This version of the form is not currently in use and is provided for reference only. Download this version of

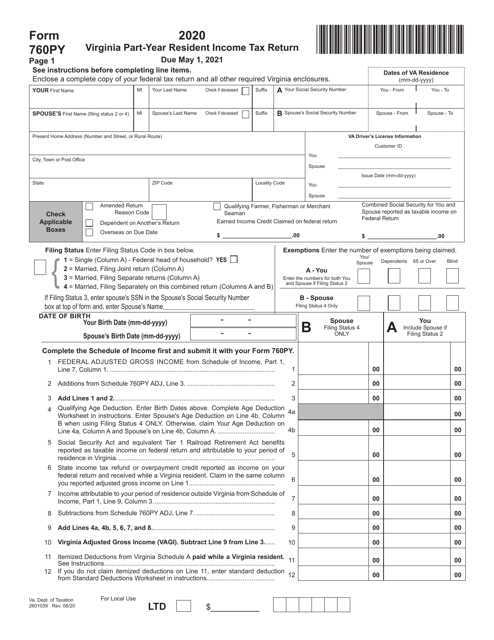

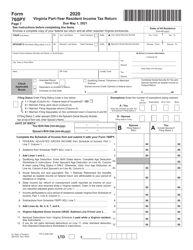

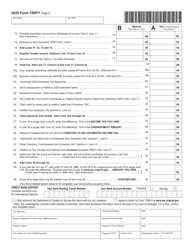

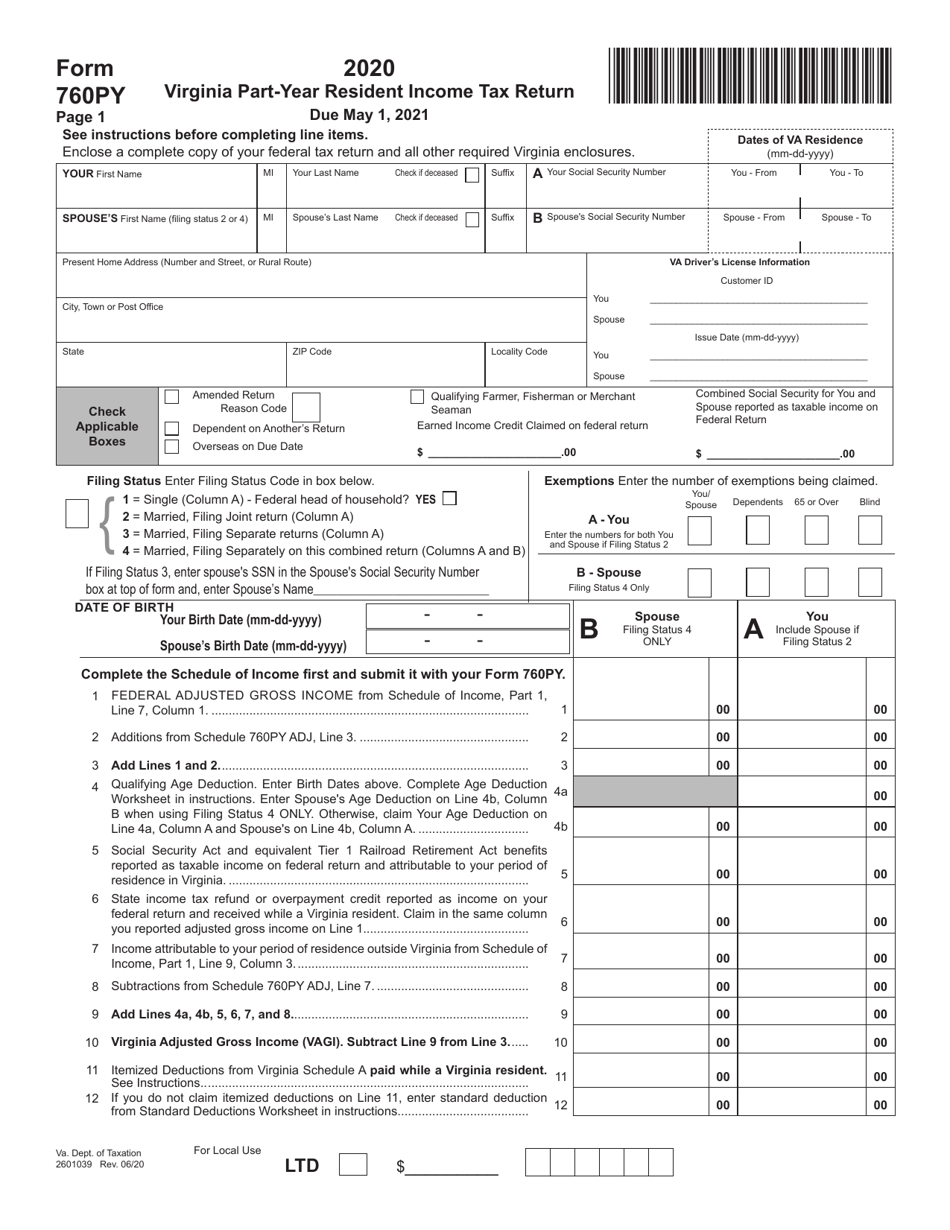

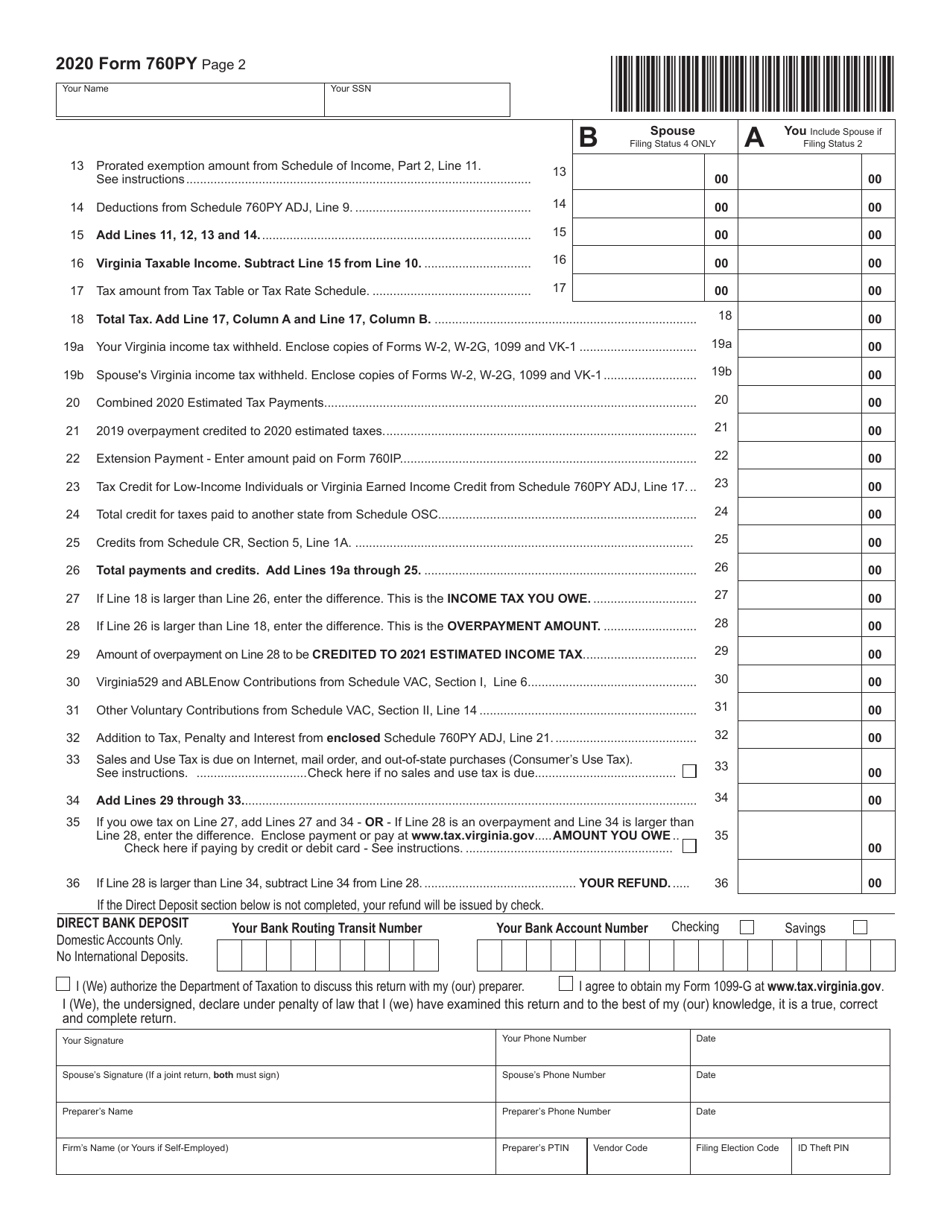

Form 760PY

for the current year.

Form 760PY Part-Year Resident Individual Income Tax Return - Virginia

What Is Form 760PY?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 760PY?

A: Form 760PY is the Part-Year Resident Individual Income Tax Return for Virginia.

Q: Who needs to file Form 760PY?

A: Part-year residents of Virginia who have earned income in the state or have Virginia source income may need to file Form 760PY.

Q: What is a part-year resident?

A: A part-year resident is an individual who has lived in Virginia for only a portion of the tax year.

Q: What is Virginia source income?

A: Virginia source income includes income earned from sources within the state, such as wages from a job located in Virginia.

Q: When is the deadline to file Form 760PY?

A: The deadline to file Form 760PY is generally the same as the deadline for filing your federal income tax return, which is April 15th.

Q: Are there any special considerations for part-year residents on Form 760PY?

A: Yes, part-year residents may need to prorate their income, deductions, and credits based on the portion of the tax year they were a resident of Virginia.

Q: Do part-year residents need to file a tax return in their previous state of residence?

A: Part-year residents may be required to file a tax return in their previous state of residence, depending on the rules of that state.

Q: Is there any fee for filing Form 760PY?

A: There is no fee for filing Form 760PY.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760PY by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.