This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule A

for the current year.

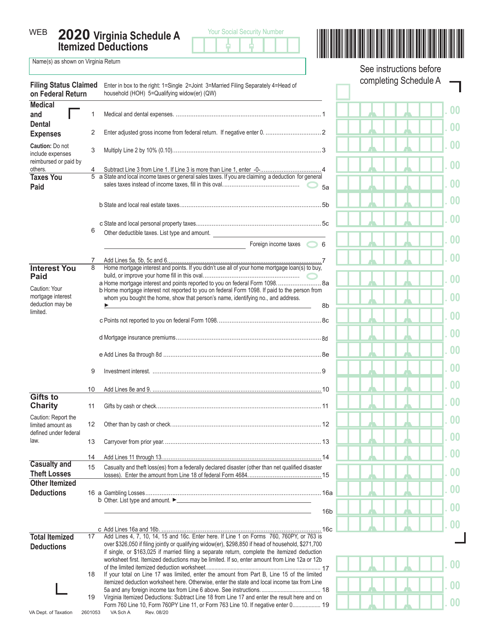

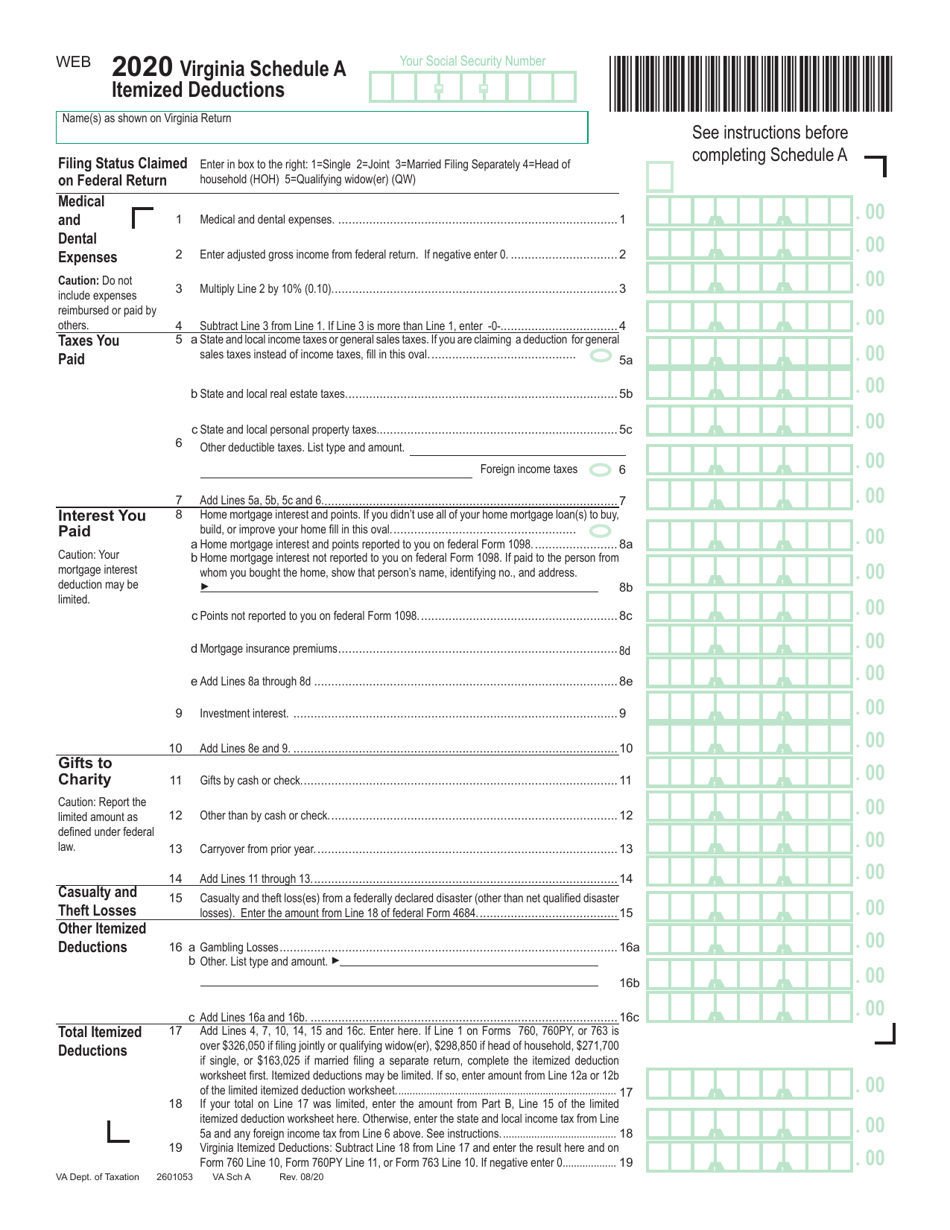

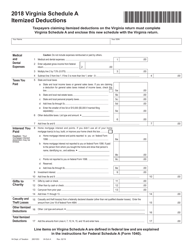

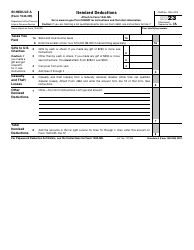

Schedule A Virginia Itemized Deductions - Virginia

What Is Schedule A?

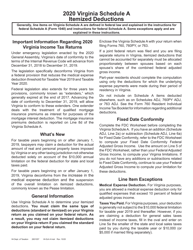

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule A Virginia Itemized Deductions?

A: Schedule A Virginia Itemized Deductions is a form used by Virginia residents to claim deductions on their state income taxes.

Q: What deductions can be claimed on Schedule A Virginia Itemized Deductions?

A: Some common deductions that can be claimed on Schedule A Virginia Itemized Deductions include medical expenses, mortgage interest, real estate taxes, charitable contributions, and certain job-related expenses.

Q: How do I know if I should itemize deductions on my Virginia state taxes?

A: You should consider itemizing deductions on your Virginia state taxes if your total deductions exceed the standard deduction amount set by the state.

Q: Do I need to attach Schedule A Virginia Itemized Deductions to my federal tax return?

A: No, Schedule A Virginia Itemized Deductions is only used for your Virginia state tax return and should not be attached to your federal tax return.

Q: Are all deductions allowed on Schedule A Virginia Itemized Deductions?

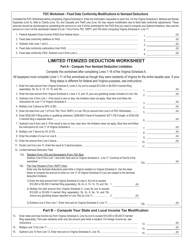

A: Not all deductions allowed on the federal Schedule A are allowed on Schedule A Virginia Itemized Deductions. Virginia has its own rules and limitations for deductions, so it's important to review the specific instructions provided by the Virginia Department of Taxation.

Q: Can I file Schedule A Virginia Itemized Deductions electronically?

A: Yes, Virginia residents have the option to file their state tax return electronically, including Schedule A Virginia Itemized Deductions, if they choose to do so.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.