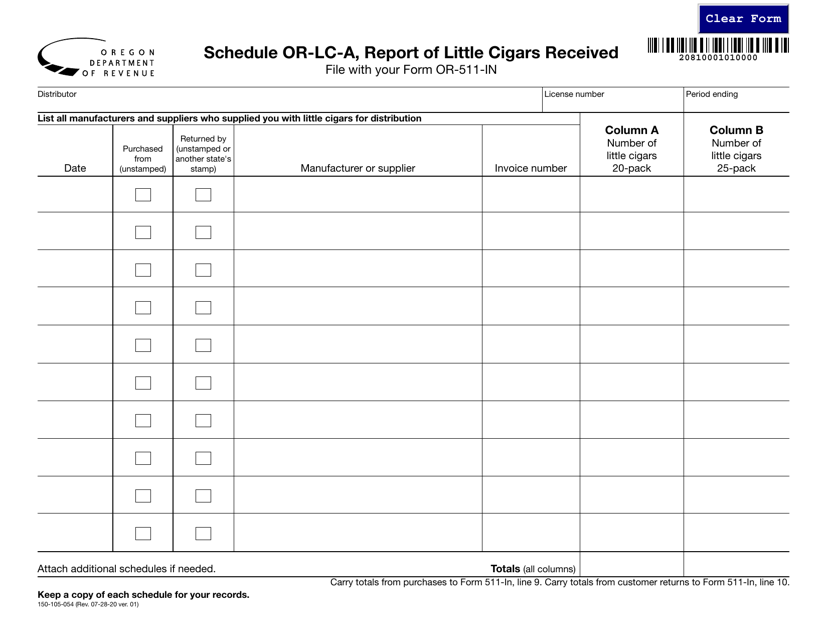

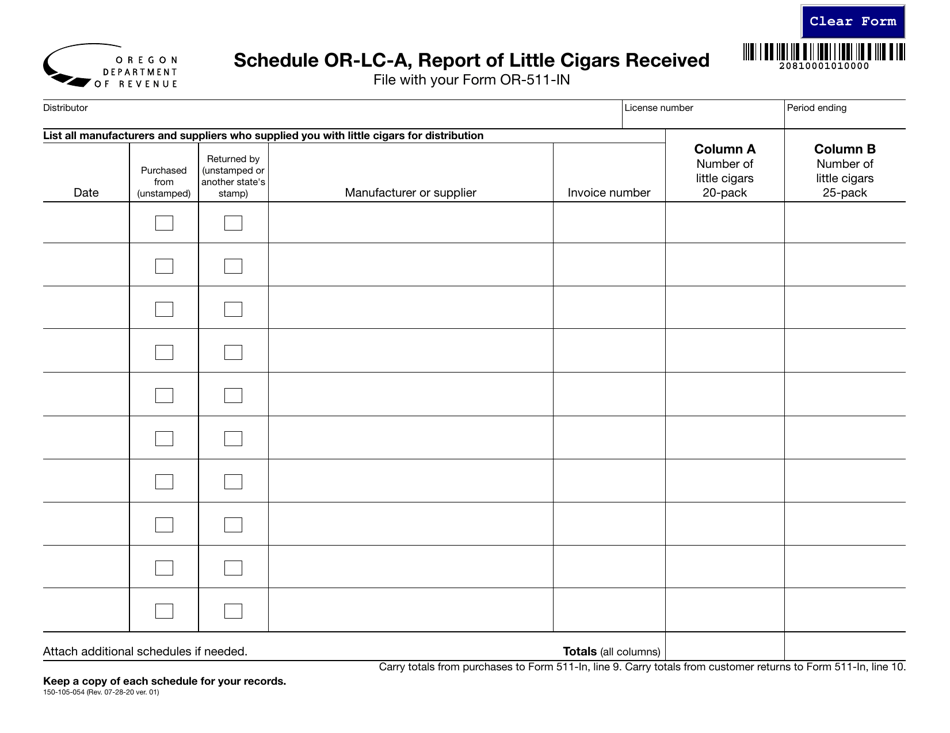

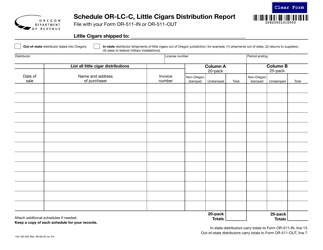

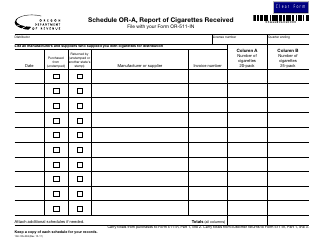

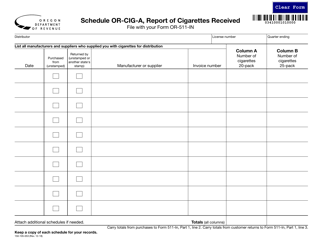

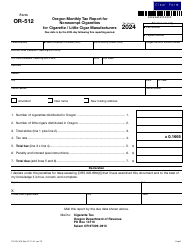

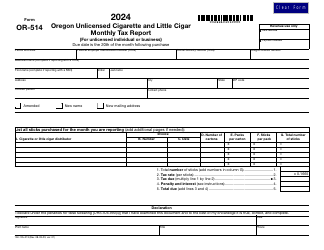

Form 150-105-054 Schedule OR-LC-A Report of Little Cigars Received - Oregon

What Is Form 150-105-054 Schedule OR-LC-A?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-105-054?

A: Form 150-105-054 is the Schedule OR-LC-A Report of Little Cigars Received form in Oregon.

Q: What is the purpose of Form 150-105-054?

A: The purpose of Form 150-105-054 is to report the receipt of little cigars in Oregon.

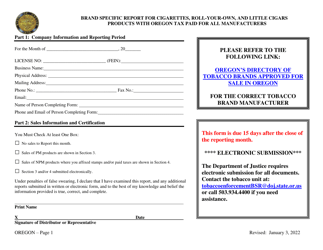

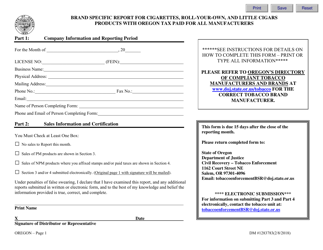

Q: Who needs to file Form 150-105-054?

A: Any person or entity that receives little cigars in Oregon needs to file Form 150-105-054.

Q: What information is required on Form 150-105-054?

A: Form 150-105-054 requires information such as the quantity and type of little cigars received, the name and address of the person or entity receiving them, and the date of receipt.

Q: When is Form 150-105-054 due?

A: Form 150-105-054 is due by the 20th day of the month following the end of the reporting period.

Form Details:

- Released on July 28, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-105-054 Schedule OR-LC-A by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.