This version of the form is not currently in use and is provided for reference only. Download this version of

Form 502

for the current year.

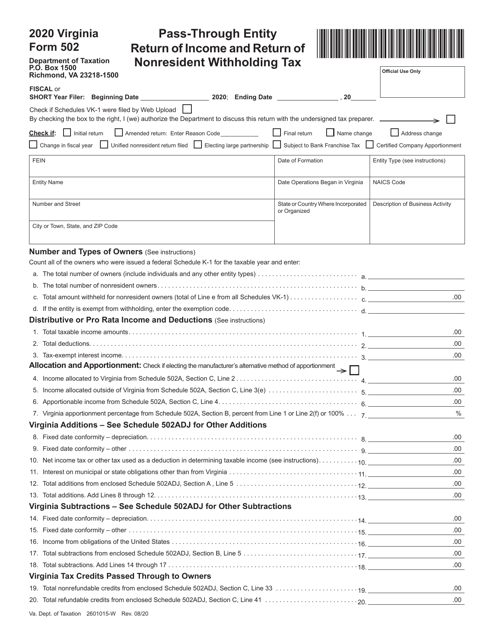

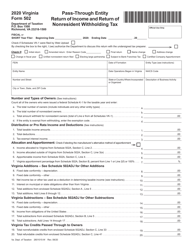

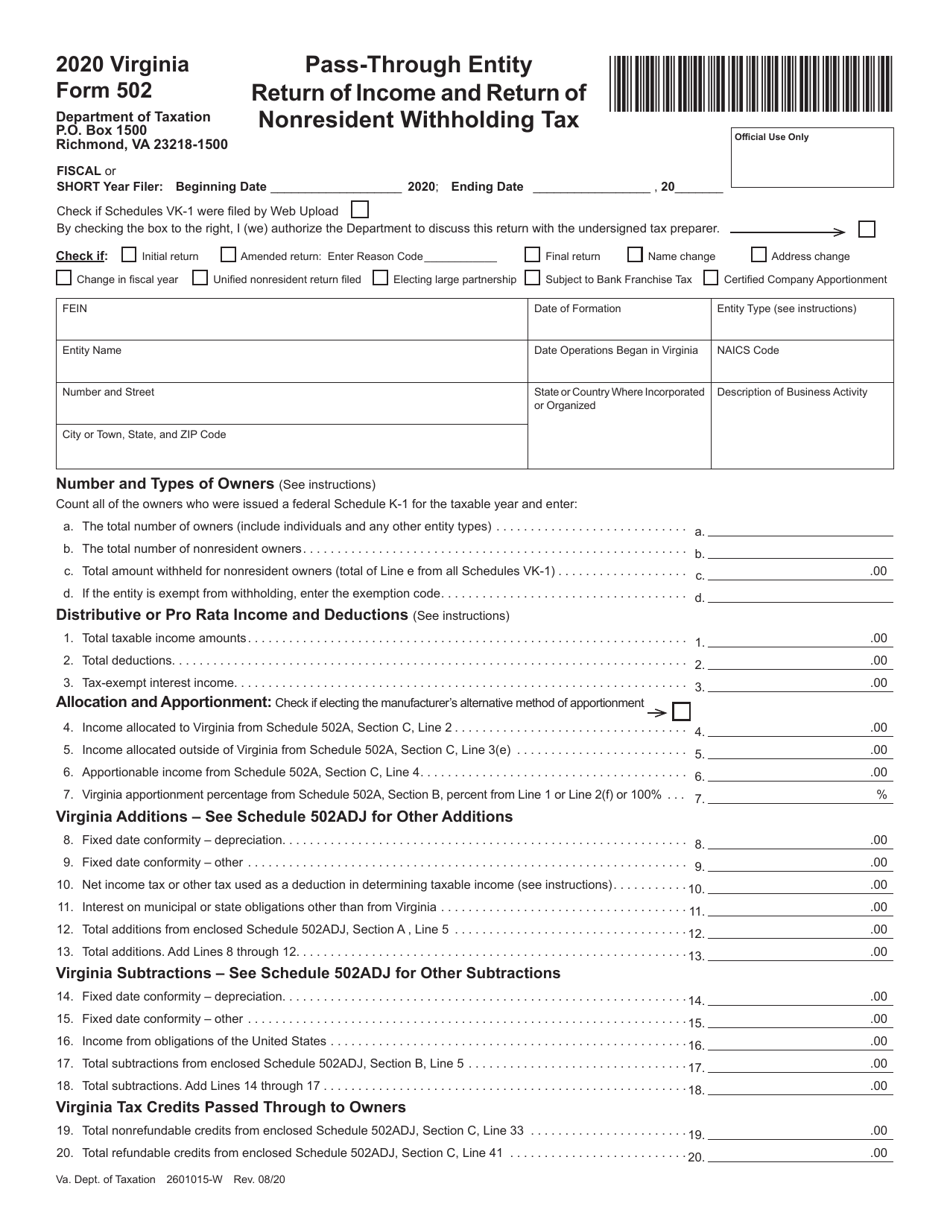

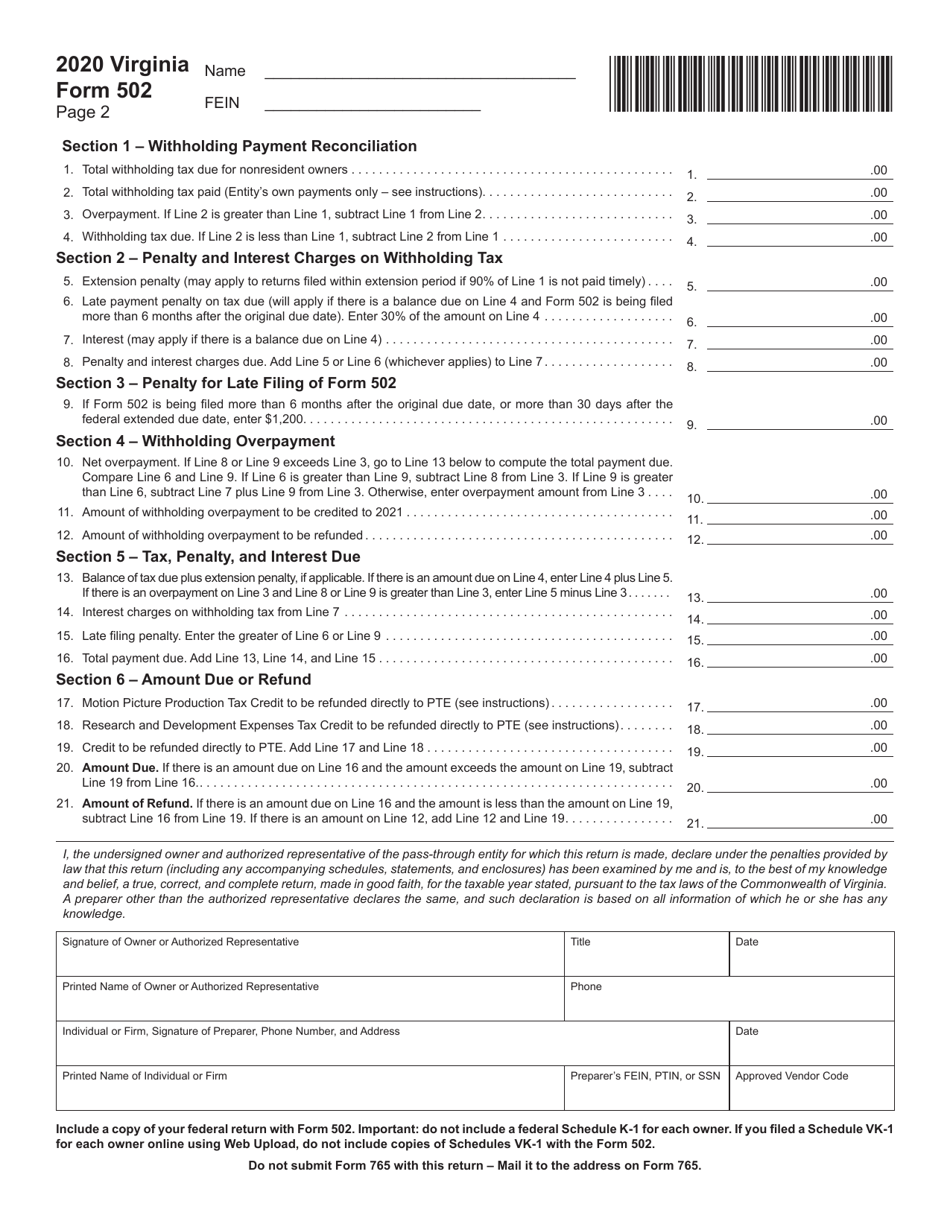

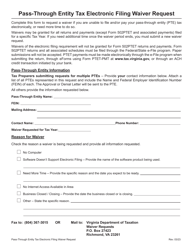

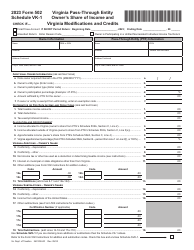

Form 502 Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax - Virginia

What Is Form 502?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 502?

A: Form 502 is the Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax in the state of Virginia.

Q: Who needs to file Form 502?

A: Pass-through entities such as partnerships, S corporations, limited liability companies, and others that are required to file a return of income in Virginia need to file Form 502.

Q: What is the purpose of Form 502?

A: The purpose of Form 502 is to report the income, deductions, and credits of pass-through entities in Virginia as well as any nonresident withholding tax.

Q: What is nonresident withholding tax?

A: Nonresident withholding tax is a tax that is withheld from nonresident individuals or entities who receive income from Virginia sources.

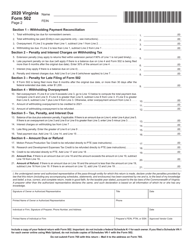

Q: When is Form 502 due?

A: Form 502 is generally due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form 502?

A: Yes, there may be penalties for late filing or failure to file Form 502, so it is important to file on time.

Q: Is Form 502 required for individual taxpayers?

A: No, Form 502 is specifically for pass-through entities and not for individual taxpayers.

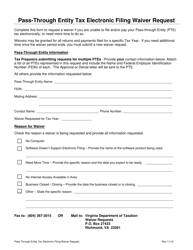

Q: Can Form 502 be filed electronically?

A: Yes, Form 502 can be filed electronically through the Virginia Department of Taxation's eForms system.

Q: Can Form 502 be amended if there are errors or changes?

A: Yes, if there are errors or changes to the original Form 502, you can file an amended return using Form 502X.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.