This version of the form is not currently in use and is provided for reference only. Download this version of

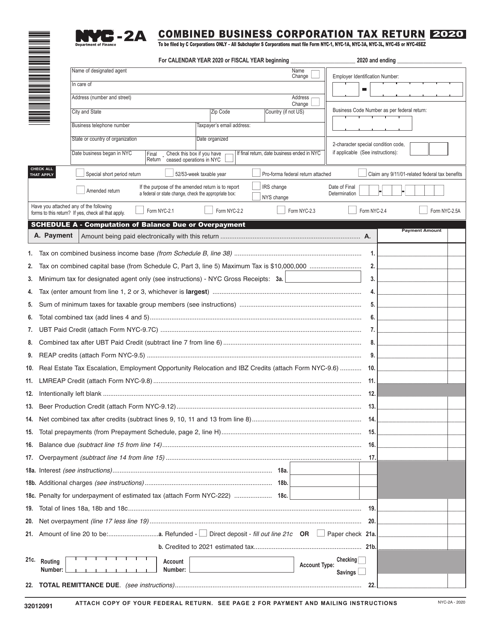

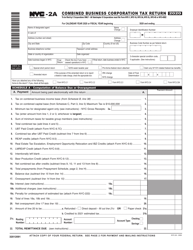

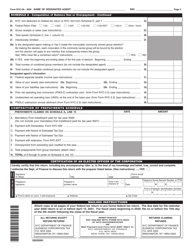

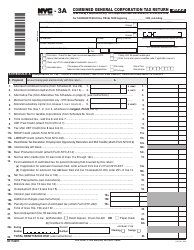

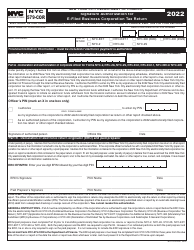

Form NYC-2A

for the current year.

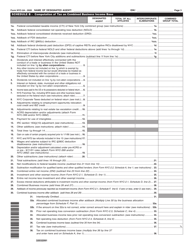

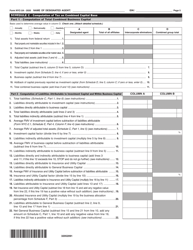

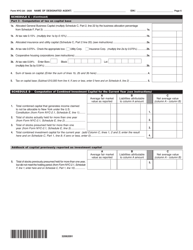

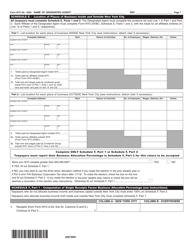

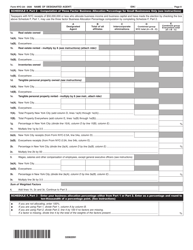

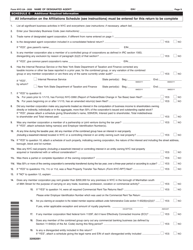

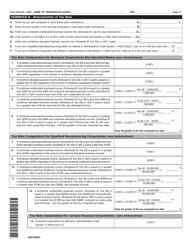

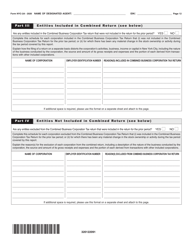

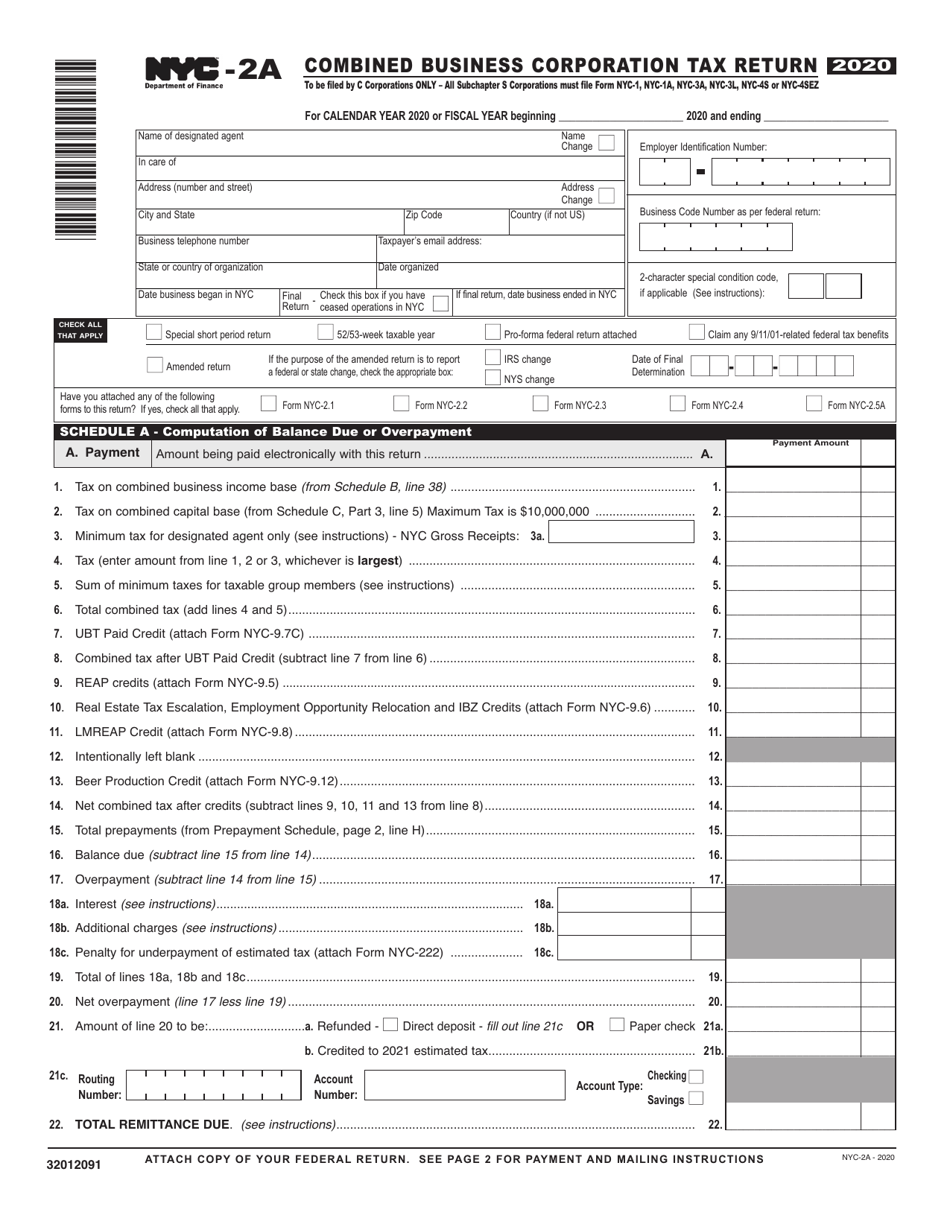

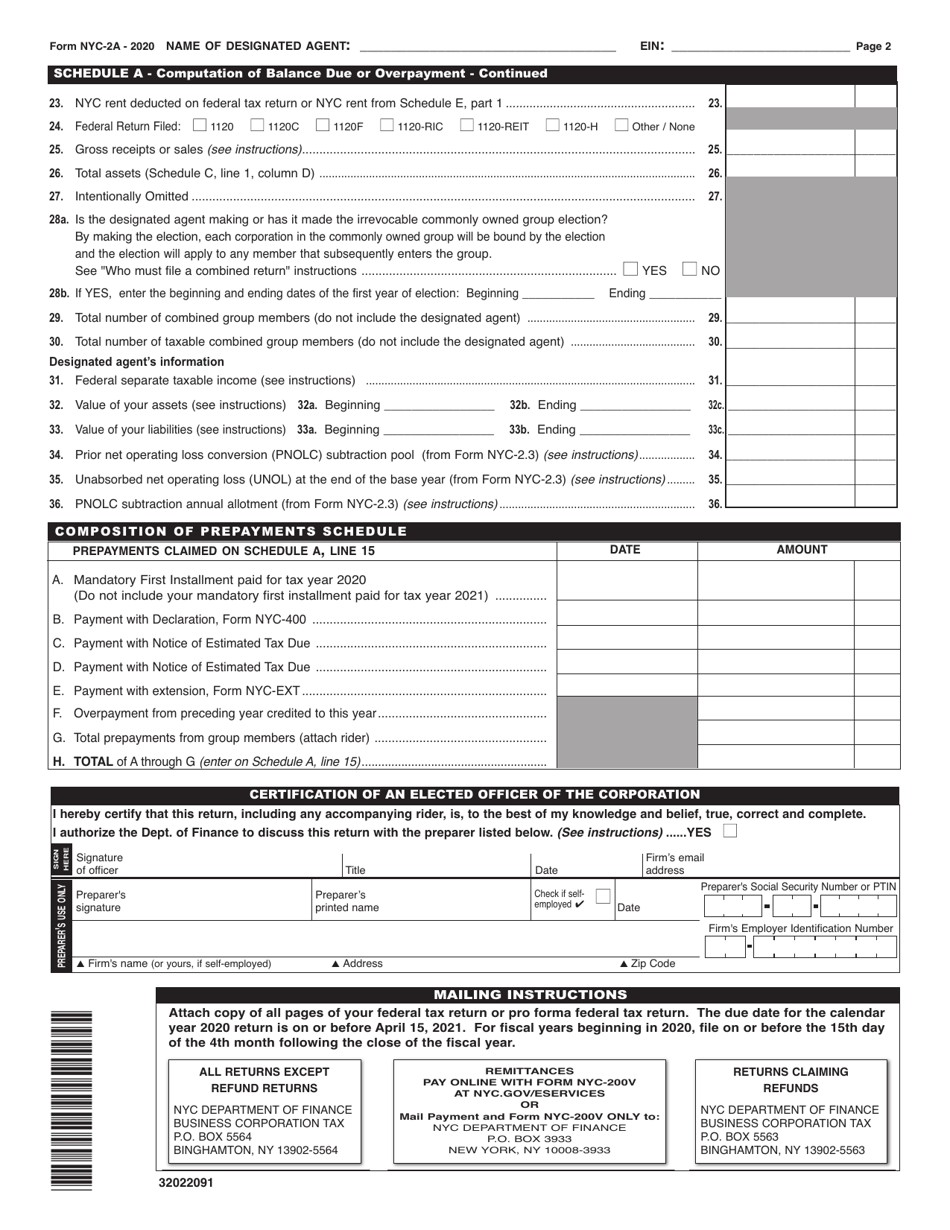

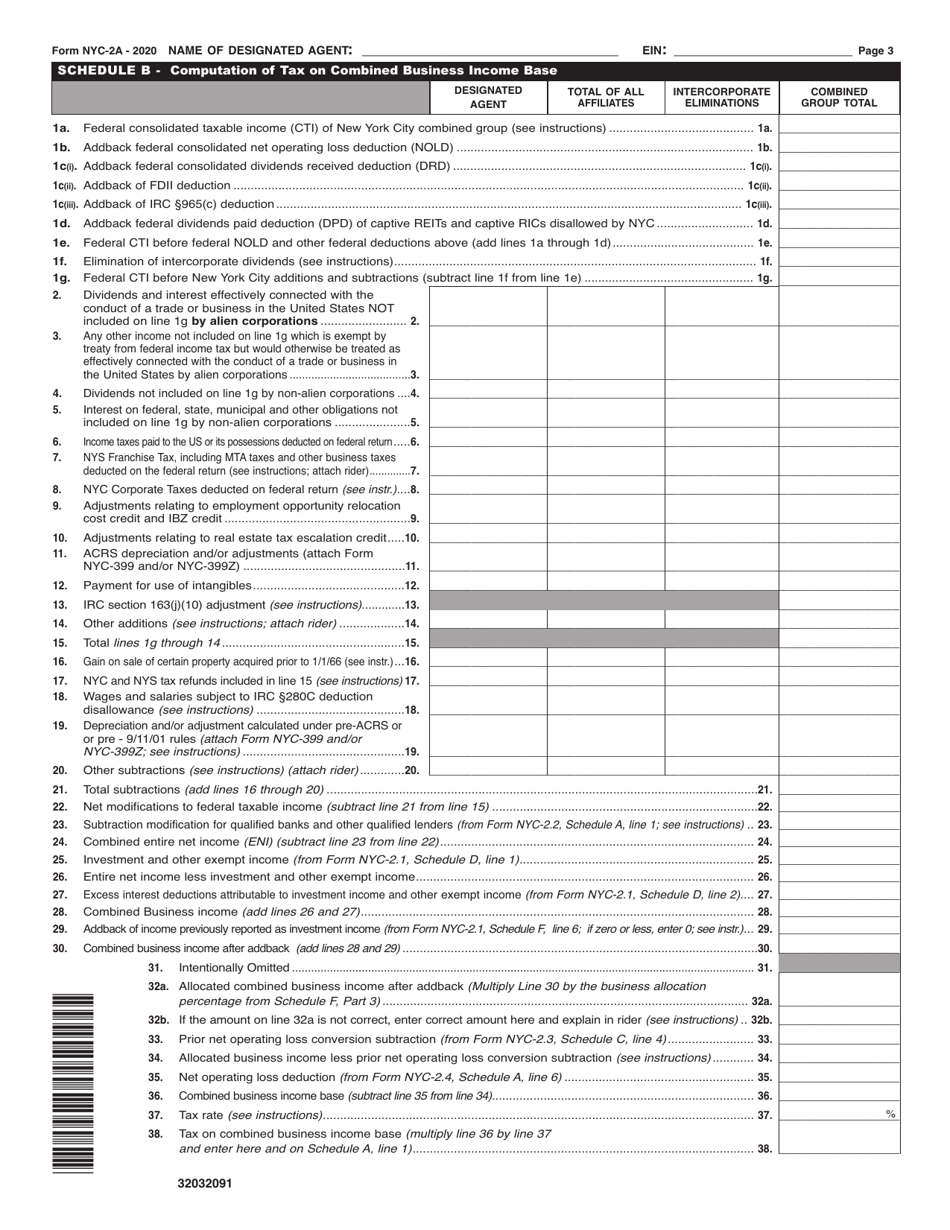

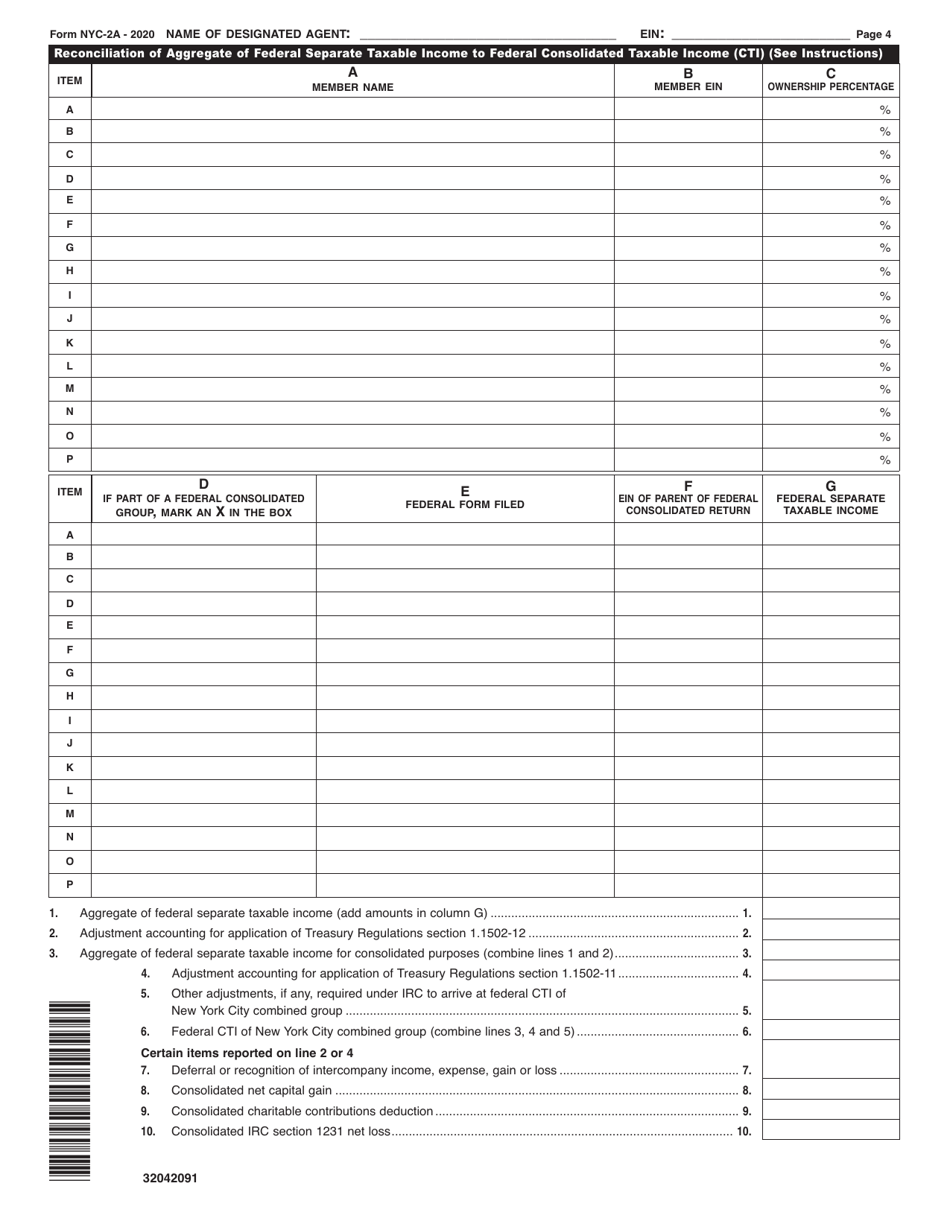

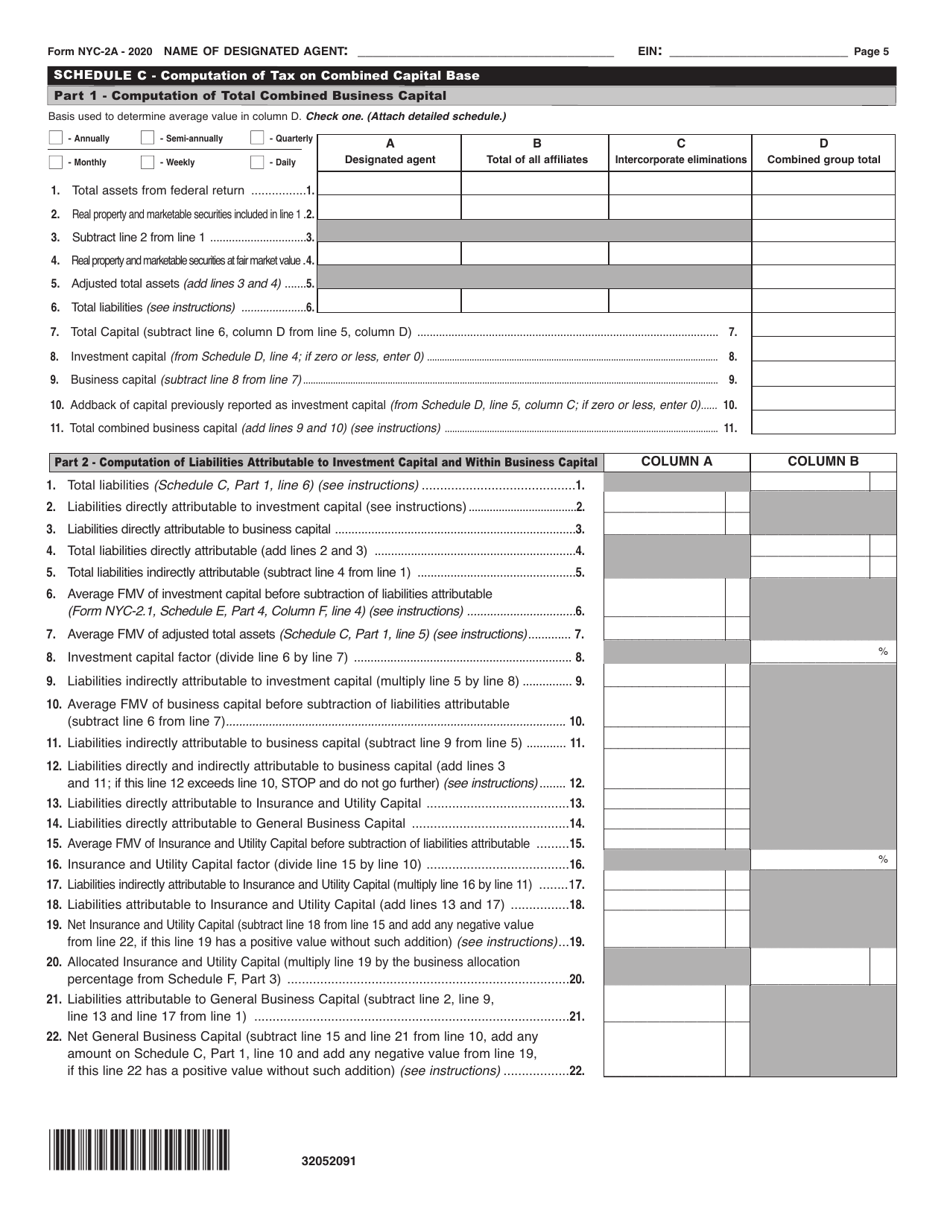

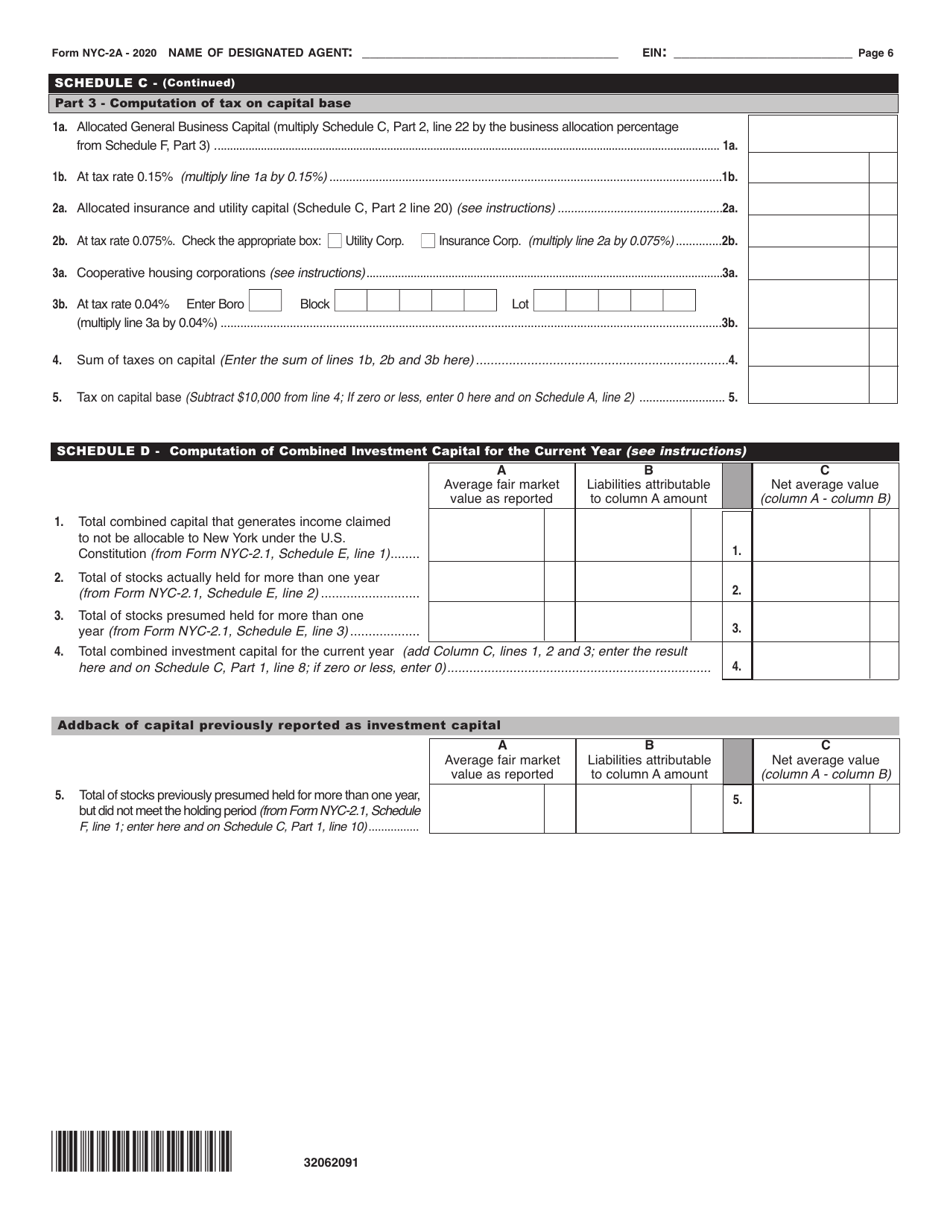

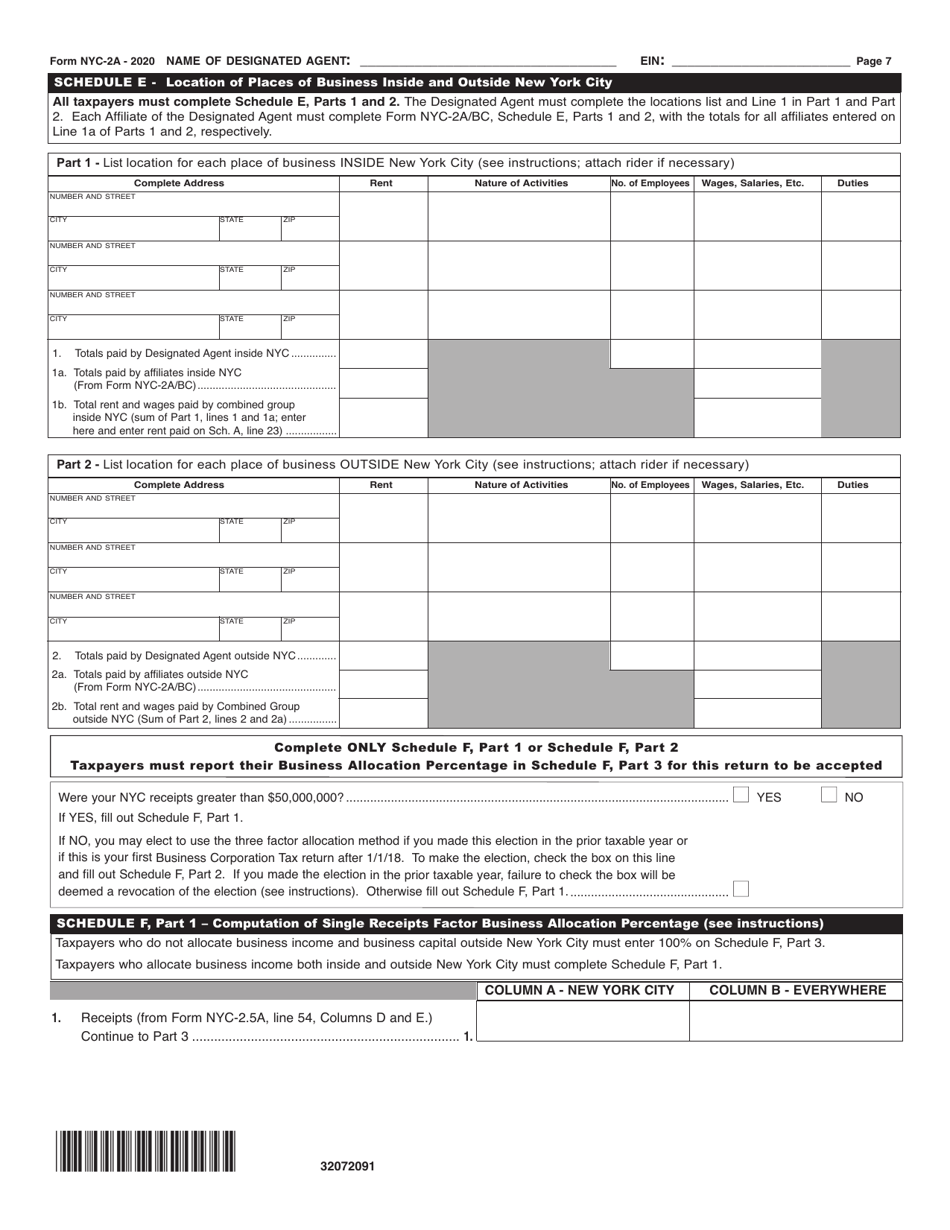

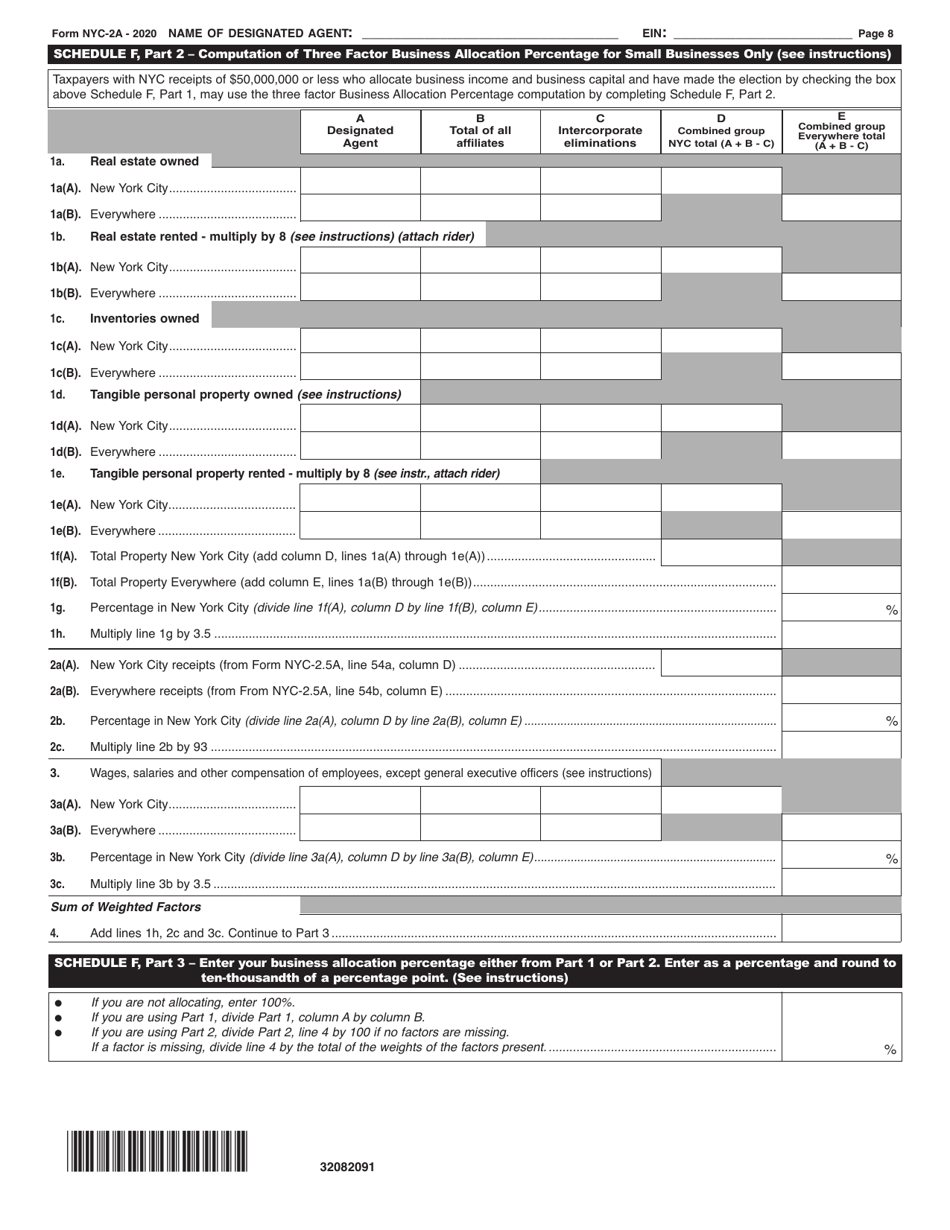

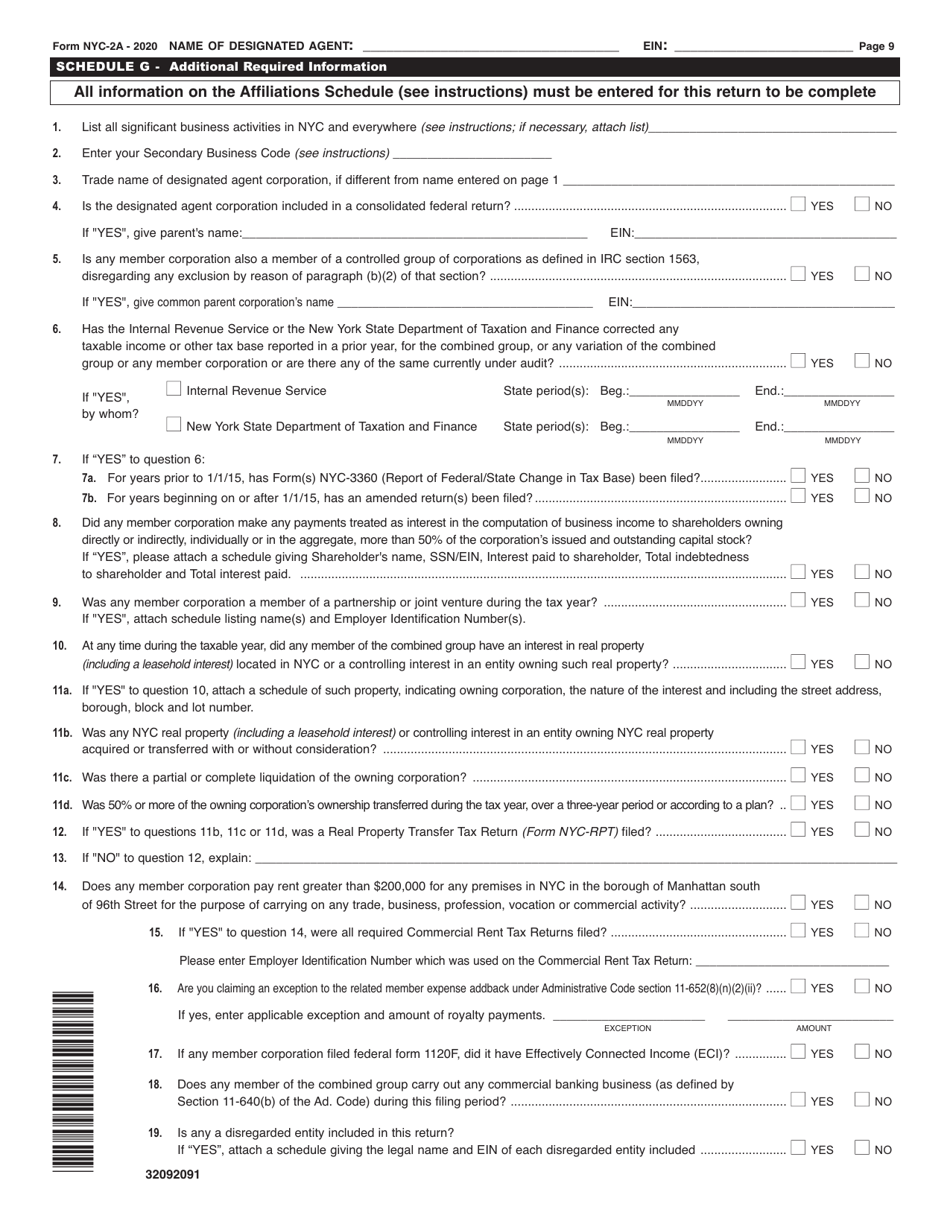

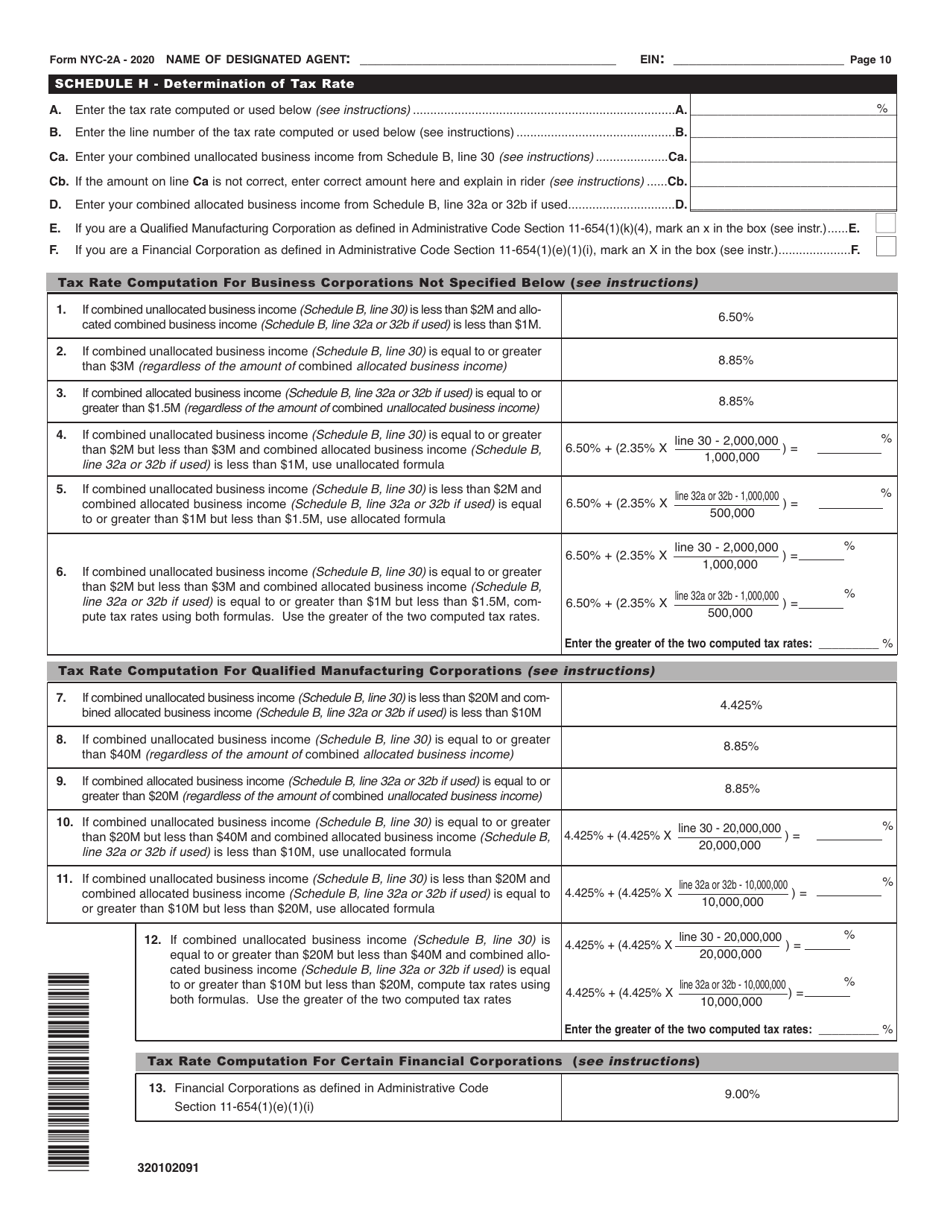

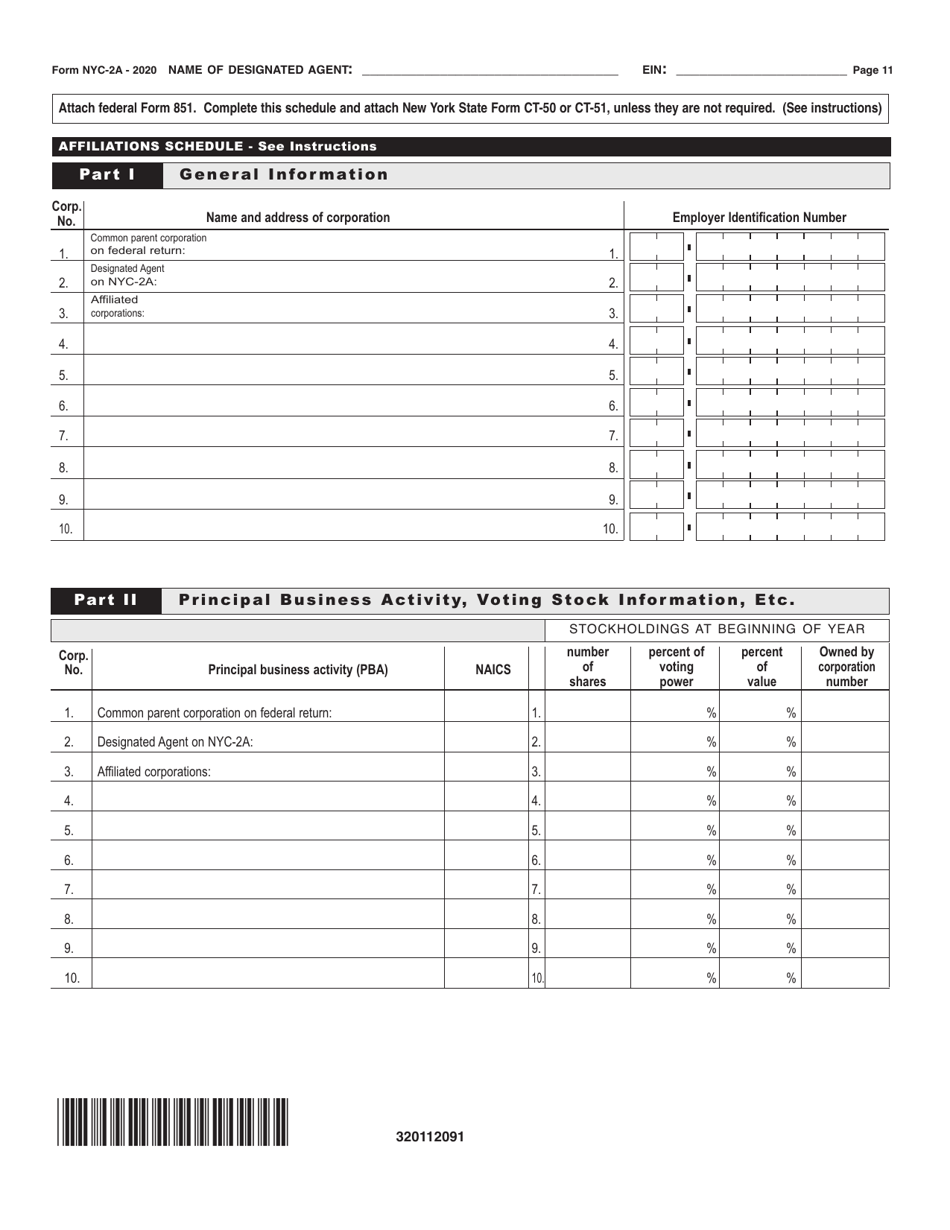

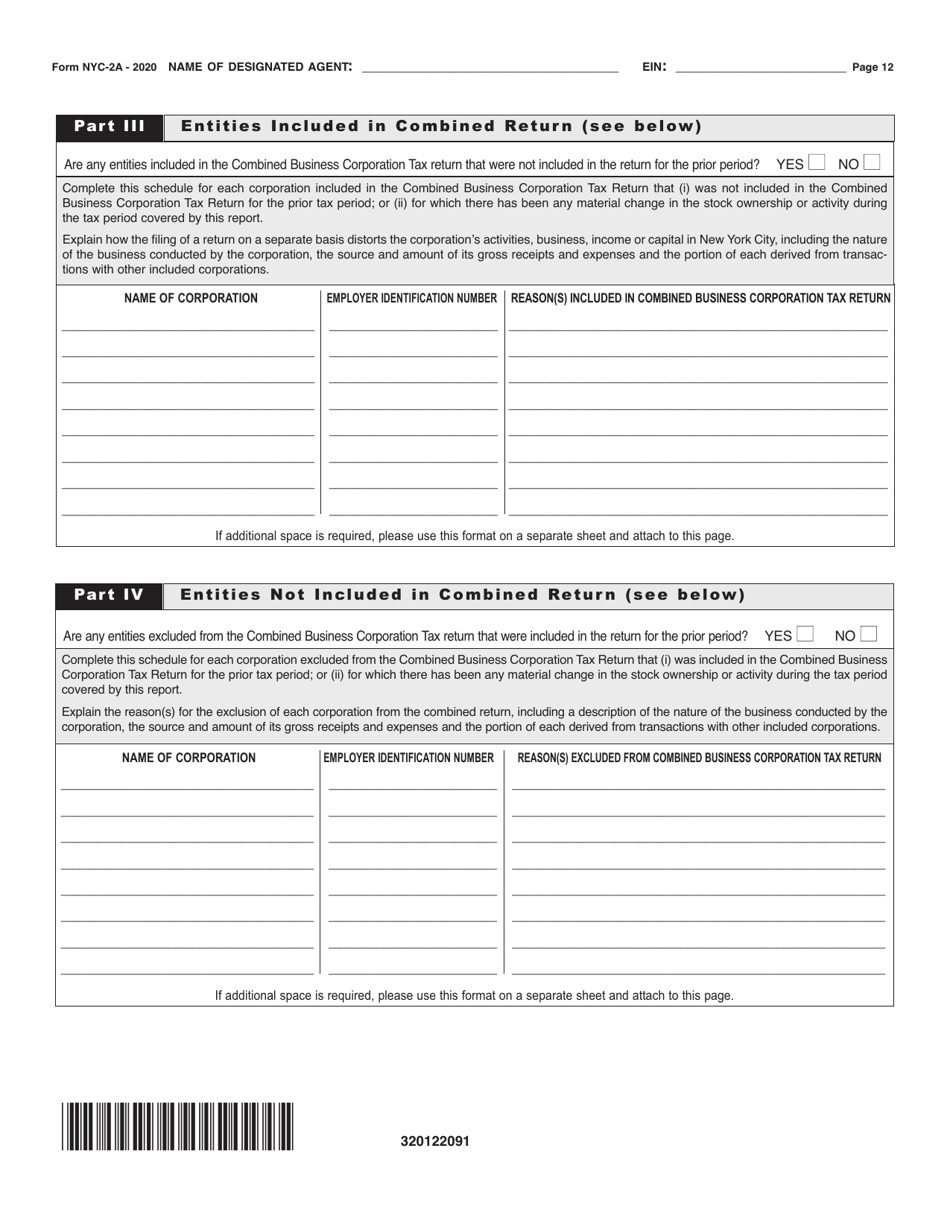

Form NYC-2A Combined Business Corporation Tax Return - New York City

What Is Form NYC-2A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

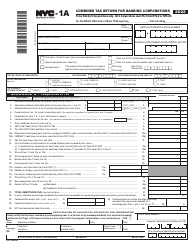

Q: What is the NYC-2A Combined Business Corporation Tax Return?

A: The NYC-2A Combined Business Corporation Tax Return is a form used to report the business corporationtax owed to the City of New York.

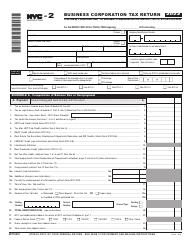

Q: Who needs to file the NYC-2A Combined Business Corporation Tax Return?

A: All business corporations that are subject to tax in New York City must file the NYC-2A form.

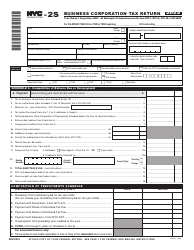

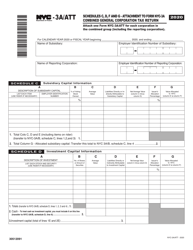

Q: What information is required to complete the NYC-2A Combined Business Corporation Tax Return?

A: You'll need to provide details about your business, including its income, expenses, and deductions.

Q: When is the deadline for filing the NYC-2A Combined Business Corporation Tax Return?

A: The deadline for filing the NYC-2A form is typically March 15th of each year.

Q: Are there any penalties for late filing of the NYC-2A Combined Business Corporation Tax Return?

A: Yes, there are penalties for late filing, including interest charges and possible penalties for underpayment of taxes.

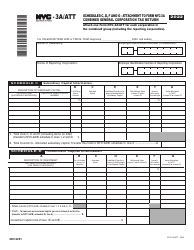

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.