This version of the form is not currently in use and is provided for reference only. Download this version of

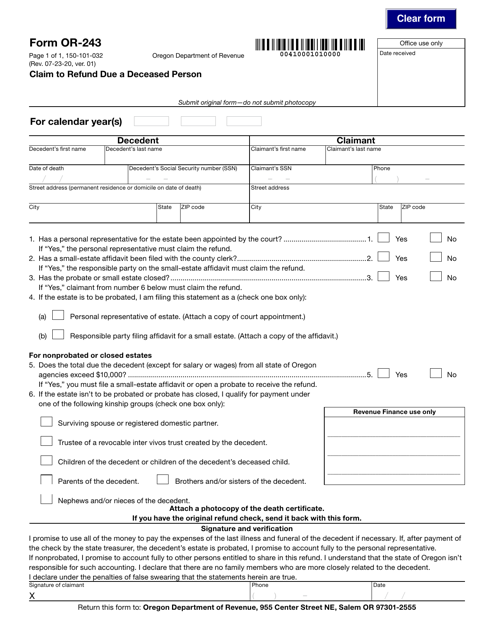

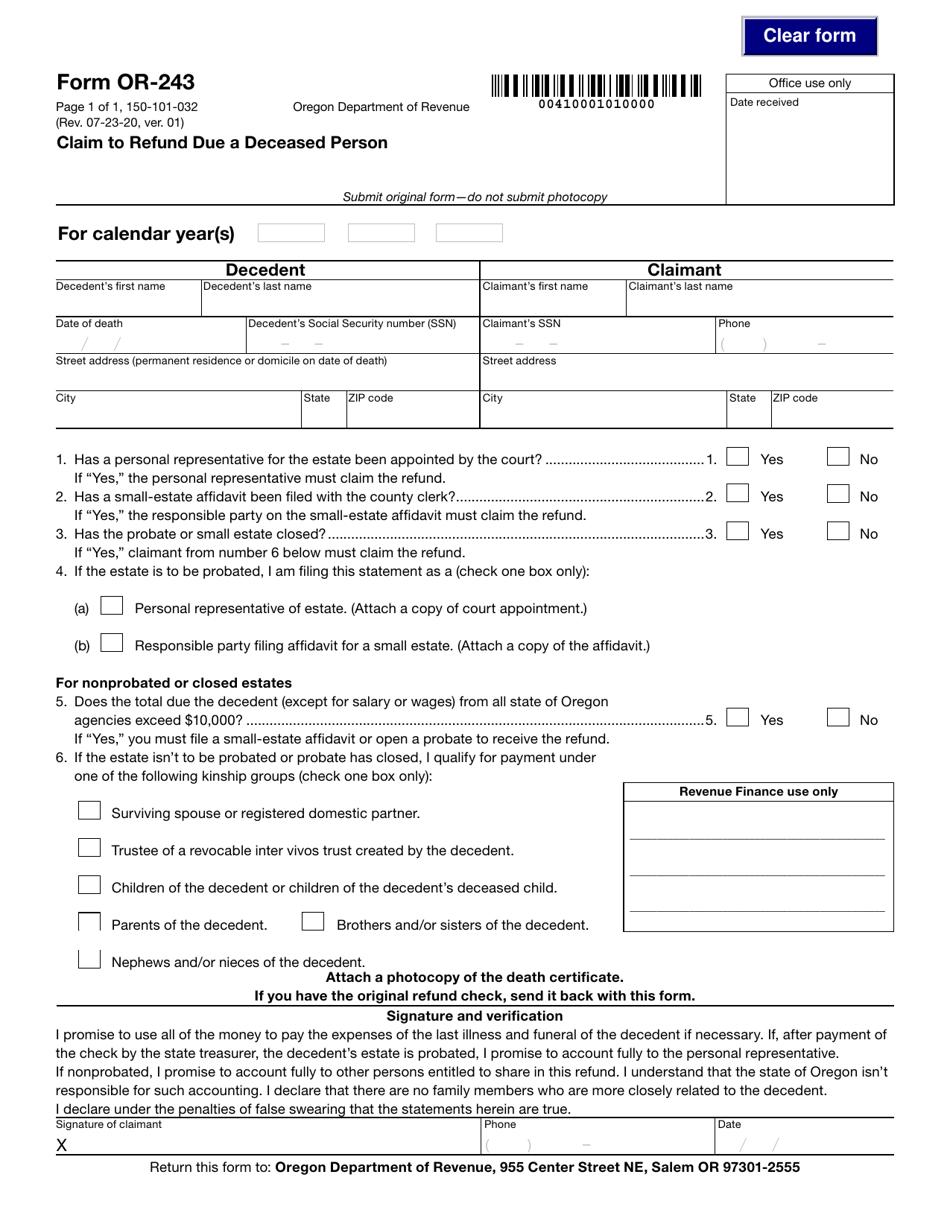

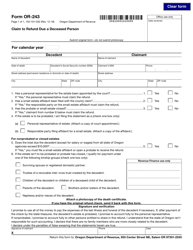

Form OR-243 (150-101-032)

for the current year.

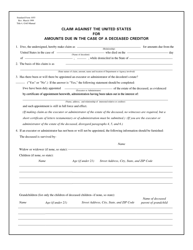

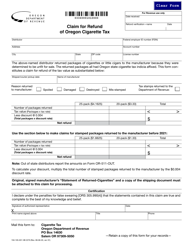

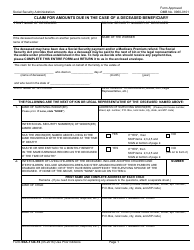

Form OR-243 (150-101-032) Claim to Refund Due a Deceased Person - Oregon

What Is Form OR-243 (150-101-032)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-243?

A: Form OR-243 is a claim to refund due a deceased person in Oregon.

Q: Who can use Form OR-243?

A: Form OR-243 can be used by individuals who are filing a refund claim on behalf of a deceased person in Oregon.

Q: What is the purpose of Form OR-243?

A: The purpose of Form OR-243 is to claim a refund on behalf of a deceased person in Oregon.

Q: What information do I need to fill out Form OR-243?

A: You will need information about the deceased person, their income, and any taxes paid or withheld.

Q: Is there a deadline for filing Form OR-243?

A: Yes, Form OR-243 must be filed within 3 years from the due date of the original tax return or within 2 years from the date of payment, whichever is later.

Form Details:

- Released on July 23, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-243 (150-101-032) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.