This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule D

for the current year.

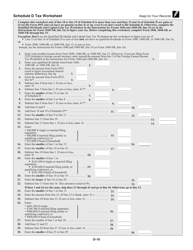

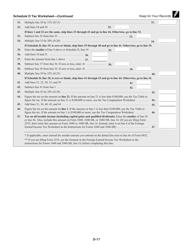

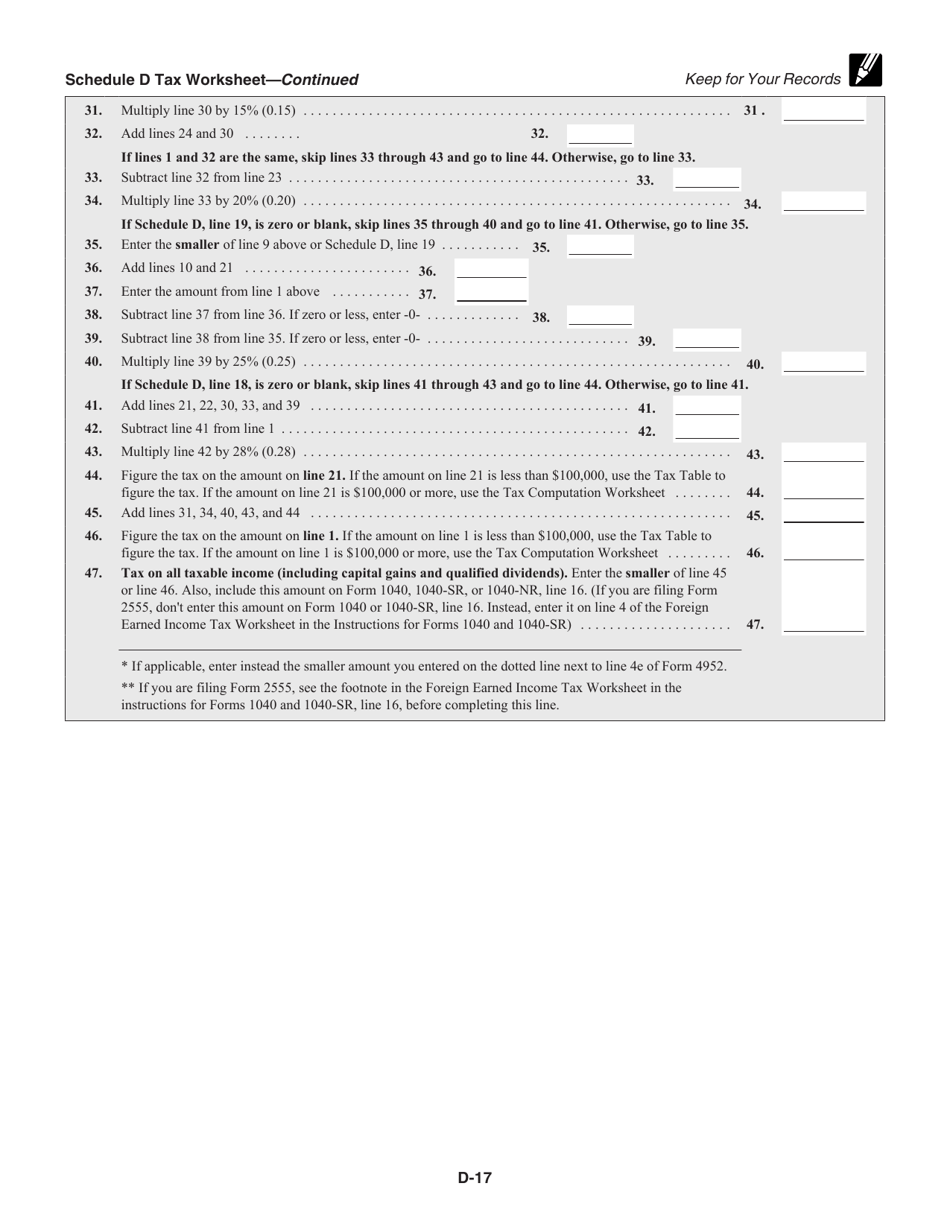

Instructions for IRS Form 1040 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1040 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule D?

A: IRS Form 1040 Schedule D is a tax form used to report capital gains and losses in the United States.

Q: What are capital gains and losses?

A: Capital gains and losses are the profits or losses made from the sale or exchange of assets, such as stocks, bonds, real estate, or other investments.

Q: When is Schedule D required?

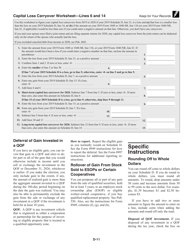

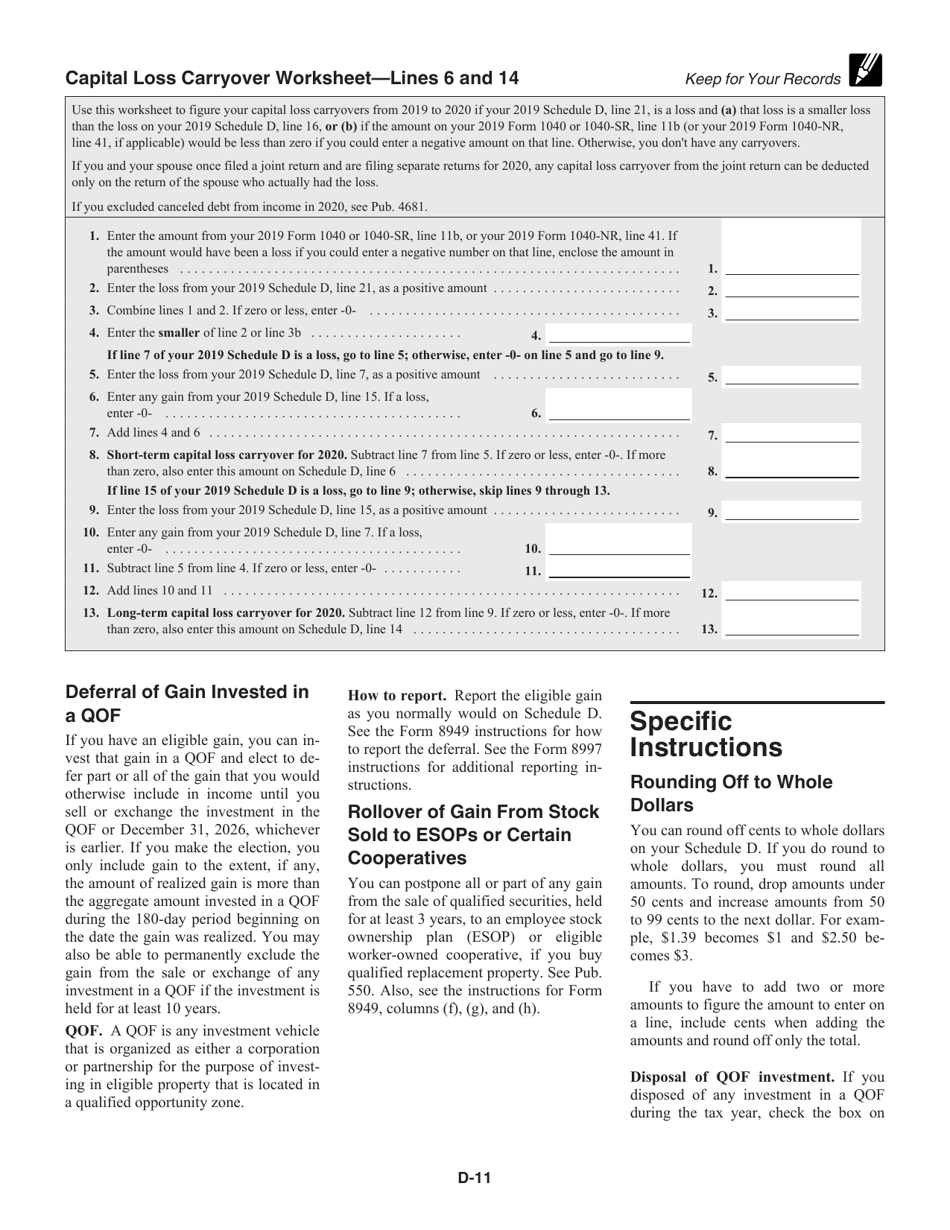

A: Schedule D is required if you have capital gains or losses to report, or if you received capital gain distributions or had a capital loss carryover from a previous year.

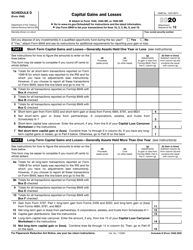

Q: What information is needed to fill out Schedule D?

A: To fill out Schedule D, you will need information about the assets you sold, including the purchase date, sale date, purchase price, sale price, and any adjustments or costs related to the sale.

Q: How do I calculate capital gains or losses?

A: To calculate capital gains or losses, subtract the purchase price and any related costs from the sale price. If the result is positive, it is a capital gain. If the result is negative, it is a capital loss.

Q: What are the tax rates for capital gains?

A: The tax rates for capital gains vary depending on your income and the length of time you held the asset. They can be either short-term (held for one year or less) or long-term (held for more than one year).

Q: Can I deduct capital losses?

A: Yes, you can deduct capital losses up to a certain limit. Any excess losses can be carried forward to future years.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.