This version of the form is not currently in use and is provided for reference only. Download this version of

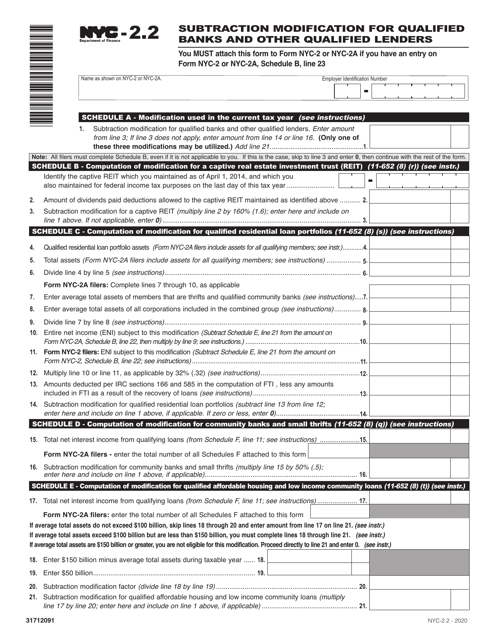

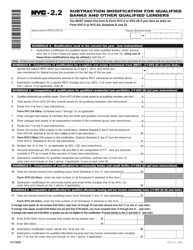

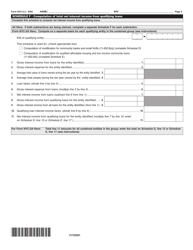

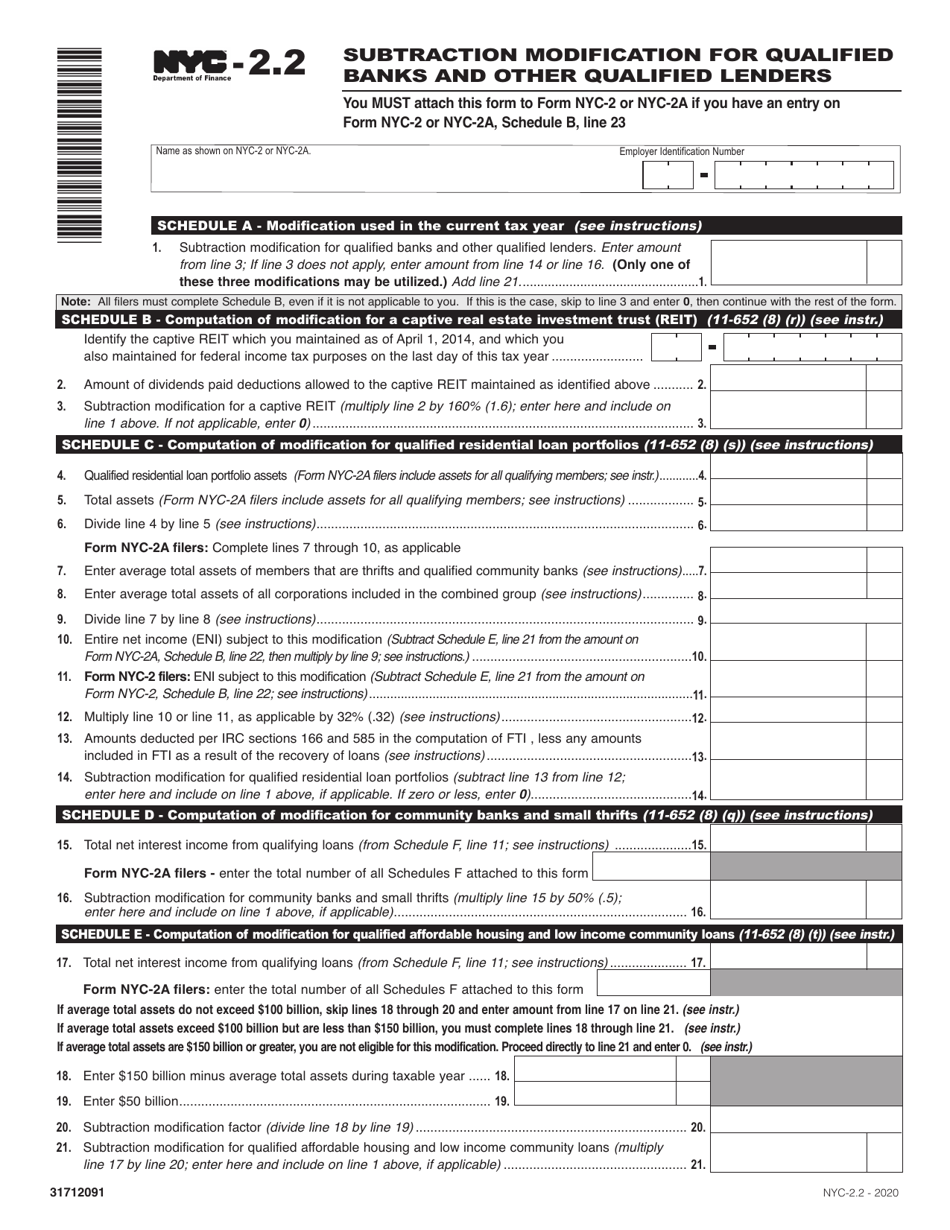

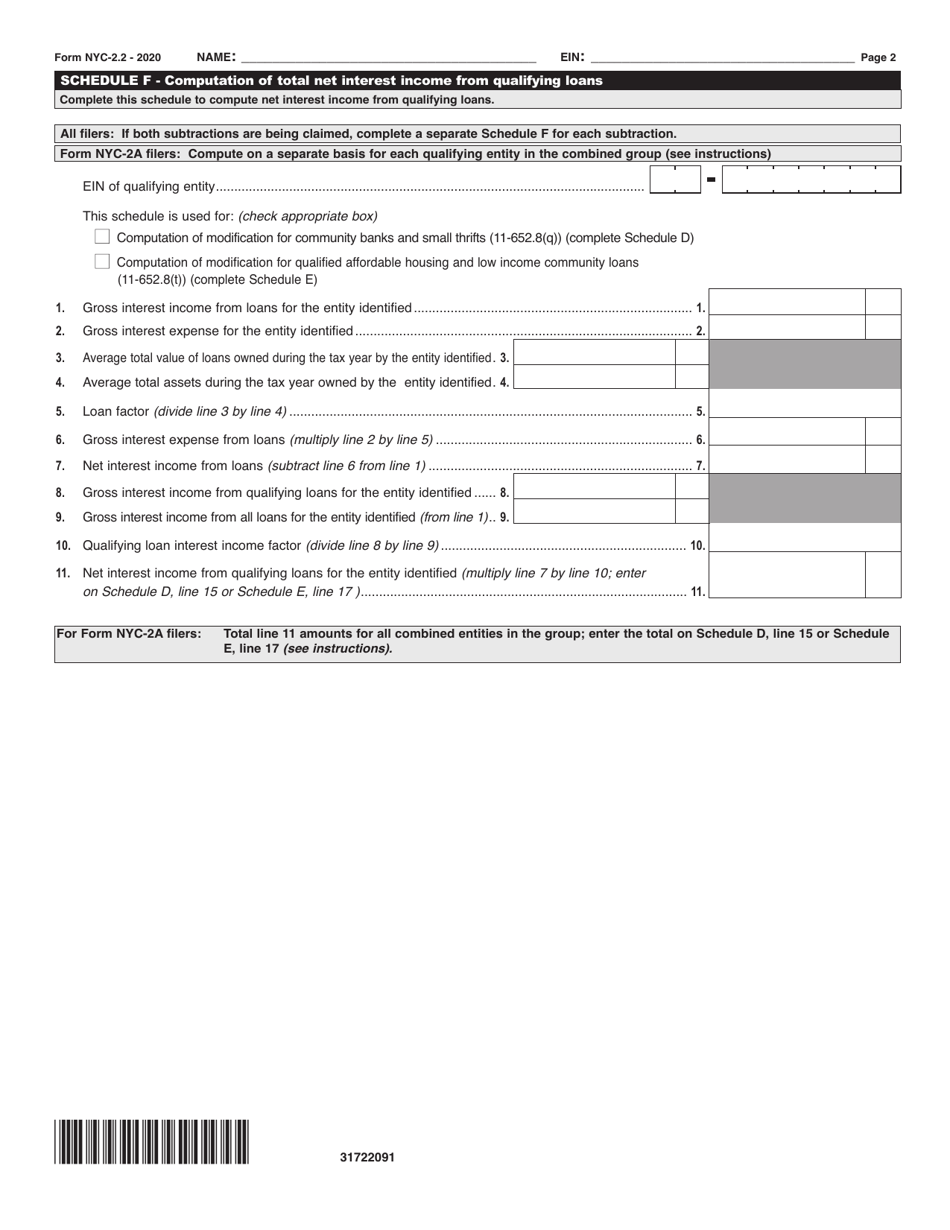

Form NYC-2.2

for the current year.

Form NYC-2.2 Subtraction Modification for Qualified Banks and Other Qualified Lenders - New York City

What Is Form NYC-2.2?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-2.2 Subtraction Modification?

A: The NYC-2.2 Subtraction Modification is a tax deduction available to qualified banks and lenders in New York City.

Q: Who is eligible for the NYC-2.2 Subtraction Modification?

A: Qualified banks and other qualified lenders in New York City are eligible for the NYC-2.2 Subtraction Modification.

Q: What is the purpose of the NYC-2.2 Subtraction Modification?

A: The purpose of the NYC-2.2 Subtraction Modification is to provide tax relief to qualified banks and lenders in New York City.

Q: How does the NYC-2.2 Subtraction Modification work?

A: The NYC-2.2 Subtraction Modification allows qualified banks and lenders to subtract certain qualified income from their New York City taxable income.

Q: What qualifies as qualified income for the NYC-2.2 Subtraction Modification?

A: Qualified income for the NYC-2.2 Subtraction Modification includes certain interest income, origination fees, and other specified items.

Q: Are there any limitations or restrictions for the NYC-2.2 Subtraction Modification?

A: Yes, there are limitations and restrictions on the NYC-2.2 Subtraction Modification, such as income thresholds and certain types of income that do not qualify.

Q: How do I claim the NYC-2.2 Subtraction Modification?

A: Qualified banks and lenders can claim the NYC-2.2 Subtraction Modification on their New York City tax return.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.2 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.