This version of the form is not currently in use and is provided for reference only. Download this version of

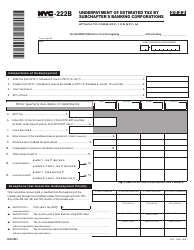

Form NYC-222

for the current year.

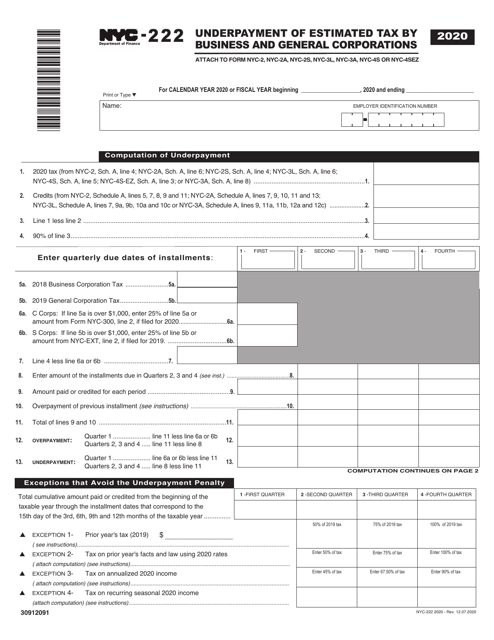

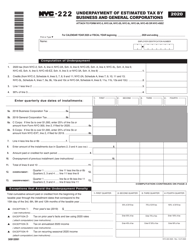

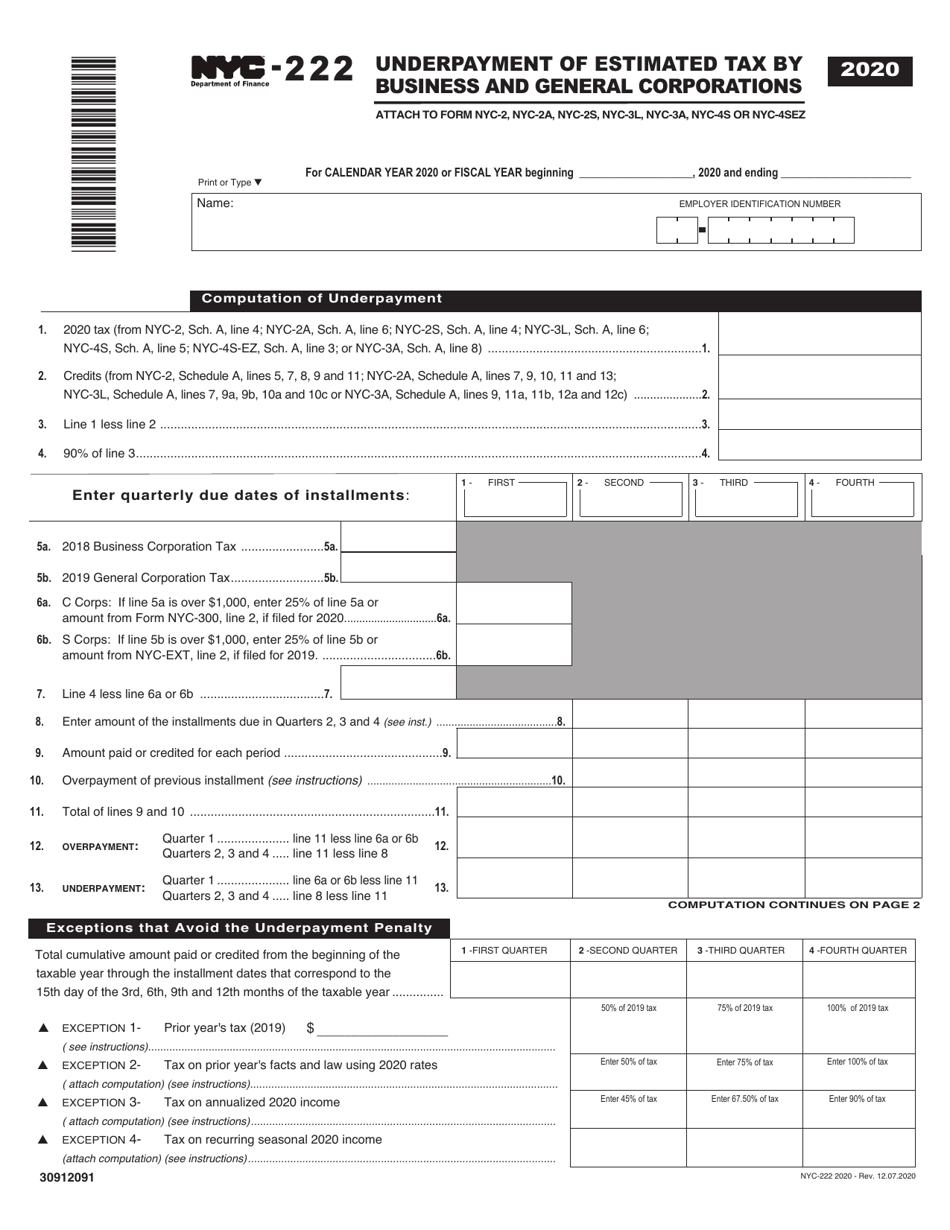

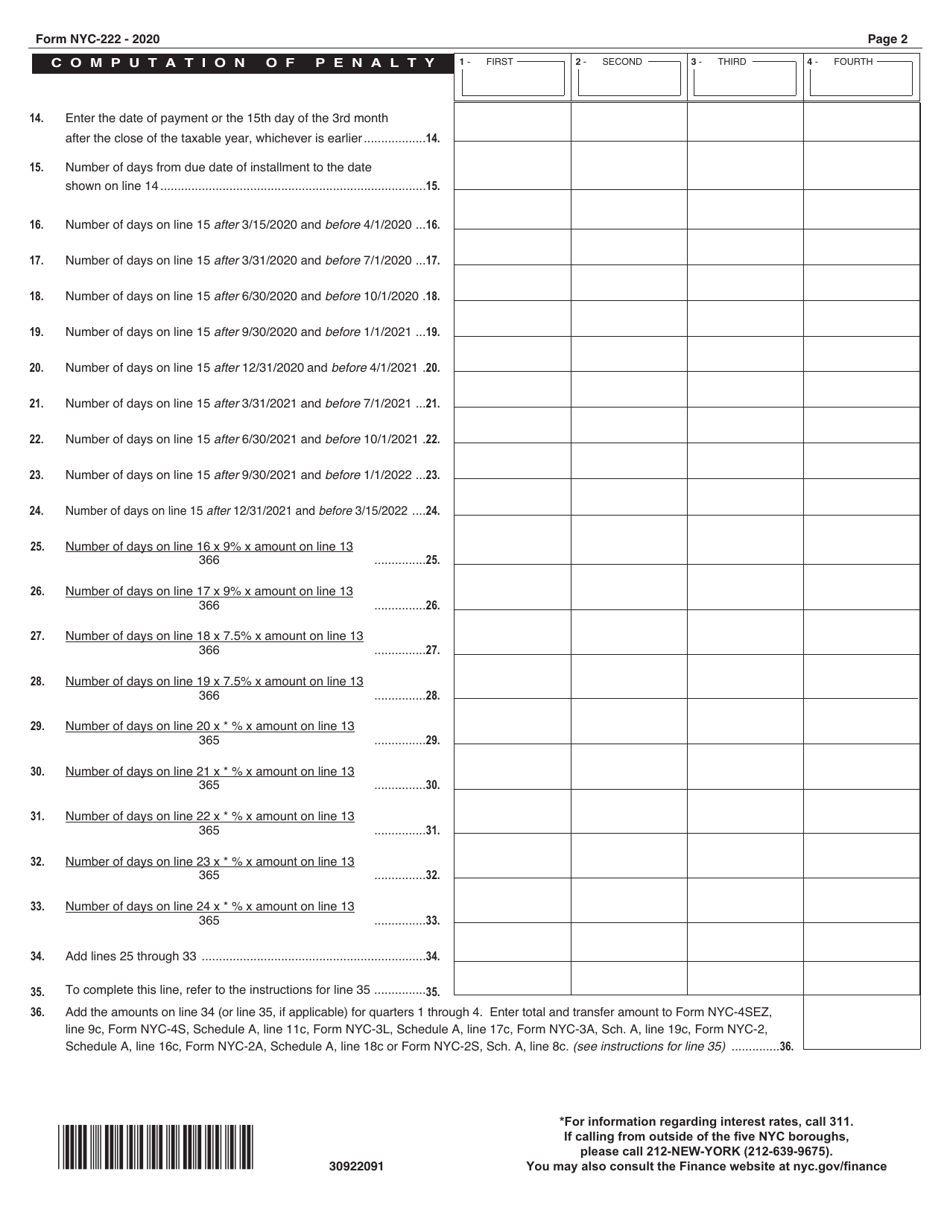

Form NYC-222 Underpayment of Estimated Tax by Business and General Corporations - New York City

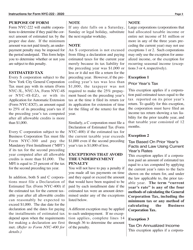

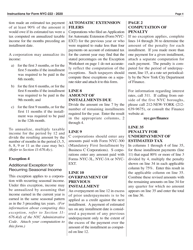

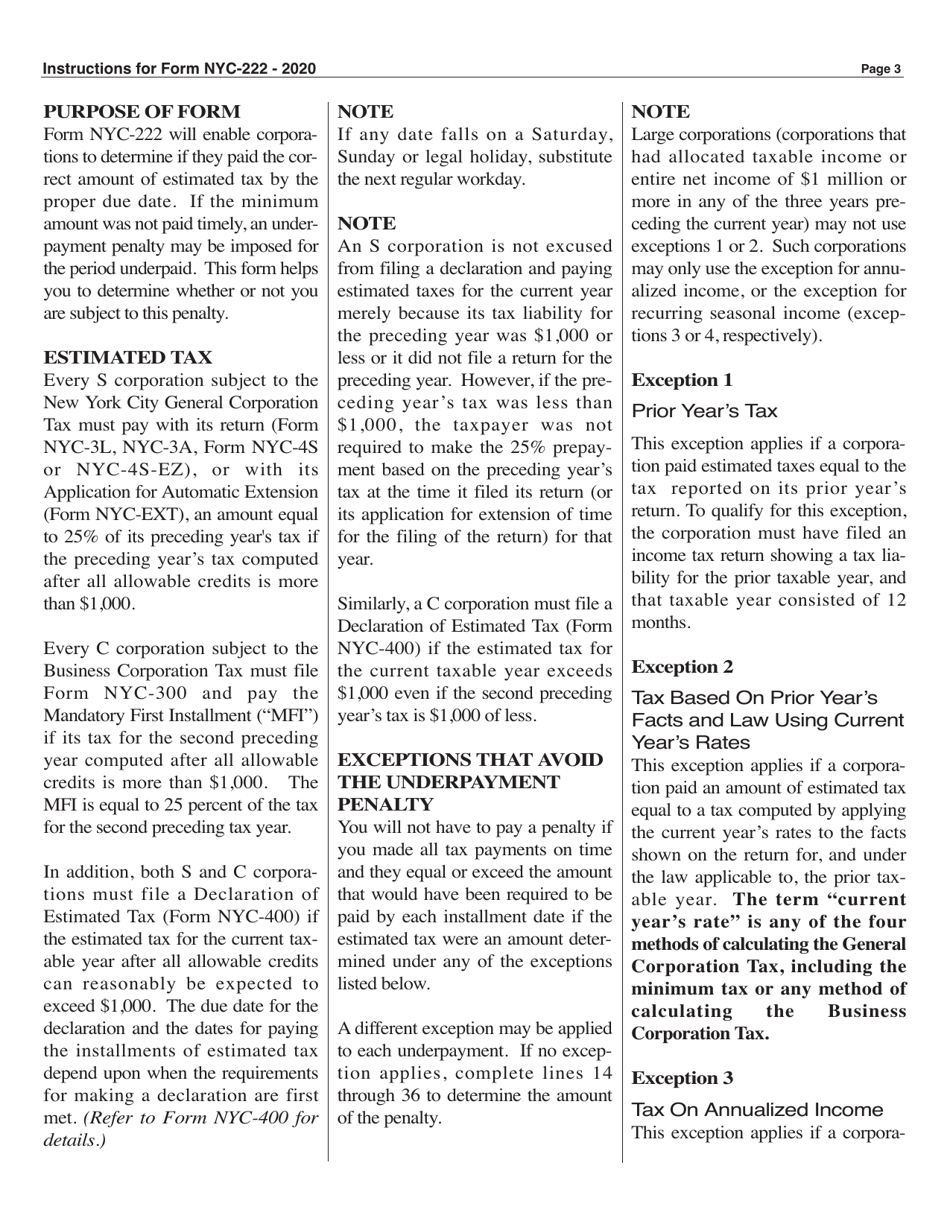

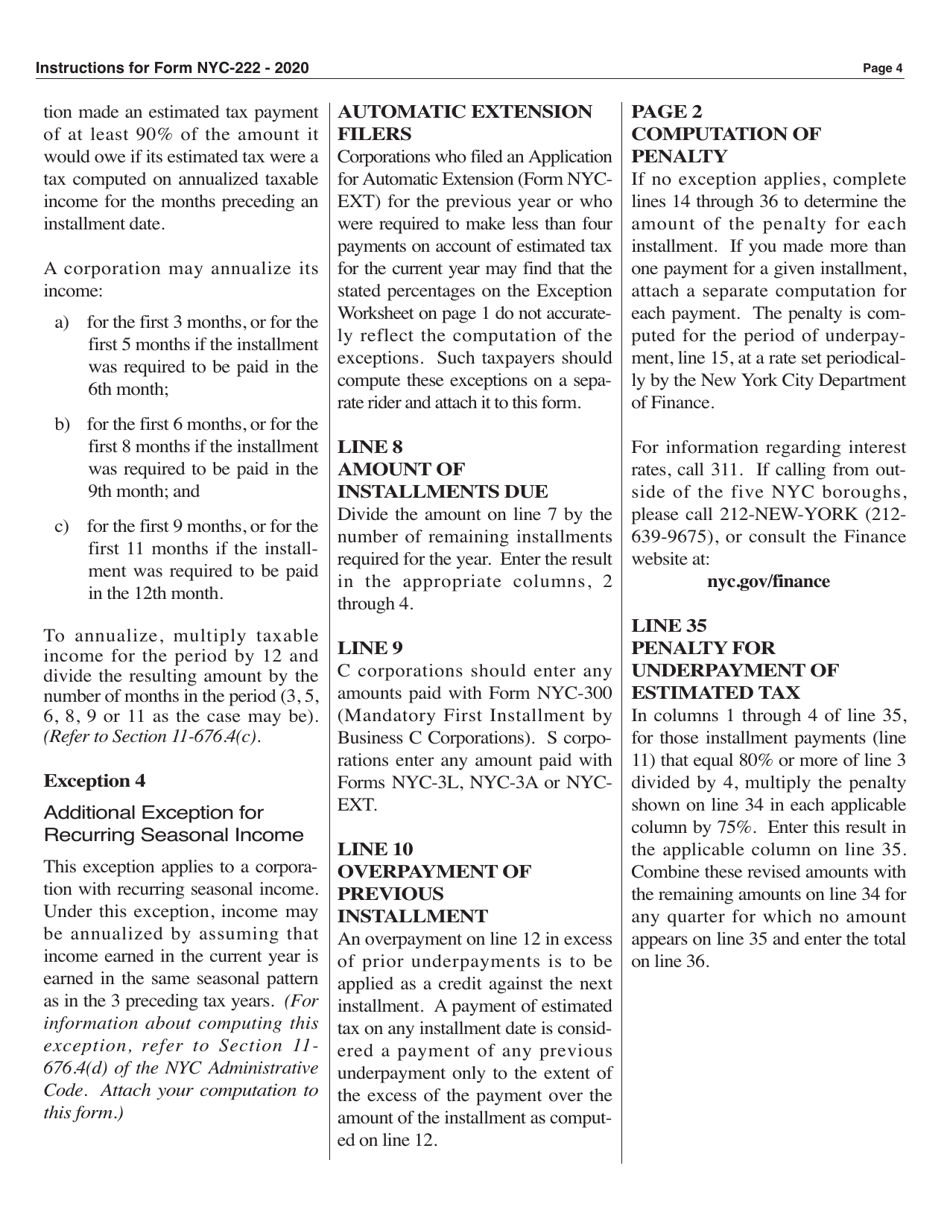

What Is Form NYC-222?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NYC-222?

A: Form NYC-222 is a tax form for underpayment of estimated tax by business and general corporations in New York City.

Q: Who needs to file form NYC-222?

A: Business and general corporations in New York City who underestimated their tax liability and made insufficient estimated tax payments need to file form NYC-222.

Q: What is the purpose of form NYC-222?

A: The purpose of form NYC-222 is to calculate and report any underpayment of estimated tax by business and general corporations in New York City.

Q: When is form NYC-222 due?

A: Form NYC-222 is typically due on or before the 15th day of the third month following the close of the corporation's tax year.

Q: Are there any penalties for not filing form NYC-222?

A: Yes, there may be penalties for not filing form NYC-222 or for underpayment of estimated tax. It is important to file the form and make accurate estimated tax payments to avoid penalties.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-222 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.