This version of the form is not currently in use and is provided for reference only. Download this version of

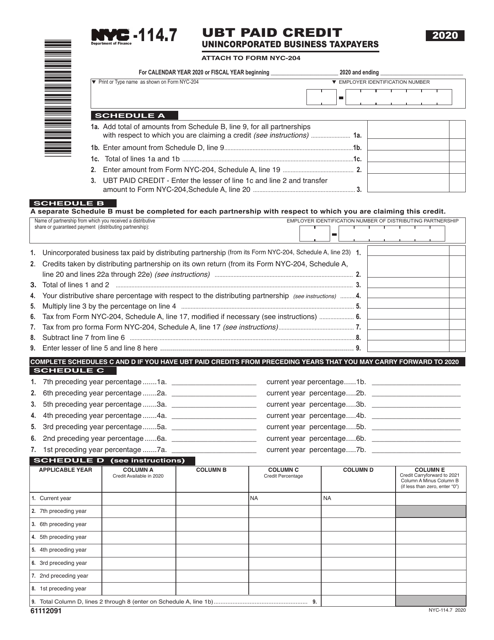

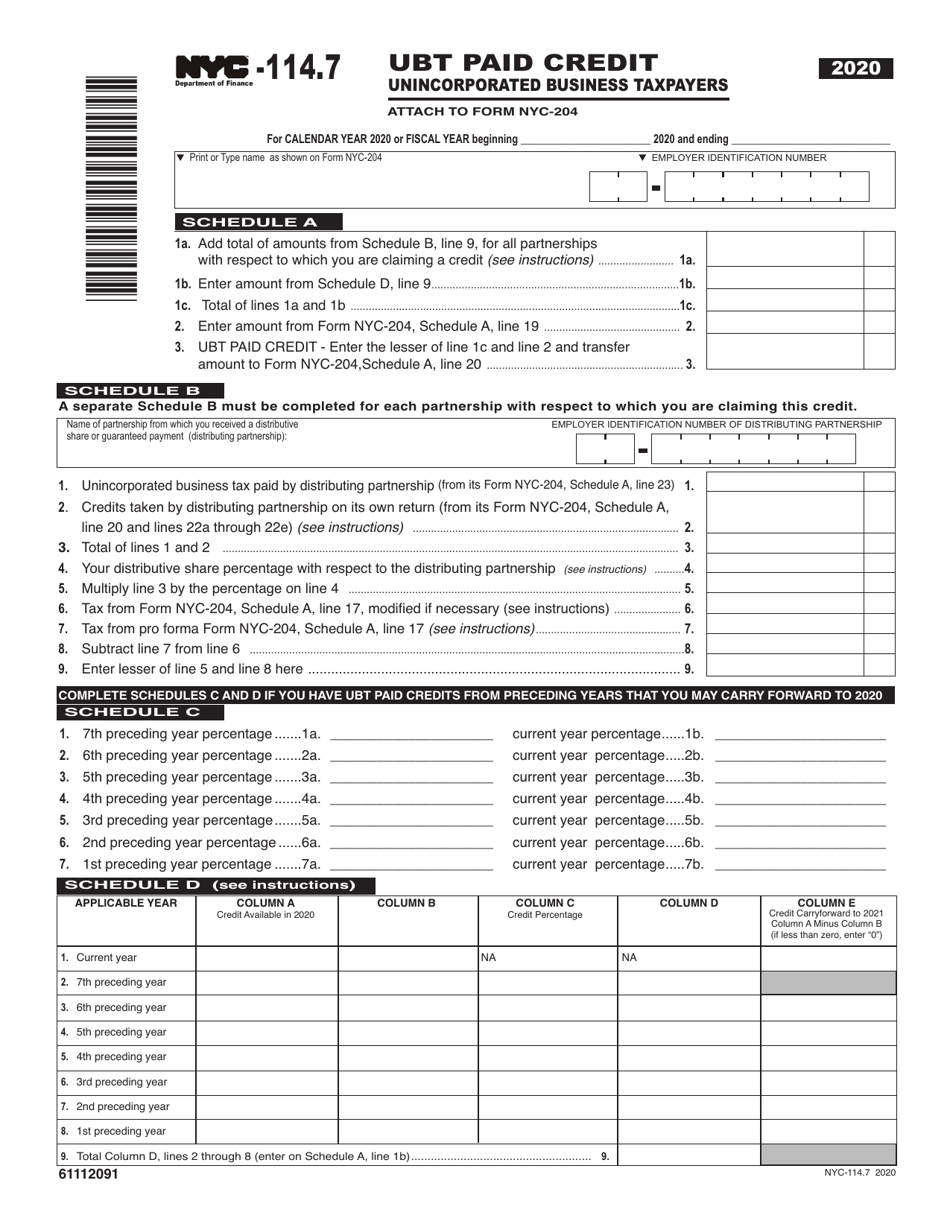

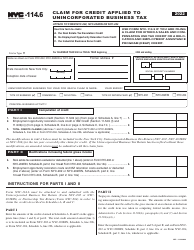

Form NYC-114.7

for the current year.

Form NYC-114.7 Ubt Paid Credit for Unincorporated Business Taxpayers - New York City

What Is Form NYC-114.7?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-114.7?

A: NYC-114.7 is a form used by unincorporated business taxpayers in New York City.

Q: What is the Ubt Paid Credit?

A: The Ubt Paid Credit is a credit that is applied to the Unincorporated Business Tax (UBT) owed by taxpayers in New York City.

Q: Who is eligible to use form NYC-114.7?

A: Unincorporated business taxpayers in New York City are eligible to use form NYC-114.7.

Q: What is the purpose of form NYC-114.7?

A: The purpose of form NYC-114.7 is to calculate and claim the Ubt Paid Credit for unincorporated business taxpayers in New York City.

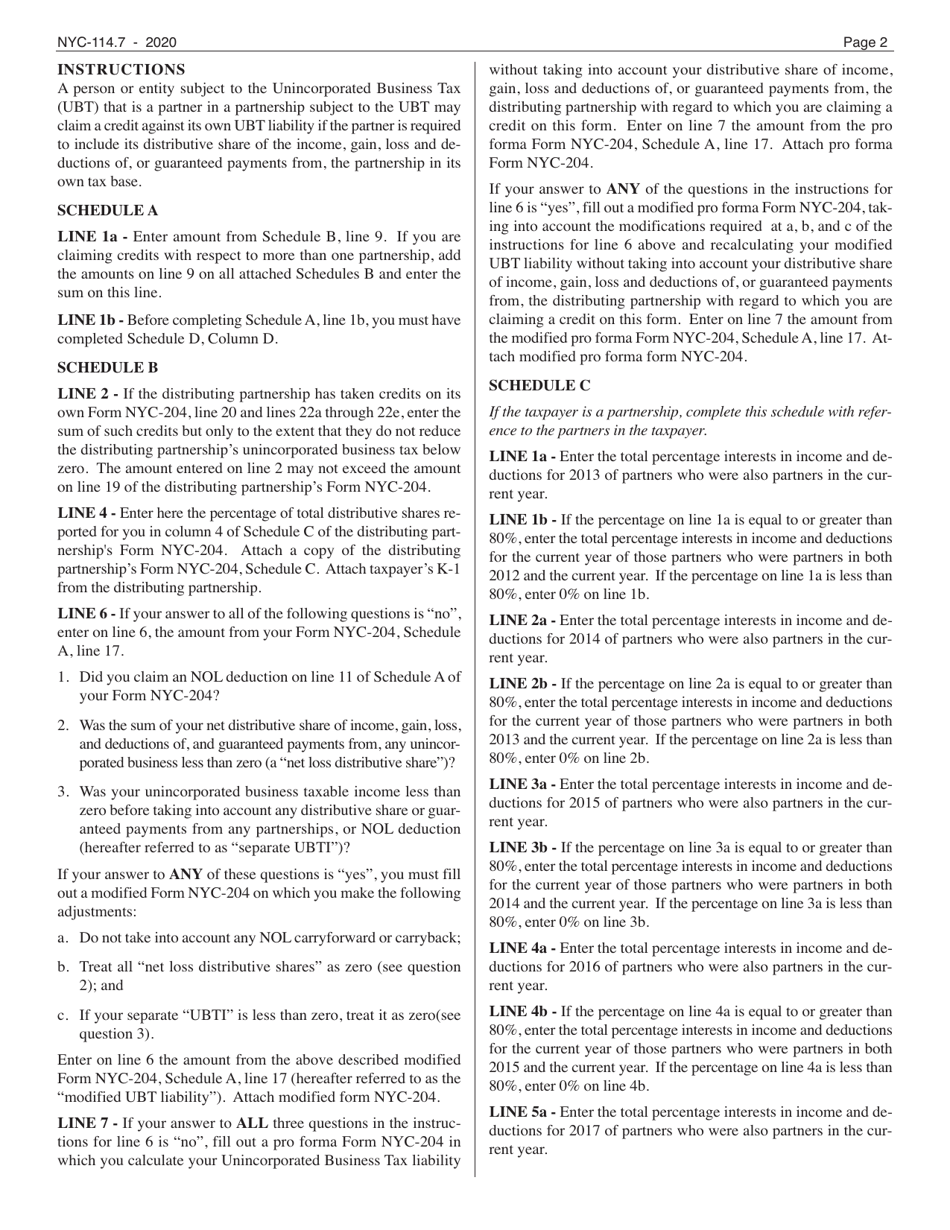

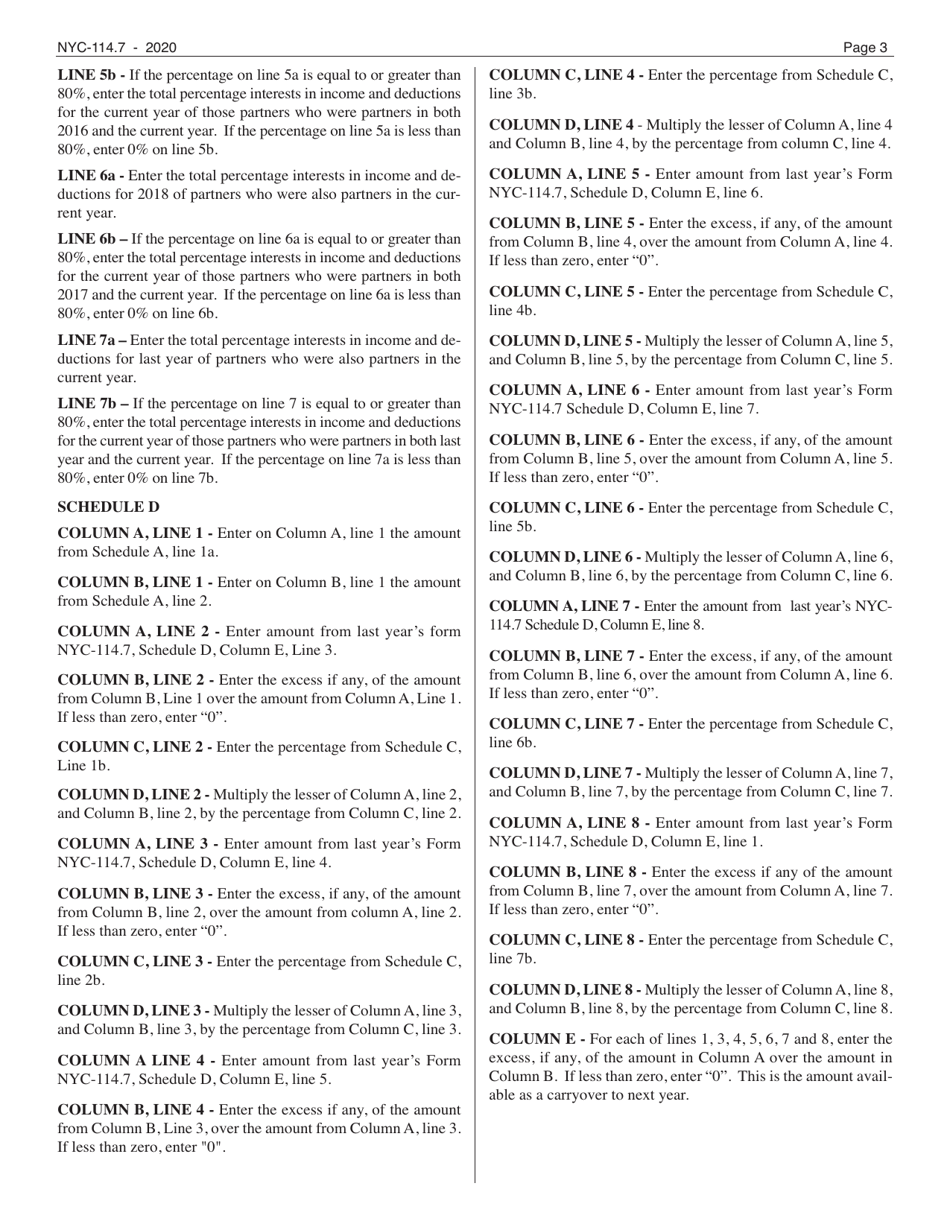

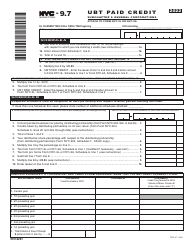

Q: How do I fill out form NYC-114.7?

A: To fill out form NYC-114.7, you will need to provide information about your business and the UBT paid, following the instructions provided on the form.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.7 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.