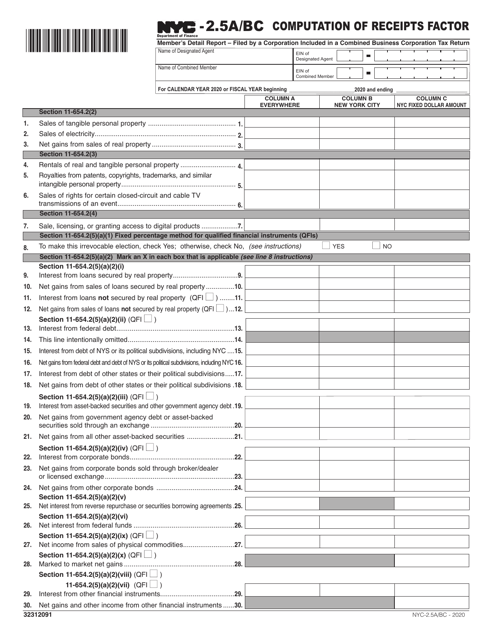

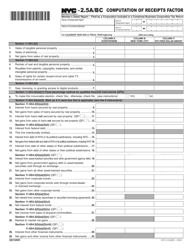

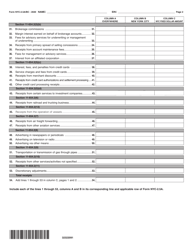

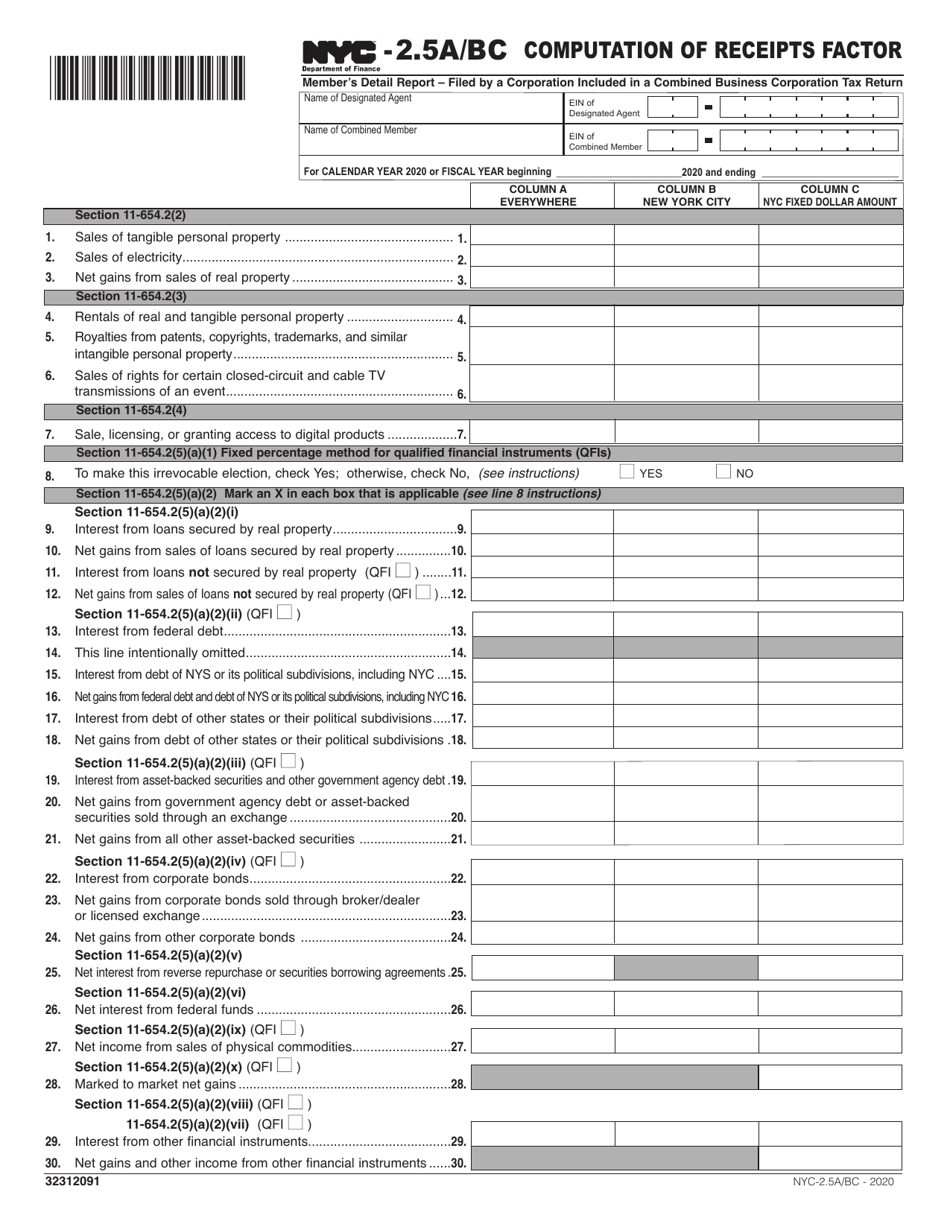

This version of the form is not currently in use and is provided for reference only. Download this version of

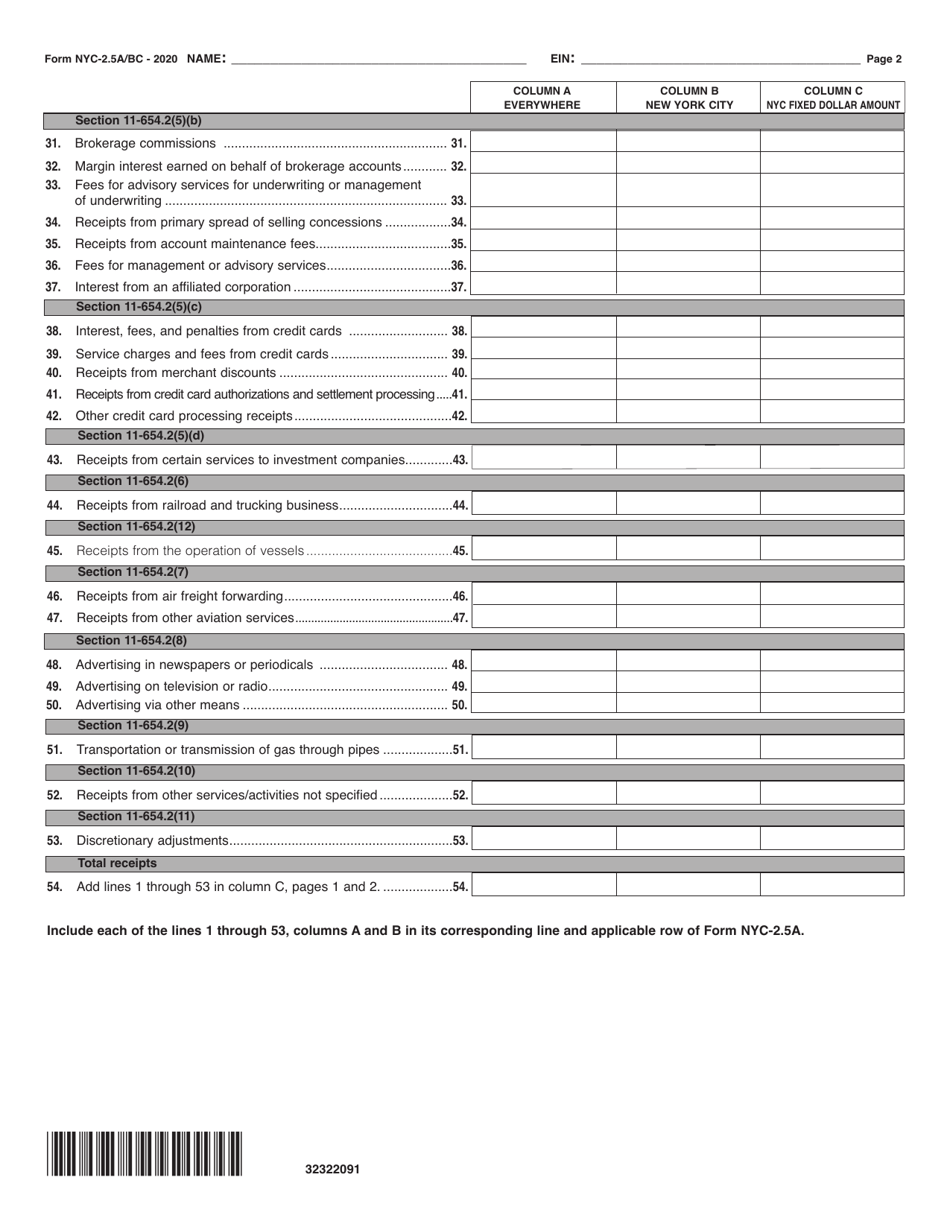

Form NYC-2.5A/BC

for the current year.

Form NYC-2.5A / BC Computation of Receipts Factor - New York City

What Is Form NYC-2.5A/BC?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the NYC-2.5A/BC form?

A: The NYC-2.5A/BC form is used to compute the receipts factor for New York City.

Q: What is the receipts factor?

A: The receipts factor is a ratio used to determine the portion of a business's receipts that are attributable to New York City.

Q: Why is the receipts factor important?

A: The receipts factor is important because it determines the portion of a business's income that is subject to tax in New York City.

Q: How is the receipts factor calculated?

A: The receipts factor is calculated by dividing the business's receipts sourced to New York City by its total receipts.

Q: What are sourced receipts?

A: Sourced receipts are the receipts that are attributed to a specific location, such as New York City.

Q: What are total receipts?

A: Total receipts are the business's overall receipts, including those from all locations.

Q: What is the purpose of the NYC-2.5A/BC form?

A: The purpose of the NYC-2.5A/BC form is to provide a standardized method for calculating the receipts factor for businesses in New York City.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5A/BC by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.