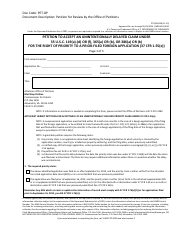

This version of the form is not currently in use and is provided for reference only. Download this version of

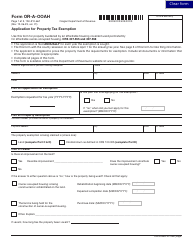

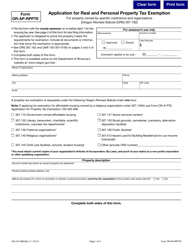

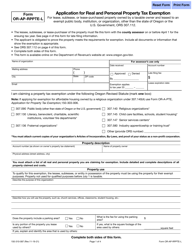

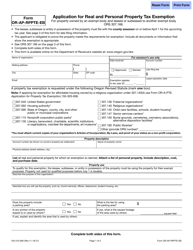

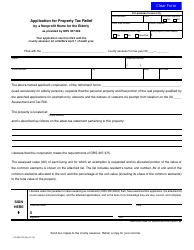

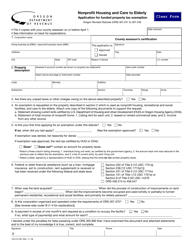

Form 150-490-017

for the current year.

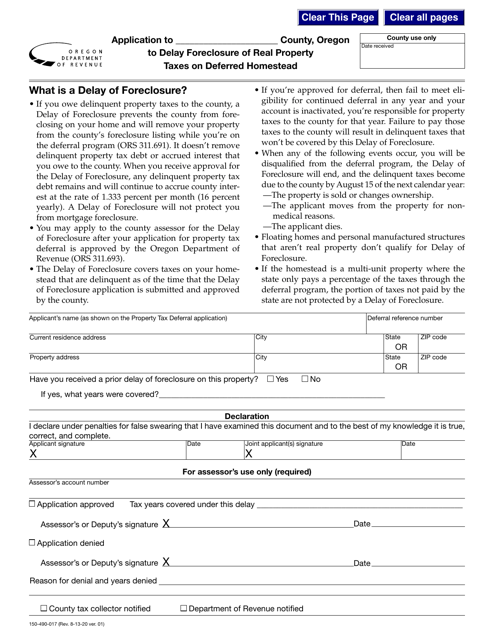

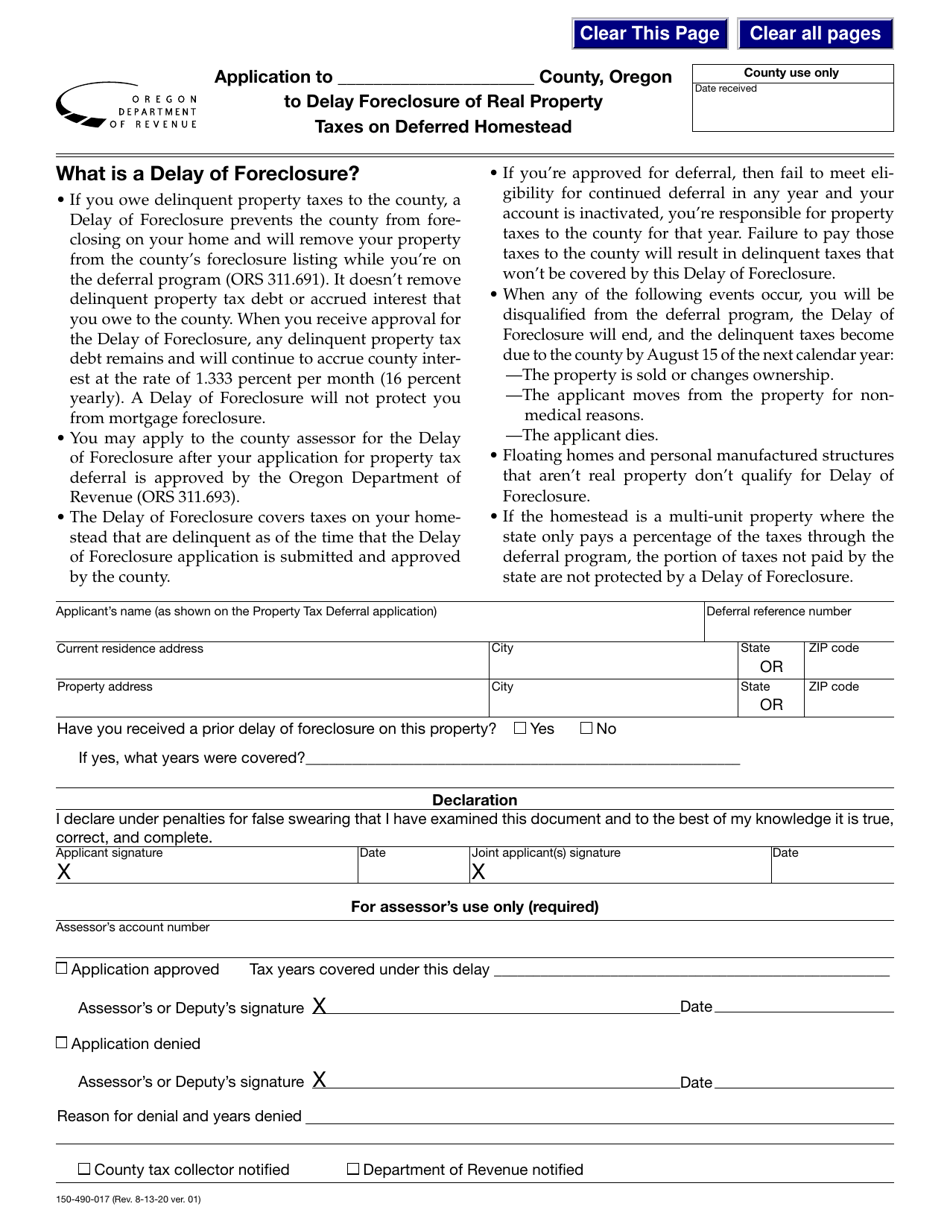

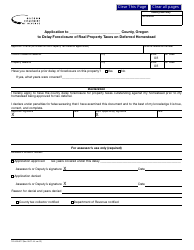

Form 150-490-017 Application to County, Oregon to Delay Foreclosure of Real Property Taxes on Deferred Homestead - Oregon

What Is Form 150-490-017?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-490-017?

A: Form 150-490-017 is an application to the County, Oregon to delay foreclosure of real property taxes on deferred homestead.

Q: What is the purpose of Form 150-490-017?

A: The purpose of Form 150-490-017 is to request a delay in foreclosure of real property taxes on a deferred homestead in Oregon.

Q: Who should use Form 150-490-017?

A: Form 150-490-017 should be used by individuals who have deferred homestead property taxes and want to delay foreclosure.

Q: Is there a fee for submitting Form 150-490-017?

A: There may be a fee associated with submitting Form 150-490-017, but you should check with the County office in Oregon for specific details.

Q: What information is required on Form 150-490-017?

A: Form 150-490-017 requires information such as the property owner's name, address, tax account number, and reasons for requesting the delay in foreclosure.

Q: What happens after submitting Form 150-490-017?

A: After submitting Form 150-490-017, the County office in Oregon will review your application and determine whether to grant the delay in foreclosure.

Q: Can I use Form 150-490-017 for properties outside of Oregon?

A: No, Form 150-490-017 is specific to properties in Oregon and cannot be used for properties outside of the state.

Q: Are there any eligibility requirements for using Form 150-490-017?

A: Yes, there are eligibility requirements for using Form 150-490-017, such as meeting the criteria for deferred homestead property taxes in Oregon.

Q: Is Form 150-490-017 the only option to delay foreclosure of property taxes?

A: No, there may be other options available to delay foreclosure of property taxes, and you should consult with a legal professional or the County office in Oregon for more information.

Form Details:

- Released on August 13, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-490-017 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.