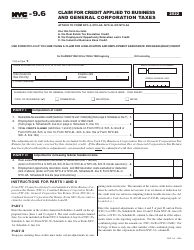

This version of the form is not currently in use and is provided for reference only. Download this version of

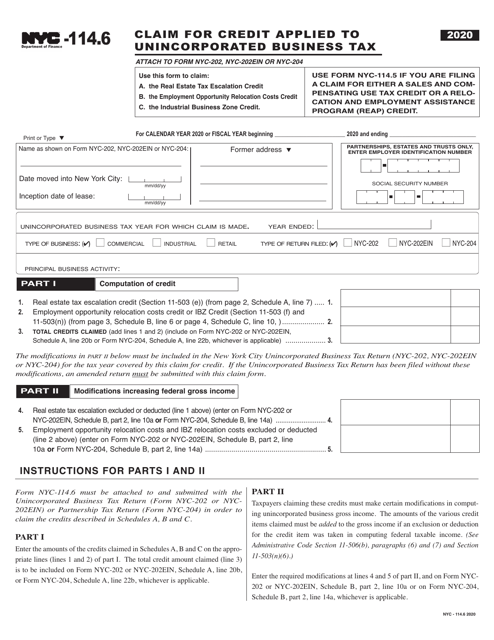

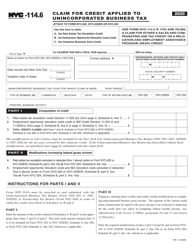

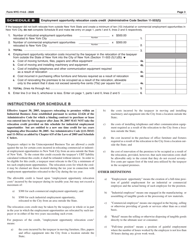

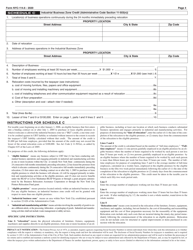

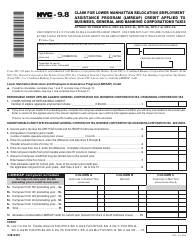

Form NYC-114.6

for the current year.

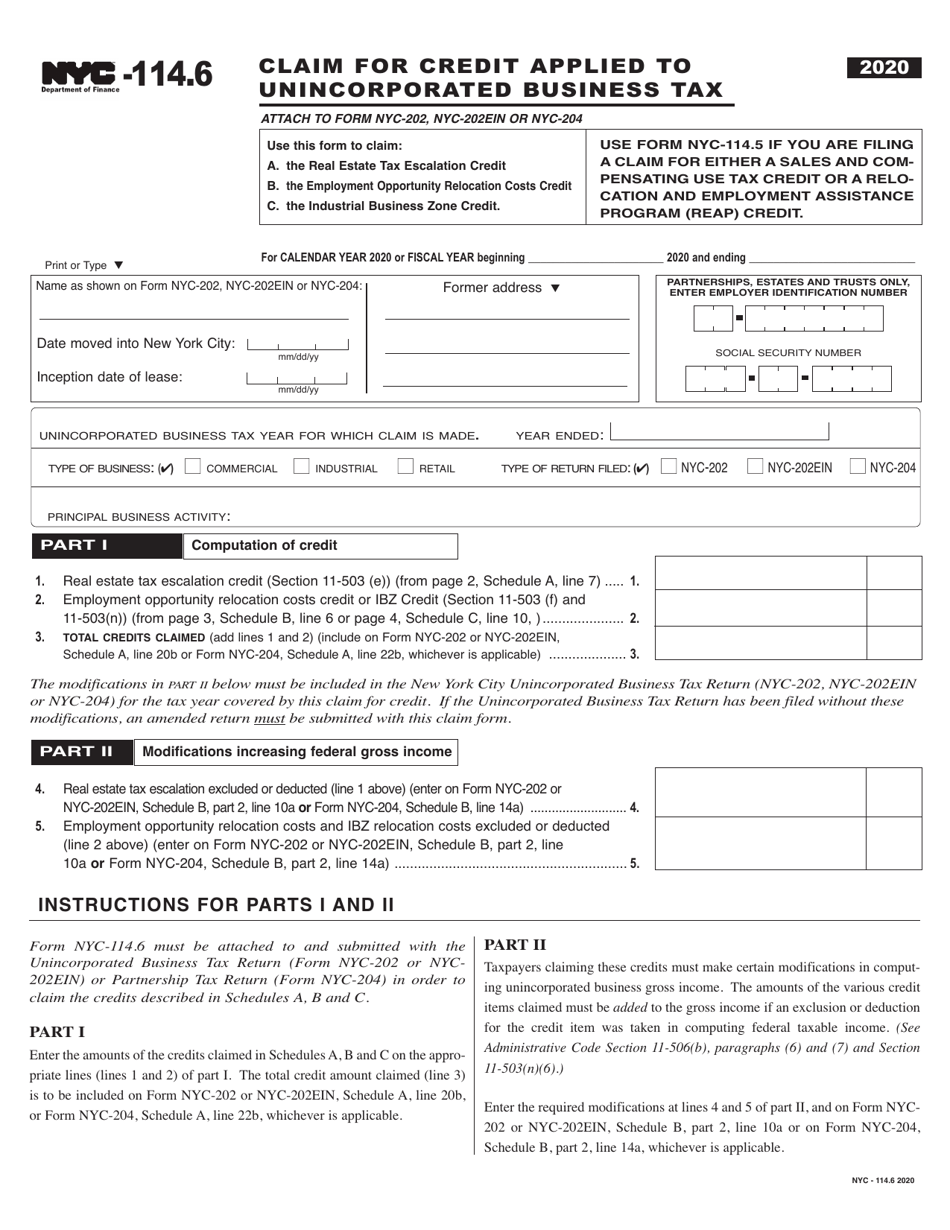

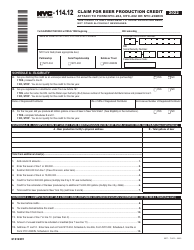

Form NYC-114.6 Claim for Credit Applied to Unincorporated Business Tax - New York City

What Is Form NYC-114.6?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-114.6 form?

A: The NYC-114.6 form is a Claim for Credit Applied to Unincorporated Business Tax in New York City.

Q: Who needs to file the NYC-114.6 form?

A: If you are a business owner operating in New York City and you have paid unincorporated business tax, you may need to file the NYC-114.6 form to claim a credit.

Q: What is the purpose of the NYC-114.6 form?

A: The purpose of the NYC-114.6 form is to claim a credit against the unincorporated business tax you have paid.

Q: When is the deadline for filing the NYC-114.6 form?

A: The deadline for filing the NYC-114.6 form is typically the same as the deadline for filing your business tax return, which is usually April 15th.

Q: Can I e-file the NYC-114.6 form?

A: No, the NYC-114.6 form cannot be e-filed. You must mail the completed form to the New York City Department of Finance.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.6 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.