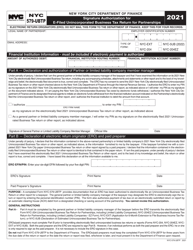

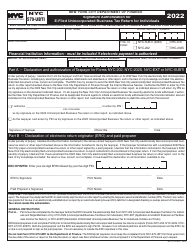

This version of the form is not currently in use and is provided for reference only. Download this version of

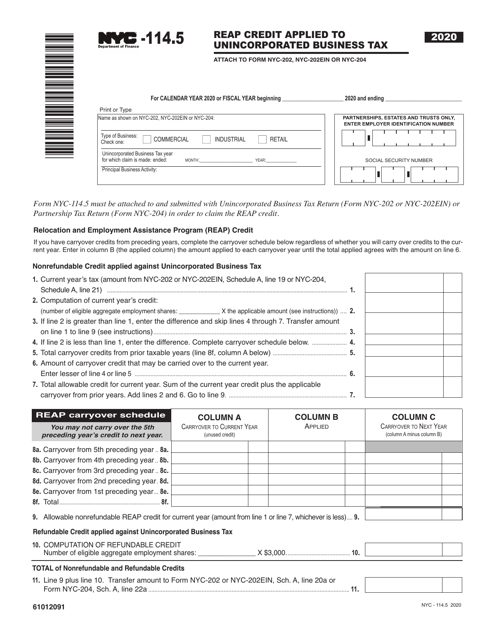

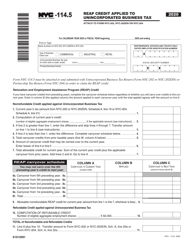

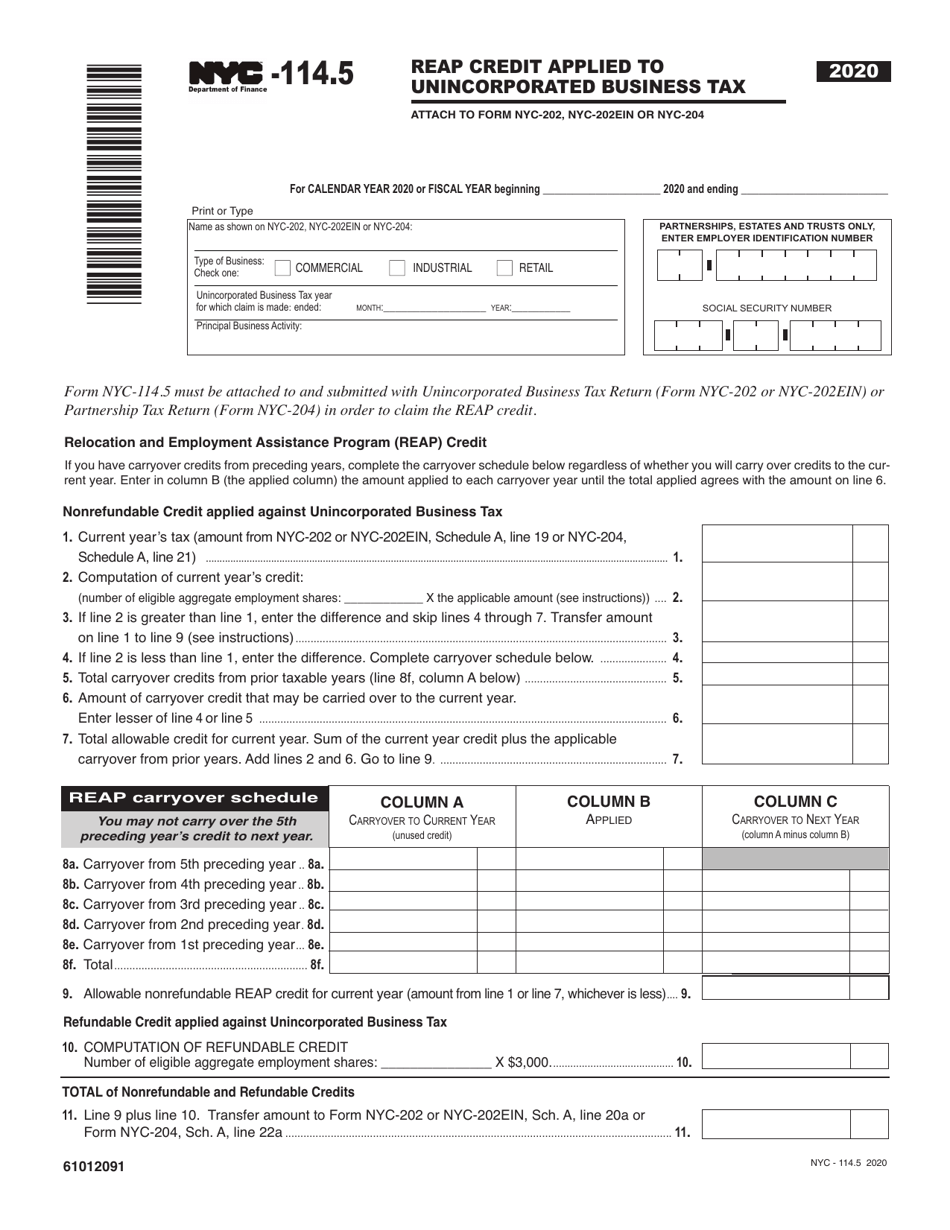

Form NYC-114.5

for the current year.

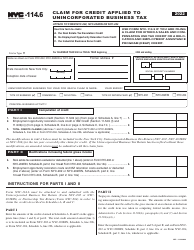

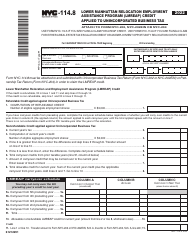

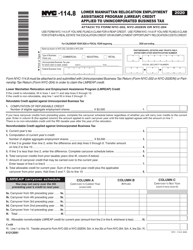

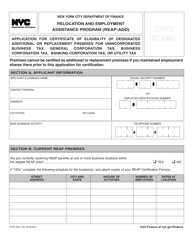

Form NYC-114.5 Reap Credit Applied to Unincorporated Business Tax - New York City

What Is Form NYC-114.5?

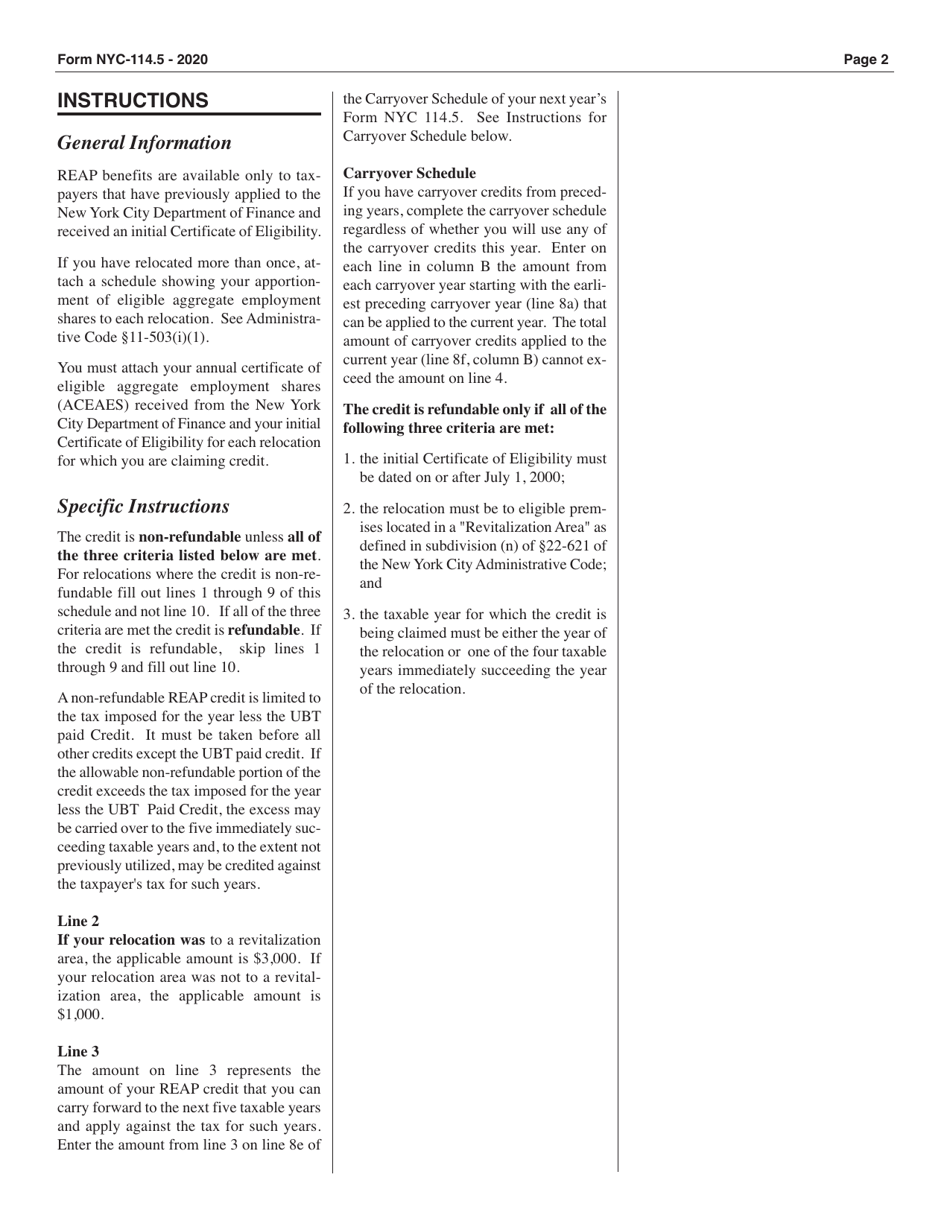

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

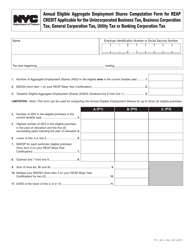

Q: What is NYC-114.5?

A: NYC-114.5 is a form used to claim the Reap Credit applied to Unincorporated Business Tax in New York City.

Q: What is the Reap Credit?

A: The Reap Credit is a tax credit applied to the Unincorporated Business Tax for qualifying businesses in New York City.

Q: Who is eligible to claim the Reap Credit?

A: Businesses that meet certain criteria, such as being located in certain areas of the city and having qualifying expenses, may be eligible to claim the Reap Credit.

Q: What should I do with the completed NYC-114.5 form?

A: Once you have completed the NYC-114.5 form, you should submit it to the New York City Department of Finance along with any required documents and forms.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.5 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.