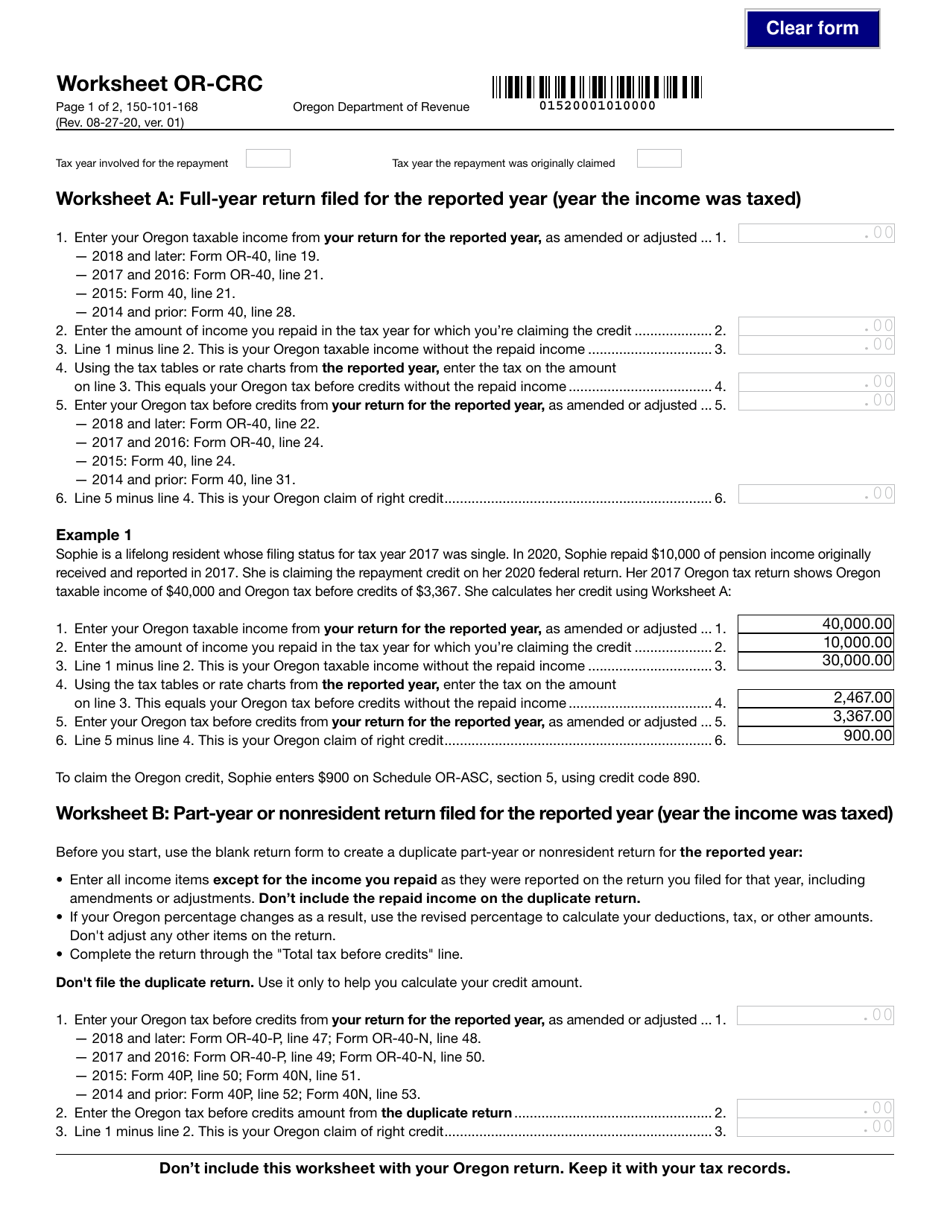

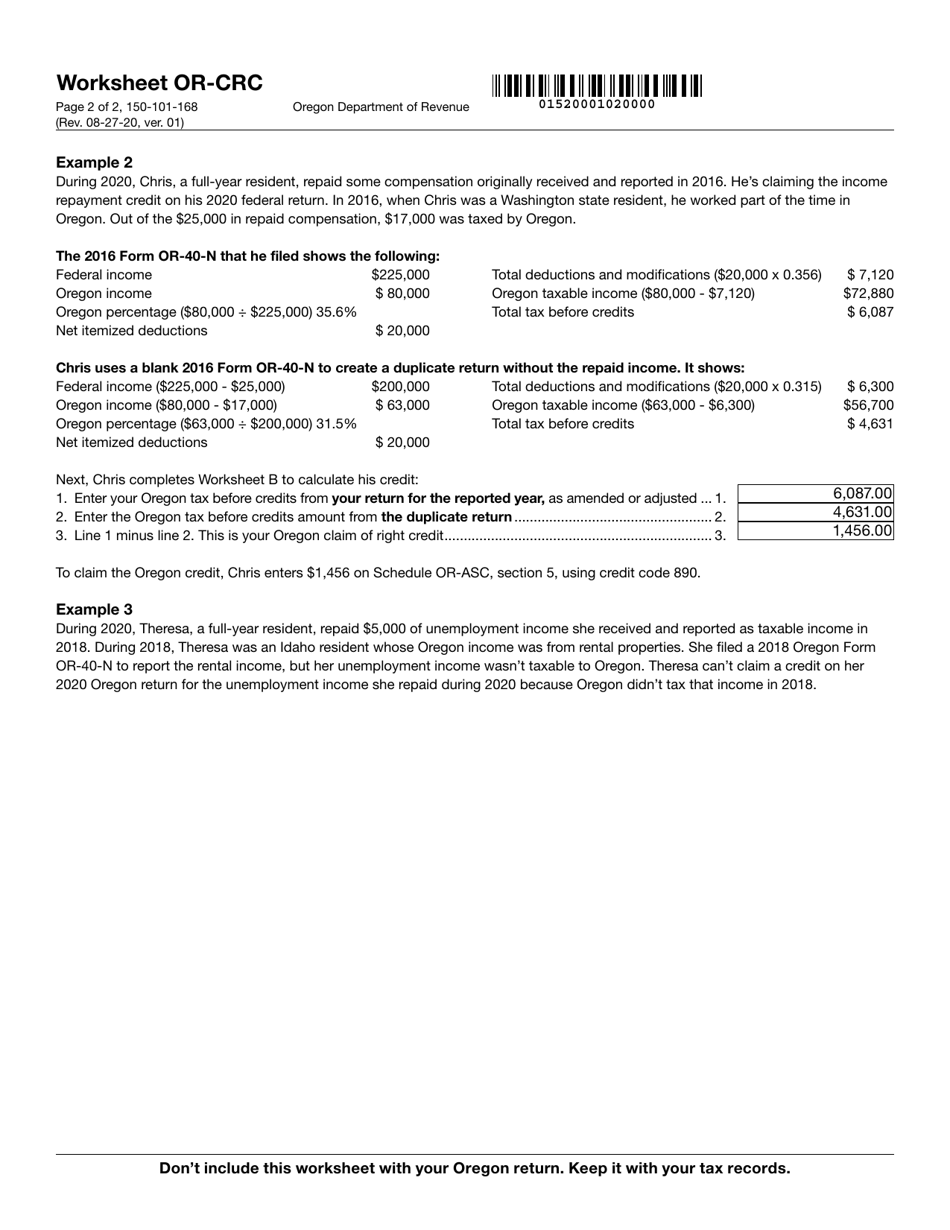

Form 150-101-168 Worksheet OR-CRC

for the current year.

Form 150-101-168 Worksheet OR-CRC Claim of Right Income Repayments - Oregon

What Is Form 150-101-168 Worksheet OR-CRC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon.The document is a supplement to Form 150-101-168, Worksheet or-Crc - Claim of Right Income Repayments. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-168?

A: Form 150-101-168 is a worksheet for claiming a deduction on your Oregon income tax return for repaying income that you previously reported as taxable.

Q: What is OR-CRC?

A: OR-CRC stands for Claim of Right Income Repayments. It refers to the income that you are repaying.

Q: What is the purpose of Form 150-101-168?

A: The purpose of Form 150-101-168 is to calculate the amount of income you can deduct on your Oregon income tax return.

Q: How do I use Form 150-101-168?

A: You need to fill out the worksheet to determine the amount of deductible repayment. The calculated amount will then be entered on your Oregon income tax return.

Q: When should I use Form 150-101-168?

A: You should use Form 150-101-168 if you are repaying income that you previously reported as taxable on your Oregon income tax return.

Form Details:

- Released on August 27, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-168 Worksheet OR-CRC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.