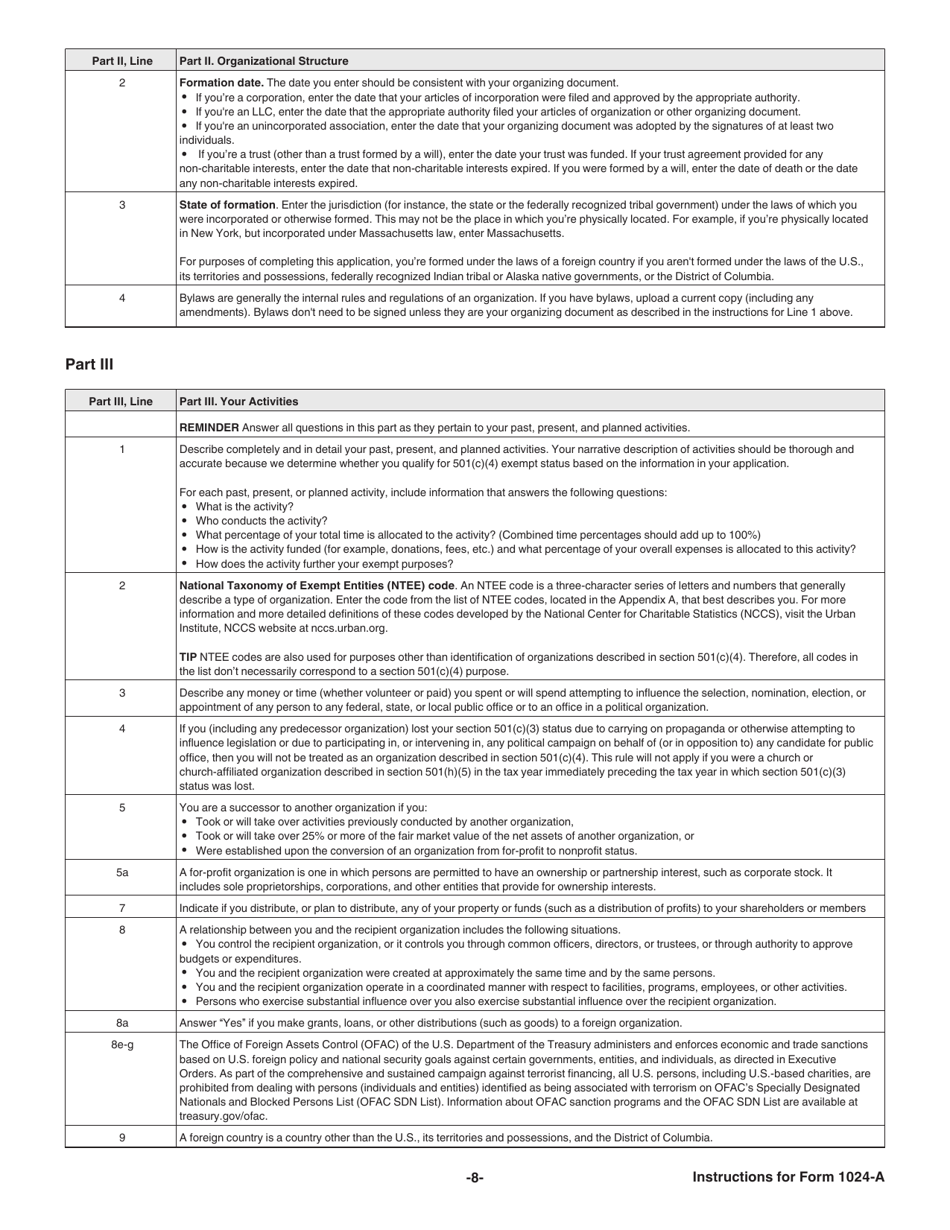

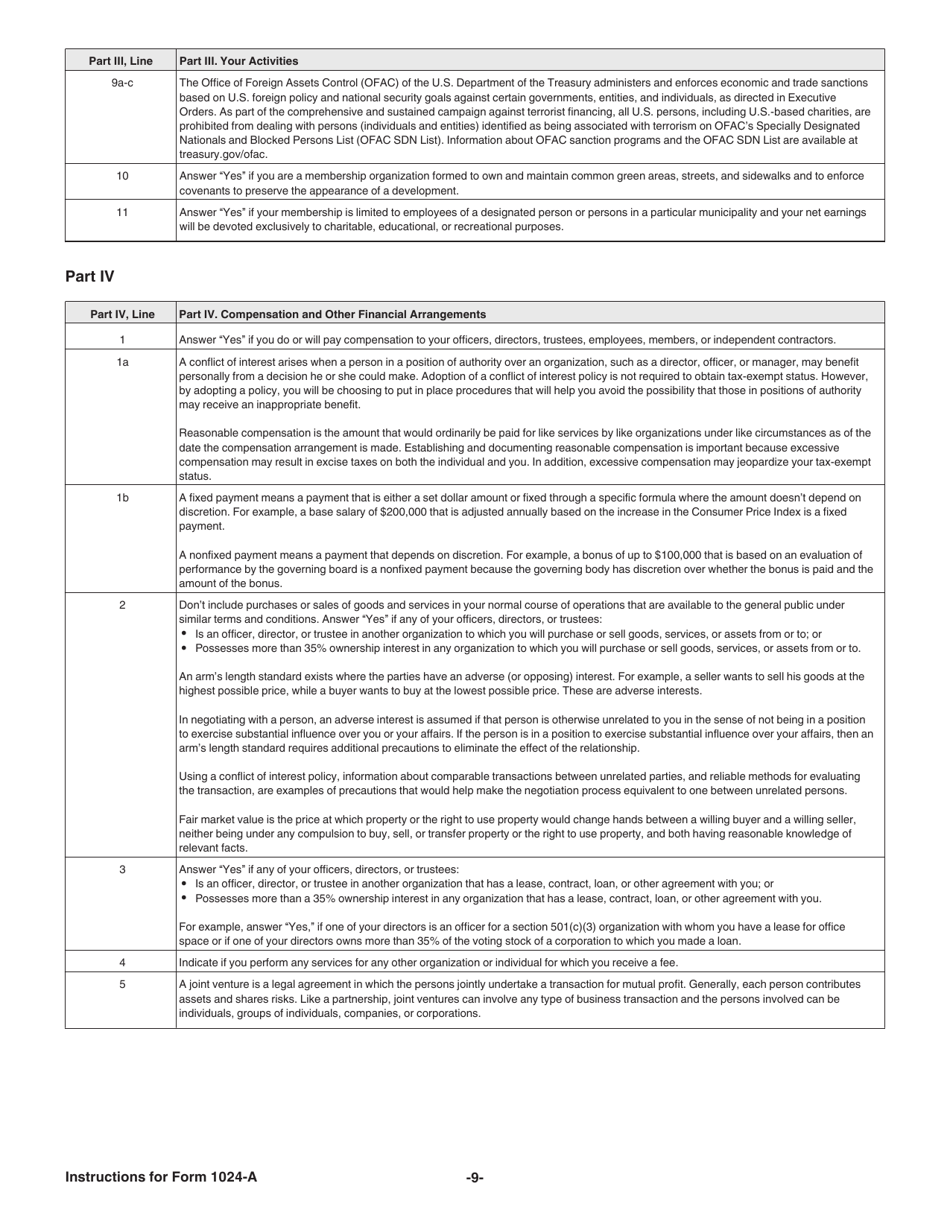

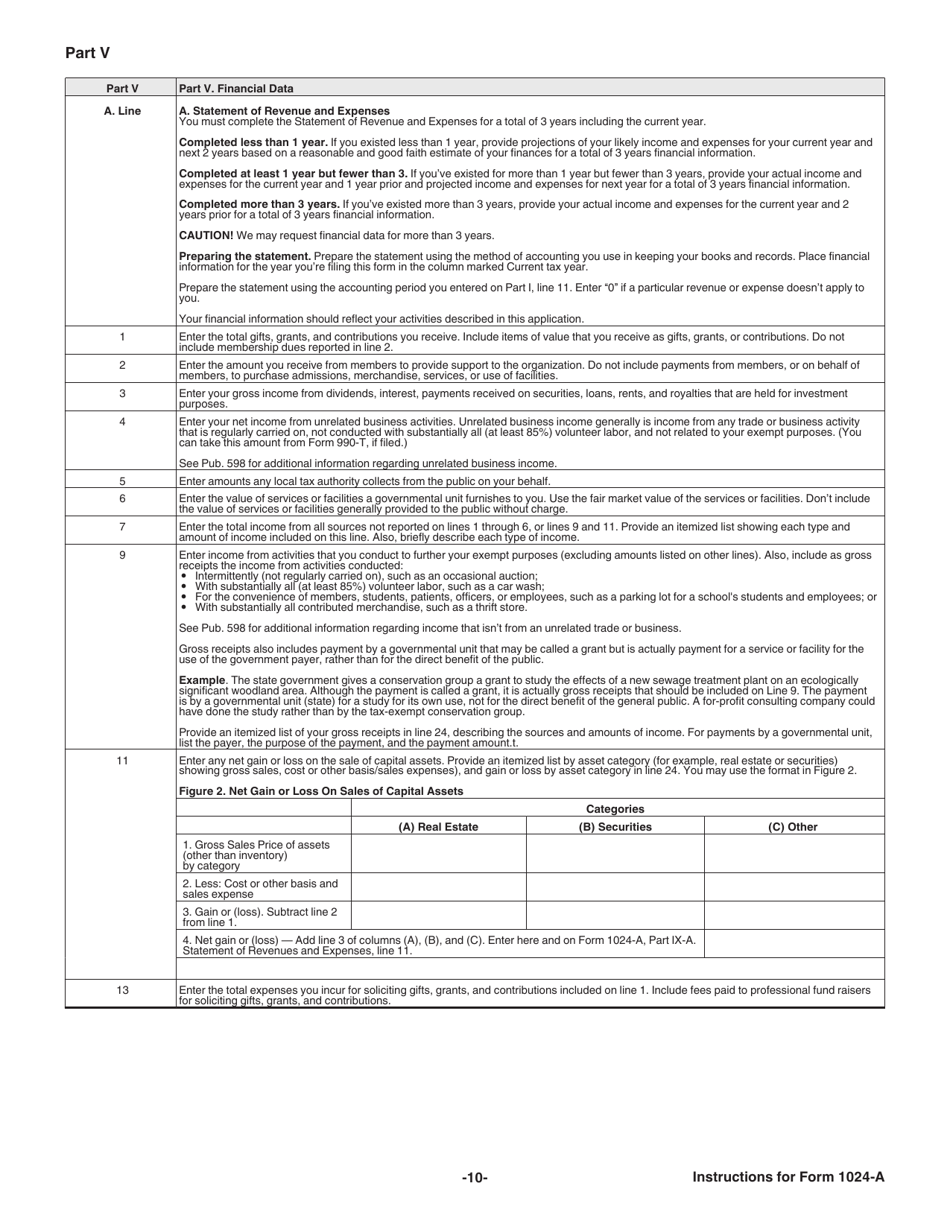

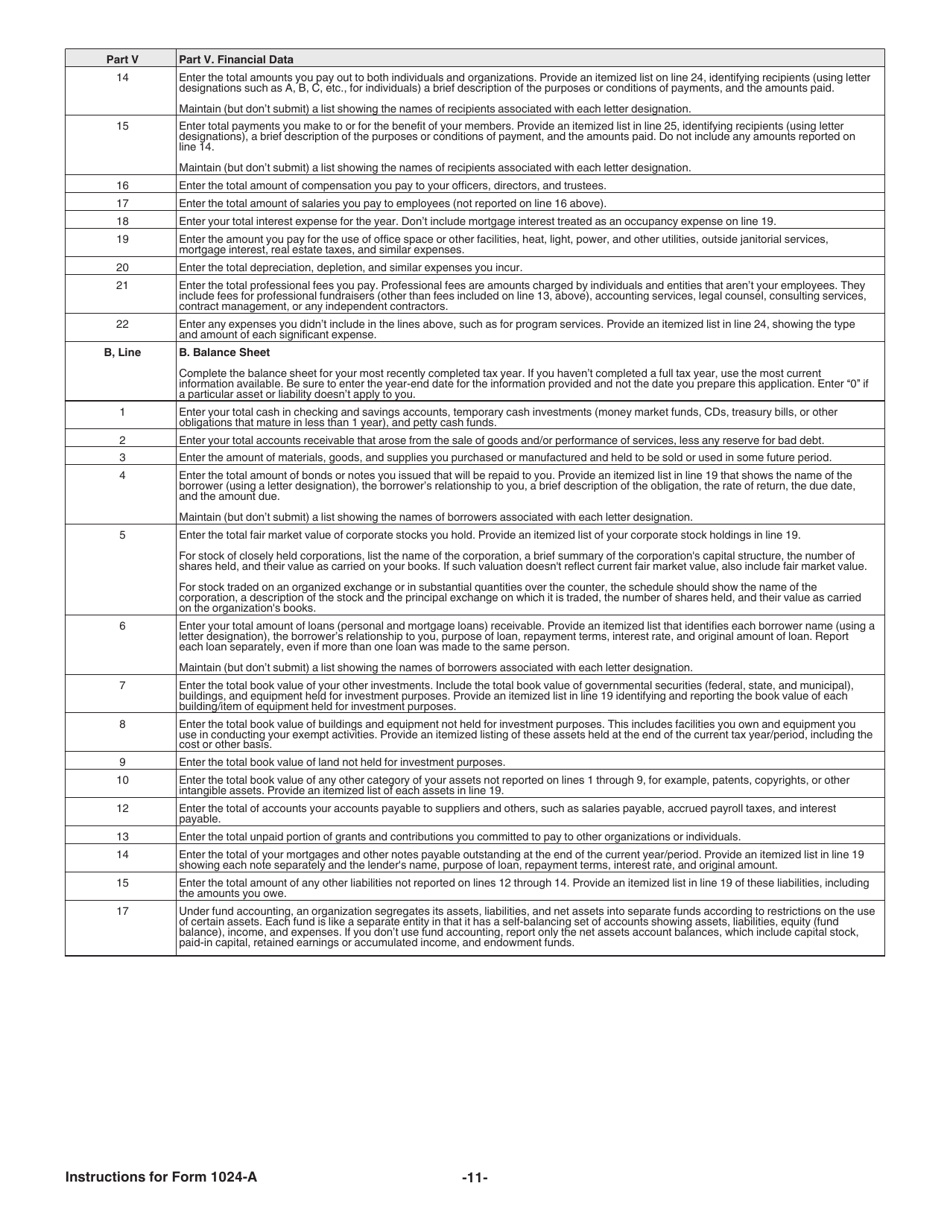

Instructions for IRS Form 1024-A Application for Recognition of Exemption Under Section 501(C)(4) of the Internal Revenue Code

This document contains official instructions for IRS Form 1024-A , Application for Recognition of Exemption Under Section 501(C)(4) of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1024-A is available for download through this link.

FAQ

Q: What is Form 1024-A?

A: Form 1024-A is an IRS application for recognition of exemption under Section 501(c)(4) of the Internal Revenue Code.

Q: Who should use Form 1024-A?

A: Form 1024-A should be used by organizations seeking recognition of exemption as a social welfare organization under Section 501(c)(4).

Q: What is the purpose of Form 1024-A?

A: The purpose of Form 1024-A is to apply for recognition of exemption as a social welfare organization.

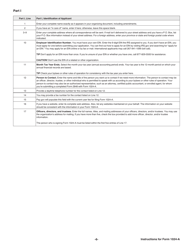

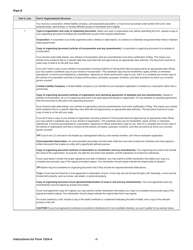

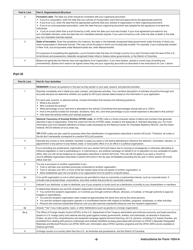

Q: What information is required on Form 1024-A?

A: Form 1024-A requires information about the organization's activities, finances, governance, and more.

Q: Is there a fee for filing Form 1024-A?

A: Yes, there is a fee for filing Form 1024-A. The current fee is specified in the instructions.

Q: What is the filing deadline for Form 1024-A?

A: The filing deadline for Form 1024-A depends on the organization's tax year. Refer to the instructions for specific details.

Q: How long does it take to process Form 1024-A?

A: The processing time for Form 1024-A can vary, but the IRS aims to process applications within 180 days.

Q: Can I submit Form 1024-A electronically?

A: No, Form 1024-A must be submitted by mail or in person.

Q: What happens after Form 1024-A is approved?

A: After Form 1024-A is approved, the organization will receive a determination letter from the IRS confirming its tax-exempt status.

Instruction Details:

- This 17-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.