This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8993

for the current year.

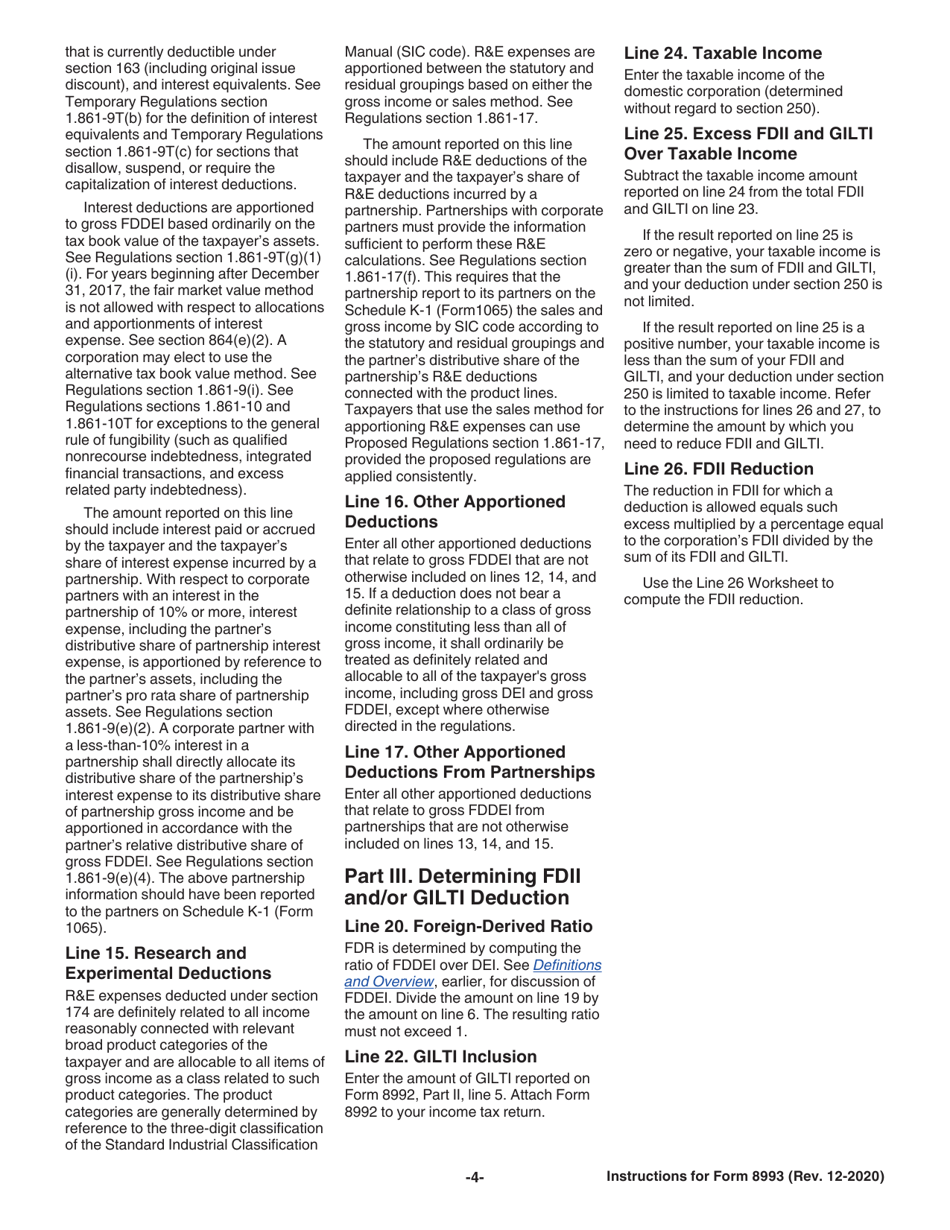

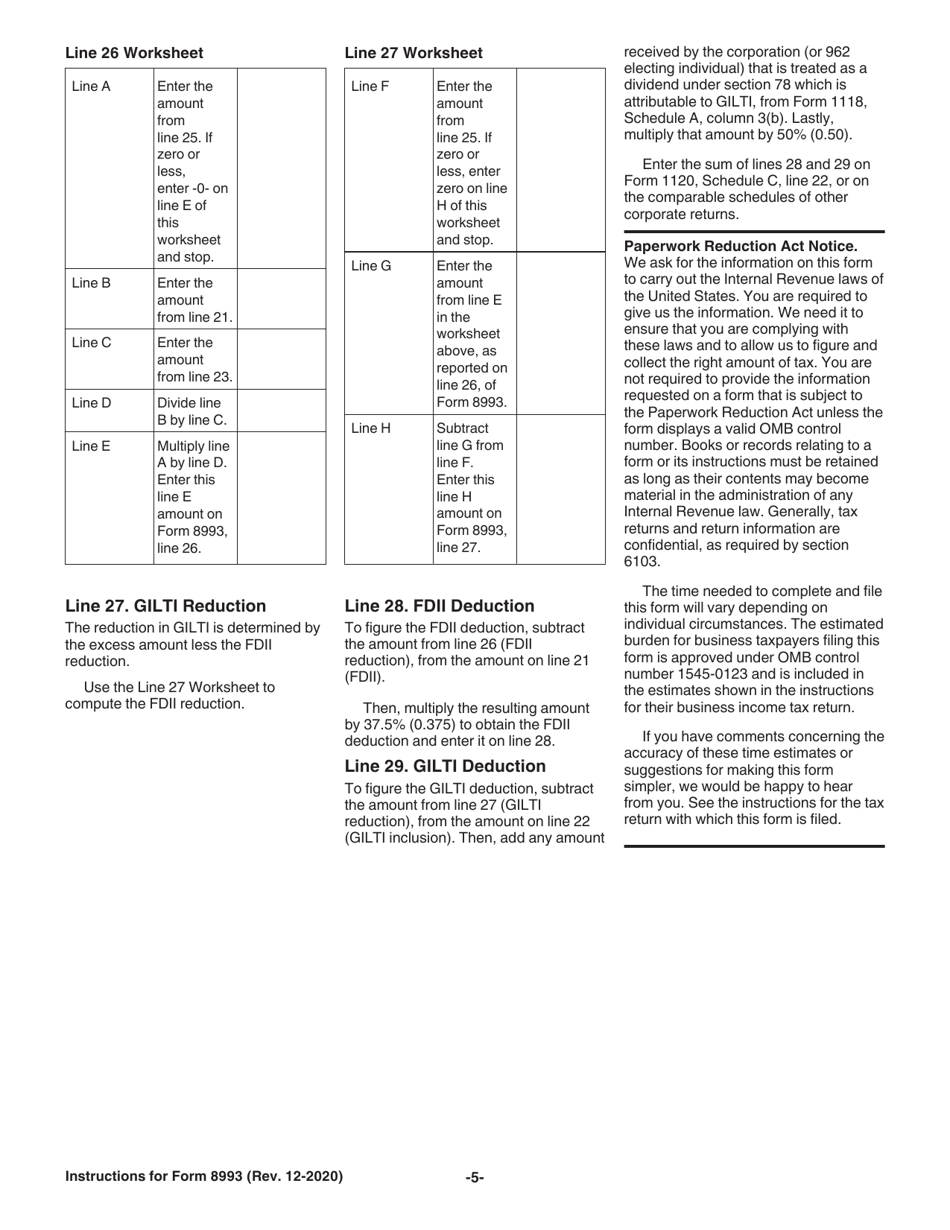

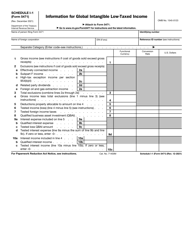

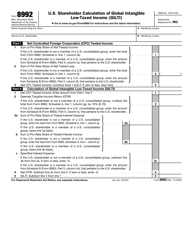

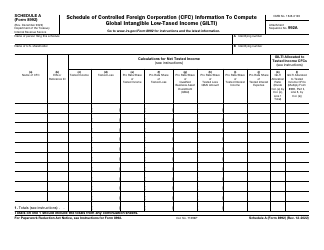

Instructions for IRS Form 8993 Section 250 Deduction for Foreign-Derived Intangible Income (Fdii) and Global Intangible Low-Taxed Income (Gilti)

This document contains official instructions for IRS Form 8993 , Section 250 Deduction for Foreign-Derived Intangible Income (Fdii) and Global Intangible Low-Taxed Income (Gilti) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8993 is available for download through this link.

FAQ

Q: What is IRS Form 8993?

A: IRS Form 8993 is a tax form used to claim the deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI).

Q: What is the Section 250 deduction?

A: The Section 250 deduction is a tax deduction that allows eligible taxpayers to reduce their taxable income by a portion of their FDII and GILTI.

Q: What is Foreign-Derived Intangible Income (FDII)?

A: Foreign-Derived Intangible Income (FDII) is income derived from sales or services provided to foreign customers or foreign branches of US companies.

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: Global Intangible Low-Taxed Income (GILTI) is income earned by US companies from their foreign subsidiaries that exceeds a certain threshold.

Q: Who is eligible to claim the Section 250 deduction?

A: US corporations that have FDII and/or GILTI can generally claim the Section 250 deduction.

Q: What is the purpose of the Section 250 deduction?

A: The purpose of the Section 250 deduction is to provide a tax incentive for US companies to keep their intangible assets and income within the United States.

Q: How do I claim the Section 250 deduction?

A: To claim the Section 250 deduction, you need to complete and file IRS Form 8993 with your annual tax return.

Q: Are there any limitations or restrictions on the Section 250 deduction?

A: Yes, there are certain limitations and restrictions on the Section 250 deduction, such as the taxable income limitation and the overall limitation on deductions.

Q: Is the Section 250 deduction available for individuals?

A: No, the Section 250 deduction is generally only available for US corporations.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.