This version of the form is not currently in use and is provided for reference only. Download this version of

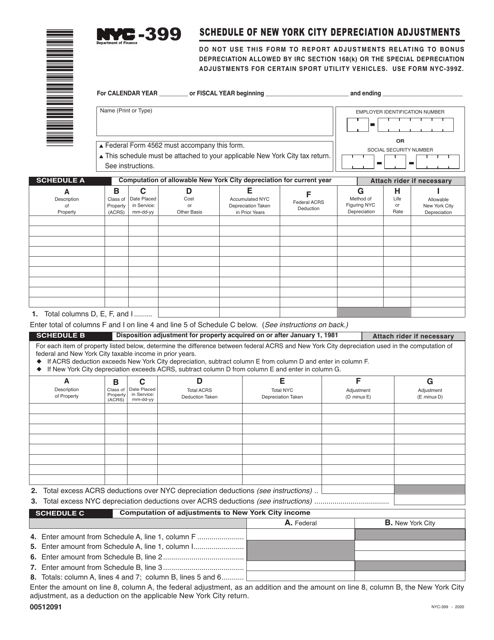

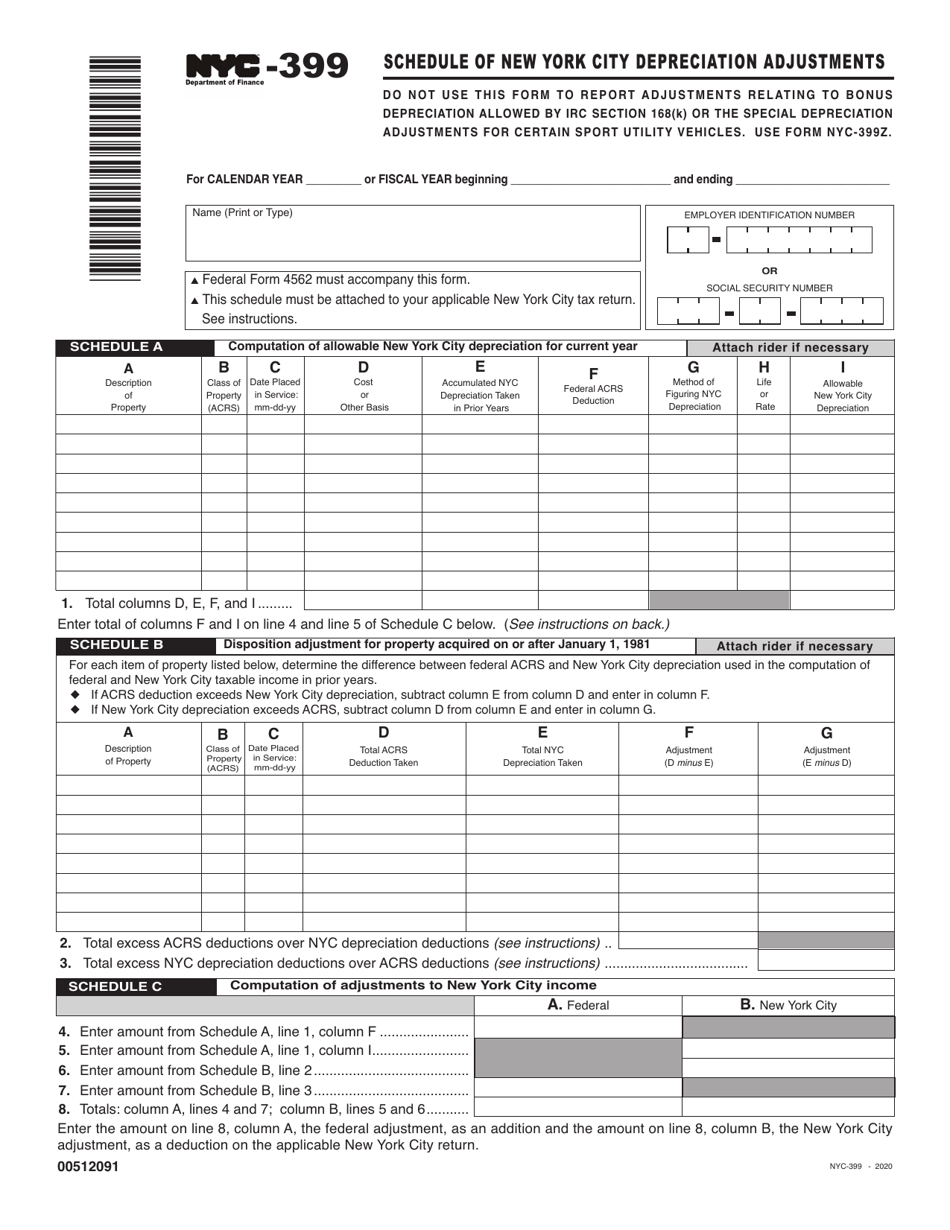

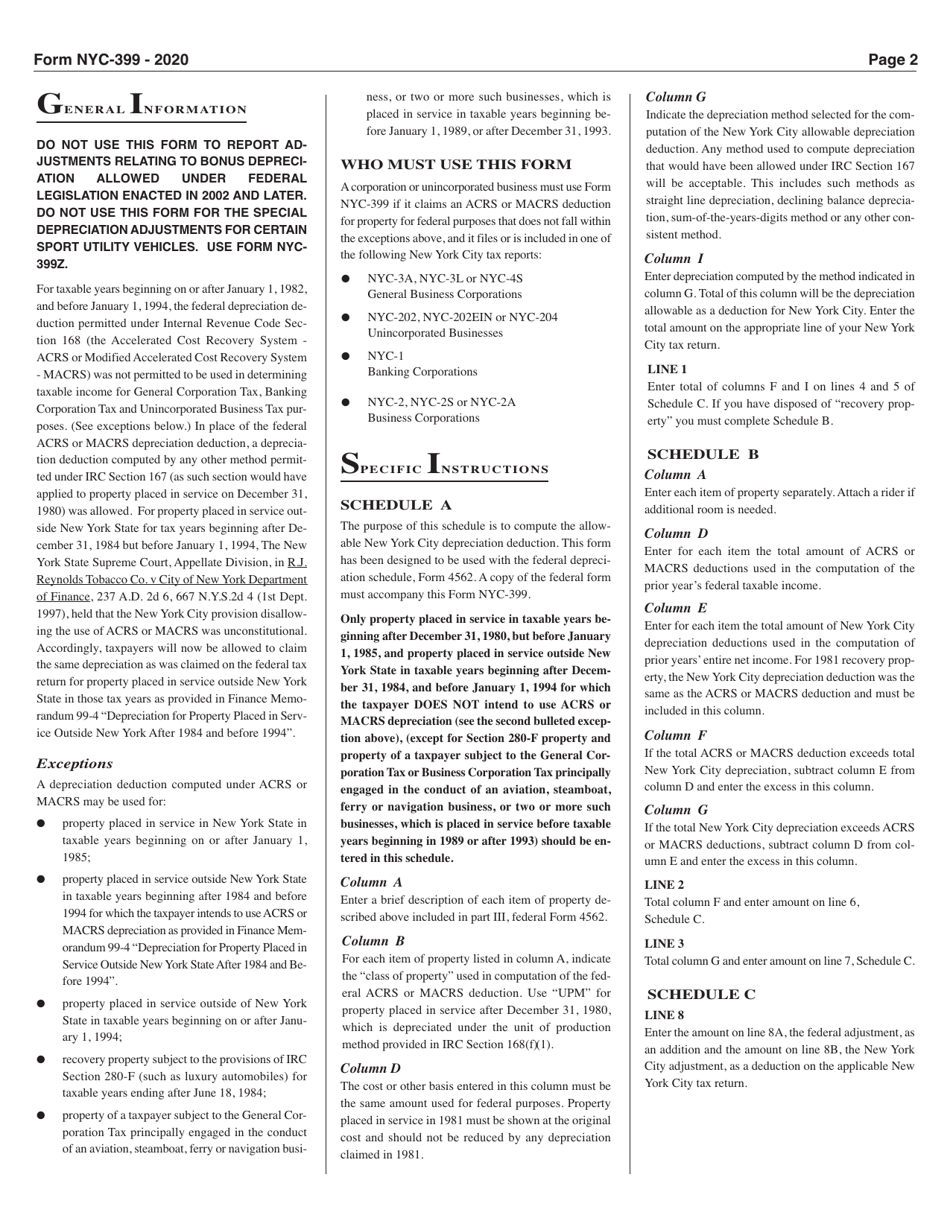

Form NYC-399

for the current year.

Form NYC-399 Schedule of New York City Depreciation Adjustments - New York City

What Is Form NYC-399?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-399 Schedule?

A: The NYC-399 Schedule is a form used for reporting New York City depreciation adjustments.

Q: Who needs to file the NYC-399 Schedule?

A: Anyone who has made depreciation adjustments for New York City tax purposes needs to file the NYC-399 Schedule.

Q: What are New York City depreciation adjustments?

A: New York City depreciation adjustments are changes made to the amount of depreciation claimed for tax purposes in the city.

Q: When is the deadline for filing the NYC-399 Schedule?

A: The deadline for filing the NYC-399 Schedule is usually the same as the deadline for filing your New York City tax return.

Q: Are there any penalties for not filing the NYC-399 Schedule?

A: Yes, there can be penalties for not filing the NYC-399 Schedule or for filing it late. It is important to file the form on time to avoid penalties.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-399 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.