This version of the form is not currently in use and is provided for reference only. Download this version of

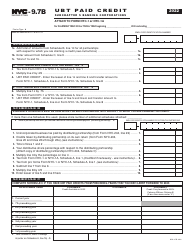

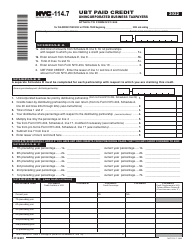

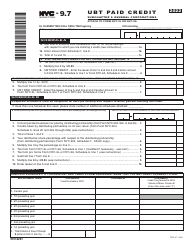

Form NYC-9.7C

for the current year.

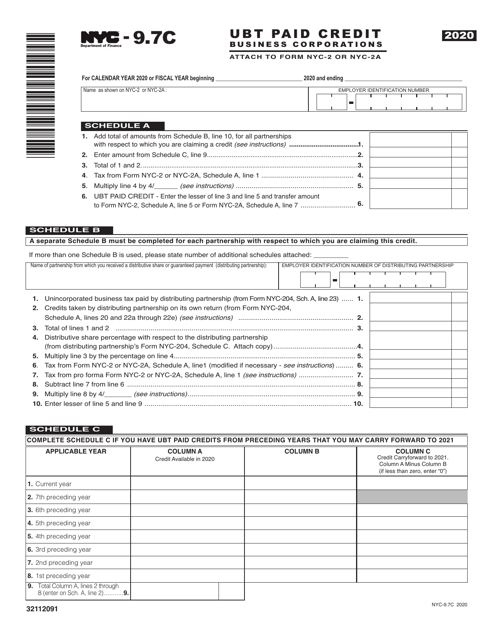

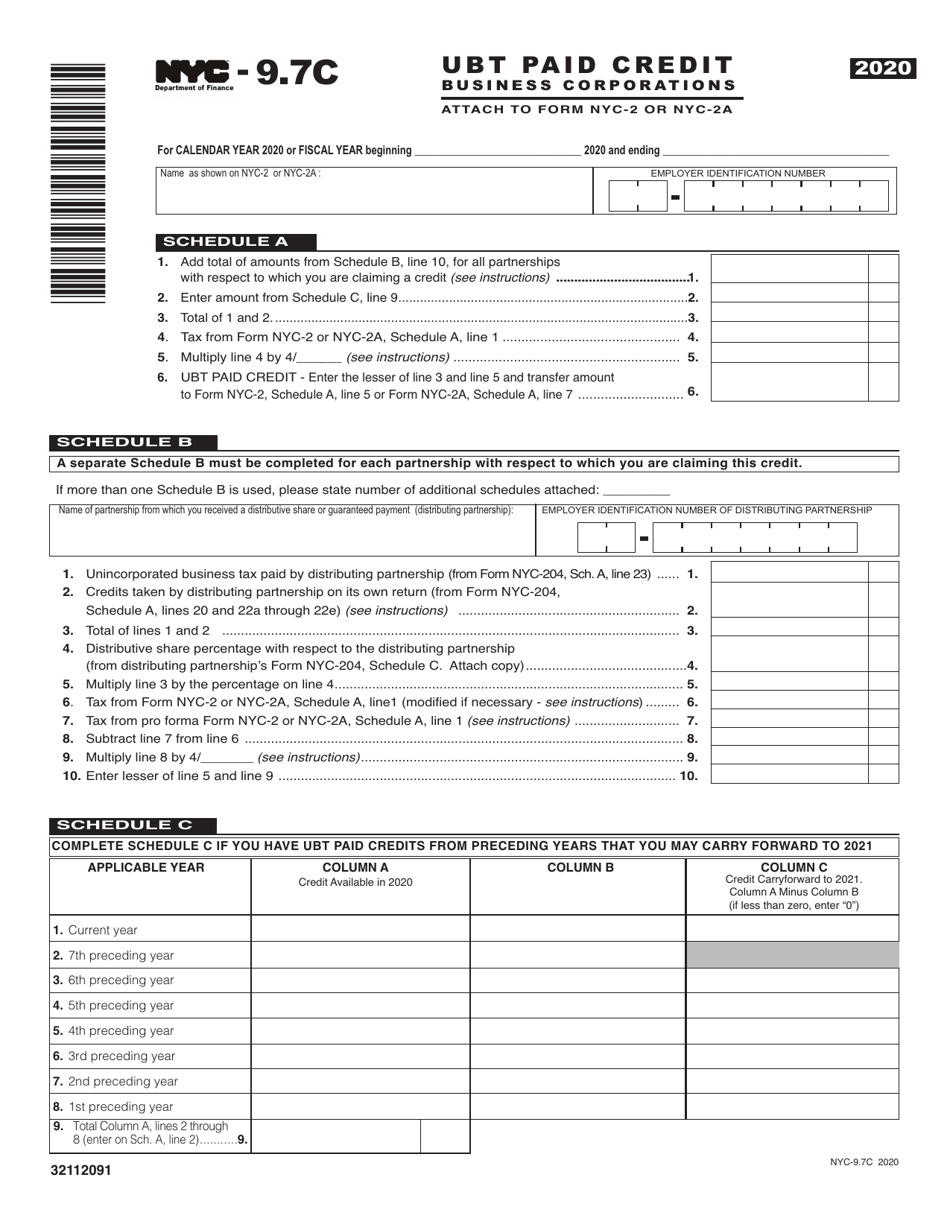

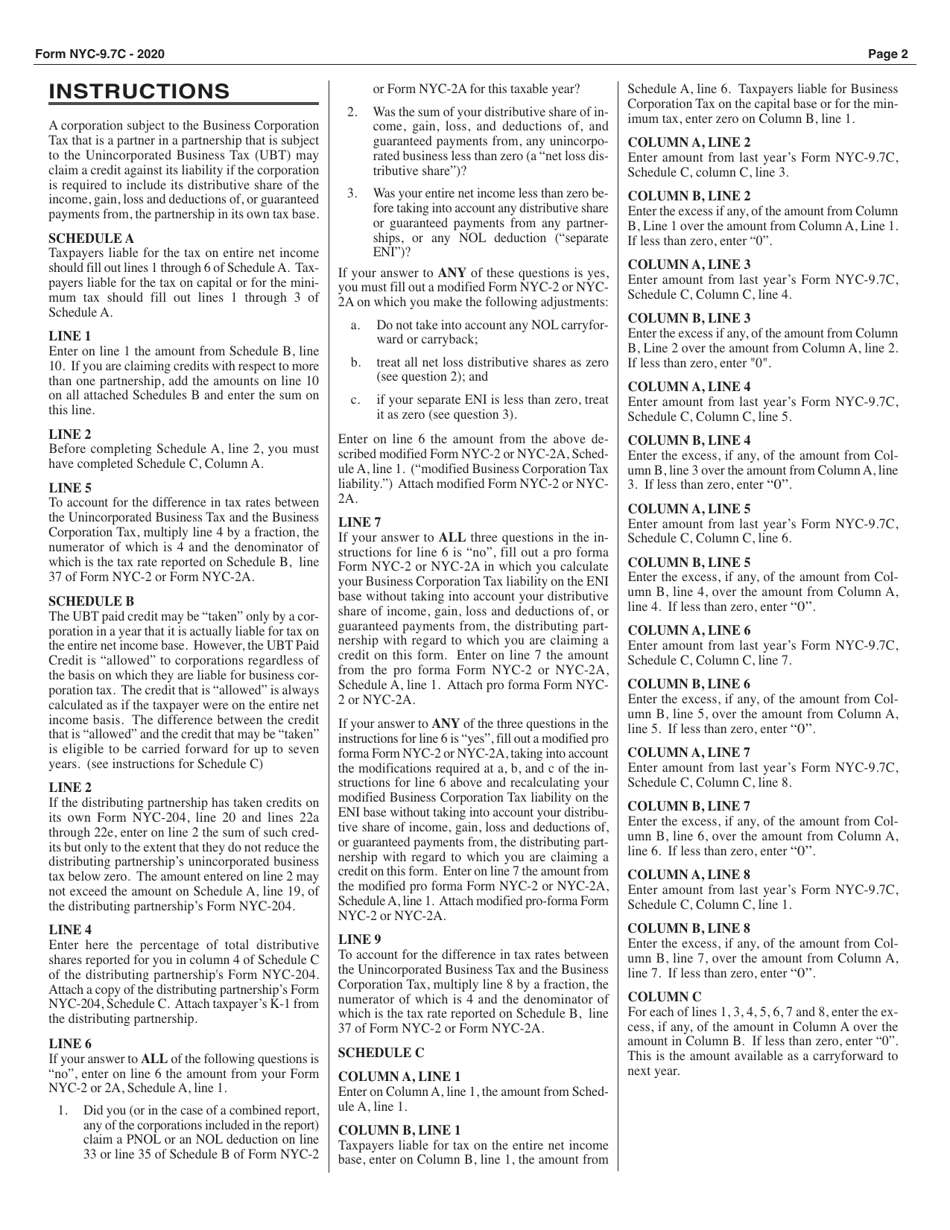

Form NYC-9.7C Ubt Paid Credit Business Corporations - New York City

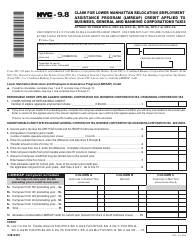

What Is Form NYC-9.7C?

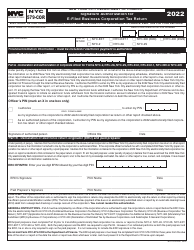

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-9.7C Ubt Paid Credit?

A: NYC-9.7C Ubt Paid Credit is a form used for Business Corporations in New York City.

Q: What is the purpose of NYC-9.7C Ubt Paid Credit?

A: The purpose of NYC-9.7C Ubt Paid Credit is to report and pay any applicable Unincorporated Business Tax (UBT) in New York City.

Q: Who needs to file NYC-9.7C Ubt Paid Credit?

A: Business Corporations operating in New York City are required to file NYC-9.7C Ubt Paid Credit.

Q: When is the deadline to file NYC-9.7C Ubt Paid Credit?

A: The deadline to file NYC-9.7C Ubt Paid Credit is typically April 15th of each year.

Q: Are there any penalties for not filing NYC-9.7C Ubt Paid Credit?

A: Yes, there may be penalties for not filing or late filing of NYC-9.7C Ubt Paid Credit, including interest and potential legal action.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-9.7C by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.