This version of the form is not currently in use and is provided for reference only. Download this version of

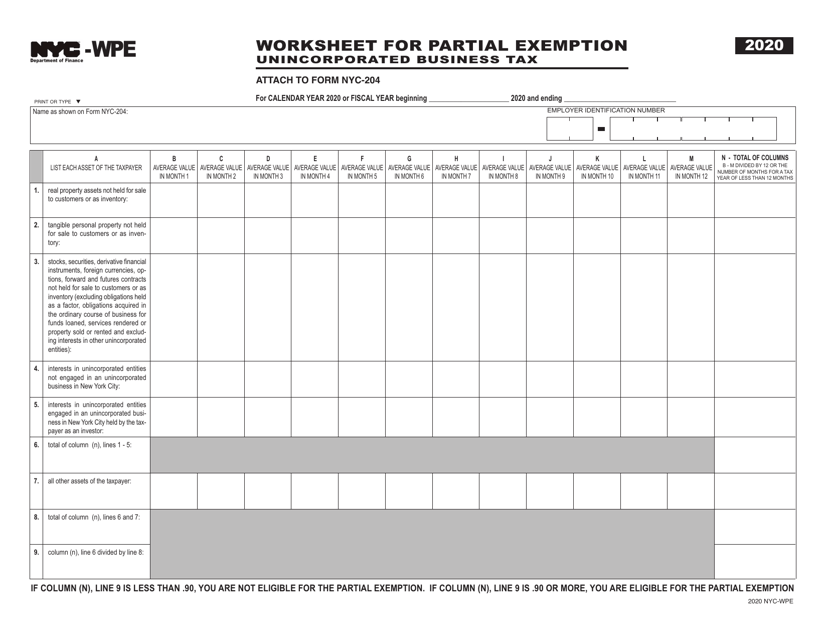

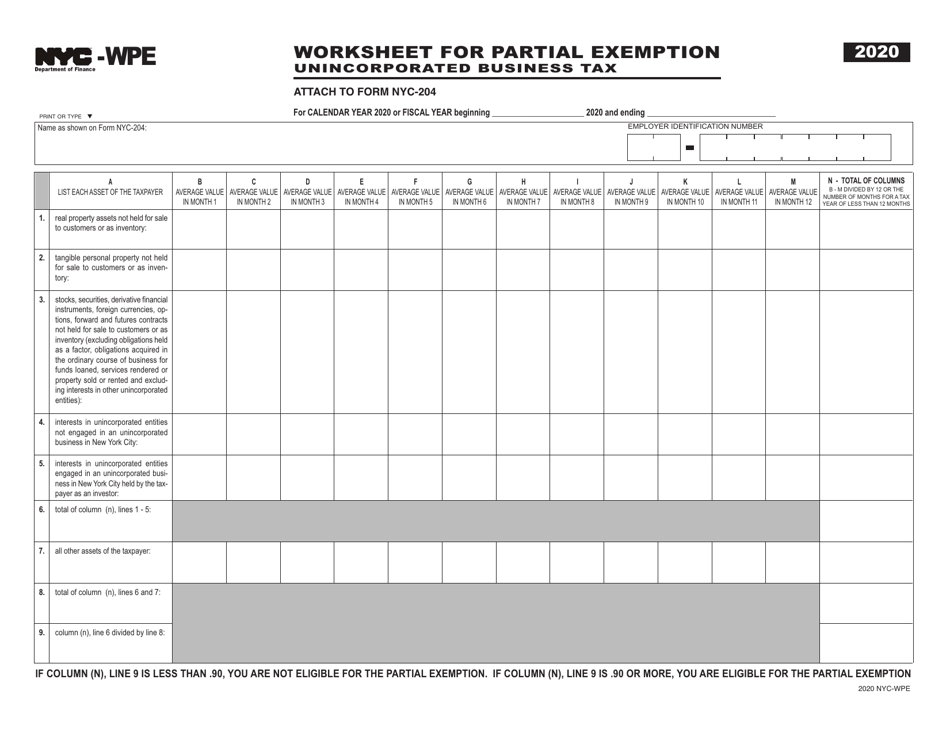

Form NYC-WPE

for the current year.

Form NYC-WPE Worksheet for Partial Exemption - New York City

What Is Form NYC-WPE?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-WPE Worksheet for Partial Exemption?

A: The NYC-WPE Worksheet for Partial Exemption is a form used in New York City to determine eligibility for real property tax exemptions.

Q: Who is eligible for the partial exemption?

A: Eligibility for the partial exemption is based on certain criteria set by the New York City Department of Finance.

Q: How do I fill out the NYC-WPE Worksheet for Partial Exemption?

A: The worksheet includes instructions on how to fill it out accurately. It requires information about the property and its owner.

Q: What documents do I need to submit with the NYC-WPE Worksheet for Partial Exemption?

A: The required documents may include proof of ownership, income documentation, and other supporting materials. Check the worksheet or consult with the New York City Department of Finance for specific requirements.

Q: What is the deadline for submitting the NYC-WPE Worksheet for Partial Exemption?

A: The deadline for submitting the worksheet is generally March 15th of each year, but check with the New York City Department of Finance for any updates or changes to the deadline.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-WPE by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.