This version of the form is not currently in use and is provided for reference only. Download this version of

Form NYC-UXS

for the current year.

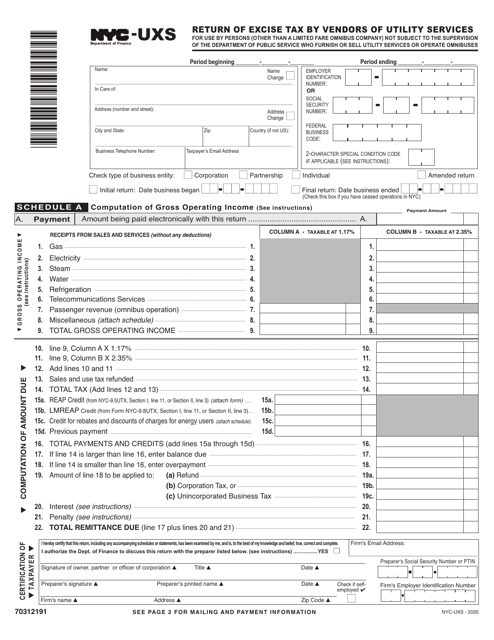

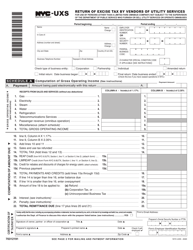

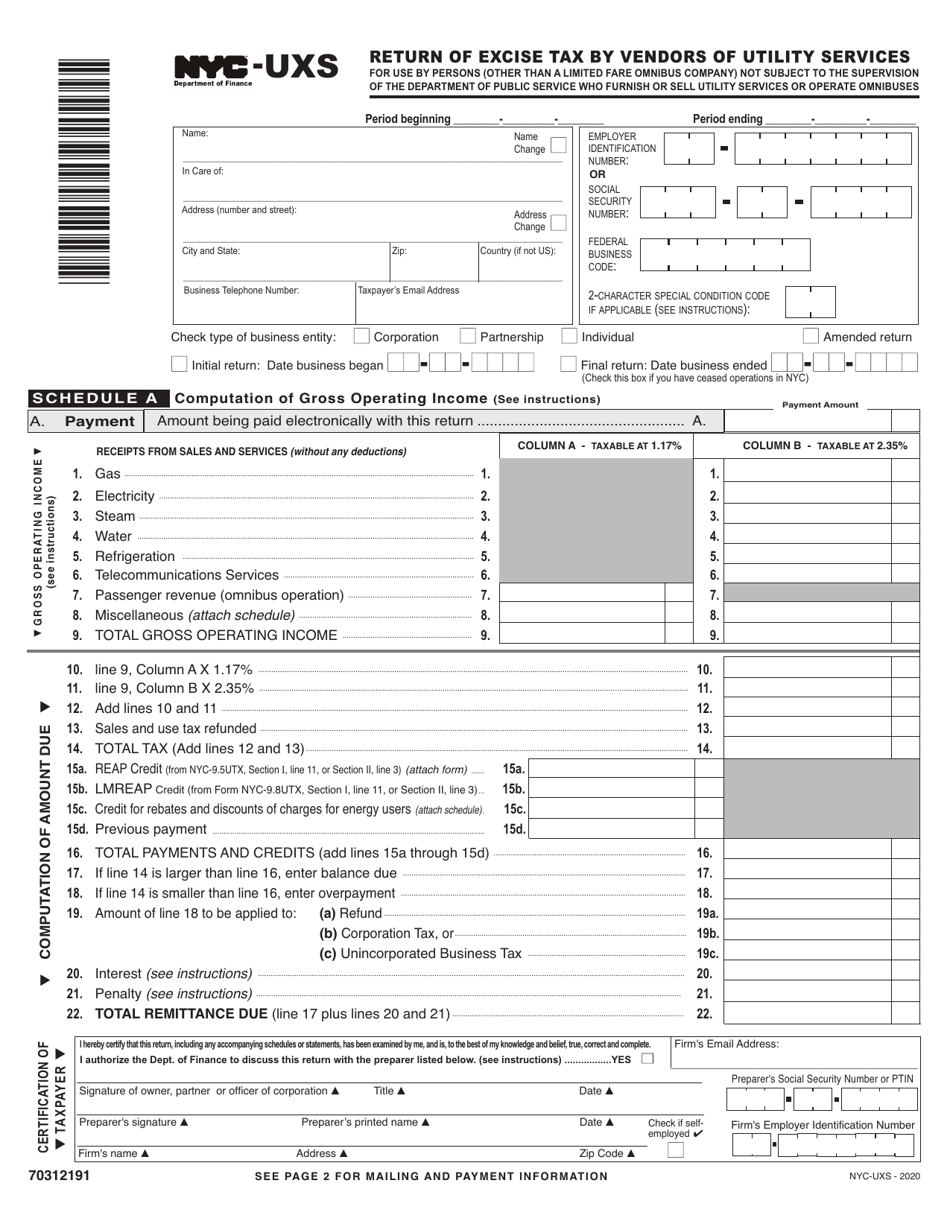

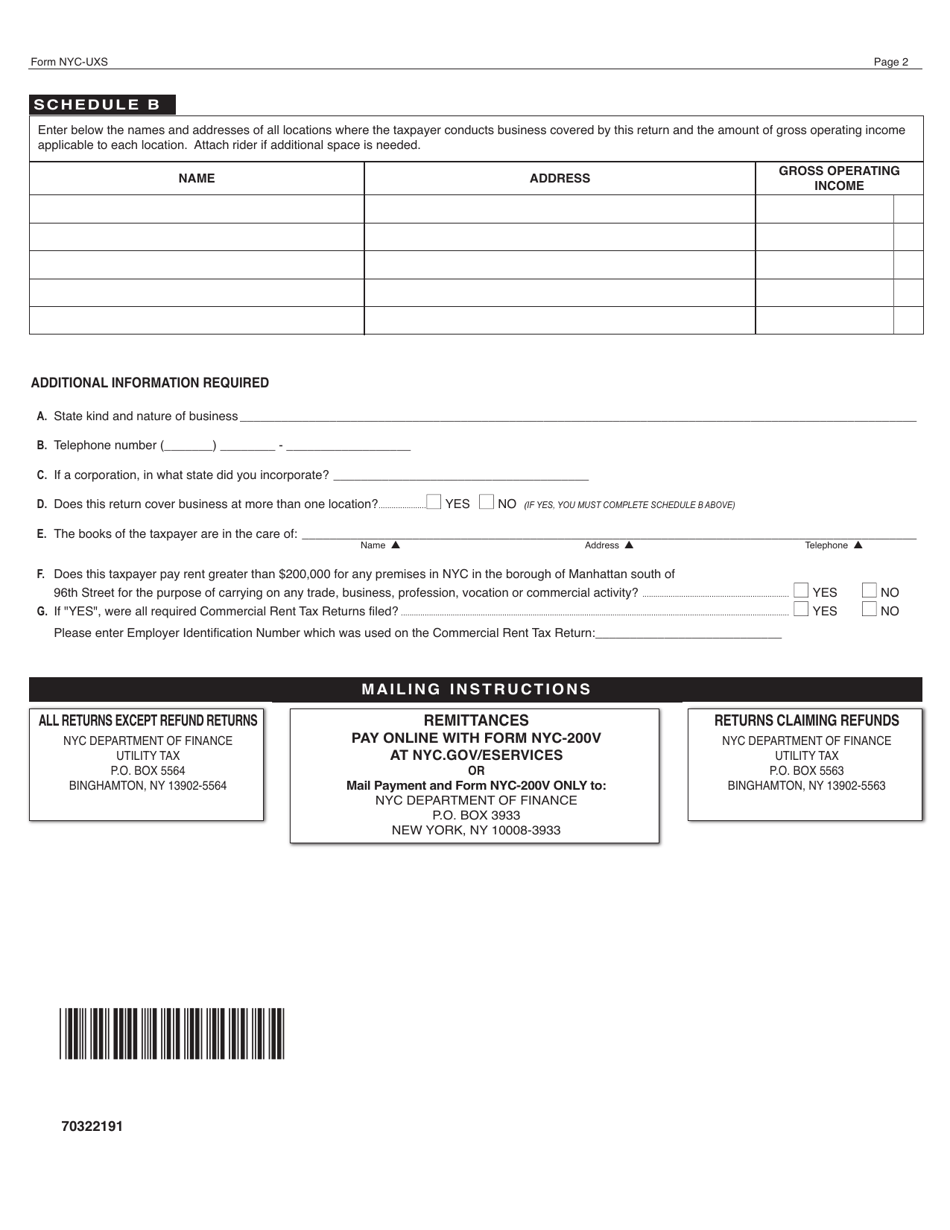

Form NYC-UXS Return of Excise Tax by Vendors of Utility Services - New York City

What Is Form NYC-UXS?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-UXS Return of Excise Tax?

A: The NYC-UXS Return of Excise Tax is a form that vendors of utility services in New York City need to file.

Q: Who needs to file the NYC-UXS Return of Excise Tax?

A: Vendors of utility services in New York City need to file the NYC-UXS Return of Excise Tax.

Q: What is the purpose of the NYC-UXS Return of Excise Tax?

A: The purpose of the NYC-UXS Return of Excise Tax is to report and remit the excise tax on utility services collected from customers.

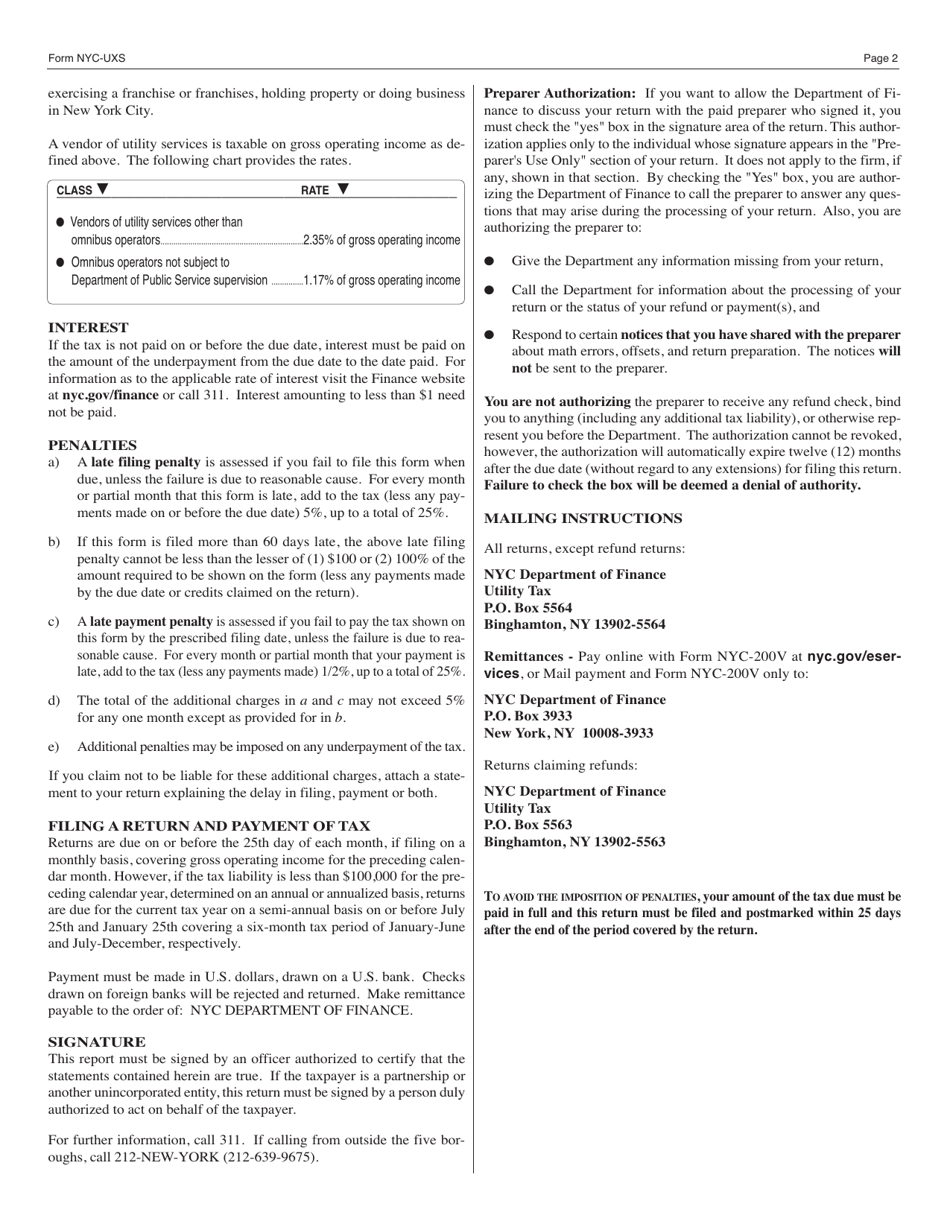

Q: How often do vendors need to file the NYC-UXS Return of Excise Tax?

A: Vendors need to file the NYC-UXS Return of Excise Tax on a quarterly basis.

Q: What information is required on the NYC-UXS Return of Excise Tax?

A: The NYC-UXS Return of Excise Tax requires vendors to provide information about their sales, tax collected, and deductions.

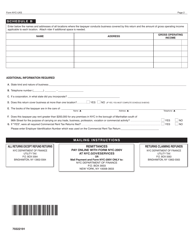

Q: Are there any penalties for not filing the NYC-UXS Return of Excise Tax?

A: Yes, there are penalties for not filing the NYC-UXS Return of Excise Tax, including late filing penalties and interest charges on unpaid taxes.

Q: Is there any assistance available for vendors in filing the NYC-UXS Return of Excise Tax?

A: Yes, vendors can contact the New York City Department of Finance for assistance in filing the NYC-UXS Return of Excise Tax.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-UXS by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.