This version of the form is not currently in use and is provided for reference only. Download this version of

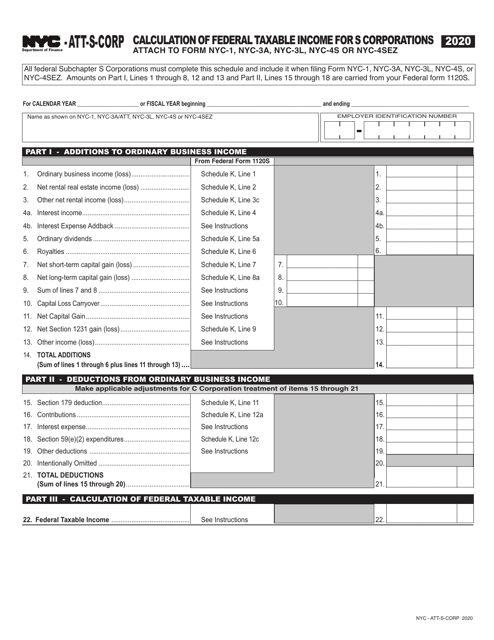

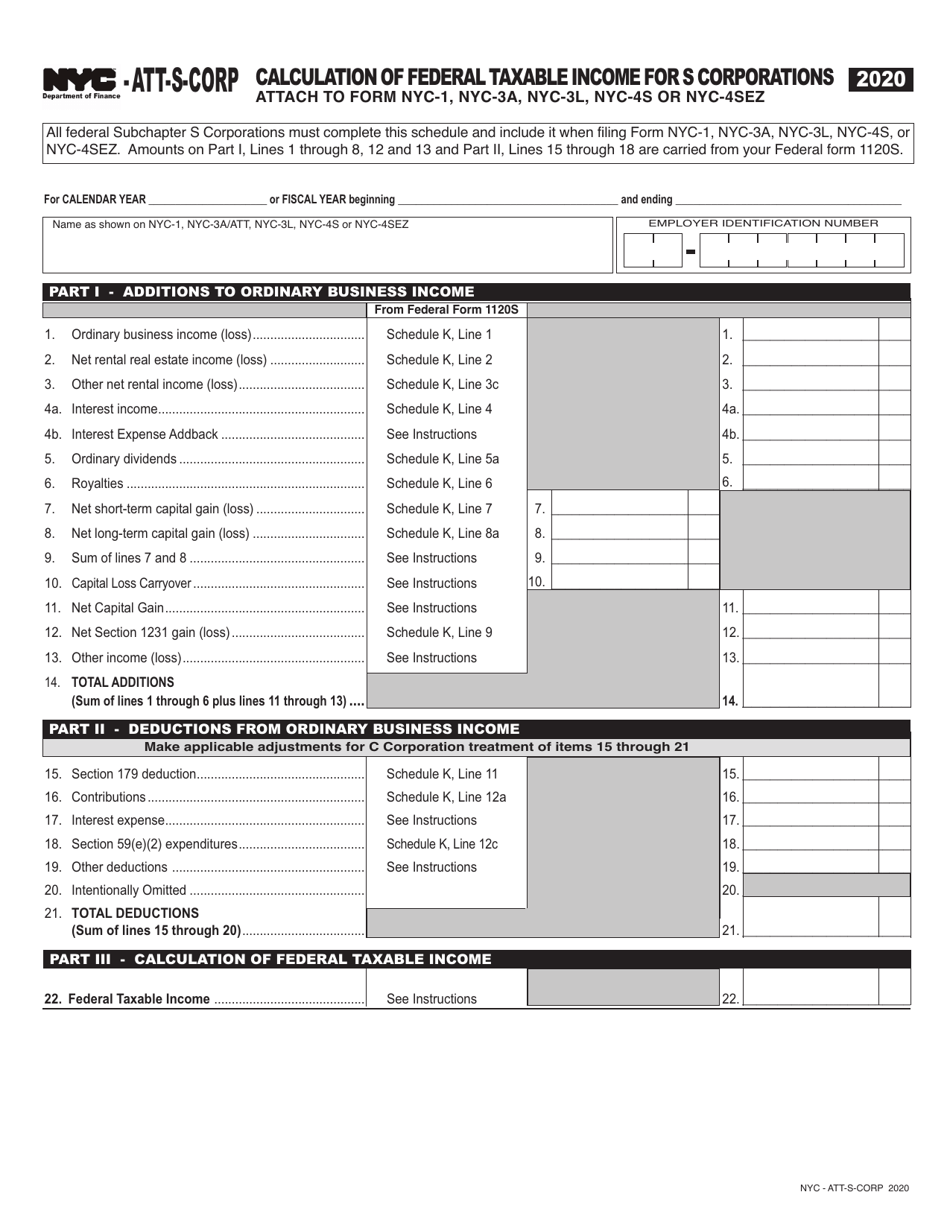

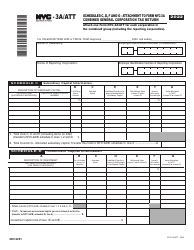

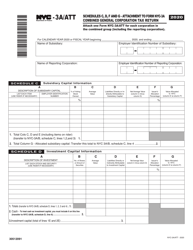

Form NYC-ATT-S-CORP

for the current year.

Form NYC-ATT-S-CORP Calculation of Federal Taxable Income for S Corporations - New York City

What Is Form NYC-ATT-S-CORP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an S corporation?

A: An S corporation is a type of corporation that passes its income, deductions, and credits through to its shareholders for federal tax purposes.

Q: How is federal taxable income calculated for S corporations in New York City?

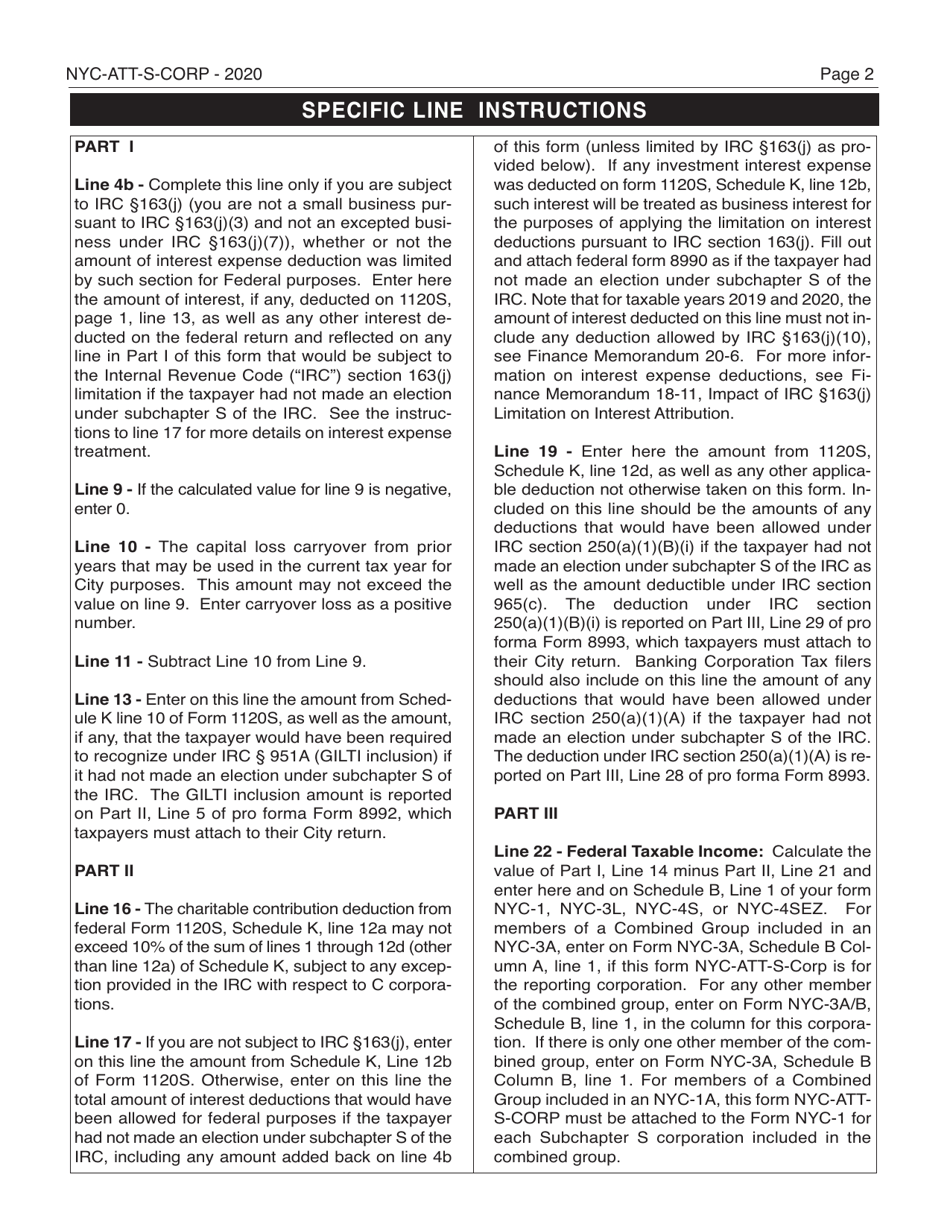

A: Federal taxable income for S corporations in New York City is calculated by starting with the federal taxable income of the S corporation and then making certain adjustments and additions required by New York City tax law.

Q: What are some common adjustments and additions made to federal taxable income for S corporations in New York City?

A: Some common adjustments and additions include adding back certain expenses deducted for federal purposes, such as interest expenses on certain related-party loans, and subtracting certain income excluded for federal purposes, such as exempt interest from certain obligations of the U.S. government.

Q: Are there any specific deductions or credits available for S corporations in New York City?

A: Yes, there are certain deductions and credits available to S corporations in New York City, such as the general business tax credits.

Q: Is there a separate tax return for S corporations in New York City?

A: Yes, S corporations in New York City must file a separate tax return using Form NYC-ATT-S-CORP.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-ATT-S-CORP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.