This version of the form is not currently in use and is provided for reference only. Download this version of

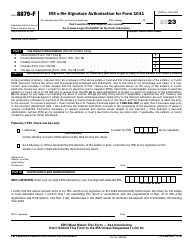

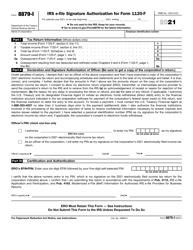

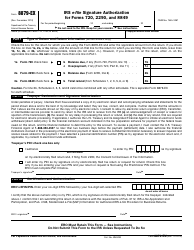

IRS Form 8879-PE

for the current year.

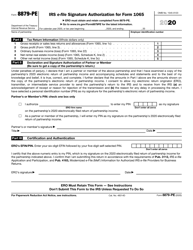

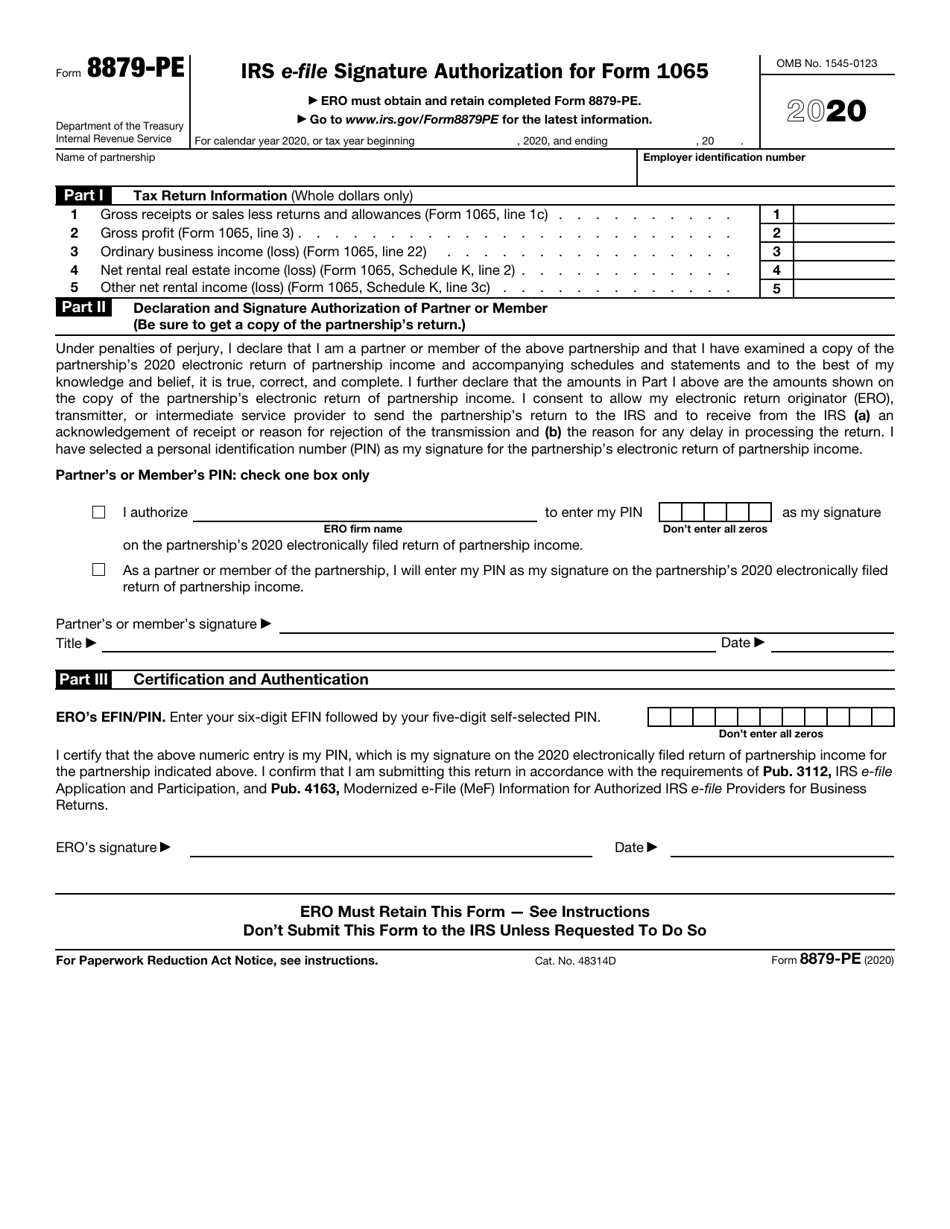

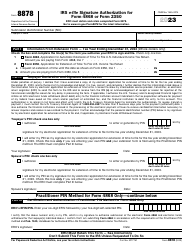

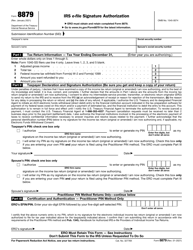

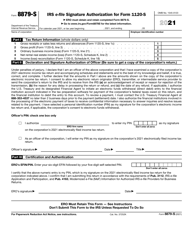

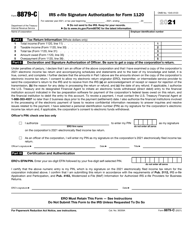

IRS Form 8879-PE IRS E-File Signature Authorization for Form 1065

What Is IRS Form 8879-PE?

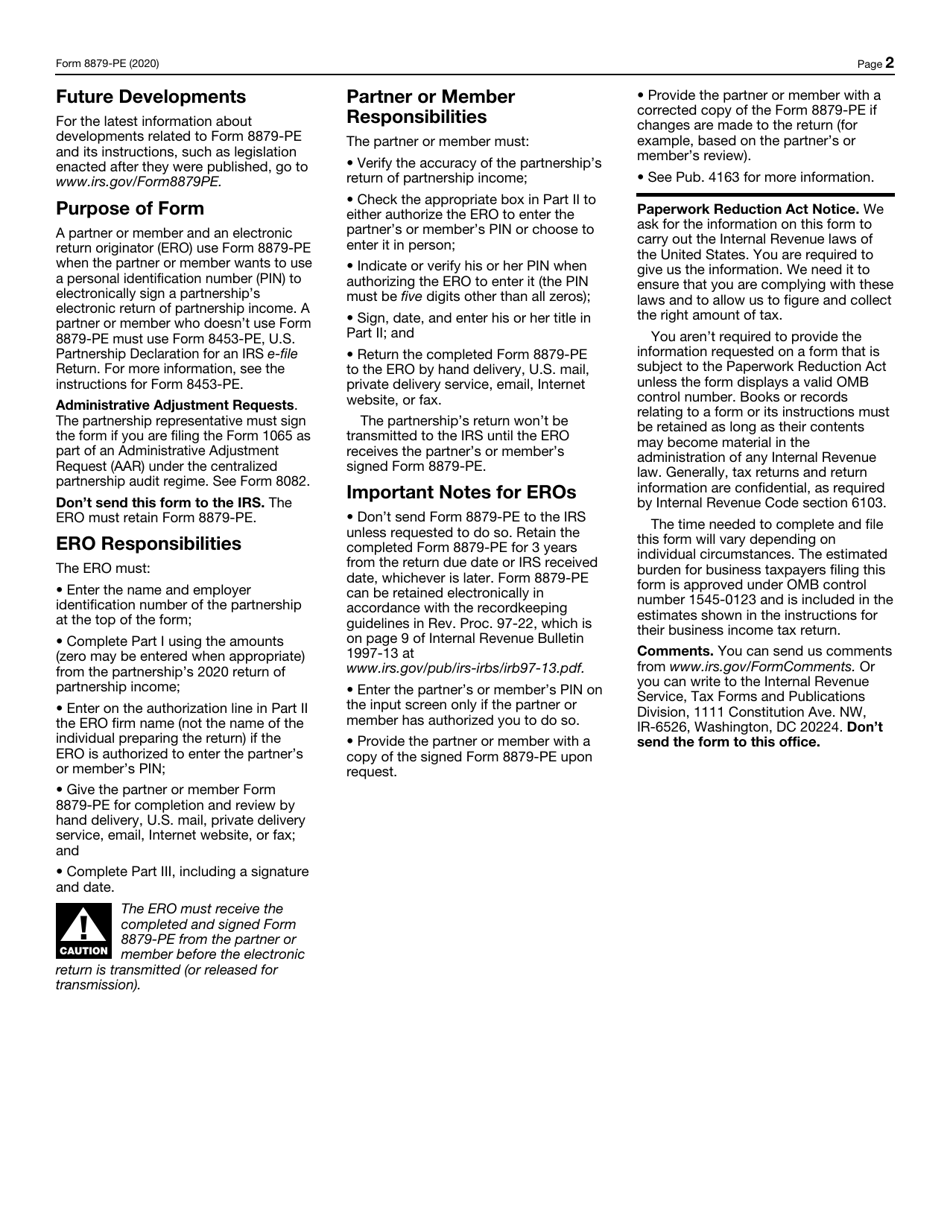

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8879-PE?

A: IRS Form 8879-PE is the E-File Signature Authorization form for Form 1065.

Q: What is Form 1065?

A: Form 1065 is the U.S. Return of Partnership Income.

Q: Why do I need to file IRS Form 8879-PE?

A: You need to file IRS Form 8879-PE to authorize the electronic filing of your partnership's Form 1065.

Q: Can I file Form 1065 electronically without IRS Form 8879-PE?

A: No, you cannot file Form 1065 electronically without IRS Form 8879-PE. It is required to authorize the e-filing process.

Q: How do I complete IRS Form 8879-PE?

A: You need to provide the required information on the form, including the partnership name, EIN, and the name of the authorized signer.

Q: Can I sign IRS Form 8879-PE electronically?

A: Yes, you can sign IRS Form 8879-PE electronically using a self-selected personal identification number (PIN).

Q: When is the deadline to file IRS Form 8879-PE?

A: The deadline to file IRS Form 8879-PE is the same as the deadline to file Form 1065, which is typically March 15th.

Q: What happens after I file IRS Form 8879-PE?

A: Once you file IRS Form 8879-PE, you will receive an acknowledgment from the IRS confirming your electronic filing.

Q: Is there a fee for filing IRS Form 8879-PE?

A: No, there is no fee for filing IRS Form 8879-PE.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8879-PE through the link below or browse more documents in our library of IRS Forms.