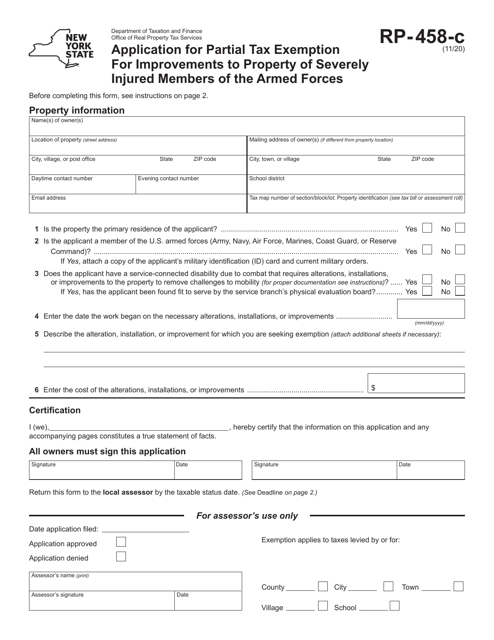

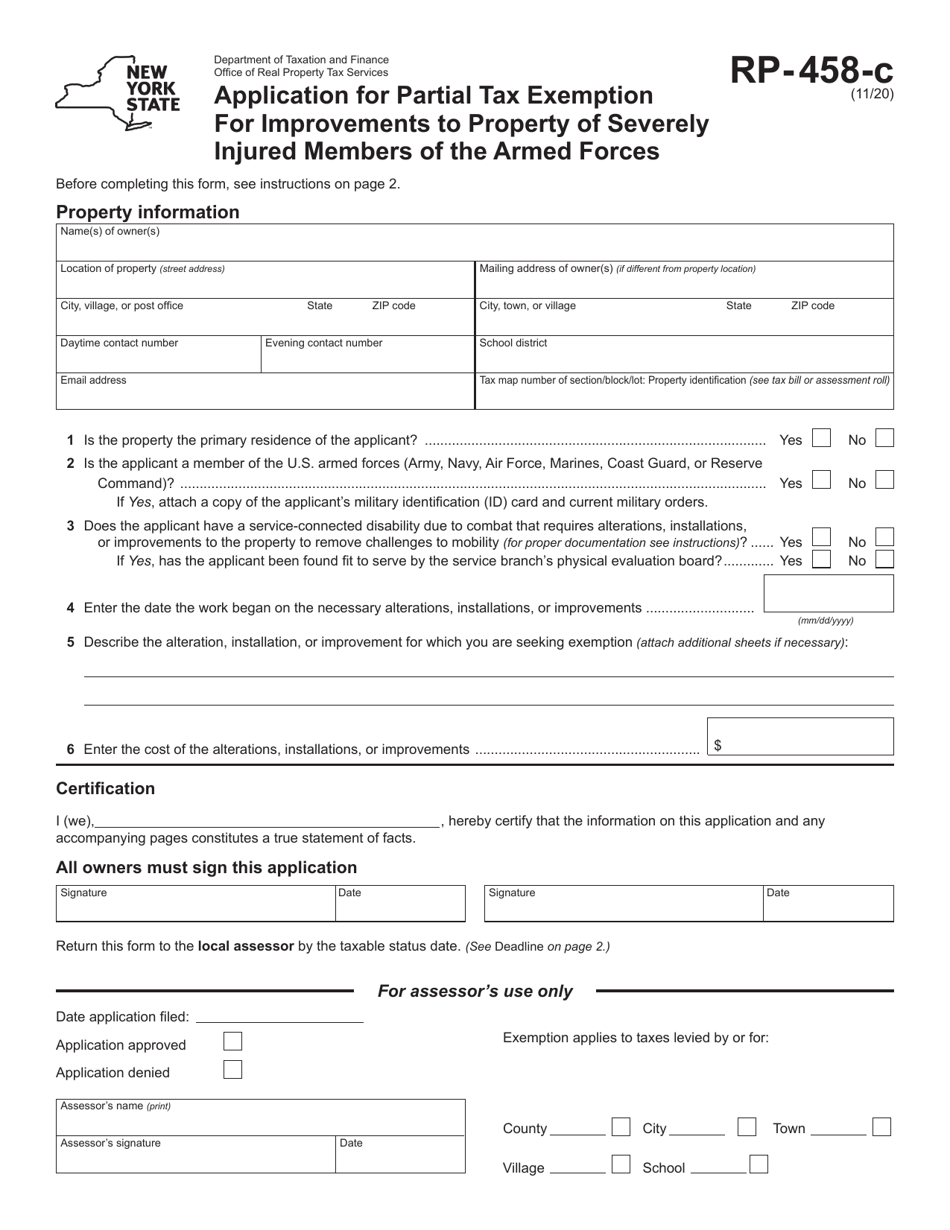

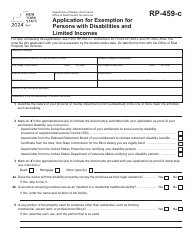

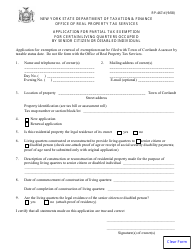

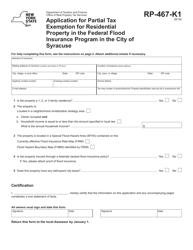

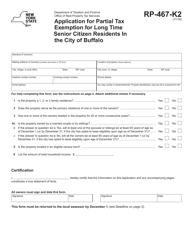

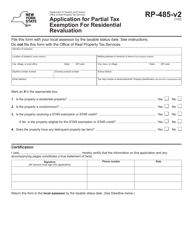

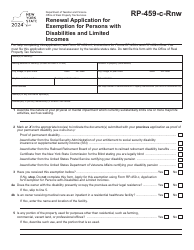

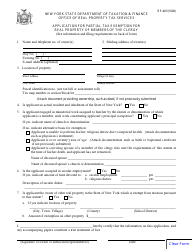

Form RP-458-C Application for Partial Tax Exemption for Improvements to Property of Severely Injured Members of the Armed Forces - New York

What Is Form RP-458-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-458-C?

A: Form RP-458-C is the application for partial tax exemption for improvements to property of severely injured members of the Armed Forces in New York.

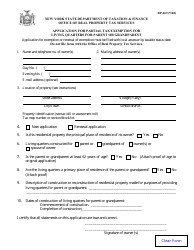

Q: Who can use Form RP-458-C?

A: Form RP-458-C can be used by severely injured members of the Armed Forces in New York who have made improvements to their property.

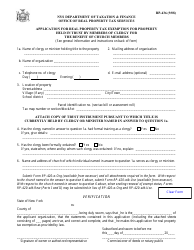

Q: What is the purpose of Form RP-458-C?

A: The purpose of Form RP-458-C is to apply for a partial tax exemption on property improvements for severely injured members of the Armed Forces in New York.

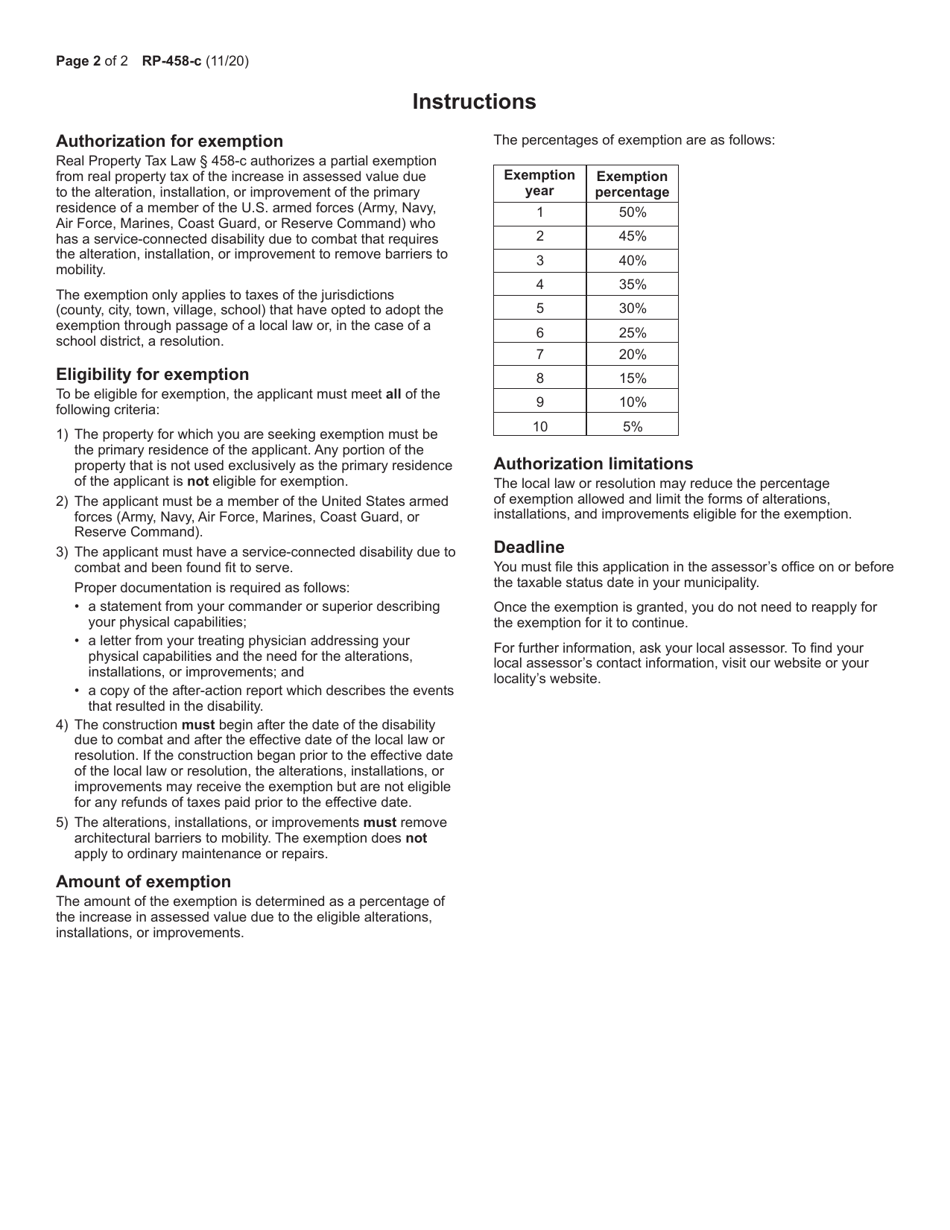

Q: What does the partial tax exemption apply to?

A: The partial tax exemption applies to improvements made to the property of severely injured members of the Armed Forces in New York.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

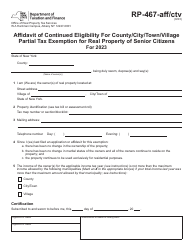

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-458-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.