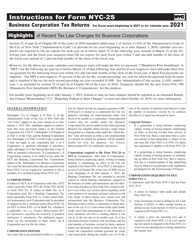

This version of the form is not currently in use and is provided for reference only. Download this version of

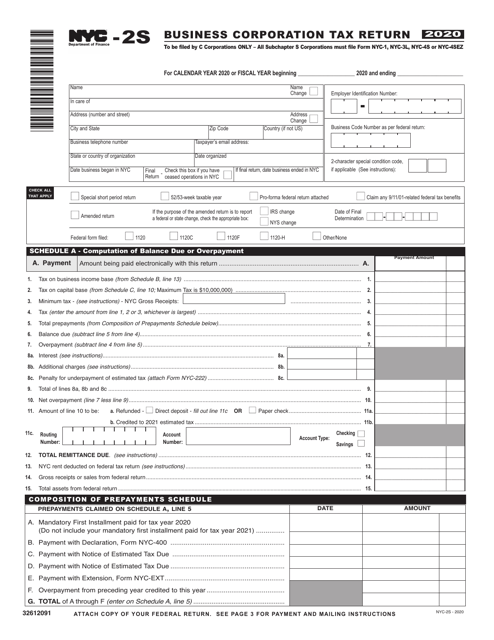

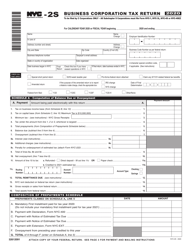

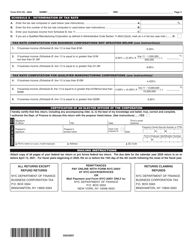

Form NYC-2S

for the current year.

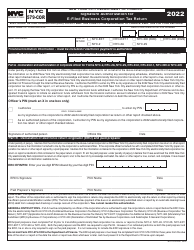

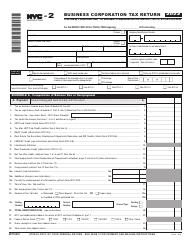

Form NYC-2S Business Corporation Tax Return - New York City

What Is Form NYC-2S?

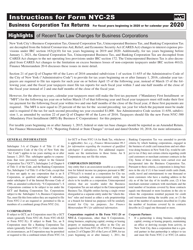

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

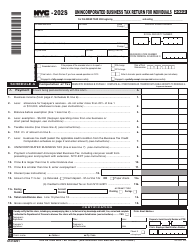

Q: What is the NYC-2S form?

A: The NYC-2S form is the Business Corporation Tax Return specifically for businesses located in New York City.

Q: Who is required to file the NYC-2S form?

A: Businesses that are subject to the New York City corporate tax and have a New York City business income of $25,000 or more are required to file the NYC-2S form.

Q: What is the purpose of the NYC-2S form?

A: The purpose of the NYC-2S form is to report and calculate the business corporationtax owed by businesses operating in New York City.

Q: How often do businesses need to file the NYC-2S form?

A: Businesses need to file the NYC-2S form annually, by the due date specified by the New York City Department of Finance.

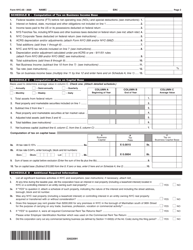

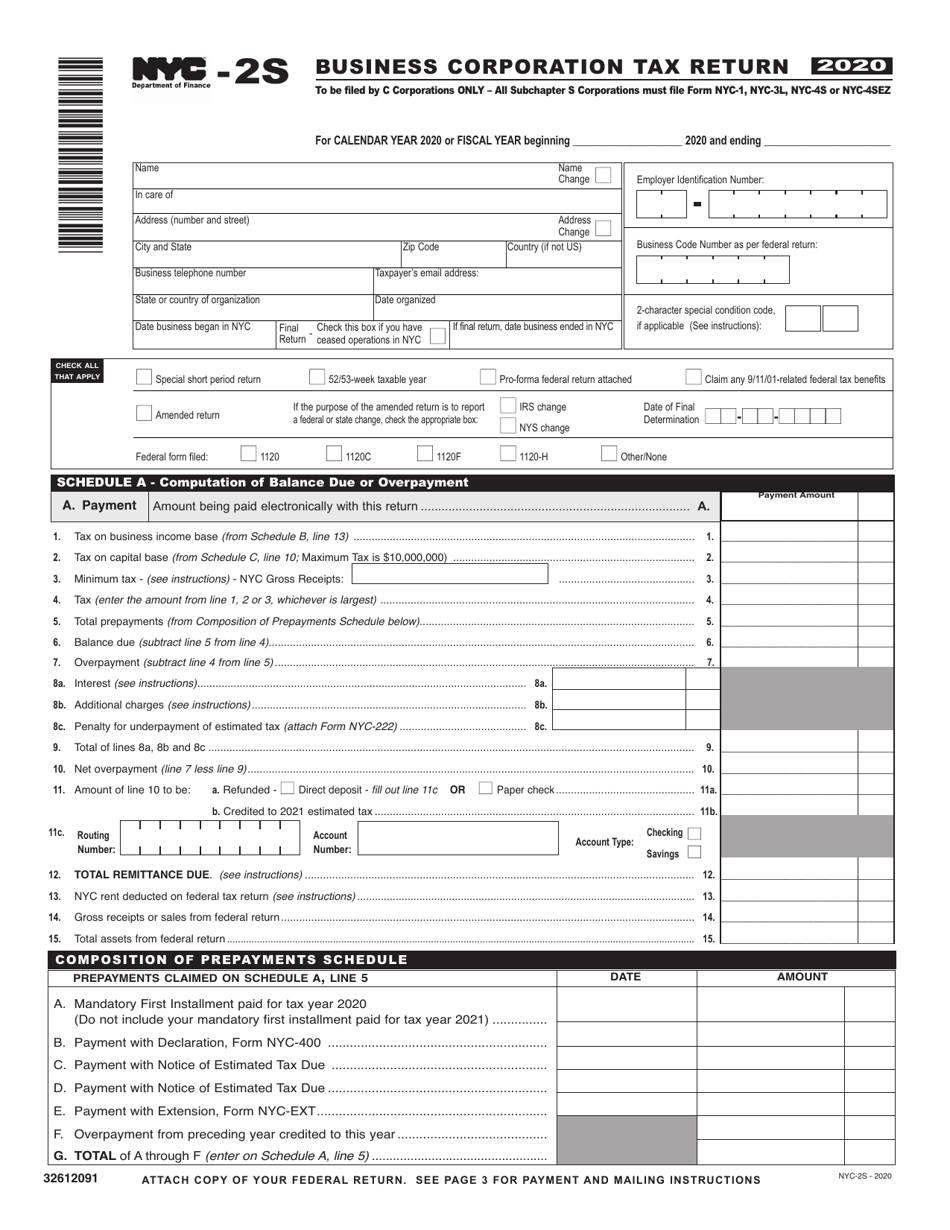

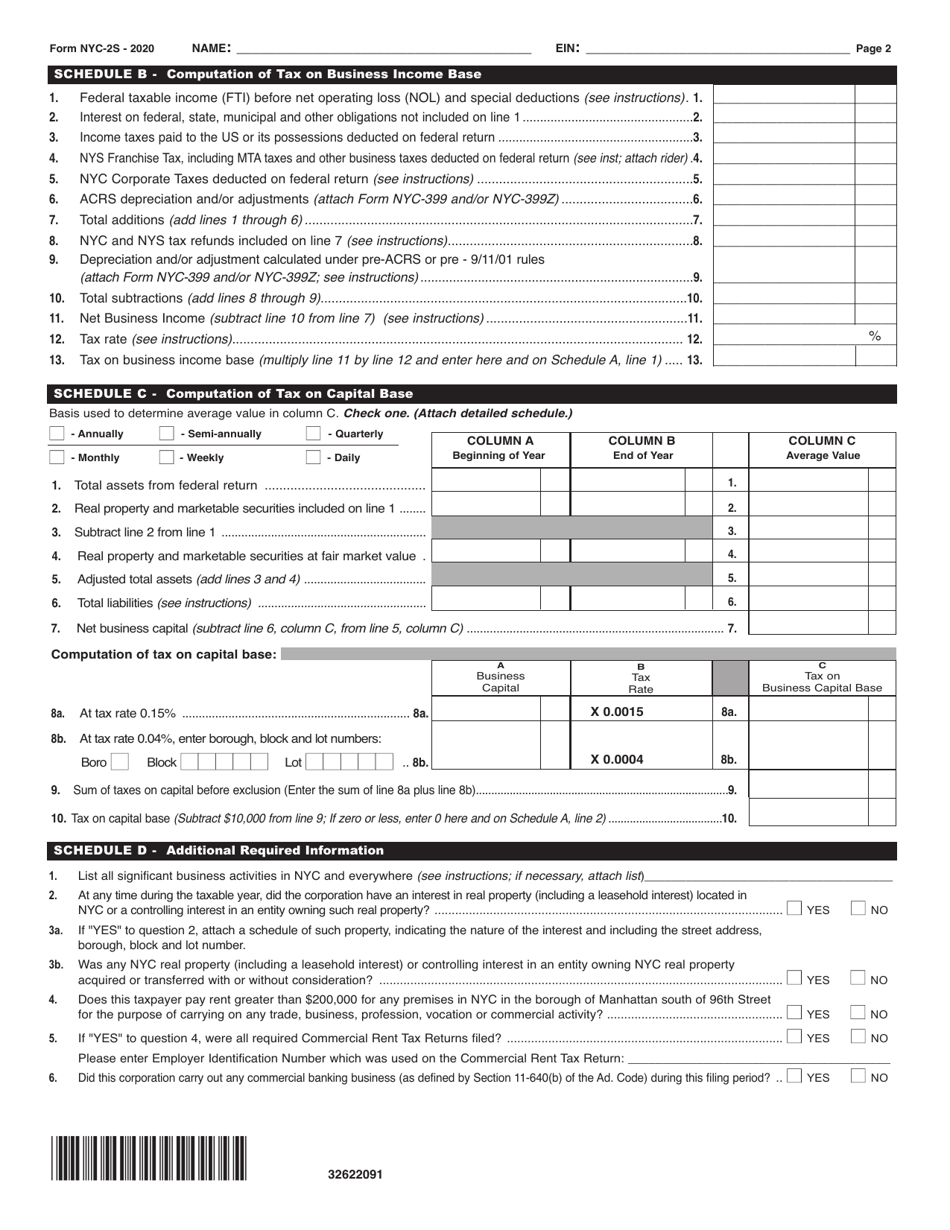

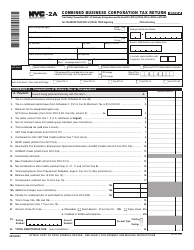

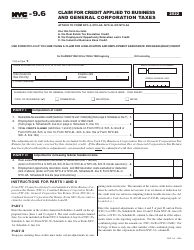

Q: What information do businesses need to provide on the NYC-2S form?

A: Businesses need to provide information about their income, deductions, credits, and other relevant financial information on the NYC-2S form.

Q: Are there any penalties for not filing the NYC-2S form?

A: Yes, businesses may be subject to penalties and interest for failing to file the NYC-2S form or for filing late.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2S by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.