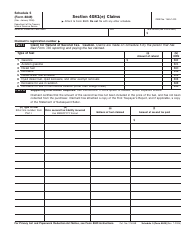

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 843

for the current year.

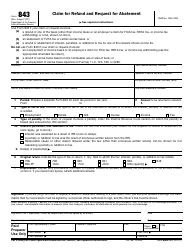

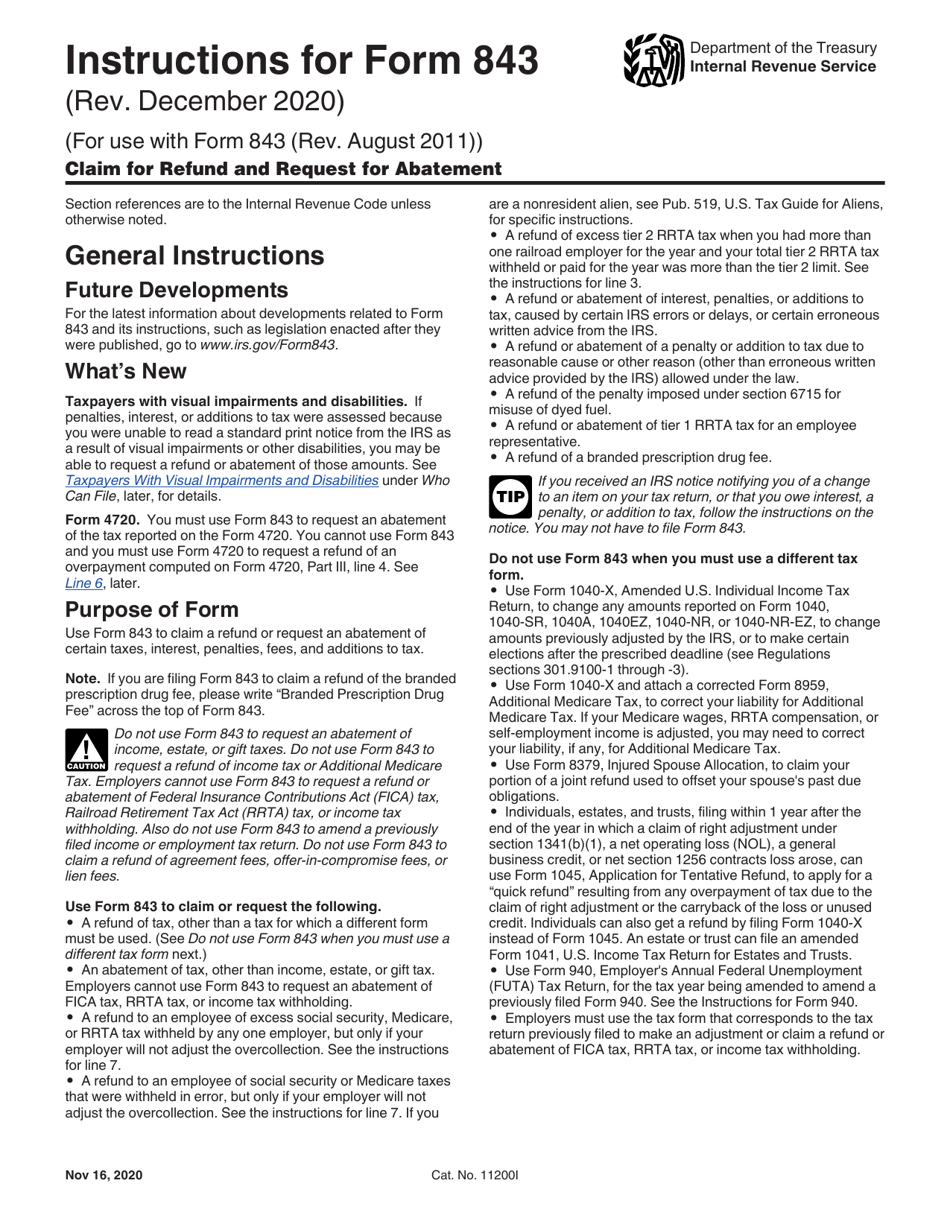

Instructions for IRS Form 843 Claim for Refund and Request for Abatement

This document contains official instructions for IRS Form 843 , Claim for Refund and Request for Abatement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 843 is available for download through this link.

FAQ

Q: What is IRS Form 843?

A: IRS Form 843 is a form used to claim a refund or request an abatement of certain taxes, penalties, and interest.

Q: When should I use IRS Form 843?

A: You should use Form 843 if you believe you have overpaid taxes, penalties, or interest or if you need to request a reduction or elimination of these amounts.

Q: What types of taxes can be claimed using Form 843?

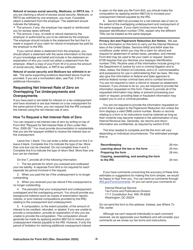

A: You can claim overpaid amounts of income tax, employment taxes, estate and gift taxes, excise taxes, and certain other taxes.

Q: How do I fill out Form 843?

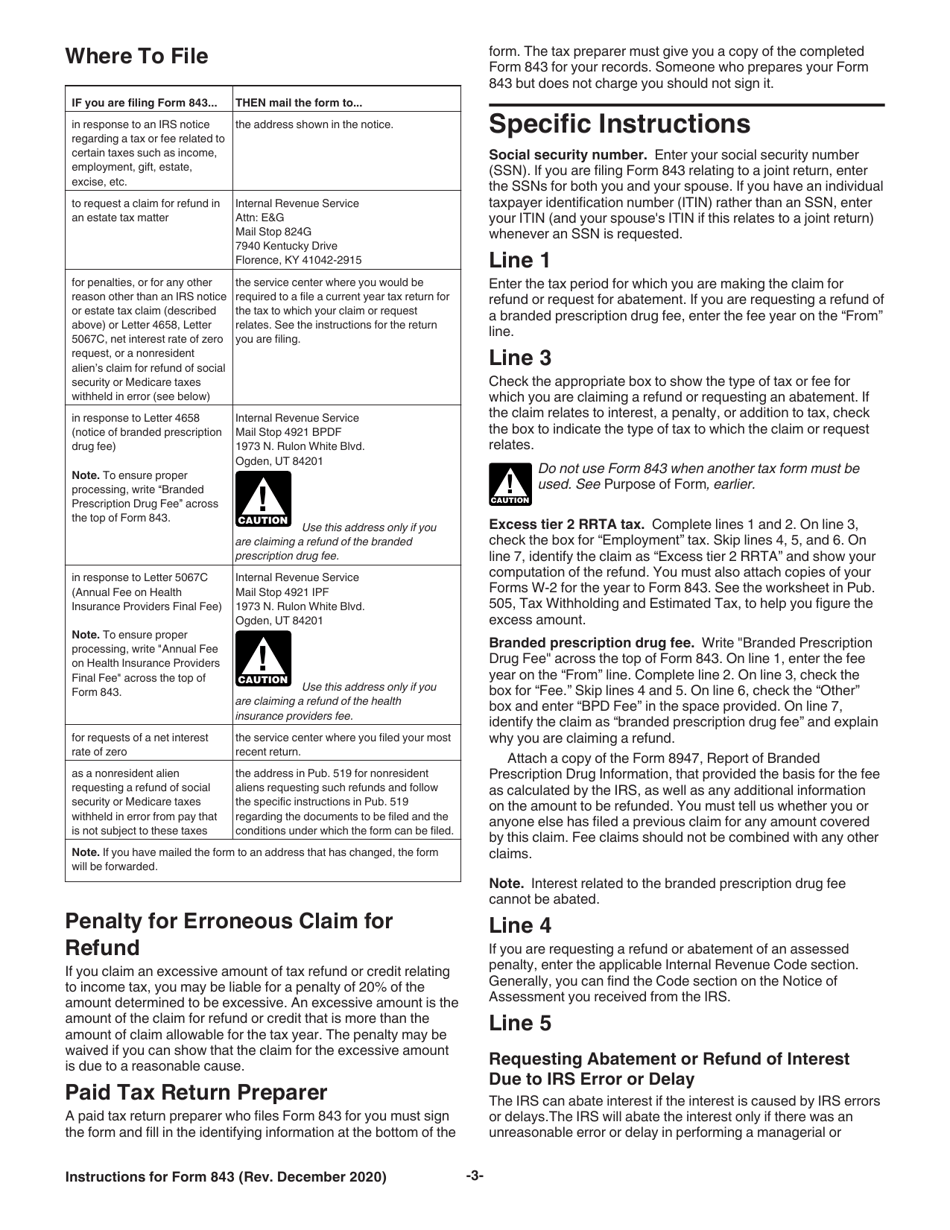

A: You need to provide your personal information, describe the tax, penalty, or interest you are claiming or requesting abatement for, and provide documentation supporting your claim.

Q: Is there a deadline for filing Form 843?

A: Yes, there is a deadline for filing Form 843. Generally, you must file the form within three years from the date you filed the original return or two years from the date you paid the tax, penalty, or interest, whichever is later.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.