This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990, 990-EZ Schedule A

for the current year.

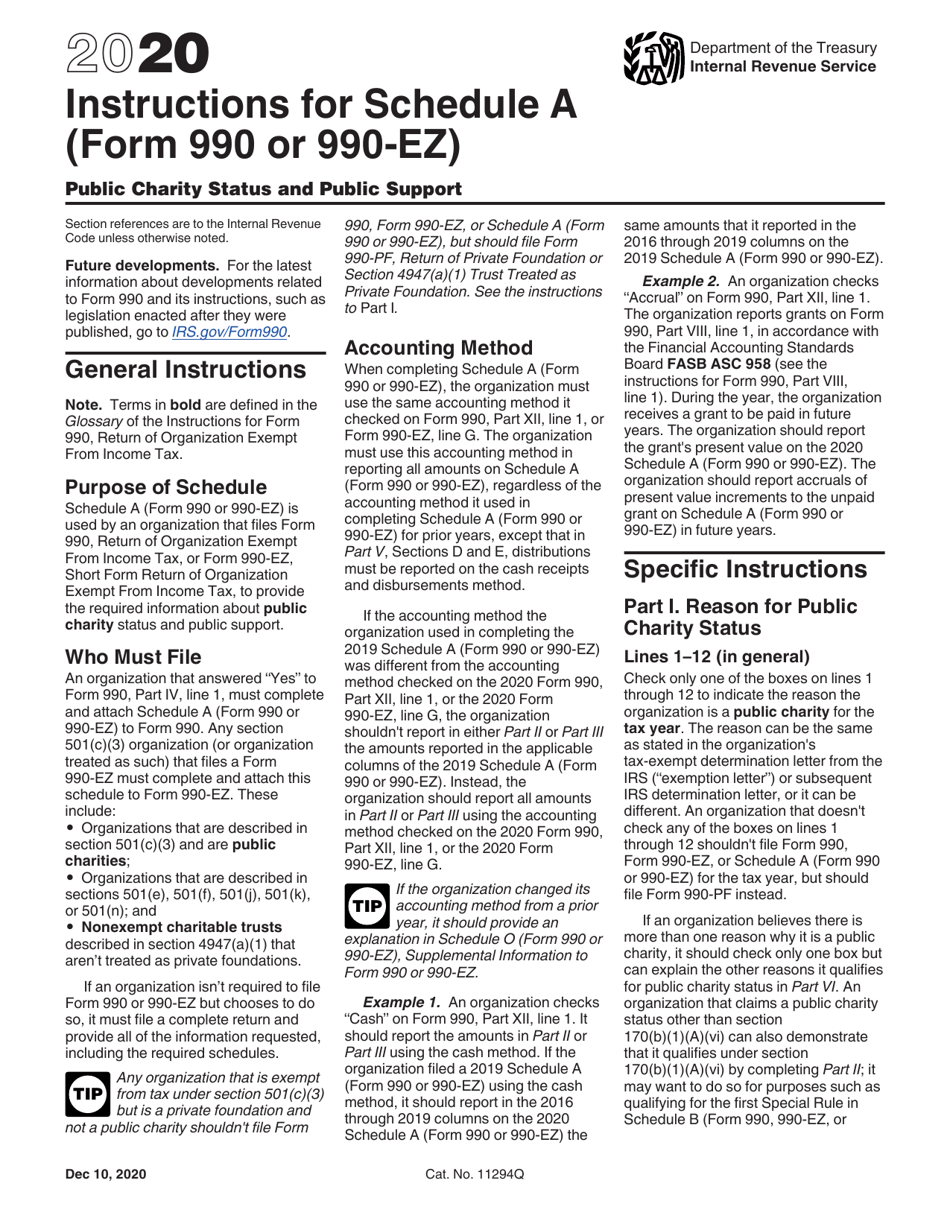

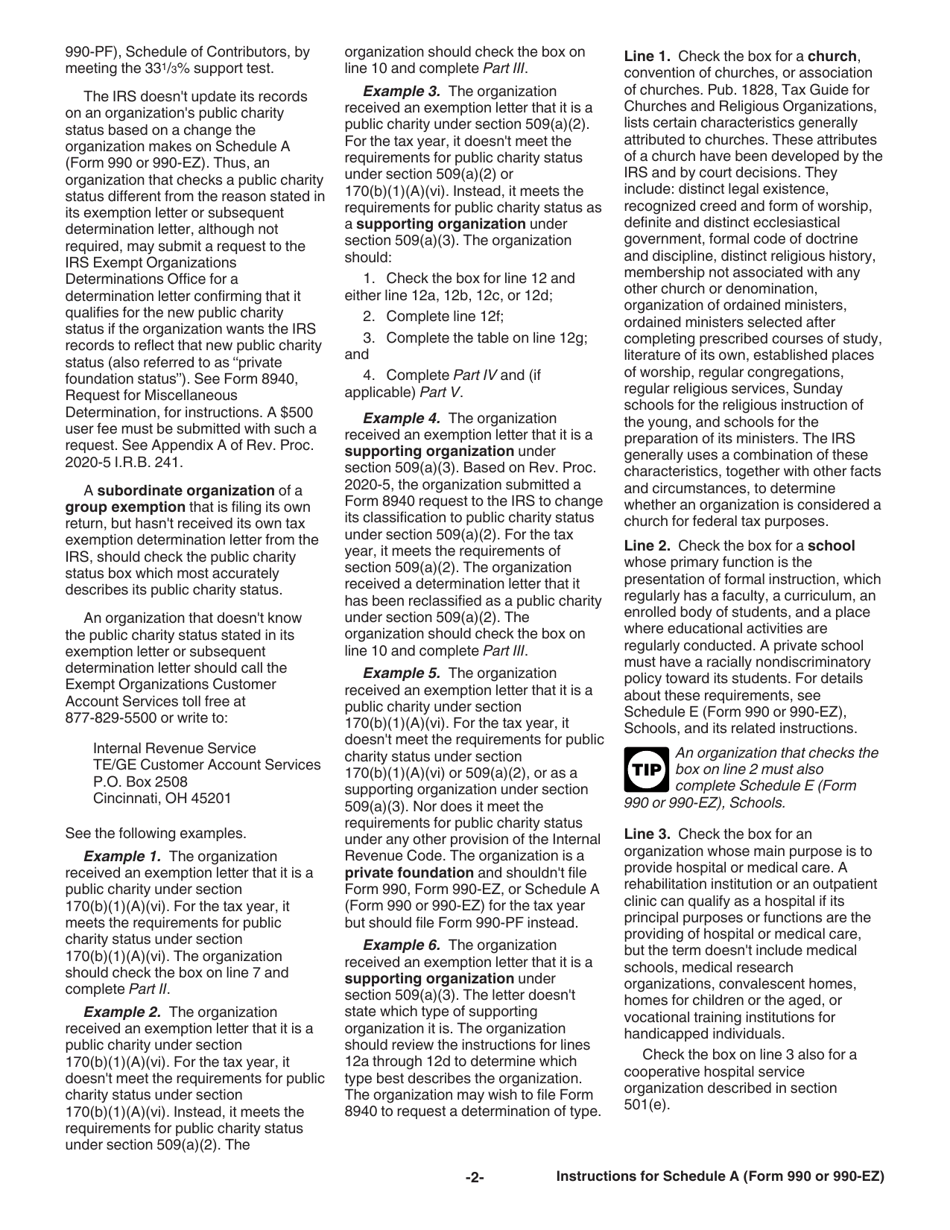

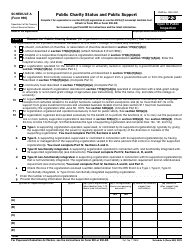

Instructions for IRS Form 990, 990-EZ Schedule A Public Charity Status and Public Support

This document contains official instructions for IRS Form 990 Schedule A and IRS Form 990-EZ Schedule A . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is an annual information return that certain tax-exempt organizations in the US must file with the Internal Revenue Service (IRS).

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of Form 990 designed for small to medium-sized tax-exempt organizations with less complex financial information.

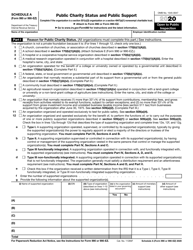

Q: What is Schedule A?

A: Schedule A is a supplemental form that must be completed and filed along with Form 990 or Form 990-EZ to provide information about an organization's public charity status and public support.

Q: What is public charity status?

A: Public charity status is a designation given to certain tax-exempt organizations that primarily rely on public support to carry out their charitable activities.

Q: What is public support?

A: Public support refers to the financial contributions and support received by a tax-exempt organization from the general public and other sources.

Q: Why is Schedule A important?

A: Schedule A is important because it helps the IRS determine if an organization qualifies for public charity status and whether it meets the requirements for public support.

Q: What information is required on Schedule A?

A: Schedule A requires the organization to provide details about its sources of support, such as contributions, grants, and government funding, as well as information about its public charity activities.

Q: Are all tax-exempt organizations required to file Schedule A?

A: No, not all tax-exempt organizations are required to file Schedule A. Only organizations that are classified as public charities and meet certain financial thresholds need to file Schedule A.

Instruction Details:

- This 20-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.