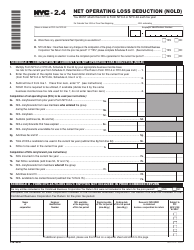

This version of the form is not currently in use and is provided for reference only. Download this version of

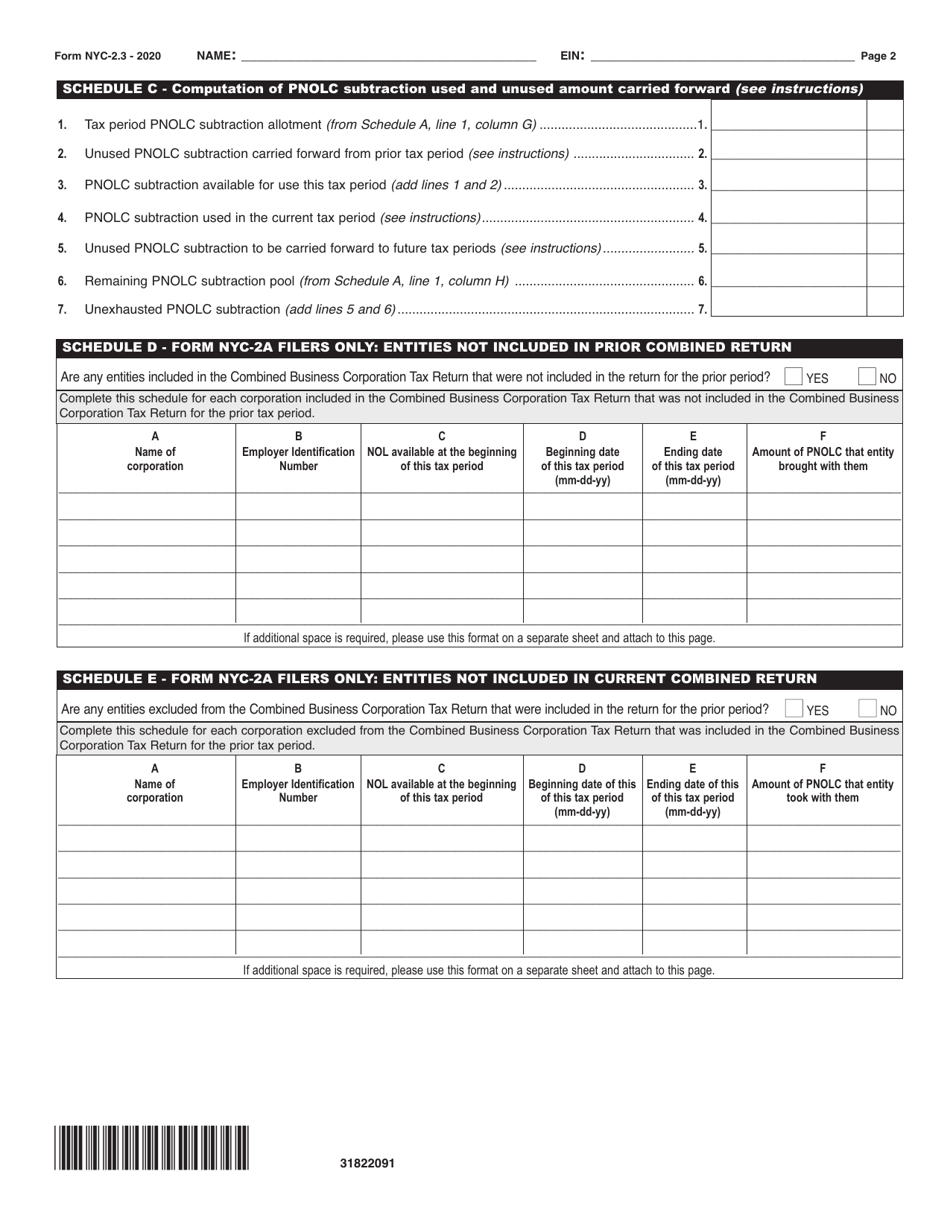

Form NYC-2.3

for the current year.

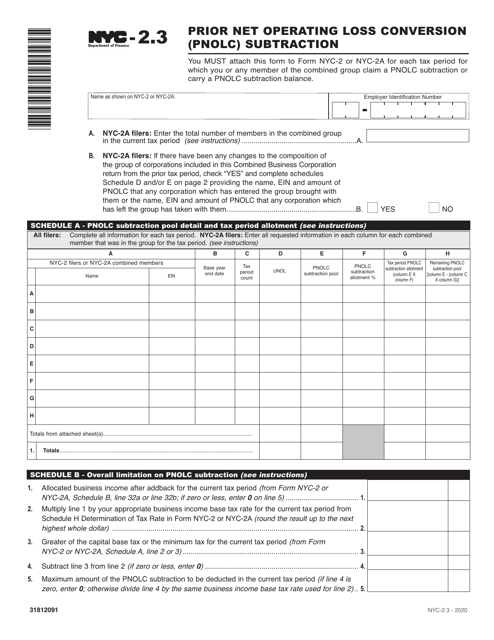

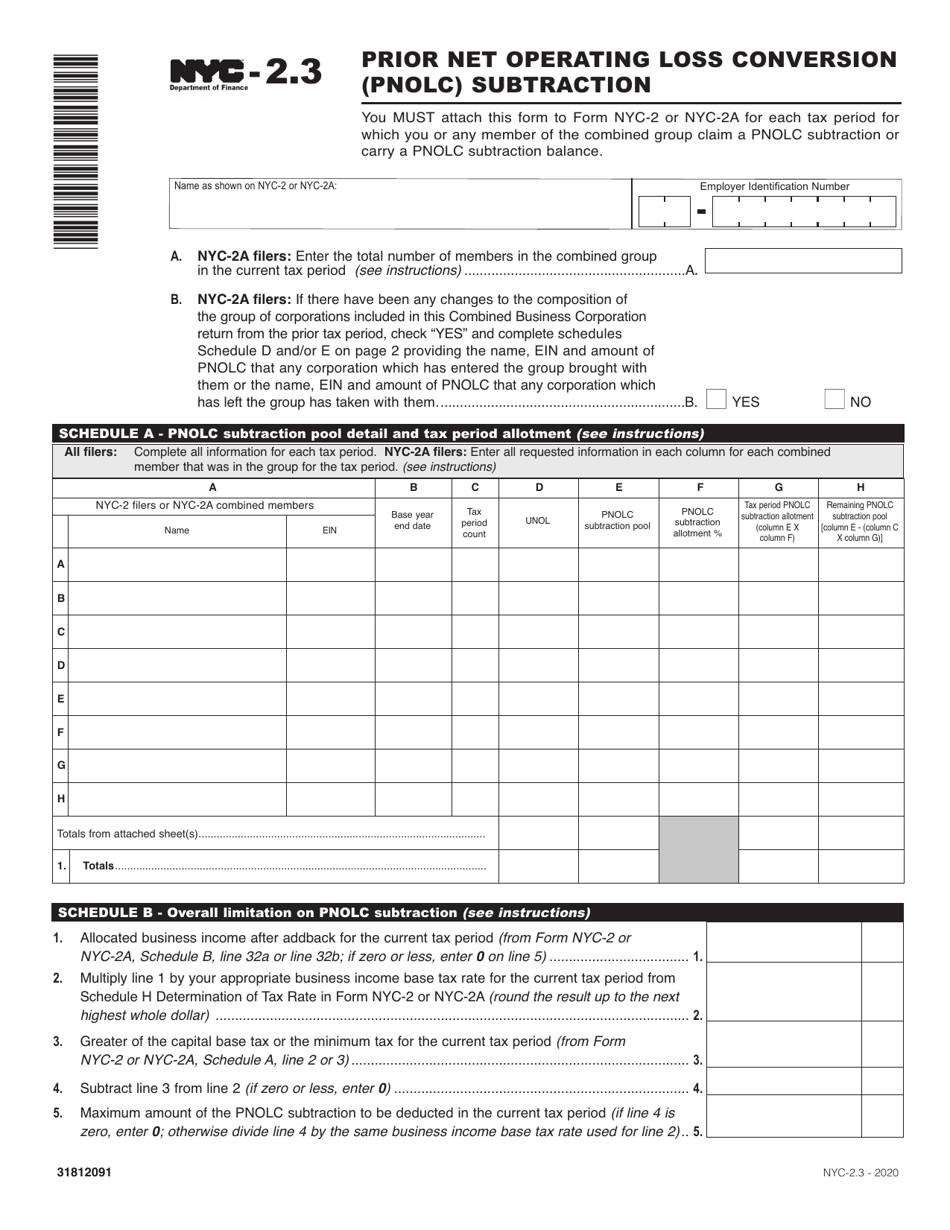

Form NYC-2.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York City

What Is Form NYC-2.3?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.3?

A: NYC-2.3 refers to the Prior Net Operating Loss Conversion (PNOLC) Subtraction form for New York City.

Q: What is the purpose of NYC-2.3?

A: The purpose of NYC-2.3 is to calculate the subtraction of prior net operating losses for businesses in New York City.

Q: What is Prior Net Operating Loss Conversion (PNOLC)?

A: PNOLC refers to the conversion of net operating losses into tax credits that can be used to reduce future tax liabilities.

Q: Who needs to file NYC-2.3?

A: Businesses operating in New York City that have prior net operating losses and want to claim the subtraction for tax purposes need to file NYC-2.3.

Q: What information do I need to complete NYC-2.3?

A: To complete NYC-2.3, you will need information regarding your prior net operating losses, including the amount and the year in which they occurred.

Q: What are the consequences of not filing NYC-2.3?

A: If you are required to file NYC-2.3 and fail to do so, you may not be able to claim the subtraction for prior net operating losses and may face penalties or fines.

Q: Can I amend NYC-2.3 if I made an error?

A: Yes, you can amend NYC-2.3 if you made an error on the original form. You should file an amended return as soon as possible to correct any mistakes.

Q: Are there any specific deadlines for filing NYC-2.3?

A: Yes, NYC-2.3 must be filed by the due date of your New York City corporate tax return, including extensions, or by the due date specified by the Department of Finance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.3 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.