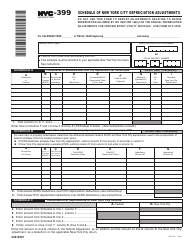

This version of the form is not currently in use and is provided for reference only. Download this version of

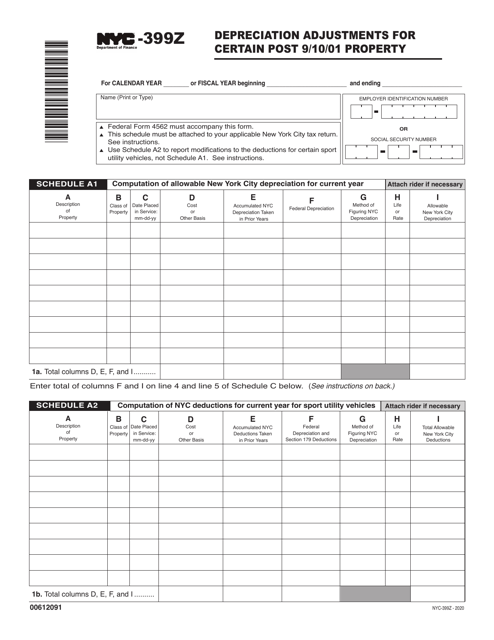

Form NYC-399Z

for the current year.

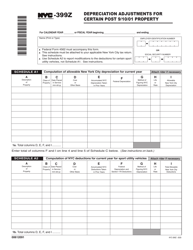

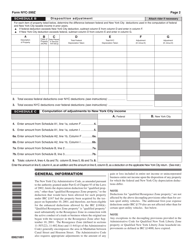

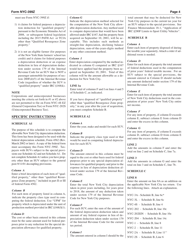

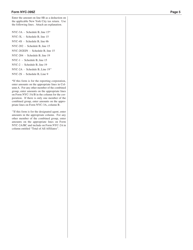

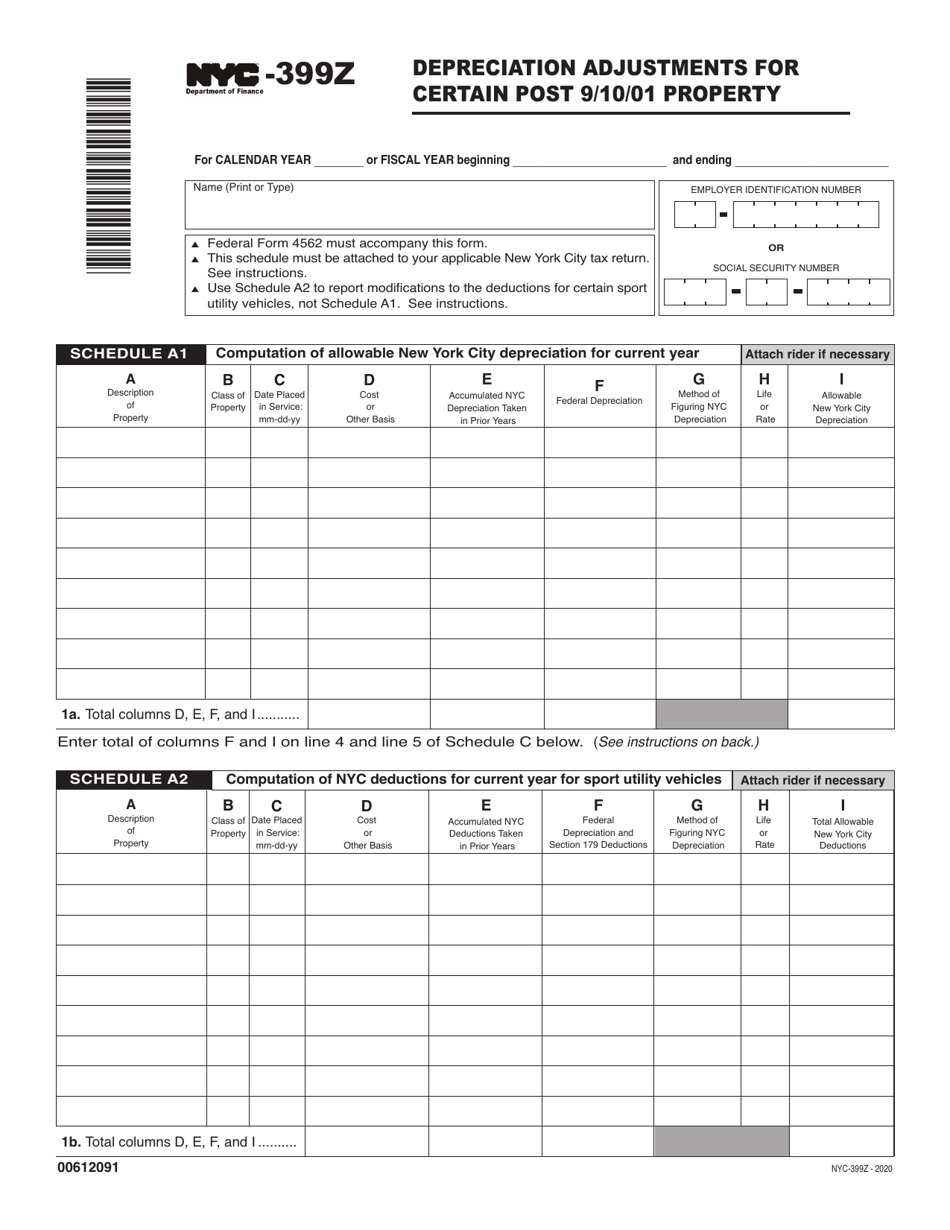

Form NYC-399Z Depreciation Adjustments for Certain Post 9 / 10 / 01 Property - New York City

What Is Form NYC-399Z?

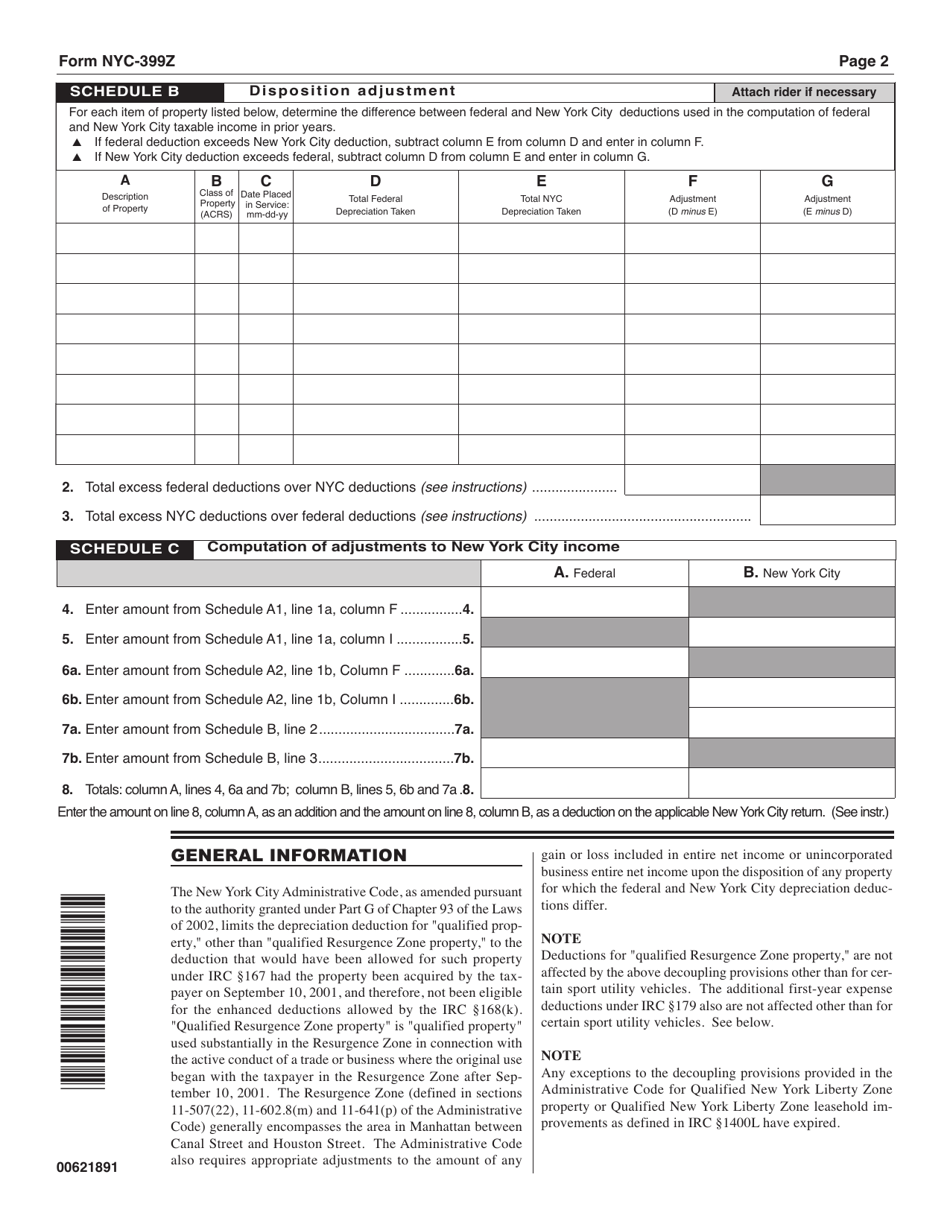

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-399Z?

A: NYC-399Z is a form for reporting depreciation adjustments for certain post 9/10/01 property in New York City.

Q: What is the purpose of NYC-399Z?

A: The purpose of NYC-399Z is to report any depreciation adjustments for property acquired after September 10, 2001, and used in New York City.

Q: Who needs to file NYC-399Z?

A: Anyone who has property acquired after September 10, 2001, and used in New York City needs to file NYC-399Z if there are any depreciation adjustments to report.

Q: When is the deadline for filing NYC-399Z?

A: The deadline for filing NYC-399Z is usually March 15th of each year.

Q: What should I do if I have questions about NYC-399Z?

A: If you have any questions about NYC-399Z, you can contact the New York City Department of Finance for assistance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-399Z by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.