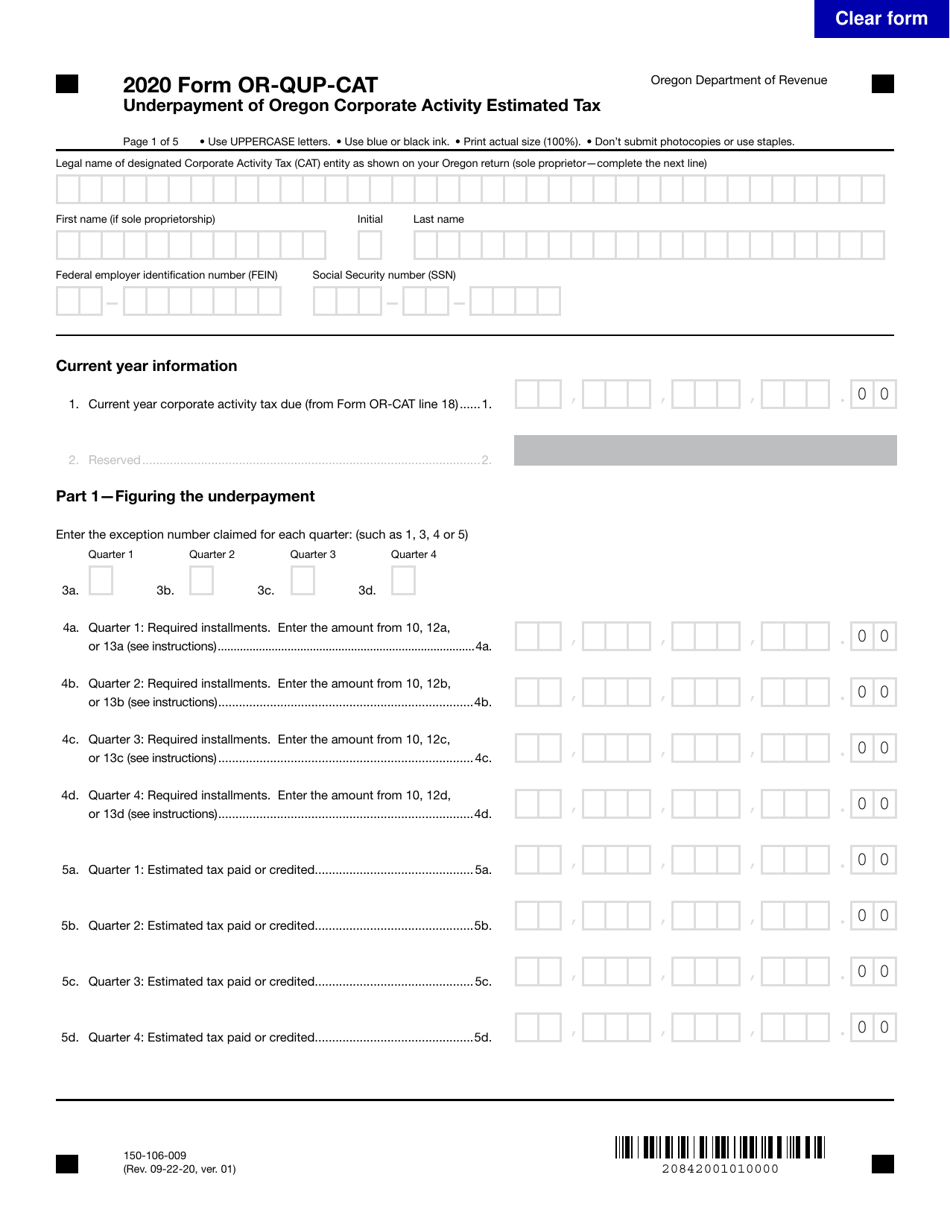

This version of the form is not currently in use and is provided for reference only. Download this version of

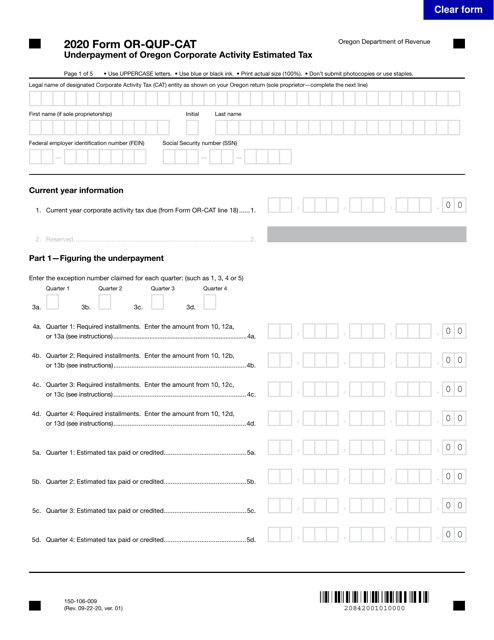

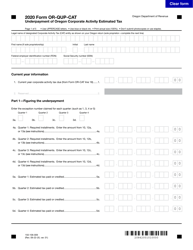

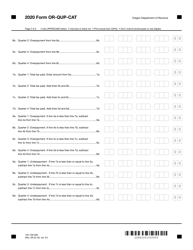

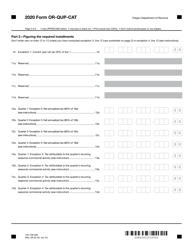

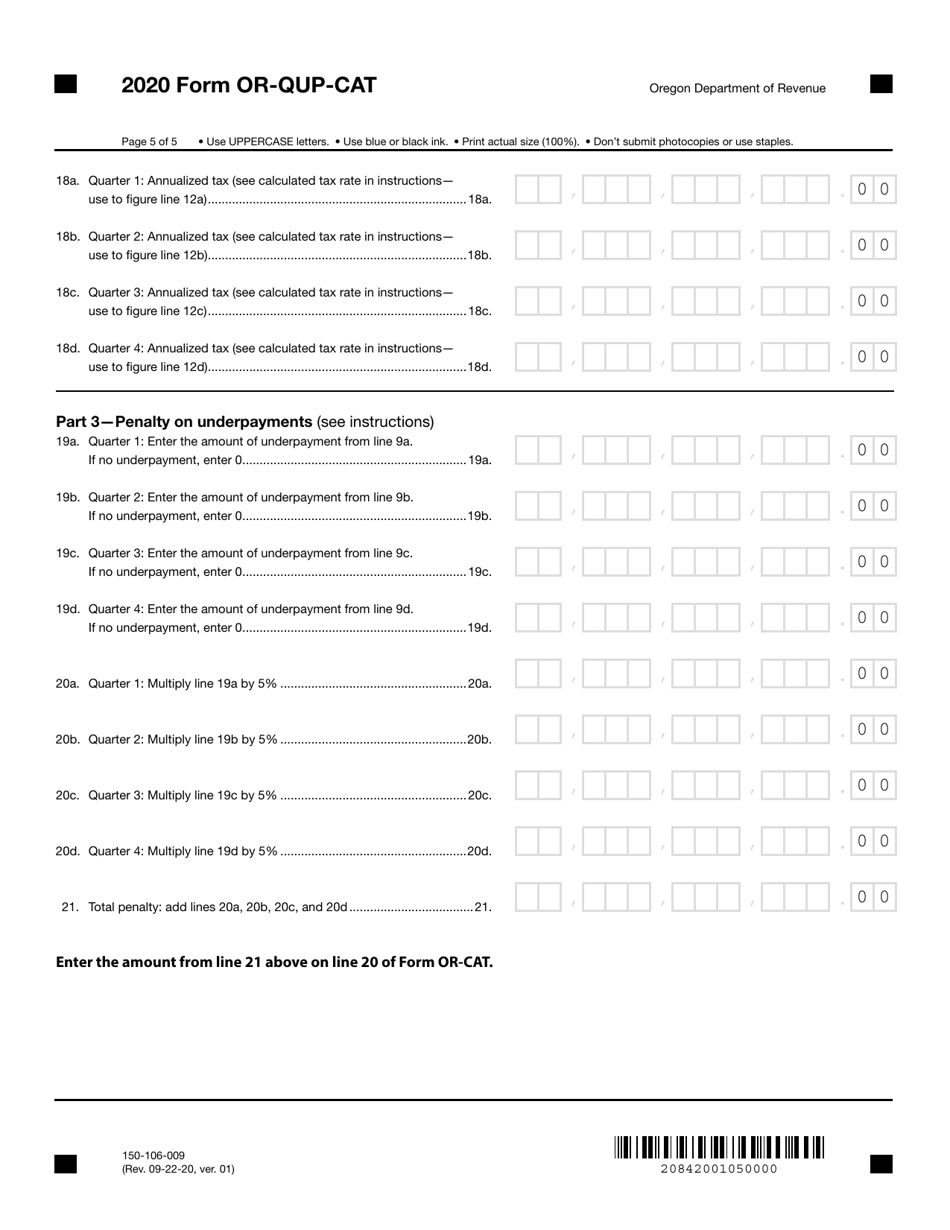

Form OR-QUP-CAT (150-106-009)

for the current year.

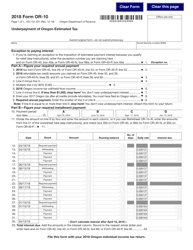

Form OR-QUP-CAT (150-106-009) Underpayment of Oregon Corporate Activity Estimated Tax - Oregon

What Is Form OR-QUP-CAT (150-106-009)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-QUP-CAT (150-106-009)?

A: OR-QUP-CAT (150-106-009) refers to the form for underpayment of Oregon corporate activity estimated tax in Oregon.

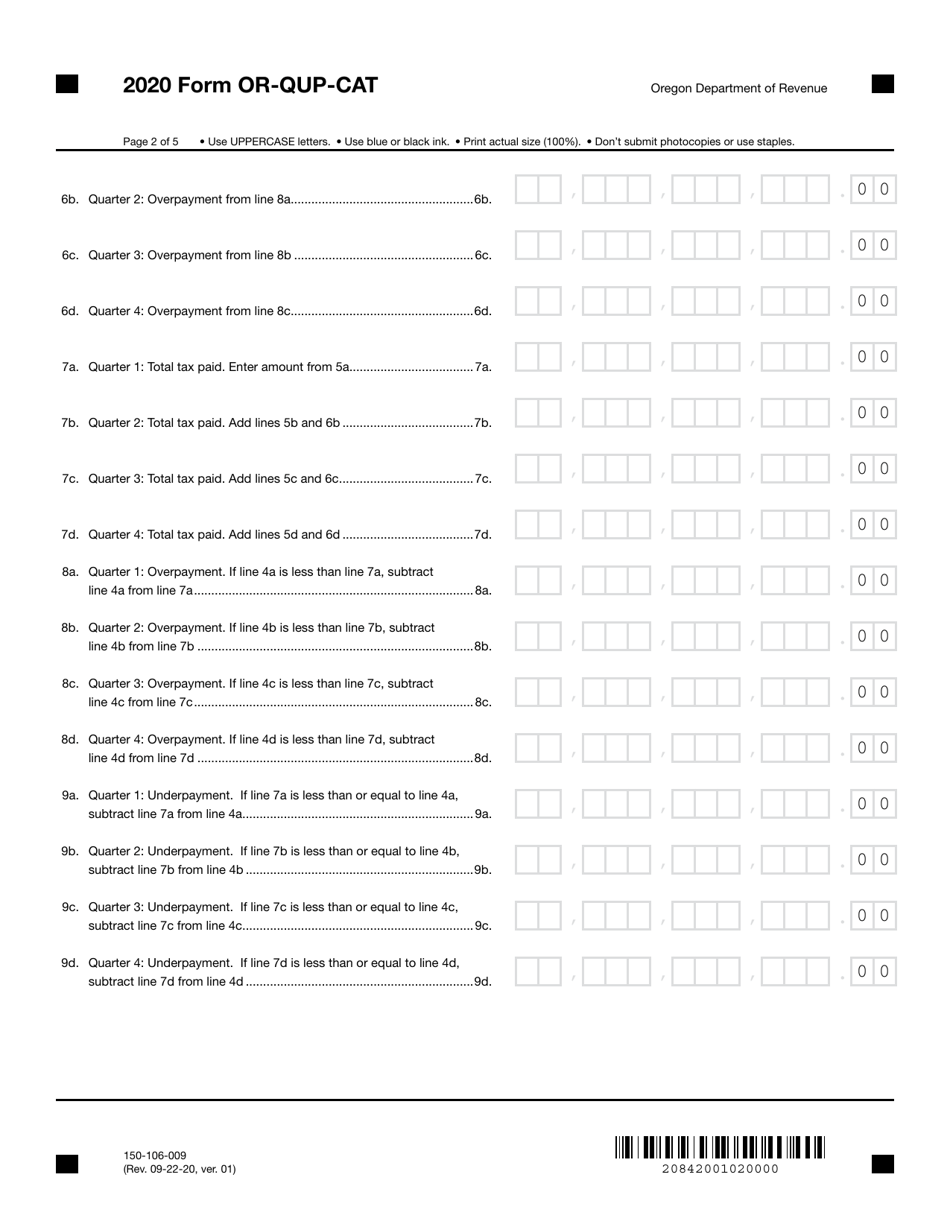

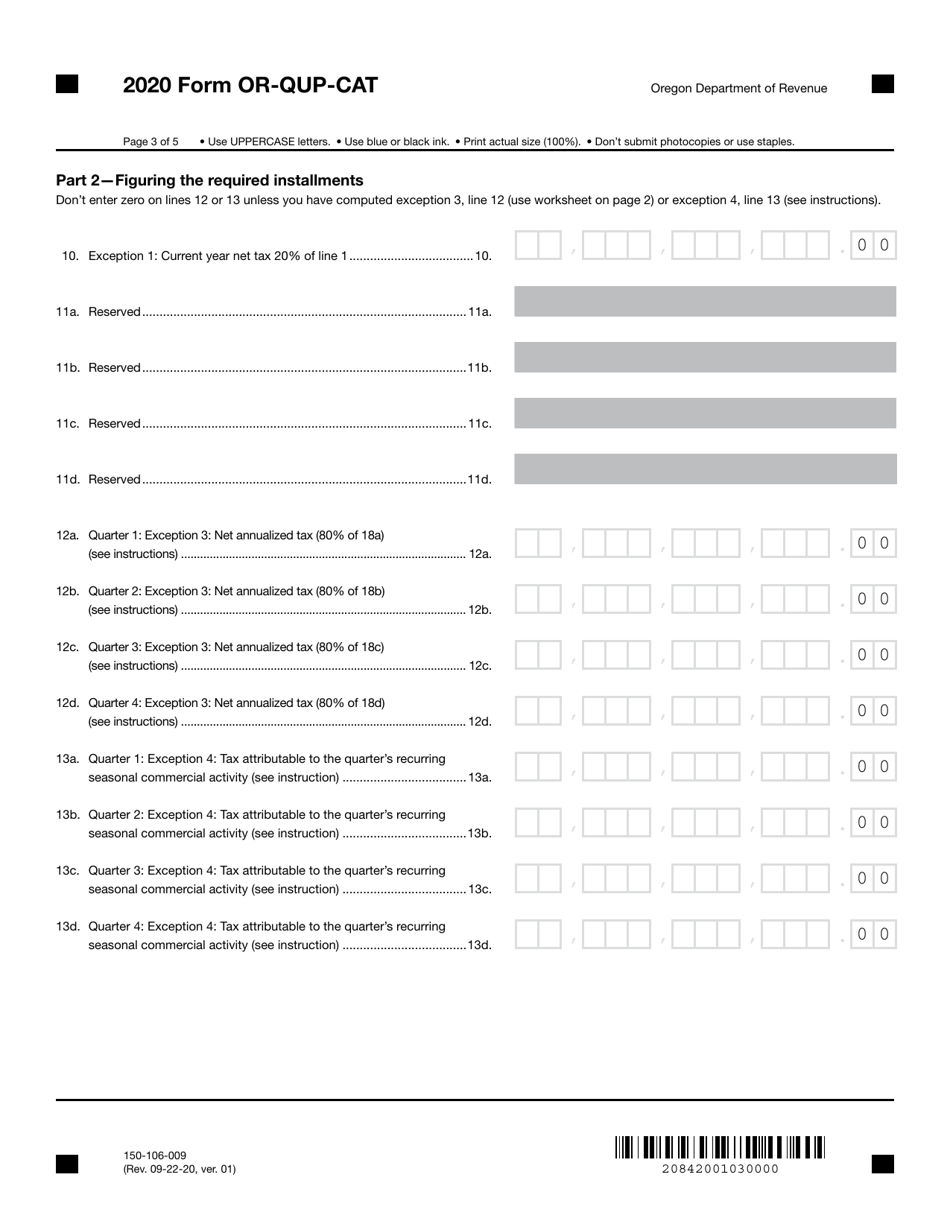

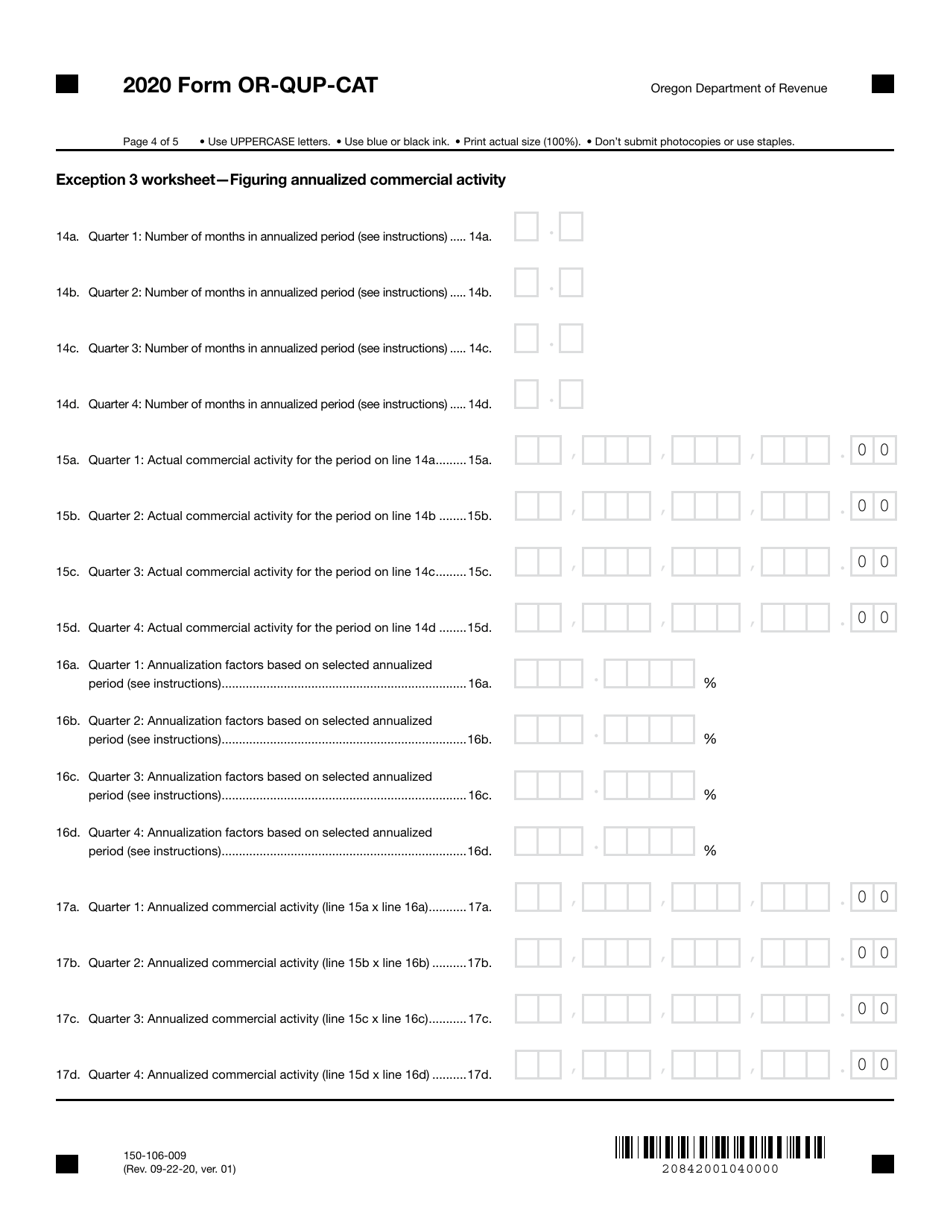

Q: What does the form OR-QUP-CAT (150-106-009) cover?

A: The form OR-QUP-CAT (150-106-009) covers underpayment of Oregon corporate activity estimated tax.

Q: What is the purpose of the form OR-QUP-CAT (150-106-009)?

A: The form OR-QUP-CAT (150-106-009) is used to report and pay for underpayment of Oregon corporate activity estimated tax.

Q: Who needs to file the form OR-QUP-CAT (150-106-009)?

A: Businesses in Oregon that have underpaid their corporate activity estimated tax need to file the form OR-QUP-CAT (150-106-009).

Q: Are there any penalties for underpayment of Oregon corporate activity estimated tax?

A: Yes, there may be penalties for underpayment of Oregon corporate activity estimated tax. You should consult the Oregon Department of Revenue for more information on penalties.

Q: Is the form OR-QUP-CAT (150-106-009) applicable in both Oregon and Canada?

A: No, the form OR-QUP-CAT (150-106-009) is applicable only in Oregon and not in Canada.

Form Details:

- Released on September 22, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-QUP-CAT (150-106-009) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.