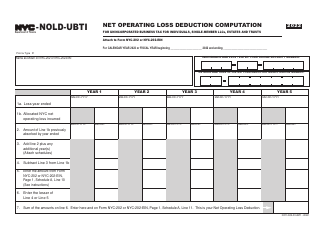

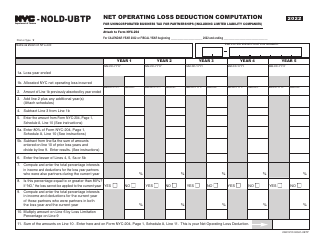

This version of the form is not currently in use and is provided for reference only. Download this version of

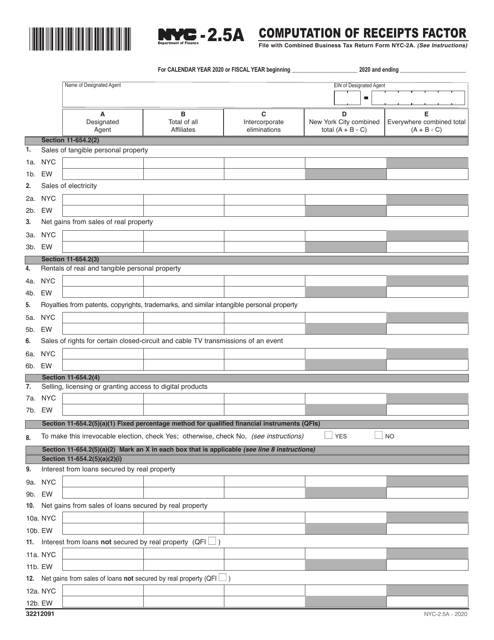

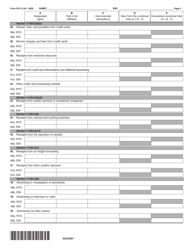

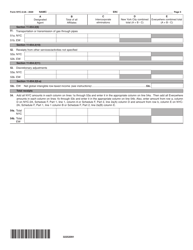

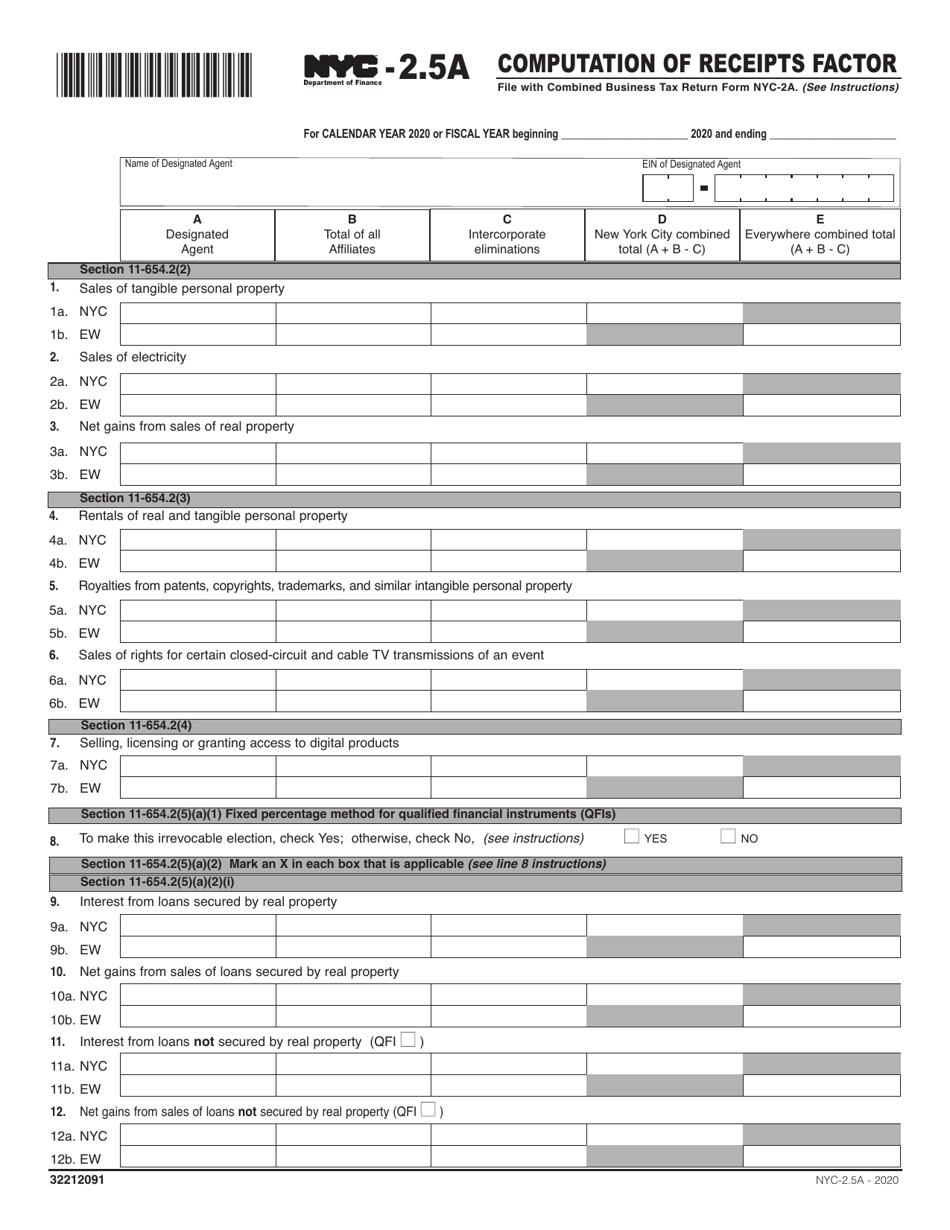

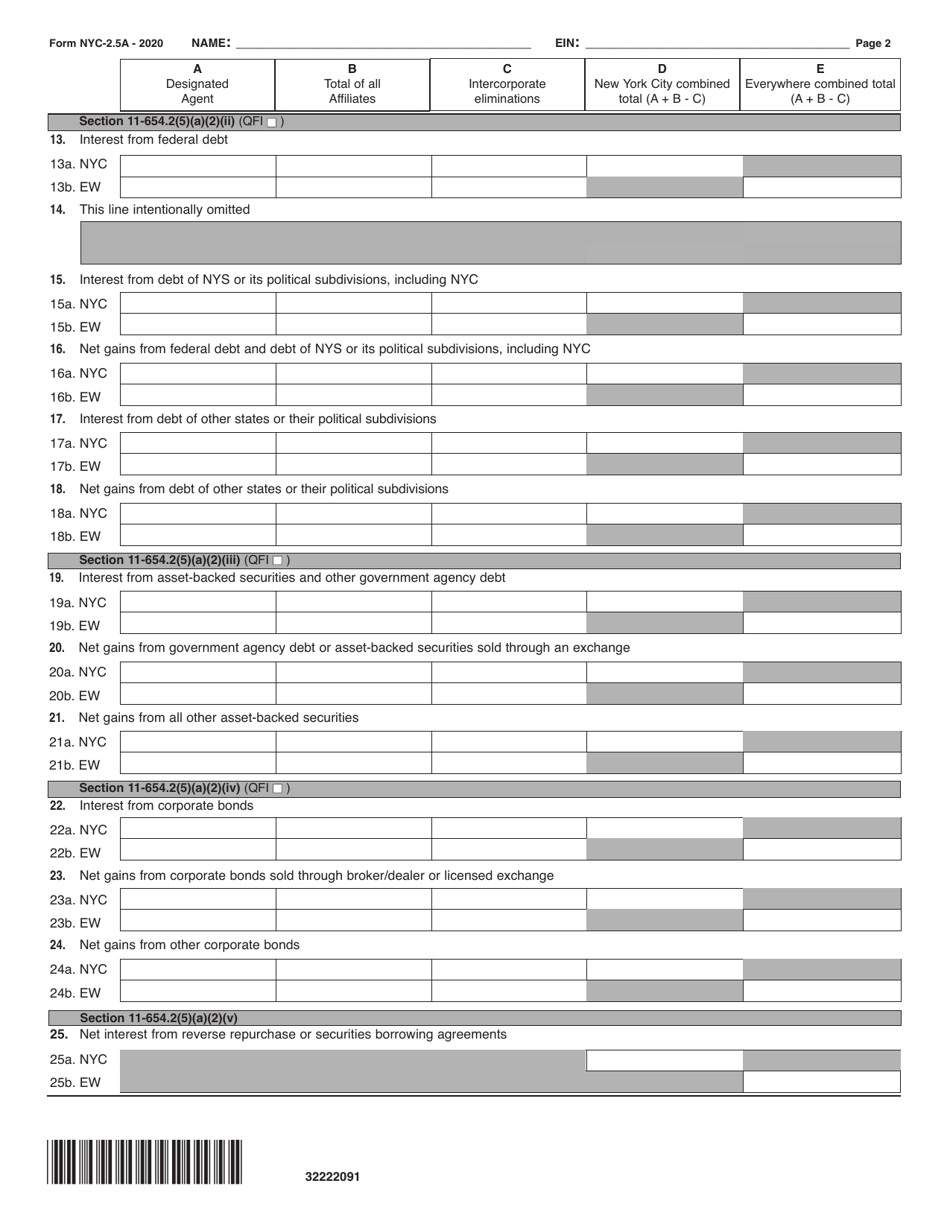

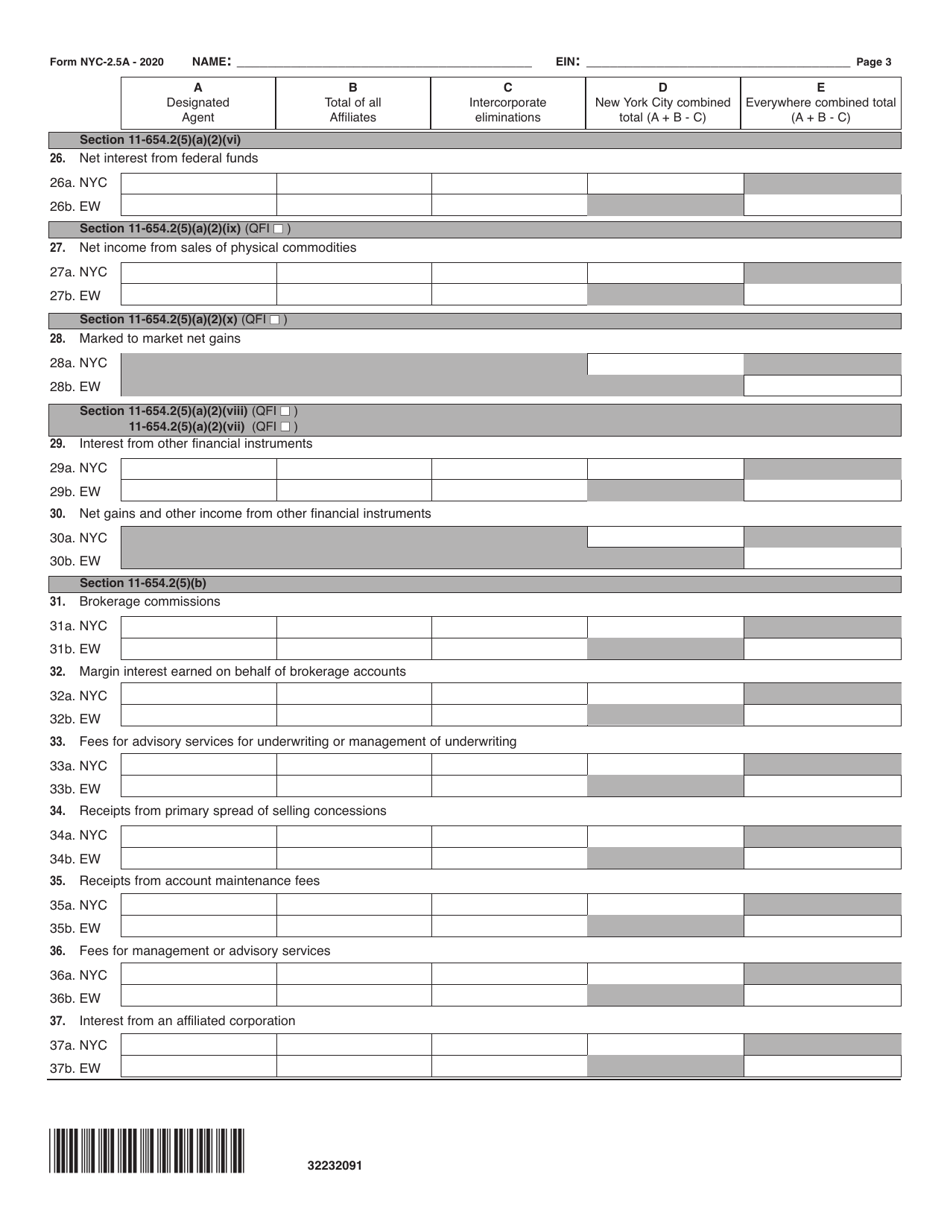

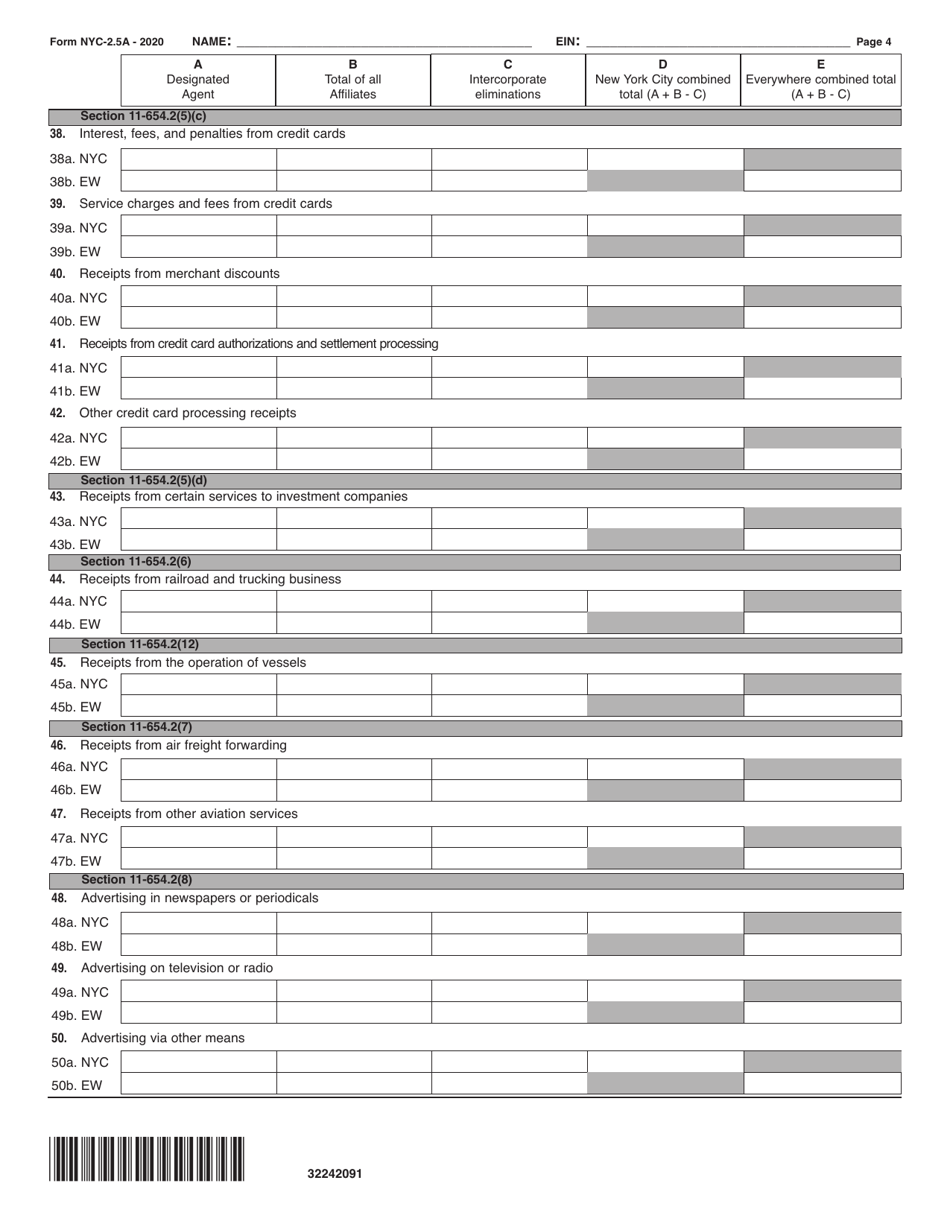

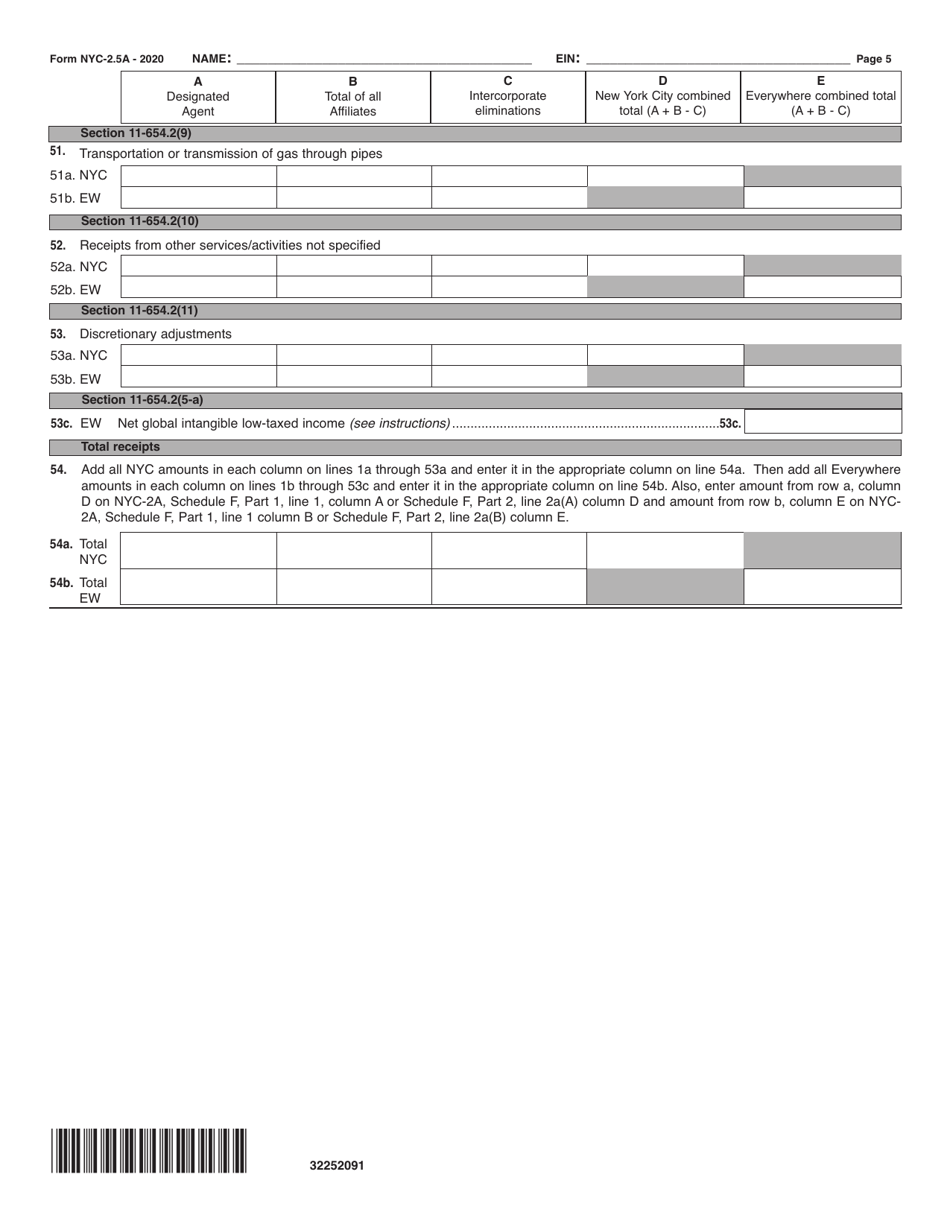

Form NYC-2.5A

for the current year.

Form NYC-2.5A Computation of Receipts Factor - New York City

What Is Form NYC-2.5A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

Q: What is NYC-2.5A?

A: NYC-2.5A is a form used to compute the Receipts Factor for businesses in New York City.

Q: What is the Receipts Factor?

A: The Receipts Factor is a calculation used to determine the portion of a business's receipts subject to tax in New York City.

Q: Who needs to file NYC-2.5A?

A: Businesses operating in New York City need to file NYC-2.5A to compute their Receipts Factor.

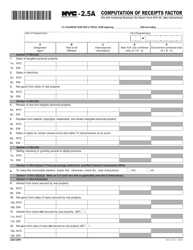

Q: How is the Receipts Factor calculated?

A: The Receipts Factor is calculated by dividing a business's receipts sourced to New York City by its total receipts.

Q: What are sourced receipts?

A: Sourced receipts are the receipts attributable to the business's activities in New York City.

Q: What are total receipts?

A: Total receipts are the business's worldwide gross receipts.

Q: Are there any exemptions or exclusions for the Receipts Factor?

A: Yes, there are certain exemptions and exclusions available for certain types of business receipts.

Q: When is the deadline for filing NYC-2.5A?

A: The deadline for filing NYC-2.5A is typically on or before the due date of the business's tax return.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.