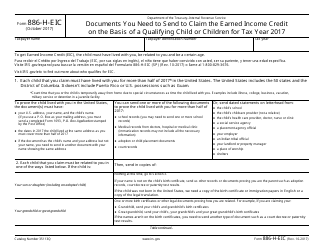

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2441

for the current year.

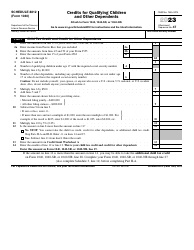

Instructions for IRS Form 2441 Child and Dependent Care Expenses

This document contains official instructions for IRS Form 2441 , Child and Dependent Care Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2441 is available for download through this link.

FAQ

Q: What is IRS Form 2441?

A: IRS Form 2441 is used to calculate the amount of child and dependent care expenses that may be claimed as a tax credit.

Q: Who should use IRS Form 2441?

A: IRS Form 2441 should be used by taxpayers who have incurred child and dependent care expenses and wish to claim a tax credit for those expenses.

Q: What are child and dependent care expenses?

A: Child and dependent care expenses are expenses incurred for the care of qualifying children or dependents to enable the taxpayer to work or seek employment.

Q: How do I calculate the child and dependent care tax credit?

A: To calculate the child and dependent care tax credit, you need to complete IRS Form 2441, which involves determining your eligible expenses, calculating your credit percentage, and applying any limits or adjustments.

Q: What documentation do I need to support my child and dependent care expenses?

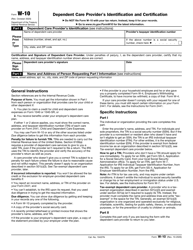

A: You will need to keep records of your child and dependent care expenses and obtain a completed Form W-10, Dependent Care Provider's Identification and Certification, from your care provider.

Q: When is the deadline to file IRS Form 2441?

A: IRS Form 2441 must be filed each year with your federal income tax return by the due date, which is typically April 15th.

Q: Can I claim child and dependent care expenses if I have a stay-at-home spouse?

A: Generally, you cannot claim child and dependent care expenses if you have a stay-at-home spouse, as these expenses are meant to enable the taxpayer to work or seek employment.

Q: Are there any income limits for claiming the child and dependent care tax credit?

A: Yes, there are income limits for claiming the child and dependent care tax credit. The credit is gradually reduced as your income exceeds certain thresholds.

Q: Can I claim child and dependent care expenses for a babysitter?

A: Yes, you can claim child and dependent care expenses for a babysitter, as long as they meet the eligibility requirements and you have the necessary documentation.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.