This version of the form is not currently in use and is provided for reference only. Download this version of

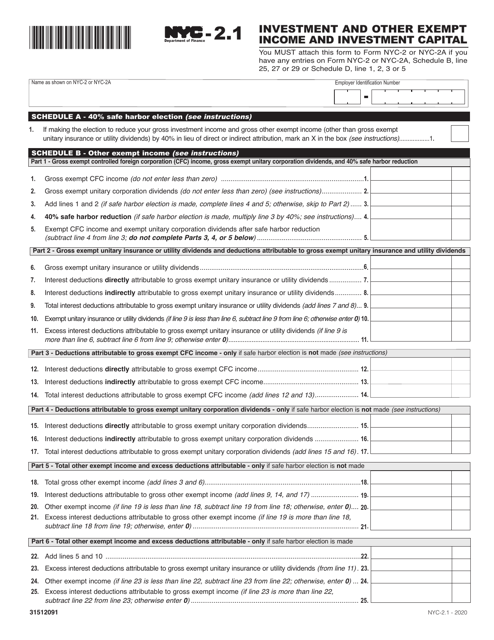

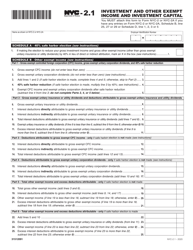

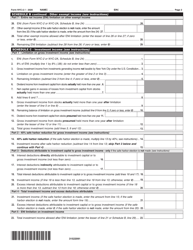

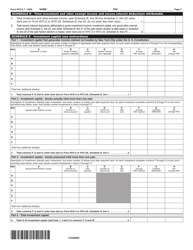

Form NYC-2.1

for the current year.

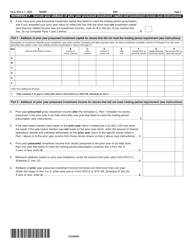

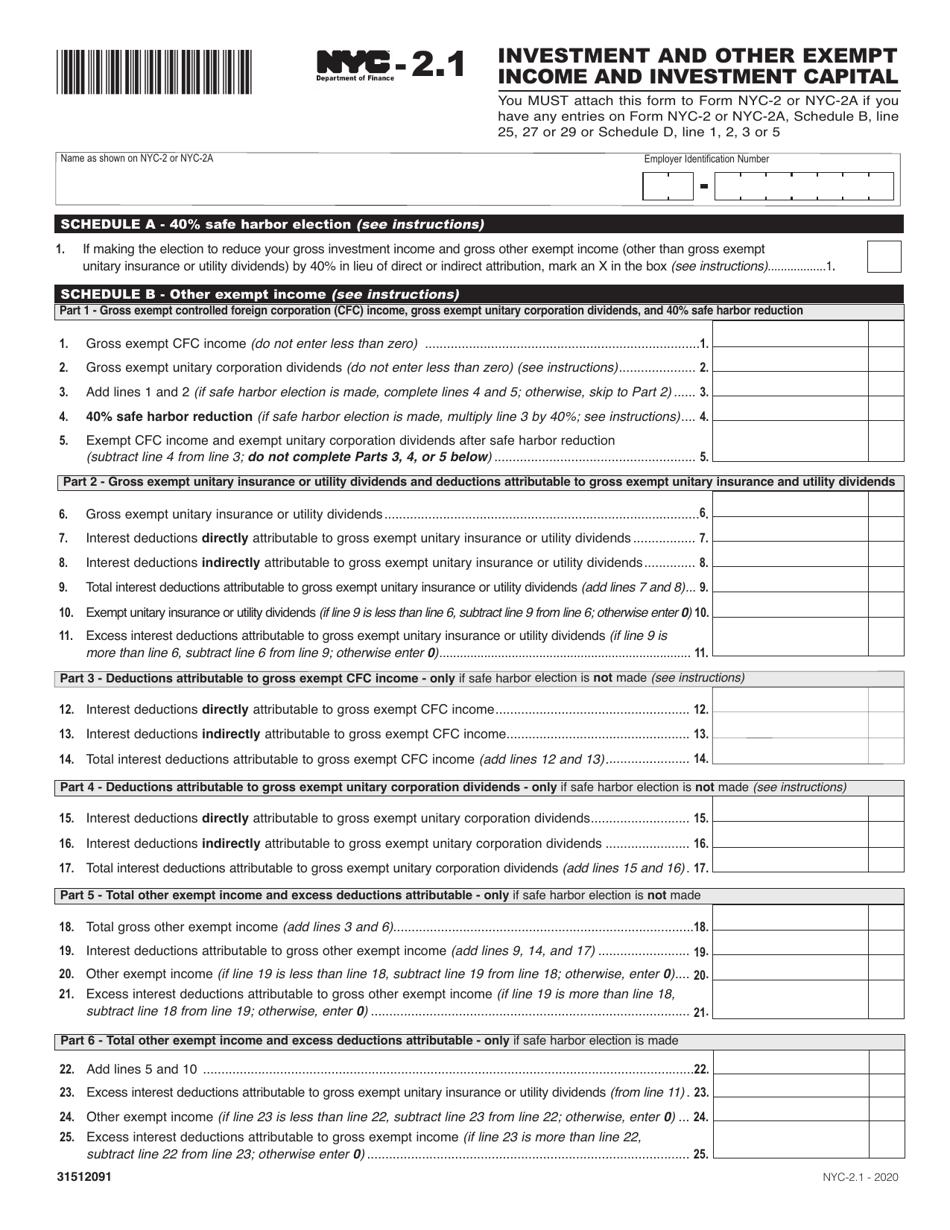

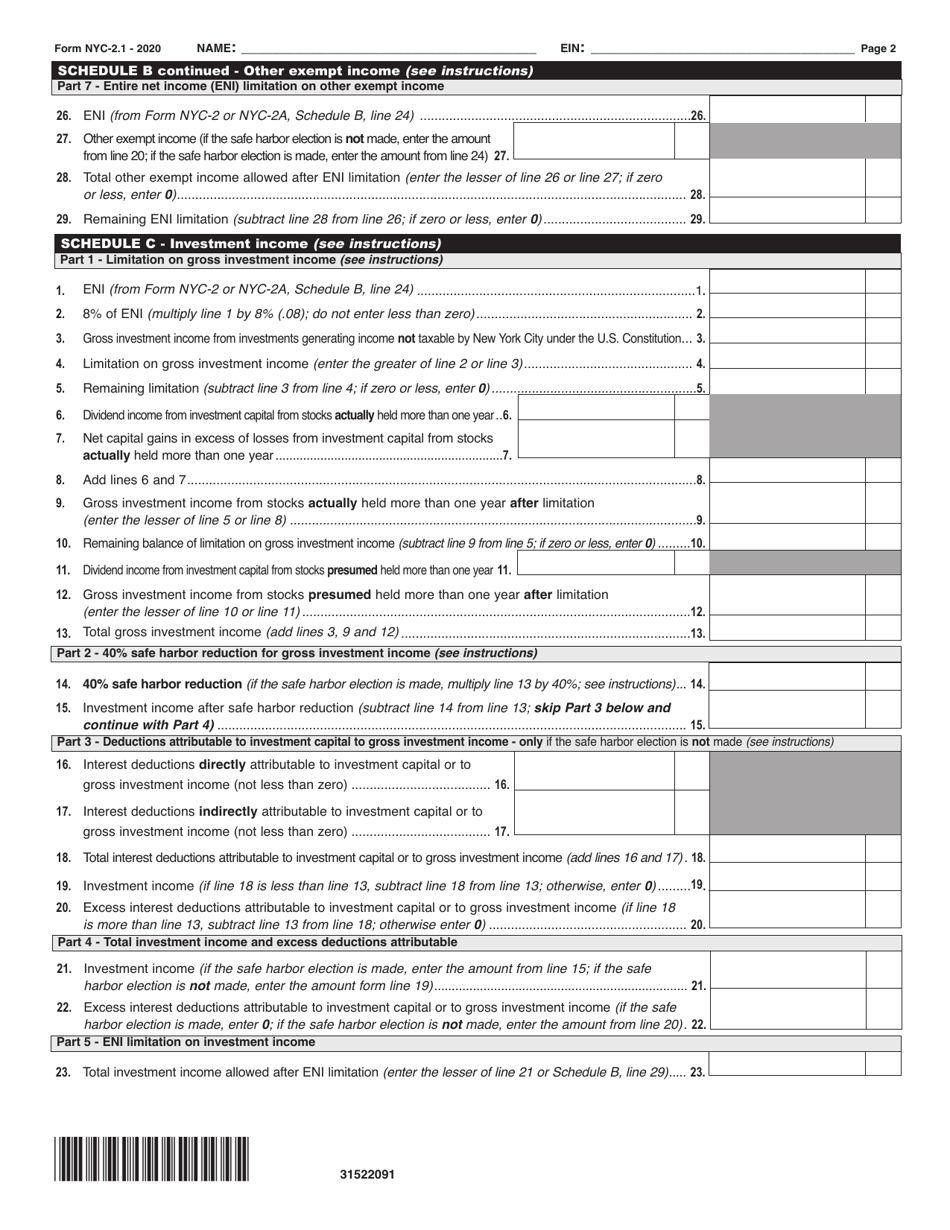

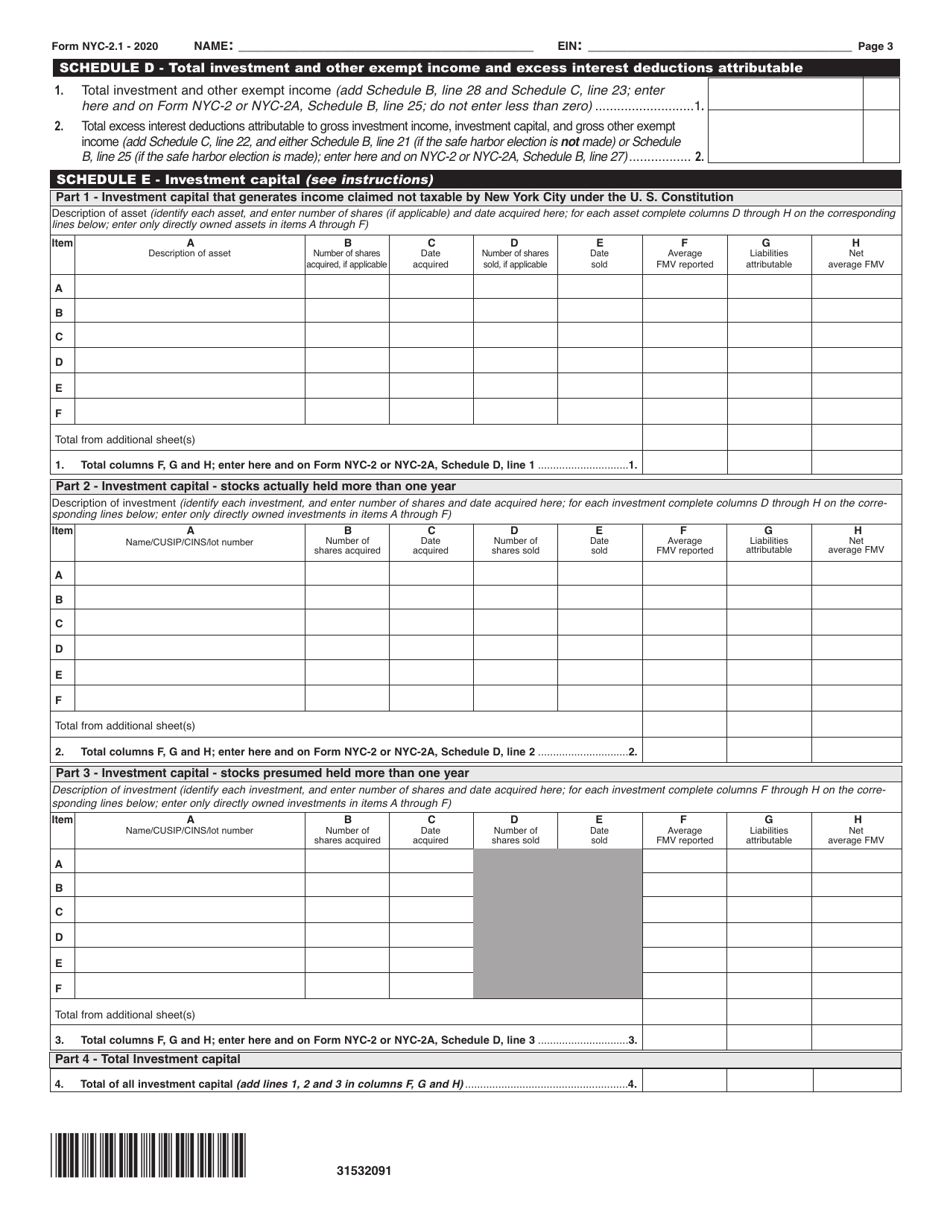

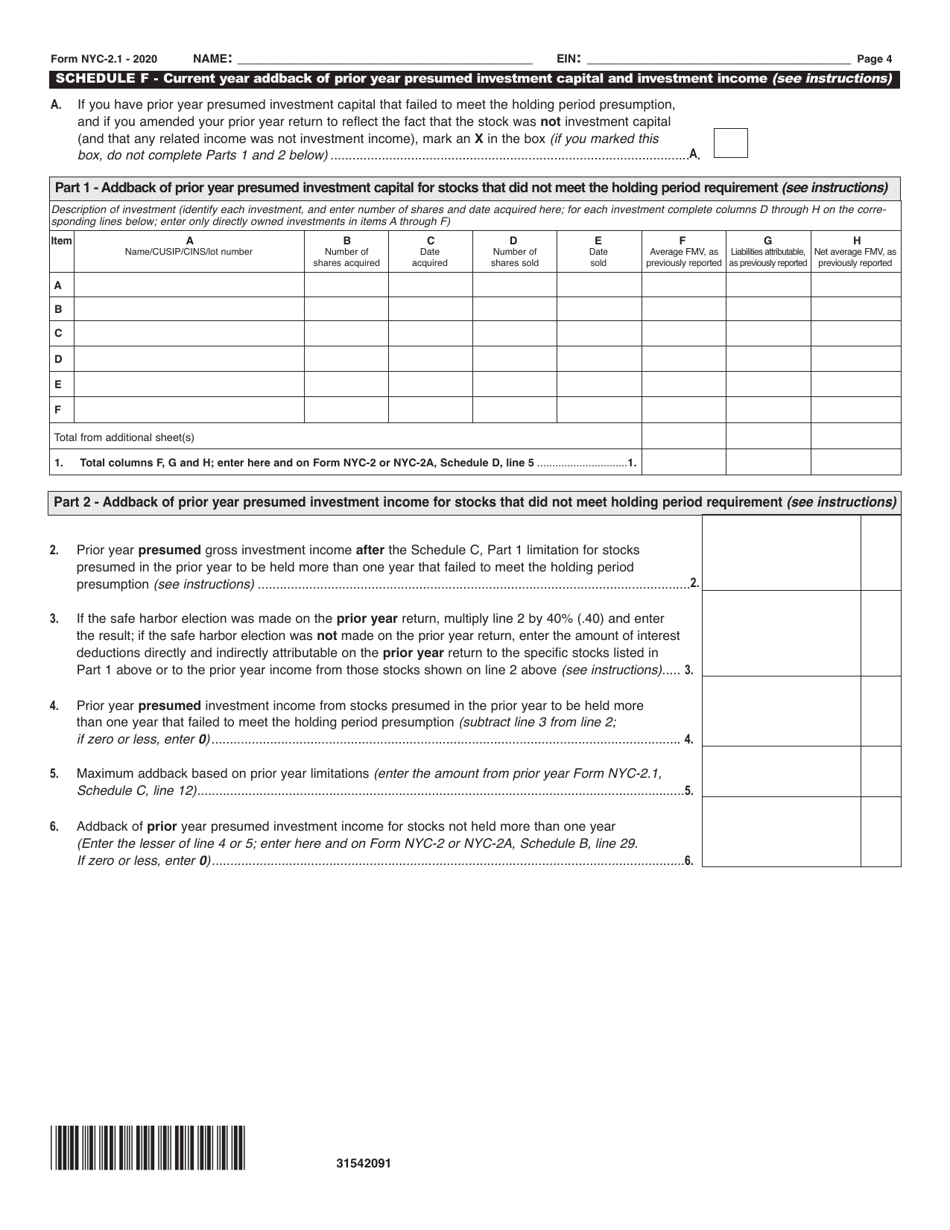

Form NYC-2.1 Investment and Other Exempt Income and Investment Capital - New York City

What Is Form NYC-2.1?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.1?

A: NYC-2.1 is a form used for reporting investment and other exempt income and investment capital in New York City.

Q: Who needs to file NYC-2.1?

A: Individuals, partnerships, and estates with investment and other exempt income and investment capital in New York City need to file NYC-2.1.

Q: What information do I need to provide on NYC-2.1?

A: You need to provide details of your investment and other exempt income, as well as information about your investment capital.

Q: When is the deadline for filing NYC-2.1?

A: The deadline for filing NYC-2.1 is usually April 15th, unless it falls on a weekend or holiday.

Q: Are there any penalties for late filing of NYC-2.1?

A: Yes, there may be penalties for late filing of NYC-2.1, so it's important to submit the form on time.

Q: Do I need to attach any supporting documents with NYC-2.1?

A: In most cases, you do not need to attach supporting documents with NYC-2.1. However, you should keep them for your records.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.1 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.