This version of the form is not currently in use and is provided for reference only. Download this version of

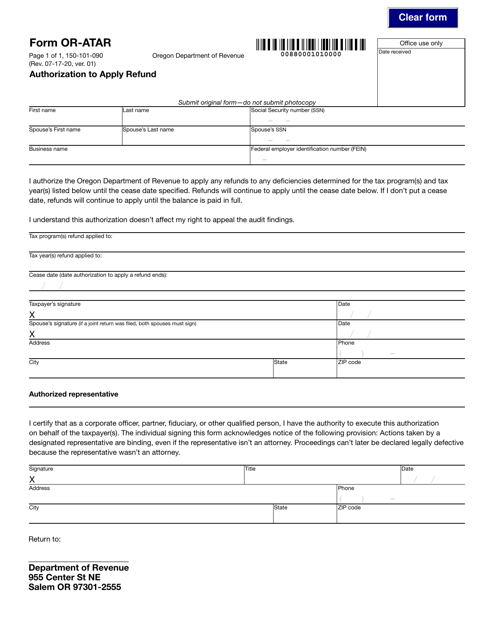

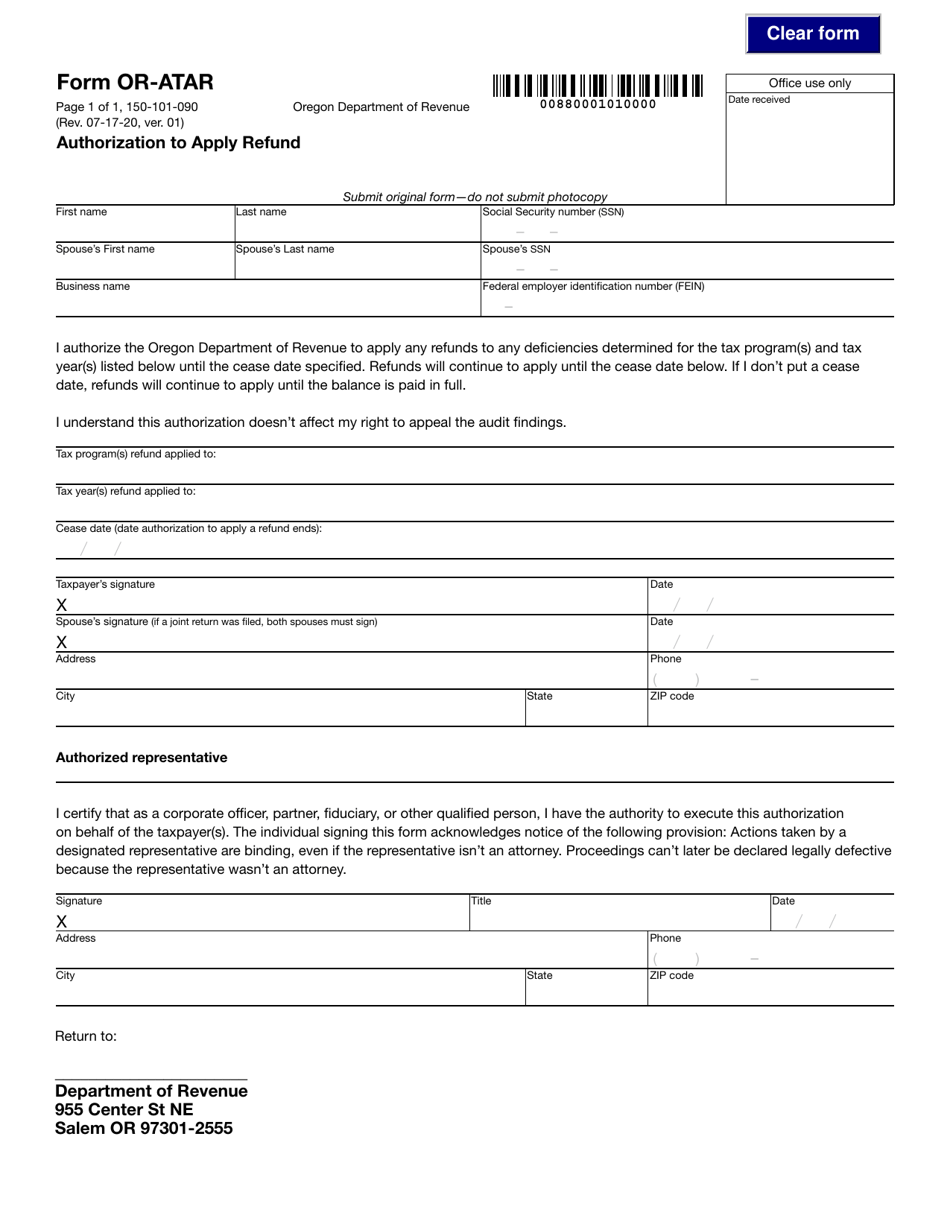

Form OR-ATAR (150-101-090)

for the current year.

Form OR-ATAR (150-101-090) Authorization to Apply Refund - Oregon

What Is Form OR-ATAR (150-101-090)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-ATAR (150-101-090)?

A: Form OR-ATAR (150-101-090) is an Authorization to Apply Refund form in Oregon.

Q: What is the purpose of Form OR-ATAR?

A: The purpose of Form OR-ATAR is to authorize the Department of Revenue to apply any refund due to you to any outstanding debt you owe to a state agency.

Q: Who needs to fill out Form OR-ATAR?

A: Form OR-ATAR needs to be filled out by taxpayers in Oregon who have a refund due but also have an outstanding debt to a state agency.

Q: Is Form OR-ATAR mandatory?

A: Form OR-ATAR is mandatory if you have a refund due and an outstanding debt to a state agency in Oregon.

Form Details:

- Released on July 17, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-ATAR (150-101-090) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.