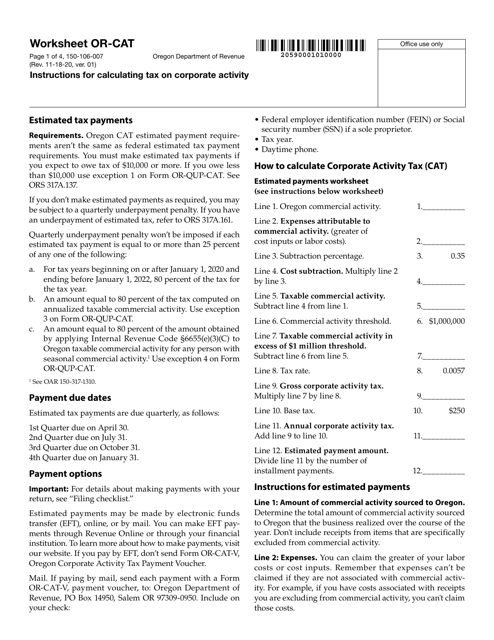

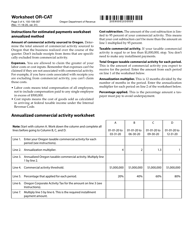

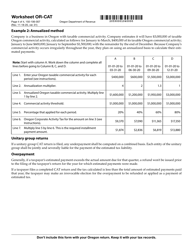

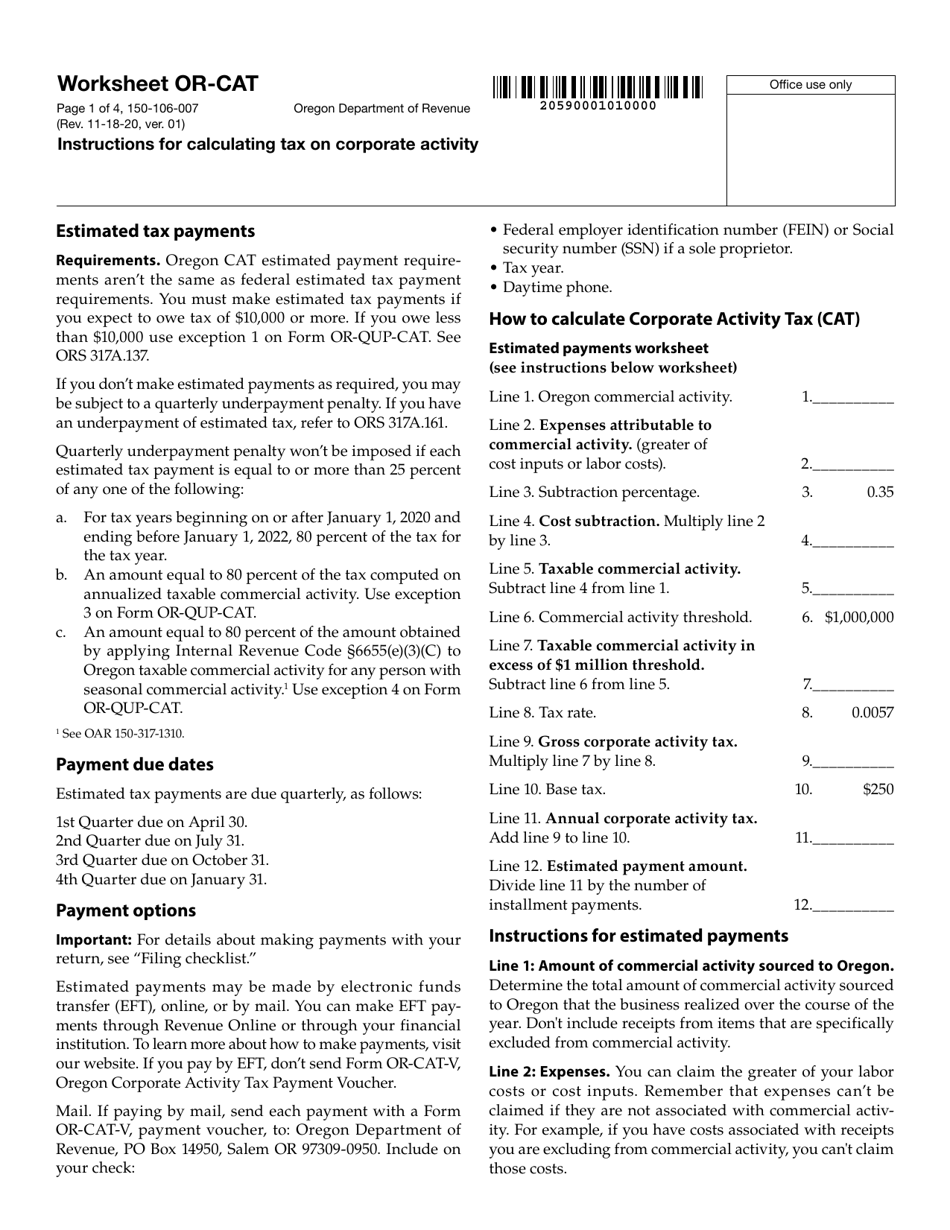

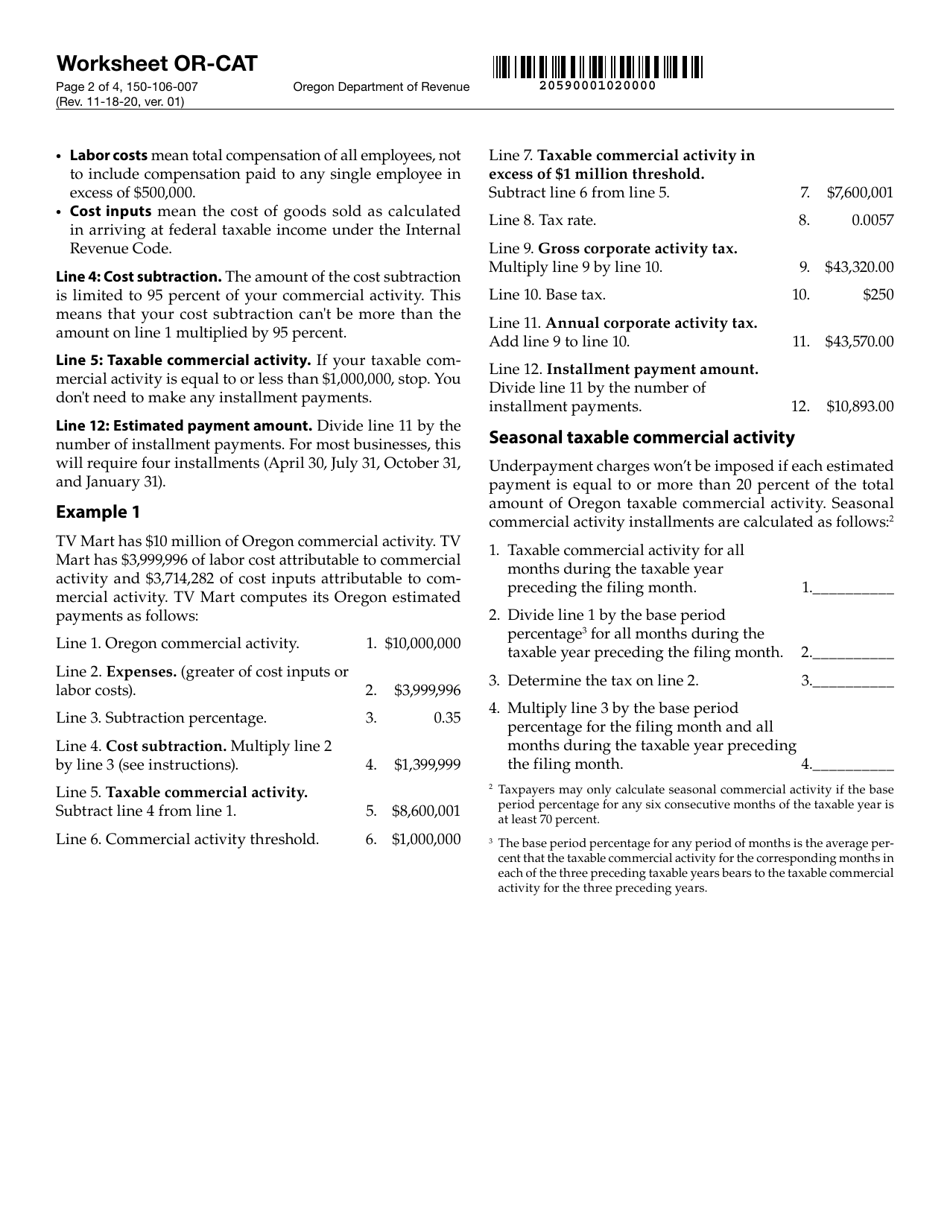

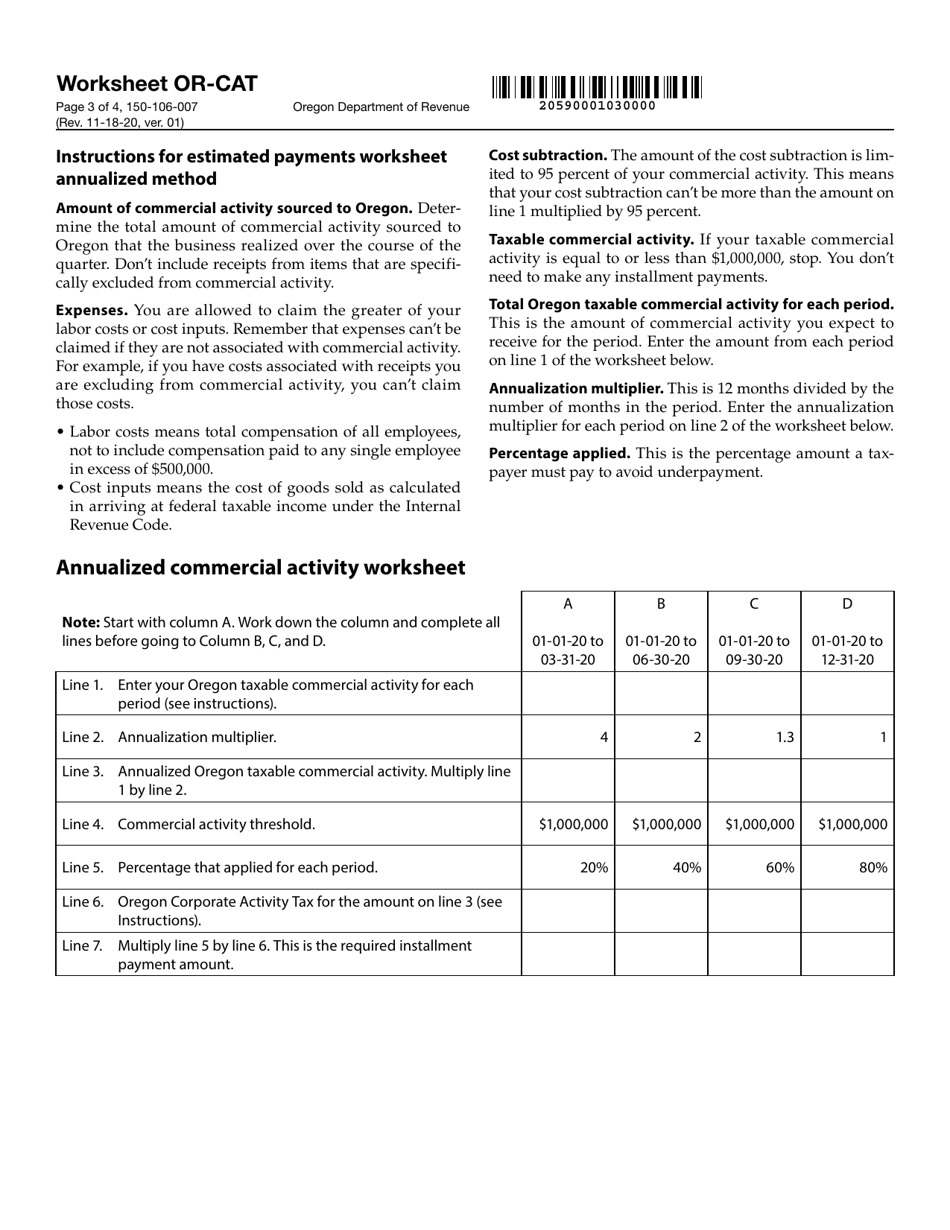

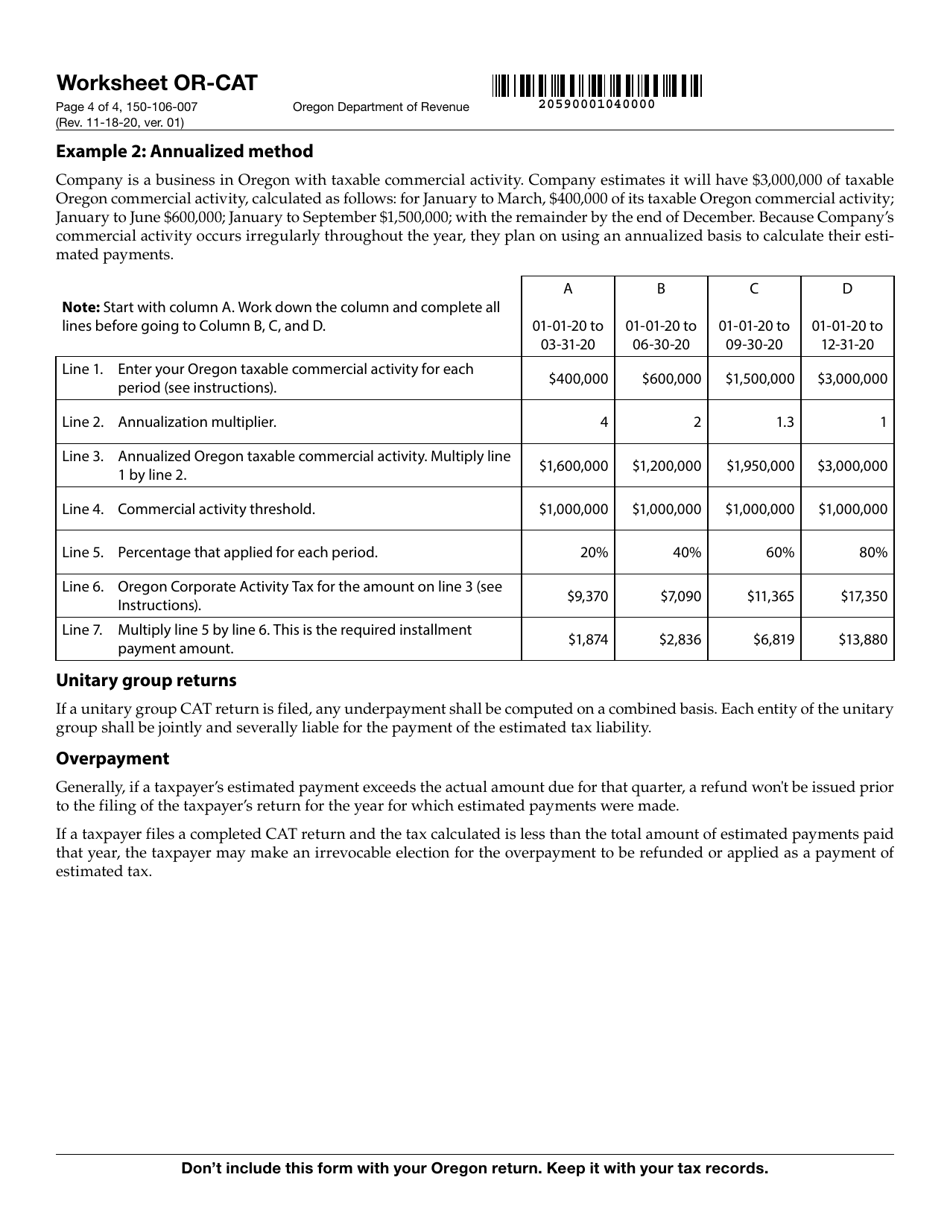

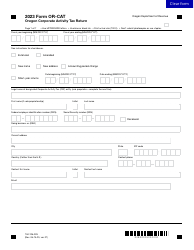

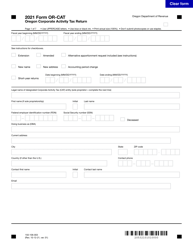

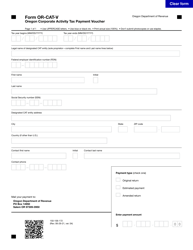

Form 150-106-007 Worksheet OR-CAT Instructions for Calculating Tax on Corporate Activity - Oregon

What Is Form 150-106-007 Worksheet OR-CAT?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-106-007?

A: Form 150-106-007 is a worksheet provided by the state of Oregon to calculate tax on corporate activity.

Q: What are OR-CAT instructions?

A: OR-CAT instructions are the instructions on how to use the worksheet to calculate the tax on corporate activity in Oregon.

Q: Who needs to use Form 150-106-007?

A: Businesses in Oregon that engage in certain types of corporate activities need to use Form 150-106-007 to calculate their tax liability.

Q: What is the purpose of calculating tax on corporate activity?

A: The purpose of calculating tax on corporate activity is to determine the amount of tax that a business must pay to the state of Oregon based on its corporate activities.

Form Details:

- Released on November 18, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 150-106-007 Worksheet OR-CAT by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.