This version of the form is not currently in use and is provided for reference only. Download this version of

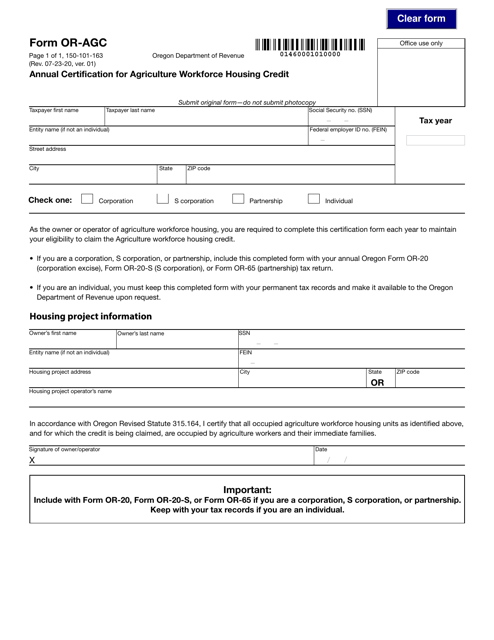

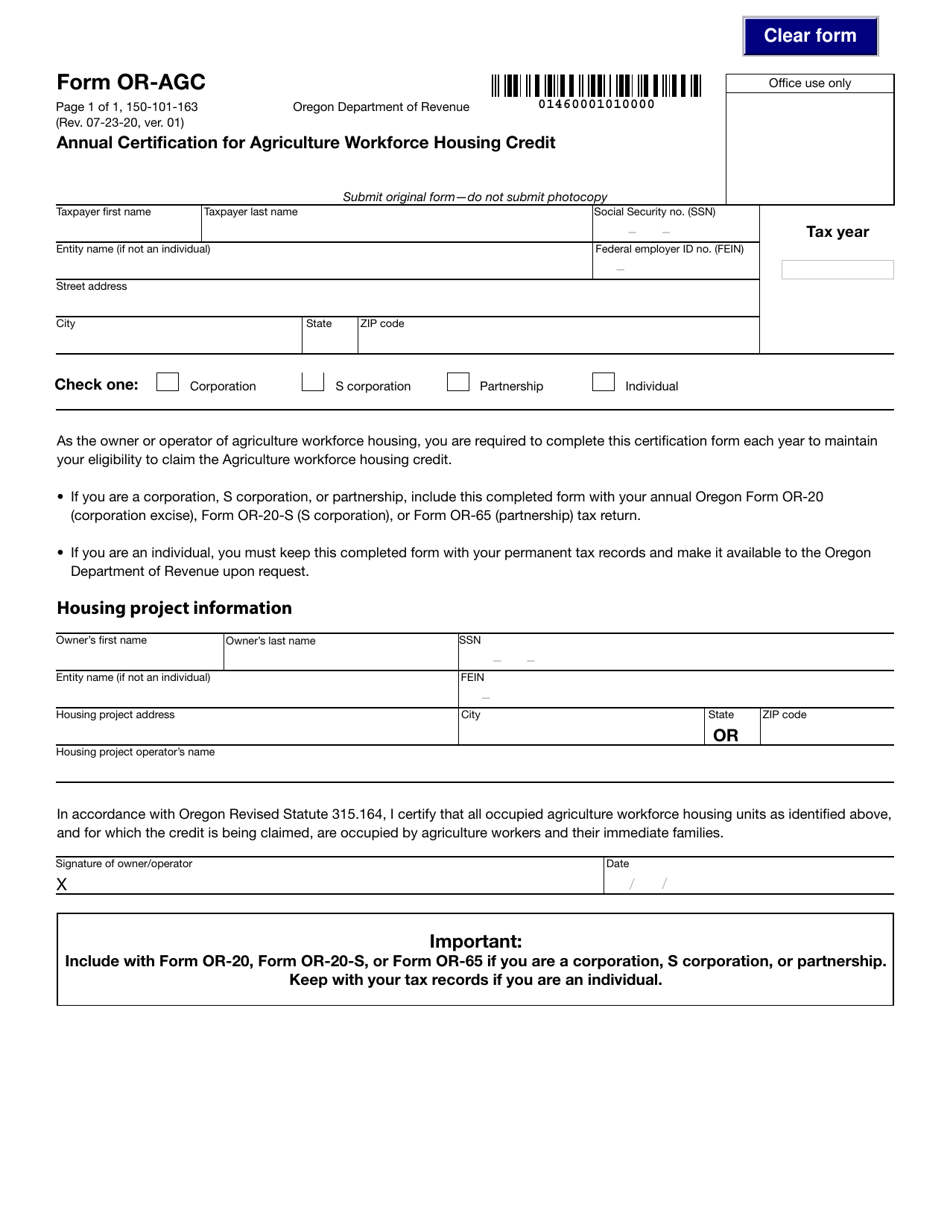

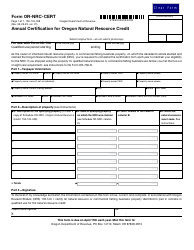

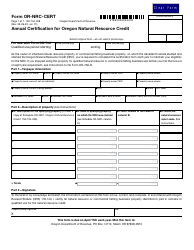

Form OR-AGC (150-101-163)

for the current year.

Form OR-AGC (150-101-163) Annual Certification for Agriculture Workforce Housing Credit - Oregon

What Is Form OR-AGC (150-101-163)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-AGC?

A: Form OR-AGC is the Annual Certification for Agriculture Workforce Housing Credit in Oregon.

Q: Who should file Form OR-AGC?

A: The form should be filed by individuals or entities that are claiming the Agriculture Workforce Housing Credit in Oregon.

Q: What is the purpose of Form OR-AGC?

A: The purpose of Form OR-AGC is to certify that the individual or entity meets the requirements for claiming the Agriculture Workforce Housing Credit in Oregon.

Q: Is there a deadline for filing Form OR-AGC?

A: Yes, Form OR-AGC must be filed on or before the due date of the tax return for the tax year for which the credit is being claimed.

Q: Are there any supporting documents required with Form OR-AGC?

A: Yes, you may be required to provide supporting documents such as lease agreements, occupancy permits, and other documents to prove your eligibility for the Agriculture Workforce Housing Credit.

Q: What happens after I file Form OR-AGC?

A: After you file Form OR-AGC, the Oregon Department of Revenue will review your application and determine if you are eligible for the Agriculture Workforce Housing Credit.

Q: Can I claim the Agriculture Workforce Housing Credit if I don't file Form OR-AGC?

A: No, you must file Form OR-AGC and receive approval from the Oregon Department of Revenue in order to claim the Agriculture Workforce Housing Credit.

Q: What if I have more questions about Form OR-AGC?

A: If you have more questions about Form OR-AGC, you can contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on July 23, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-AGC (150-101-163) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.