This version of the form is not currently in use and is provided for reference only. Download this version of

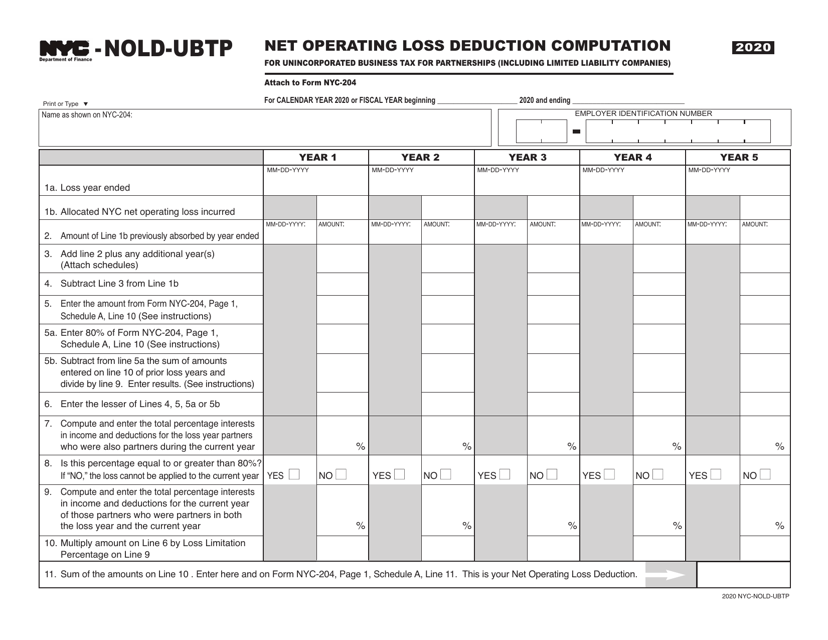

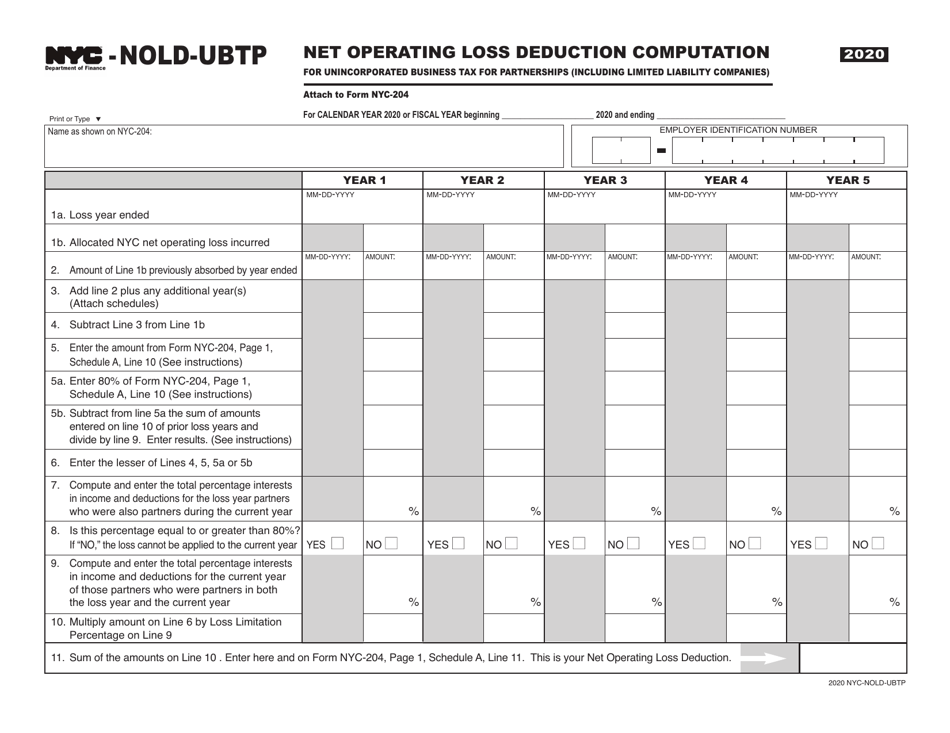

Form NYC-NOLD-UBTP

for the current year.

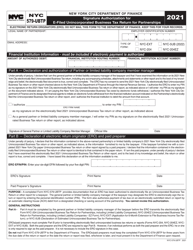

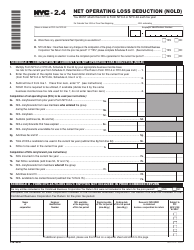

Form NYC-NOLD-UBTP Net Operating Loss Deduction Computation for Unincorporated Business Tax for Partnerships (Including Limited Liability Companies) - New York City

What Is Form NYC-NOLD-UBTP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

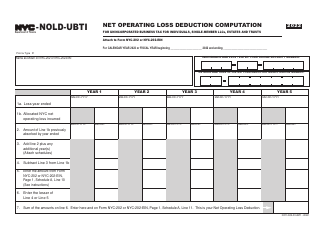

Q: What is the NYC-NOLD-UBTP Net Operating Loss Deduction Computation?

A: The NYC-NOLD-UBTP Net Operating Loss Deduction Computation is a calculation used to determine the net operating loss deducation for unincorporated businesses in New York City.

Q: Who is eligible for the NYC-NOLD-UBTP Net Operating Loss Deduction?

A: Partnerships and limited liability companies (LLCs) in New York City are eligible for the NYC-NOLD-UBTP Net Operating Loss Deduction.

Q: What is the purpose of the NYC-NOLD-UBTP Net Operating Loss Deduction?

A: The purpose of the NYC-NOLD-UBTP Net Operating Loss Deduction is to allow businesses to offset losses against income in order to reduce their overall tax liability.

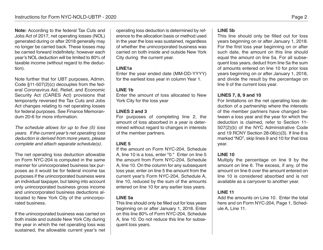

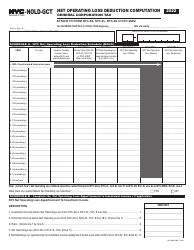

Q: How is the NYC-NOLD-UBTP Net Operating Loss Deduction calculated?

A: The NYC-NOLD-UBTP Net Operating Loss Deduction is calculated by subtracting deductible expenses and losses from gross income for the tax year.

Q: Are there any limitations on the NYC-NOLD-UBTP Net Operating Loss Deduction?

A: Yes, there are limitations on the NYC-NOLD-UBTP Net Operating Loss Deduction, including a carryback and carryforward limitation.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-NOLD-UBTP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.