This version of the form is not currently in use and is provided for reference only. Download this version of

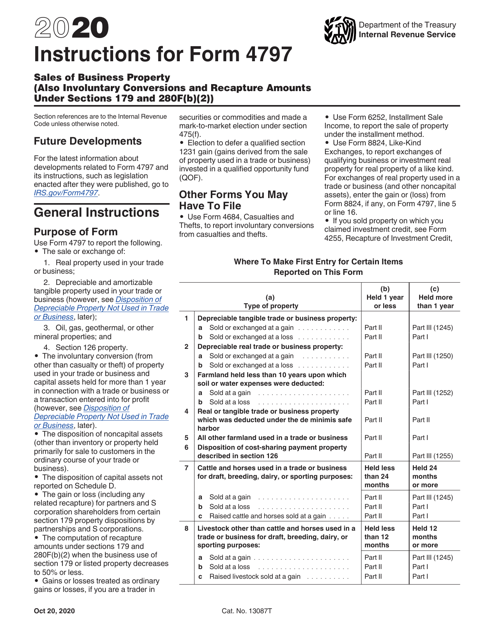

Instructions for IRS Form 4797

for the current year.

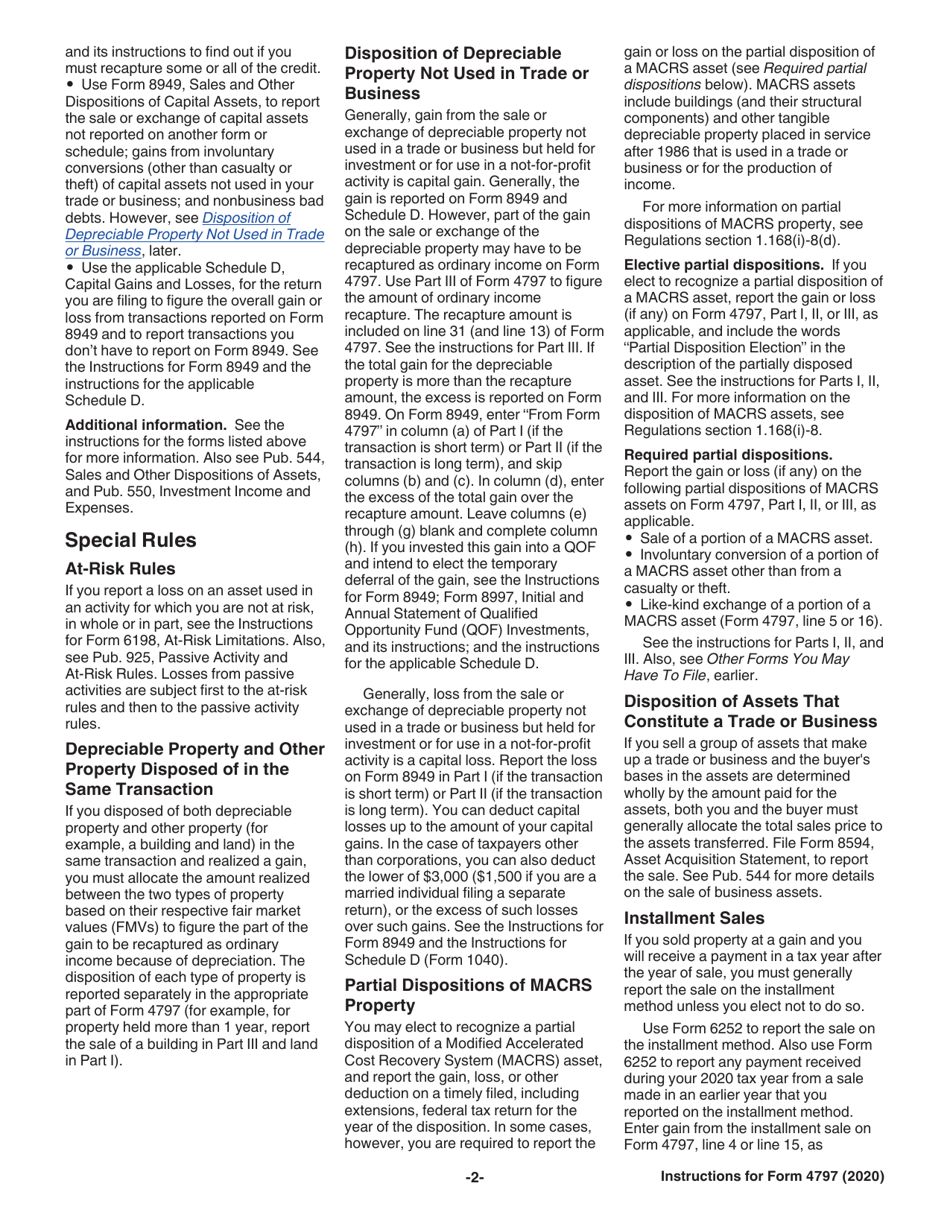

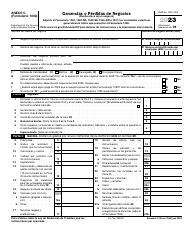

Instructions for IRS Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2))

This document contains official instructions for IRS Form 4797 , Sales of Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4797 is available for download through this link.

FAQ

Q: What is IRS Form 4797?

A: IRS Form 4797 is used to report the sales of business property, involuntary conversions, and recapture amounts under certain tax code sections.

Q: What is considered business property?

A: Business property can include assets used in a trade or business, such as buildings, equipment, and vehicles.

Q: What are involuntary conversions?

A: Involuntary conversions occur when property is destroyed or seized and the taxpayer receives compensation or replacement property.

Q: What is recapture?

A: Recapture refers to the requirement to pay back a portion of the tax benefits previously claimed on certain items, such as Section 179 and Section 280F(B)(2).

Q: What is Section 179?

A: Section 179 allows businesses to deduct the cost of certain property as an expense, rather than depreciating it over time.

Q: What is Section 280F(B)(2)?

A: Section 280F(B)(2) limits the depreciation deduction for certain vehicles, including passenger automobiles.

Q: When is IRS Form 4797 used?

A: IRS Form 4797 should be filed for each sale of business property, involuntary conversion, or recapture event that occurred during the tax year.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.