This version of the form is not currently in use and is provided for reference only. Download this version of

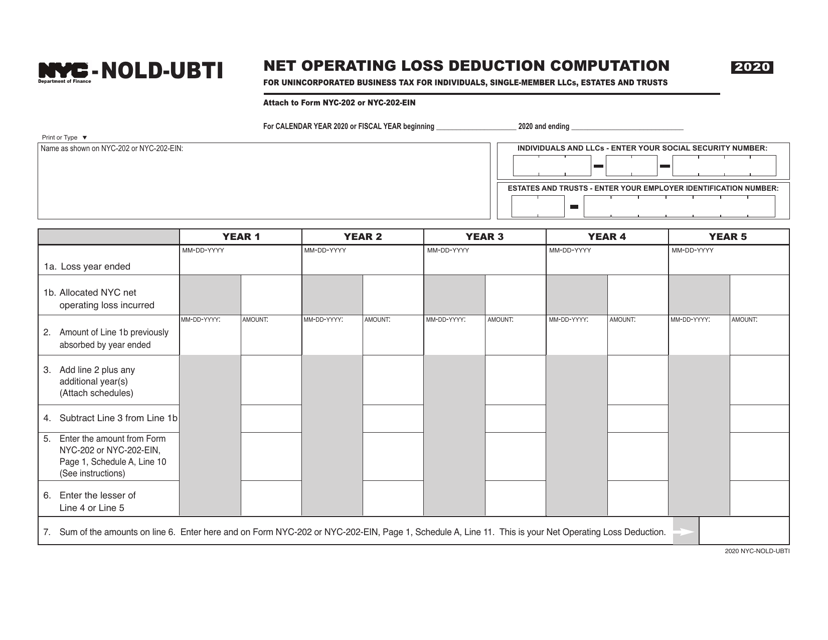

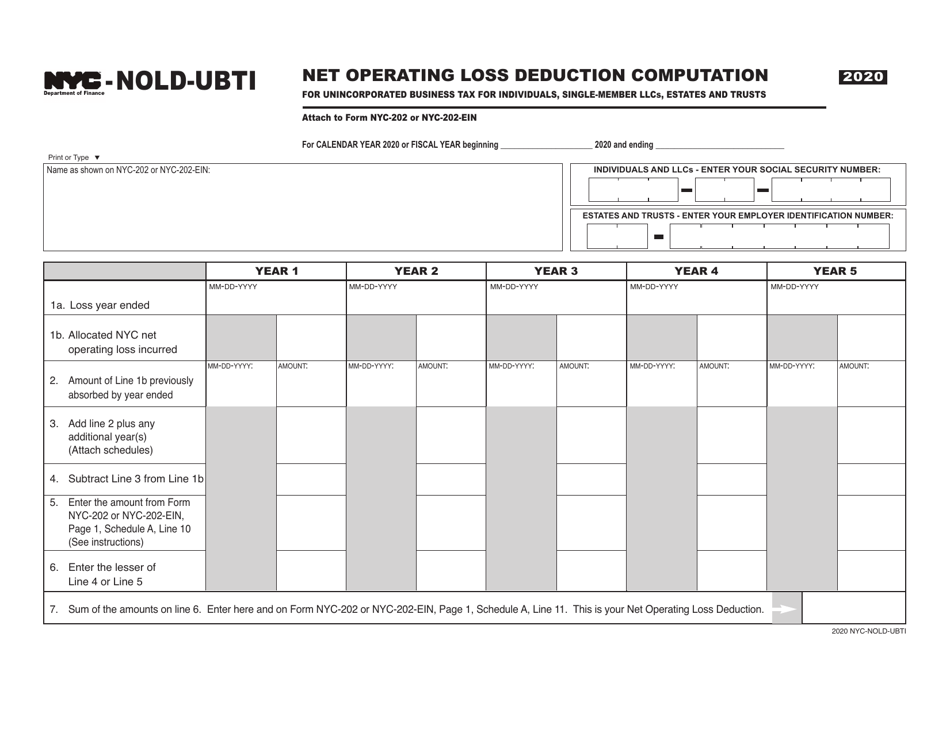

Form NYC-NOLD-UBTI

for the current year.

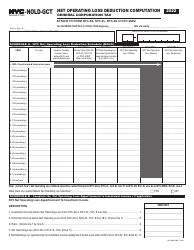

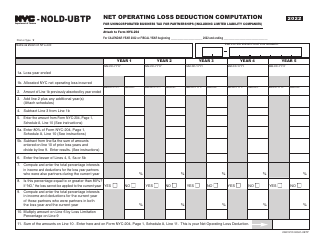

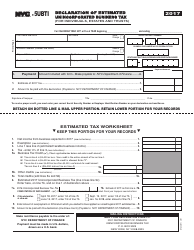

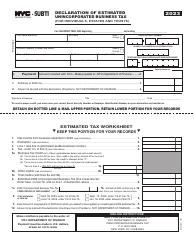

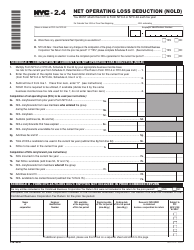

Form NYC-NOLD-UBTI Net Operating Loss Deduction Computation for Unincorporated Business Tax for Individuals, Single-Member Llcs, Estates and Trusts - New York City

What Is Form NYC-NOLD-UBTI?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

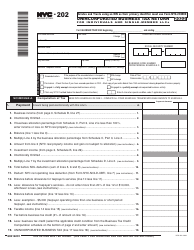

Q: What is NYC-NOLD-UBTI?

A: NYC-NOLD-UBTI refers to the Net Operating Loss Deduction Computation for Unincorporated Business Tax for Individuals, Single-Member LLCs, Estates, and Trusts in New York City.

Q: Who is eligible for the NYC-NOLD-UBTI deduction?

A: Individuals, single-member LLCs, estates, and trusts operating in New York City may be eligible for the NYC-NOLD-UBTI deduction.

Q: What is the purpose of NYC-NOLD-UBTI?

A: The purpose of NYC-NOLD-UBTI is to allow eligible businesses and entities to deduct net operating losses when calculating their Unincorporated Business Tax liability in New York City.

Q: How is NYC-NOLD-UBTI computed?

A: The computation of NYC-NOLD-UBTI involves deducting eligible net operating losses from the business income subject to Unincorporated Business Tax in New York City.

Q: Are there any limitations to the NYC-NOLD-UBTI deduction?

A: Yes, there are limitations on the amount of net operating losses that can be deducted in a given tax year, as well as carryforward and carryback rules for unused losses.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-NOLD-UBTI by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.