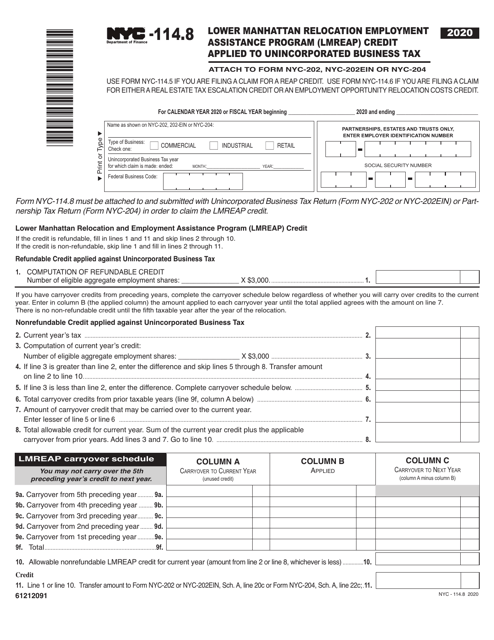

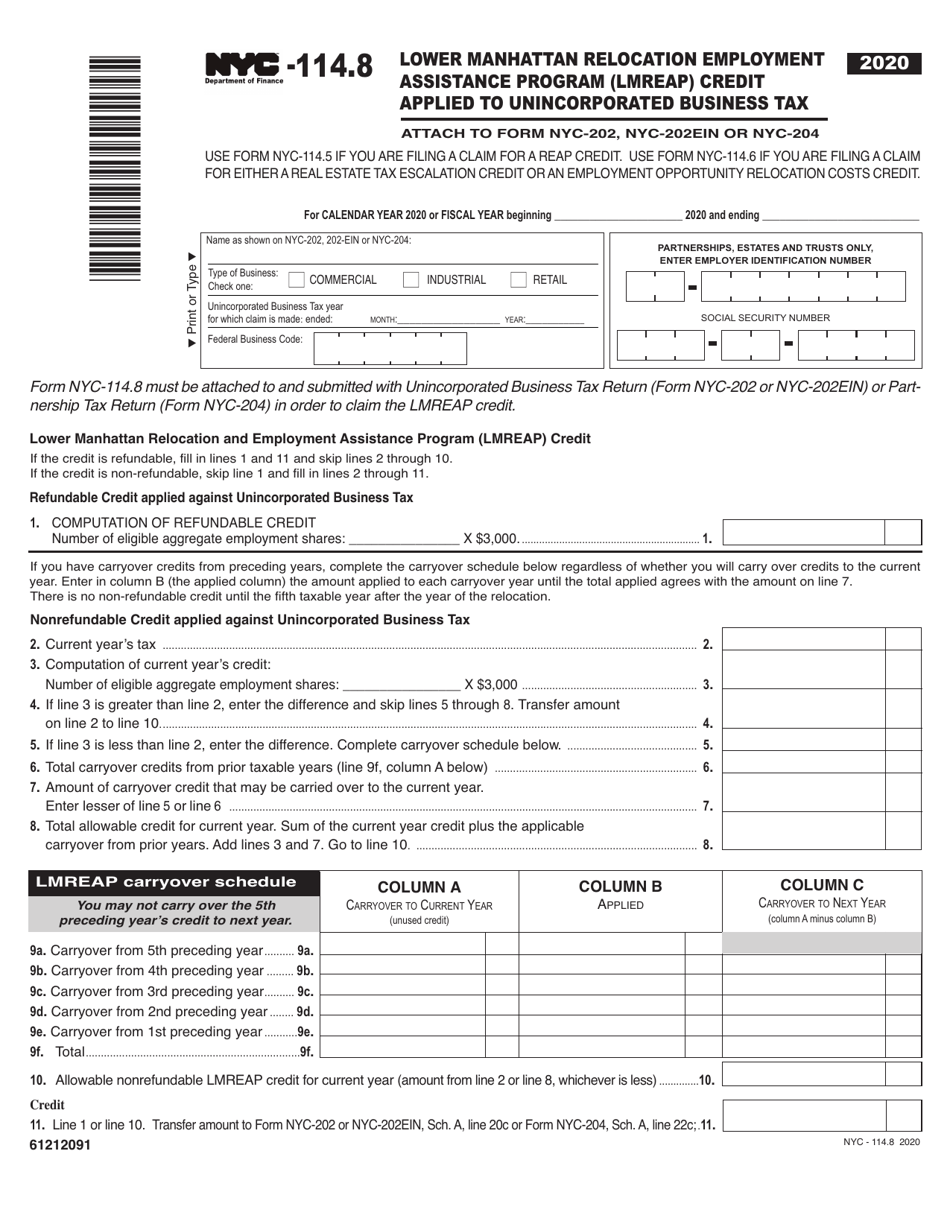

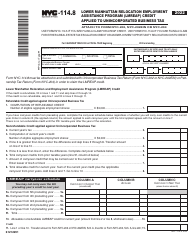

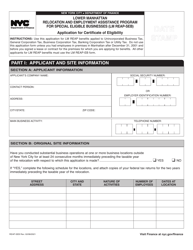

Form NYC--114.8 Lower Manhattan Relocation Employment Assistance Program (Lmreap) Credit Applied to Unincorporated Business Tax - New York City

What Is Form NYC--114.8?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Lower Manhattan Relocation Employment Assistance Program (LMREAP)?

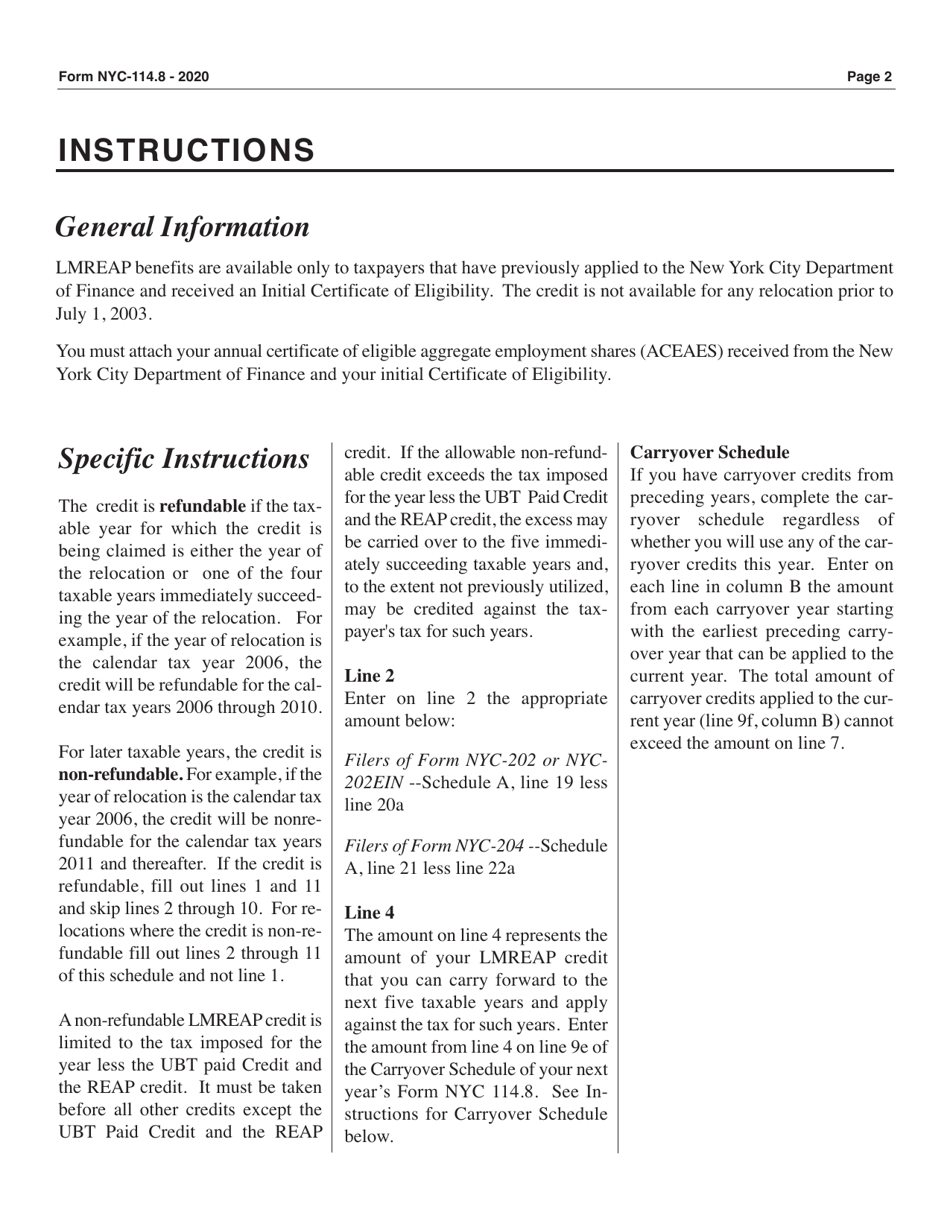

A: LMREAP is a program in New York City that provides employment assistance to businesses relocating to Lower Manhattan.

Q: What is the LMRAP credit?

A: The LMREAP credit is a tax credit applied to the Unincorporated Business Tax for businesses participating in the LMREAP program.

Q: Who is eligible for the LMREAP credit?

A: Businesses that are participating in the LMREAP program and meet certain eligibility criteria are eligible for the LMREAP credit.

Q: What is the Unincorporated Business Tax?

A: The Unincorporated Business Tax is a tax imposed on the net income derived from business activities conducted in New York City by individuals/firms that are not incorporated.

Q: How does the LMREAP credit benefit businesses?

A: The LMREAP credit helps businesses by reducing their Unincorporated Business Tax liability.

Q: How can businesses apply for the LMREAP program?

A: Businesses can contact the LMREAP program directly to inquire about eligibility and the application process.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC--114.8 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.