This version of the form is not currently in use and is provided for reference only. Download this version of

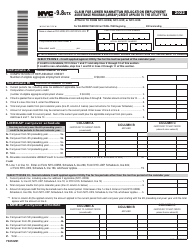

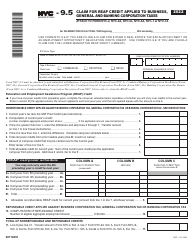

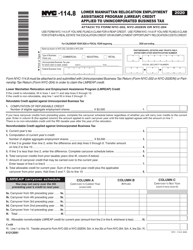

Form NYC-9.8

for the current year.

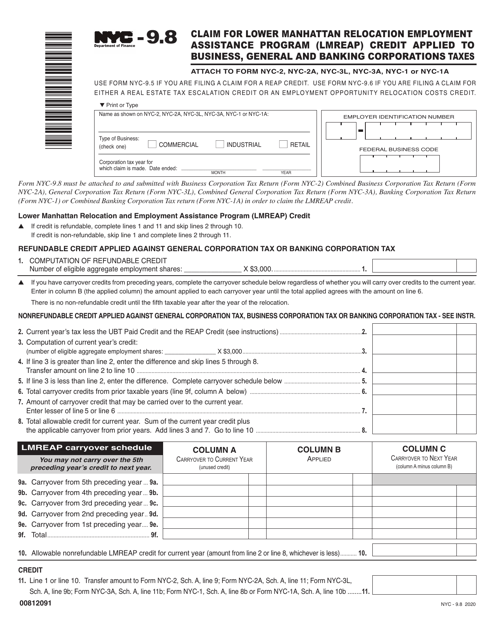

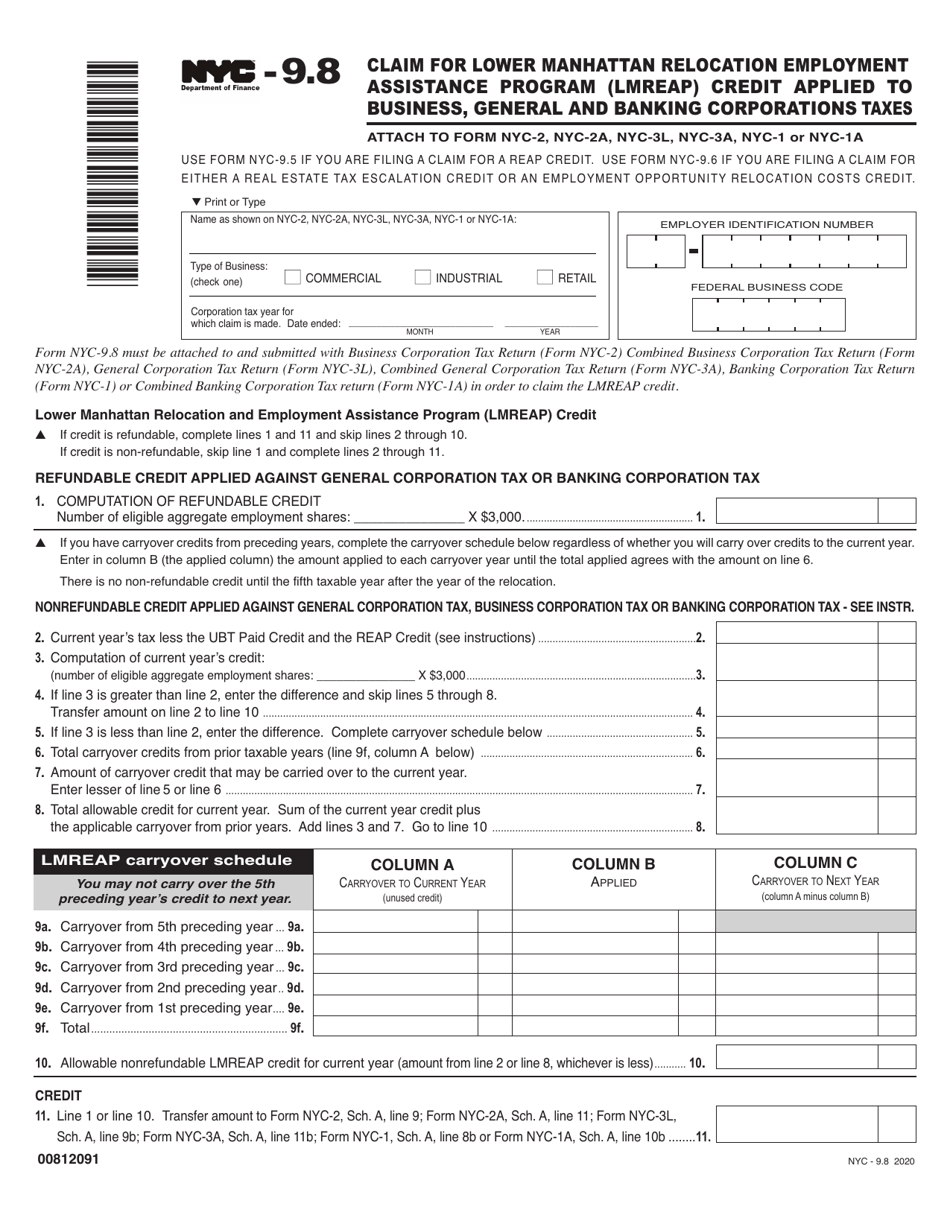

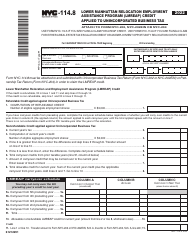

Form NYC-9.8 Claim for Lower Manhattan Relocation Employment Assistance Program (Lmreap) Credit Applied to Business, General and Banking Corporations Taxes - New York City

What Is Form NYC-9.8?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

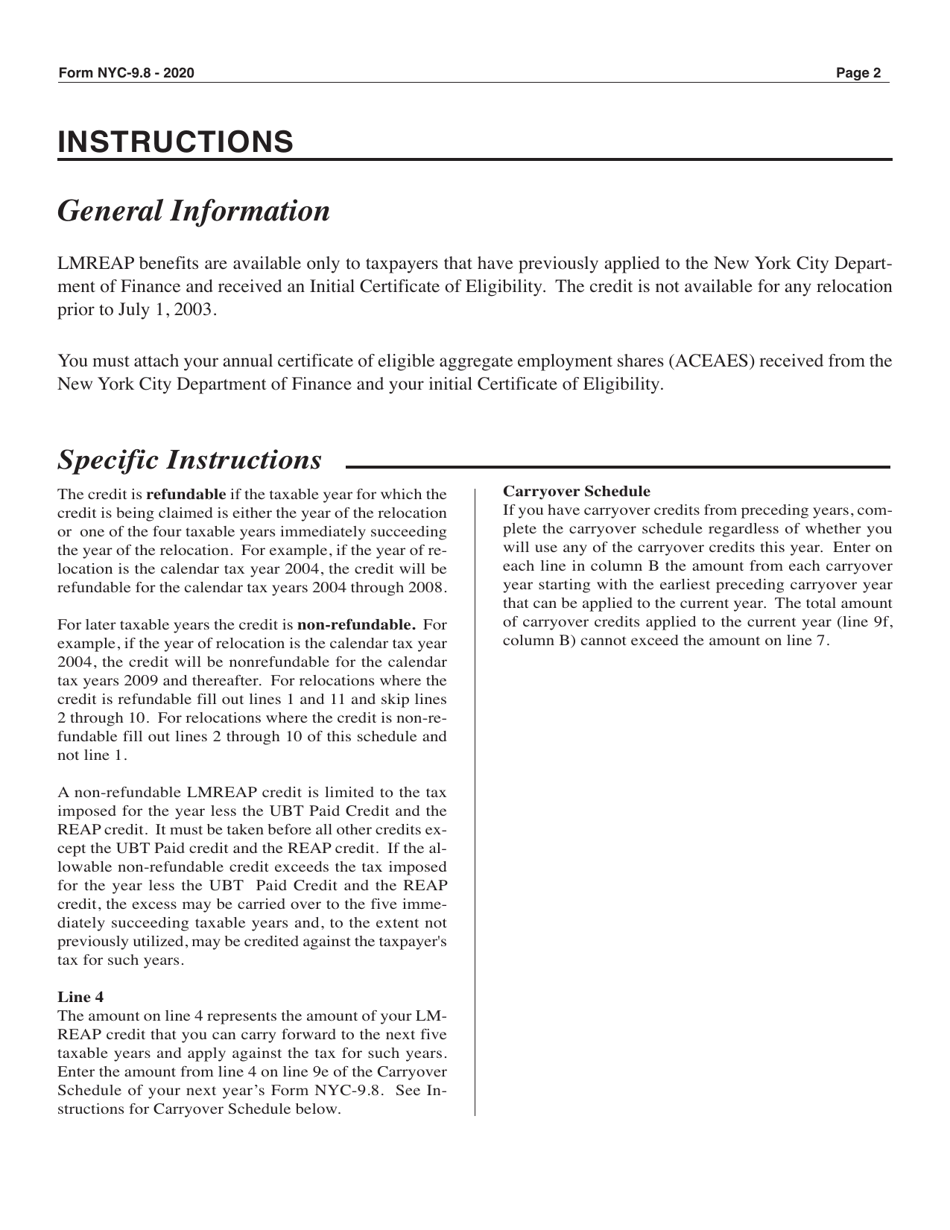

Q: What is the NYC-9.8 Claim for Lower Manhattan Relocation Employment Assistance Program?

A: The NYC-9.8 Claim is a form for applying for the Lower Manhattan Relocation Employment Assistance Program (LMREAP) credit.

Q: What is the LMREAP credit?

A: The LMREAP credit is a tax credit applied to business, general, and banking corporations taxes in New York City.

Q: Who is eligible for the LMREAP credit?

A: Businesses located in Lower Manhattan that meet certain criteria are eligible for the LMREAP credit.

Q: What is the purpose of the LMREAP credit?

A: The LMREAP credit is designed to encourage businesses to relocate to Lower Manhattan after the September 11, 2001 terrorist attacks and assist with the costs of relocation and employment.

Q: How can businesses apply for the LMREAP credit?

A: Businesses can apply for the LMREAP credit by filling out the NYC-9.8 Claim form and submitting it to the appropriate tax authority in New York City.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-9.8 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.