This version of the form is not currently in use and is provided for reference only. Download this version of

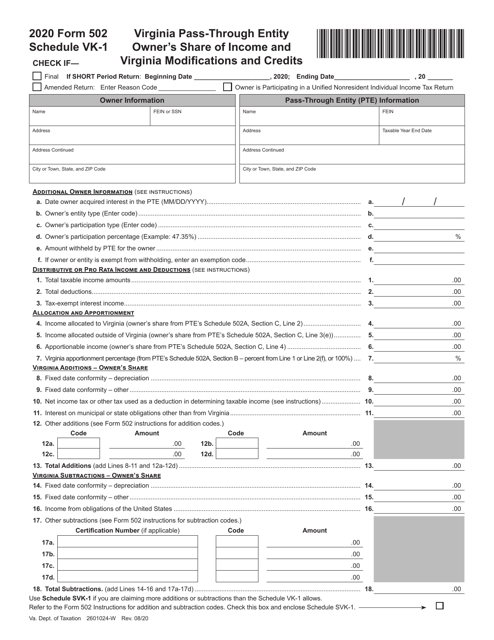

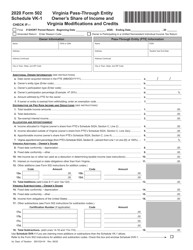

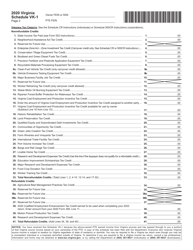

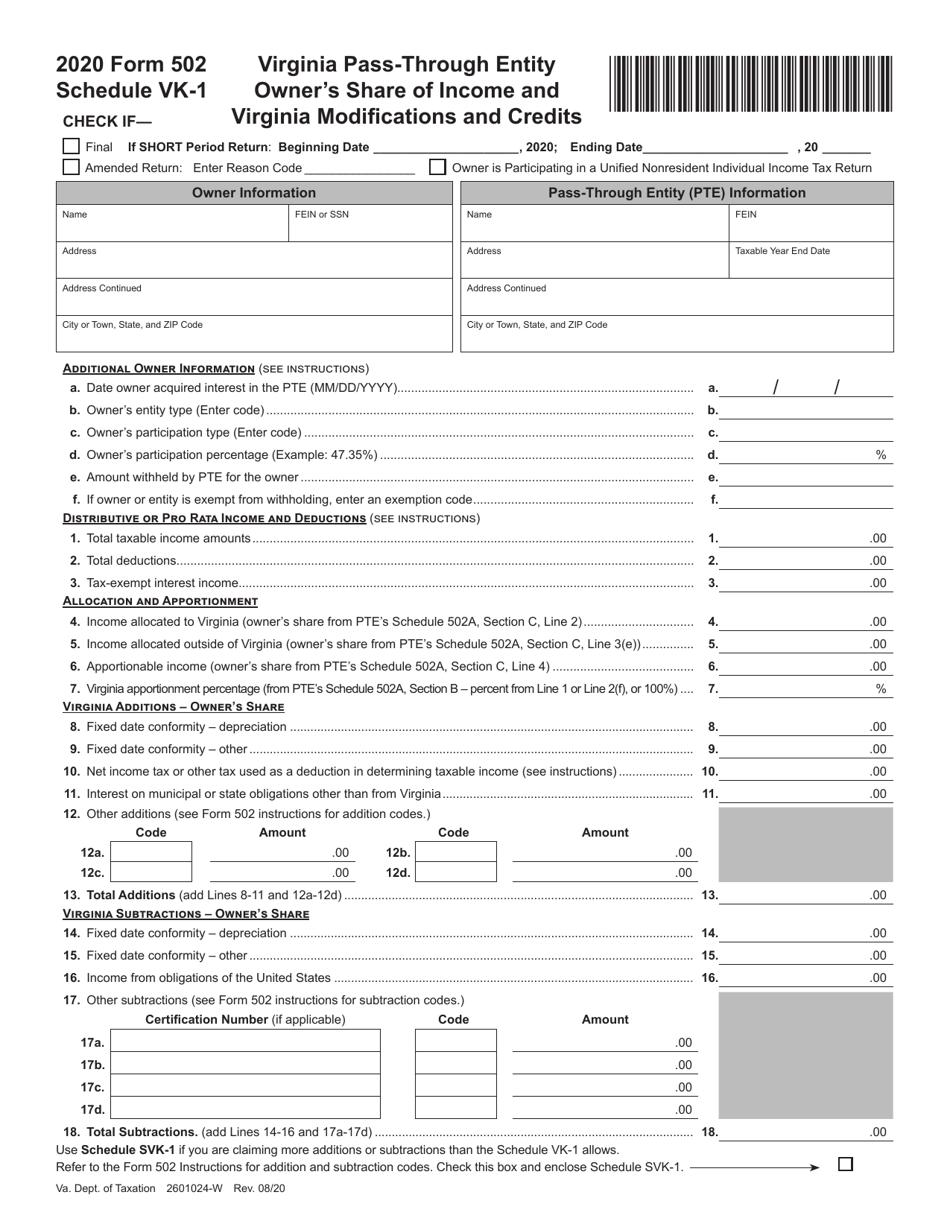

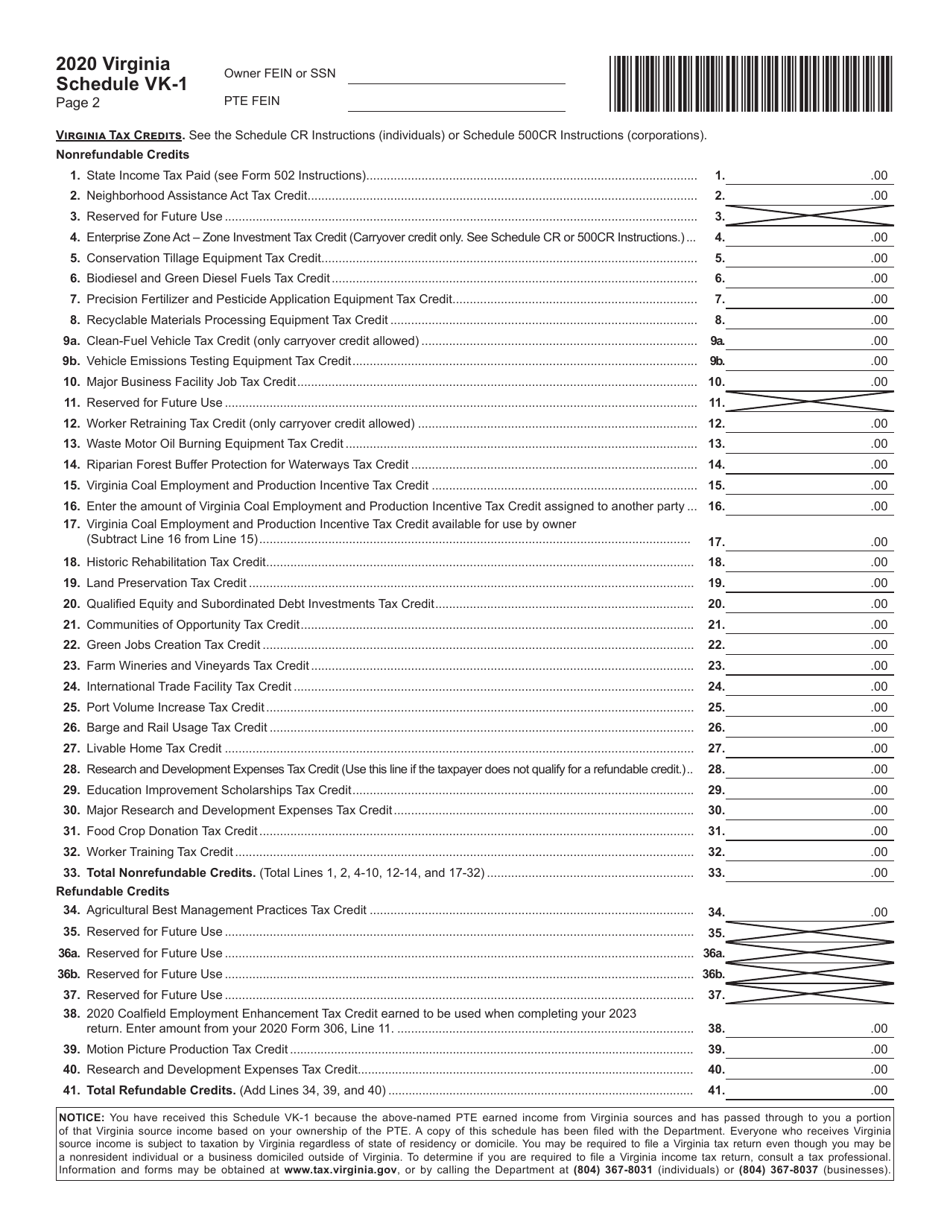

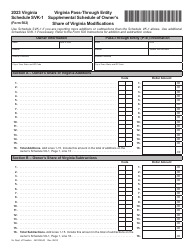

Form 502 Schedule VK-1

for the current year.

Form 502 Schedule VK-1 Virginia Pass-Through Entity Owner's Share of Income and Virginia Modifications and Credits - Virginia

What Is Form 502 Schedule VK-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 502, Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502 Schedule VK-1?

A: Form 502 Schedule VK-1 is used in Virginia to report a pass-through entity owner's share of income, modifications, and credits.

Q: Who needs to file Form 502 Schedule VK-1?

A: Pass-through entity owners in Virginia need to file Form 502 Schedule VK-1 to report their share of income, modifications, and credits.

Q: What is considered a pass-through entity in Virginia?

A: Pass-through entities in Virginia include partnerships, limited liability companies (LLCs), and S corporations.

Q: What information is reported on Form 502 Schedule VK-1?

A: Form 502 Schedule VK-1 reports a pass-through entity owner's share of income, modifications, and credits for Virginia state tax purposes.

Q: Are there any deadlines for filing Form 502 Schedule VK-1 in Virginia?

A: Yes, the deadline for filing Form 502 Schedule VK-1 in Virginia is the same as the pass-through entity's filing deadline, which is typically on or before March 15th.

Q: Are there any penalties for not filing Form 502 Schedule VK-1 in Virginia?

A: Yes, failure to file Form 502 Schedule VK-1 in Virginia may result in penalties and interest being assessed by the Virginia Department of Taxation.

Q: Can I amend Form 502 Schedule VK-1 in Virginia?

A: Yes, if you need to make changes or corrections to a previously filed Form 502 Schedule VK-1 in Virginia, you can file an amended return using Form 502X.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 Schedule VK-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.