This version of the form is not currently in use and is provided for reference only. Download this version of

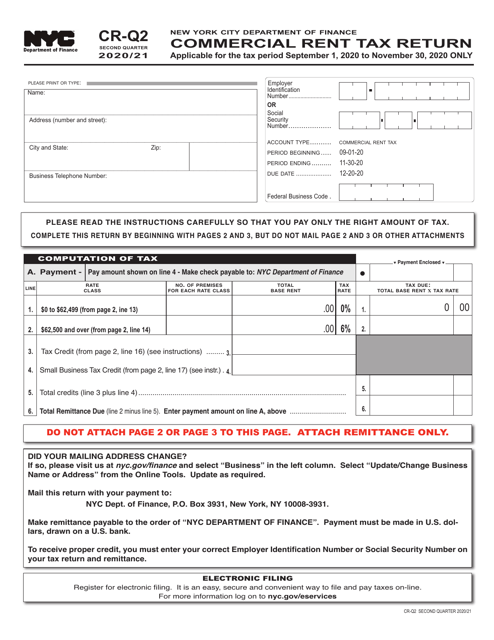

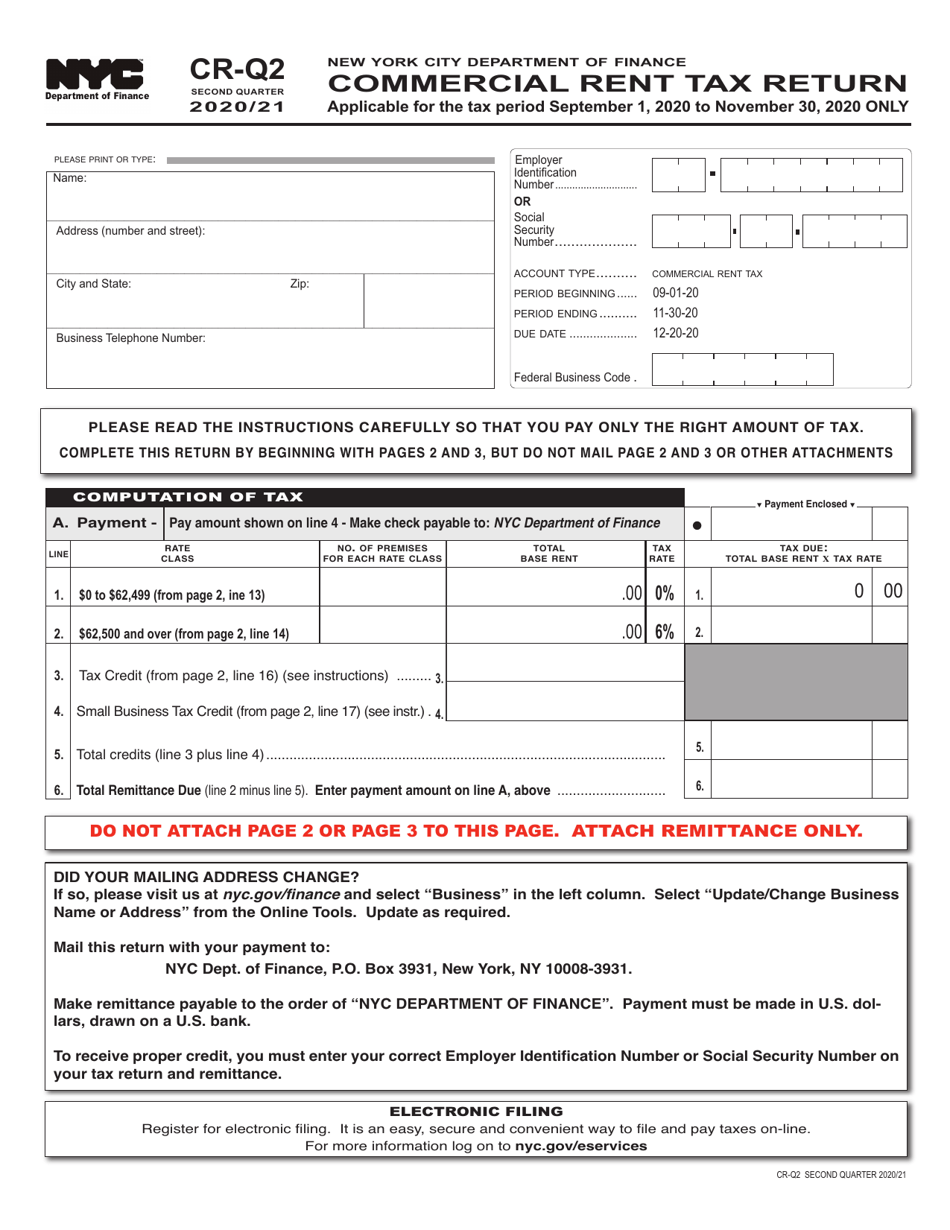

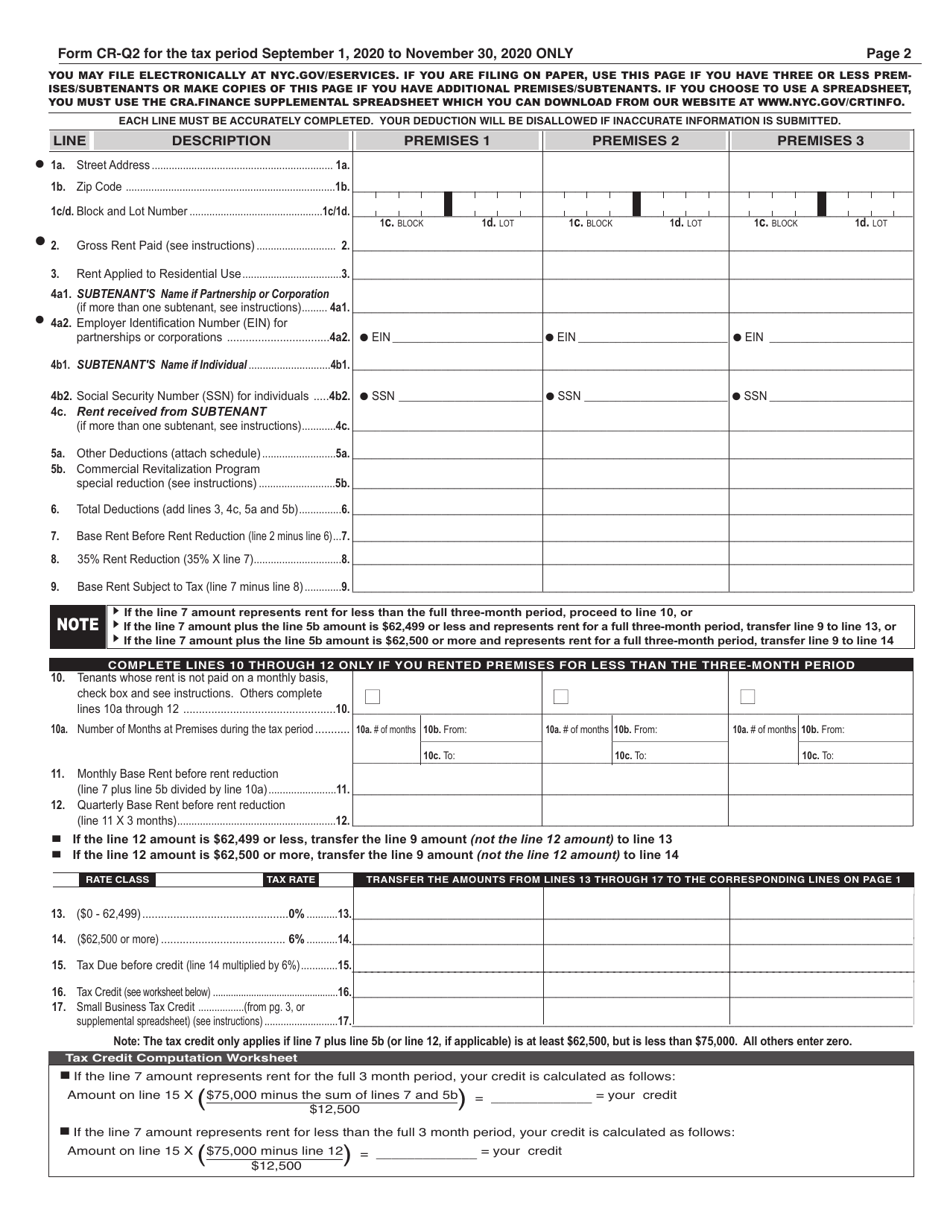

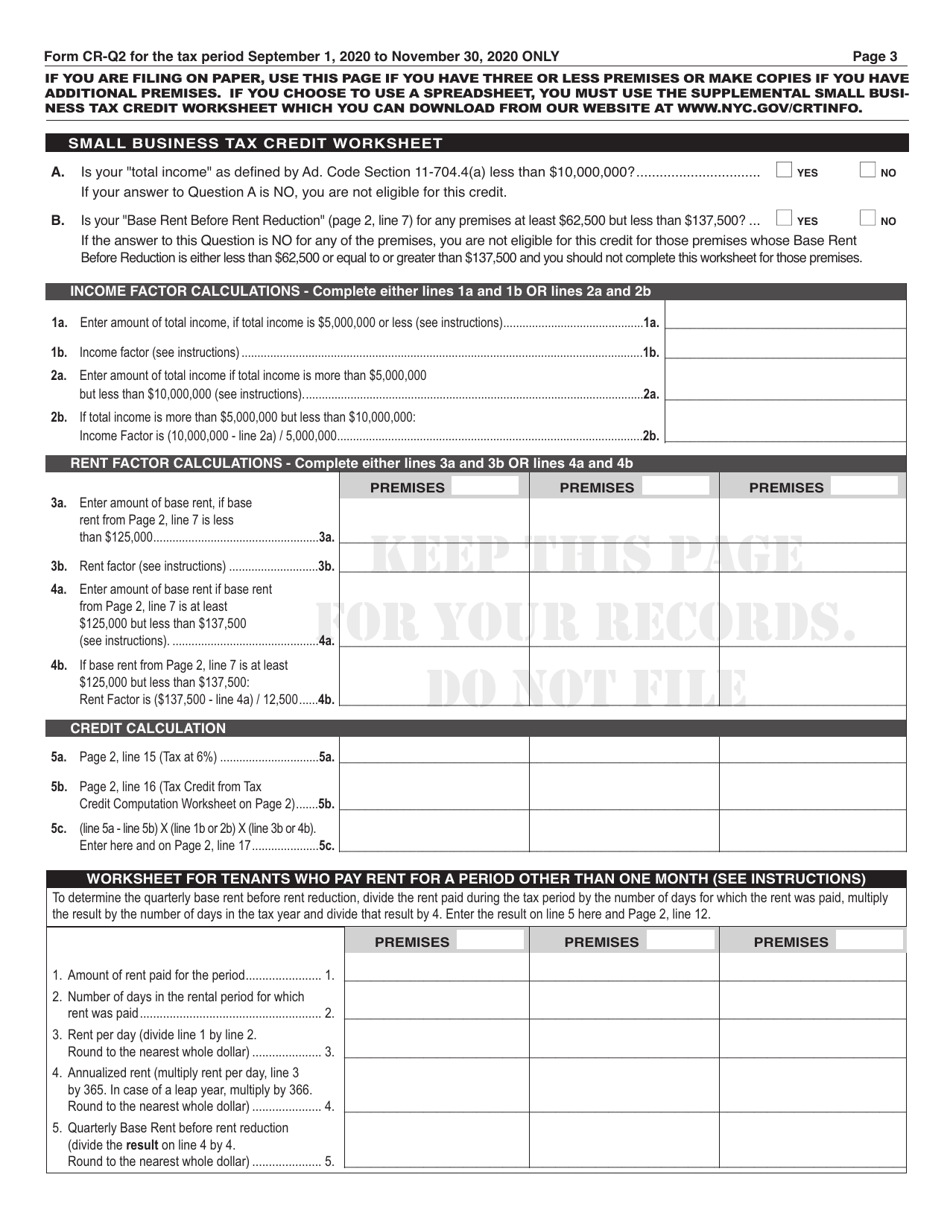

Form CR-Q2

for the current year.

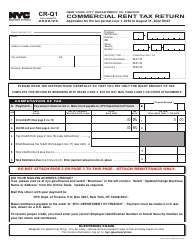

Form CR-Q2 Commercial Rent Tax 2nd Quarter Return - New York City

What Is Form CR-Q2?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-Q2?

A: Form CR-Q2 is the Commercial Rent Tax 2nd Quarter Return for businesses in New York City.

Q: Who needs to file Form CR-Q2?

A: Businesses in New York City that are required to pay the Commercial Rent Tax need to file Form CR-Q2.

Q: What is the purpose of Form CR-Q2?

A: Form CR-Q2 is used to report and pay the Commercial Rent Tax for the 2nd quarter.

Q: When is Form CR-Q2 due?

A: Form CR-Q2 is typically due on or before the 25th day of the month following the end of the quarter.

Q: Are there any penalties for late filing or payment?

A: Yes, there may be penalties for late filing or payment of the Commercial Rent Tax.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-Q2 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.