This version of the form is not currently in use and is provided for reference only. Download this version of

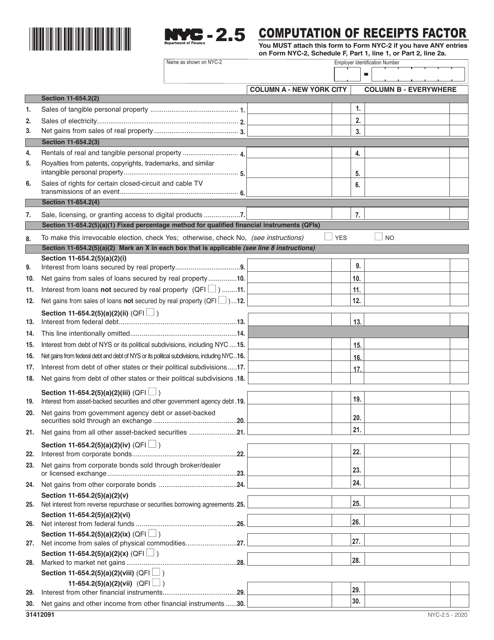

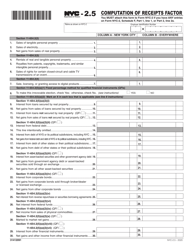

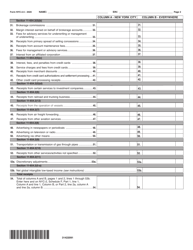

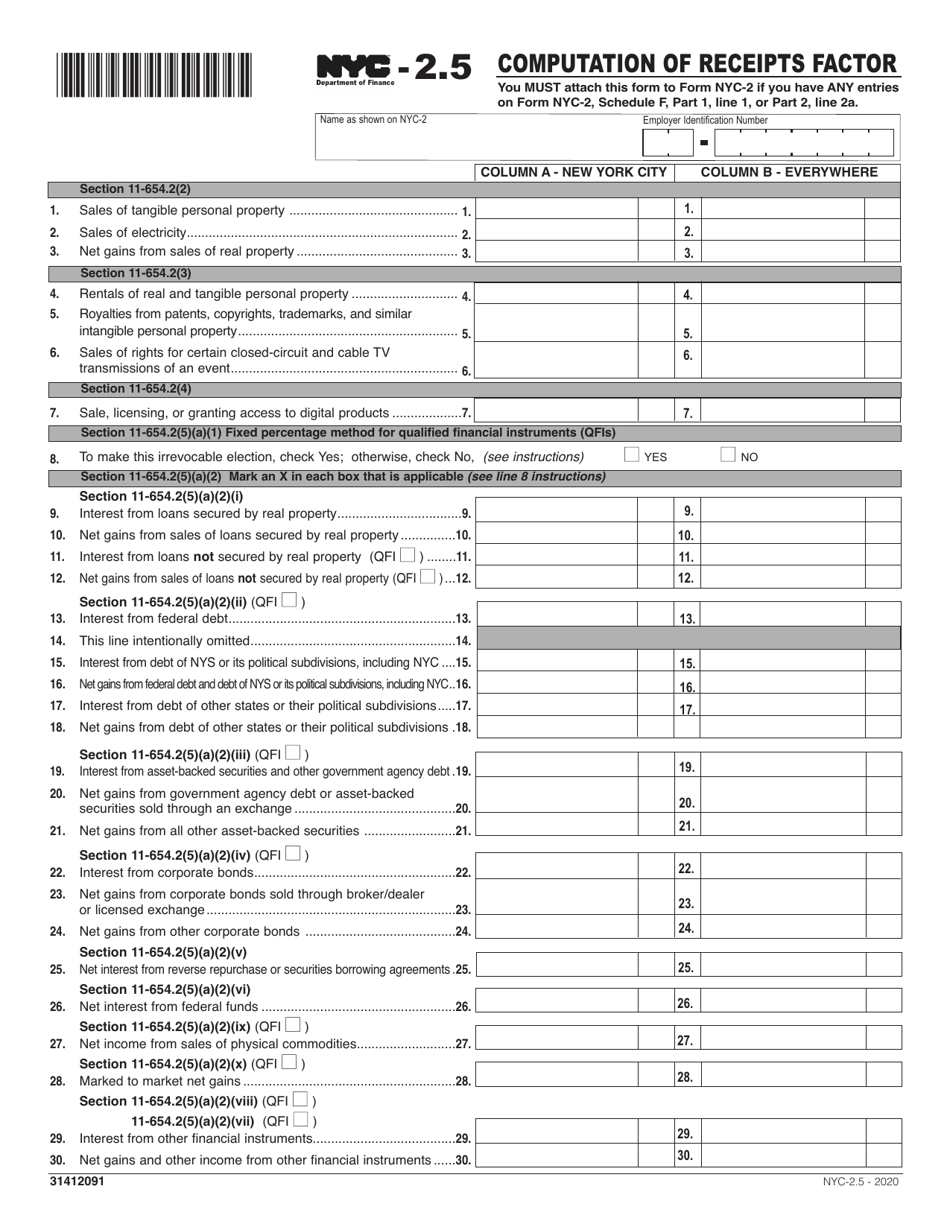

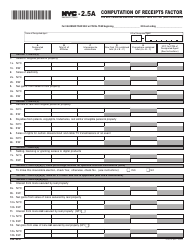

Form NYC-2.5

for the current year.

Form NYC-2.5 Computation of Receipts Factor - New York City

What Is Form NYC-2.5?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.5?

A: NYC-2.5 refers to the computation of the Receipts Factor for New York City.

Q: What is the Receipts Factor?

A: The Receipts Factor is a formula used to determine the amount of income that is sourced to New York City for tax purposes.

Q: Why is the Receipts Factor important?

A: The Receipts Factor determines how much income a business needs to allocate to New York City for tax purposes.

Q: How is the Receipts Factor computed?

A: The Receipts Factor is computed by dividing the total receipts sourced to New York City by the total receipts everywhere.

Q: What is the purpose of computing the Receipts Factor?

A: The purpose of computing the Receipts Factor is to fairly allocate income to New York City for tax purposes.

Q: What are the requirements for computing the Receipts Factor?

A: To compute the Receipts Factor, businesses must have both New York City and non-New York City receipts.

Q: Are there any exemptions or special rules for computing the Receipts Factor?

A: Yes, there may be exemptions, thresholds, or special rules for certain types of businesses or industries.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.