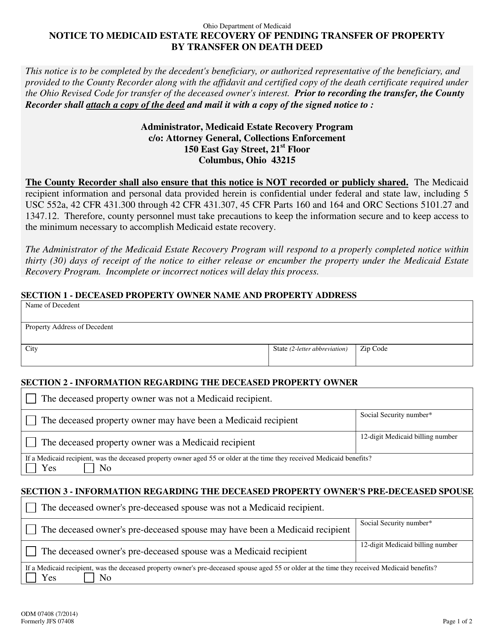

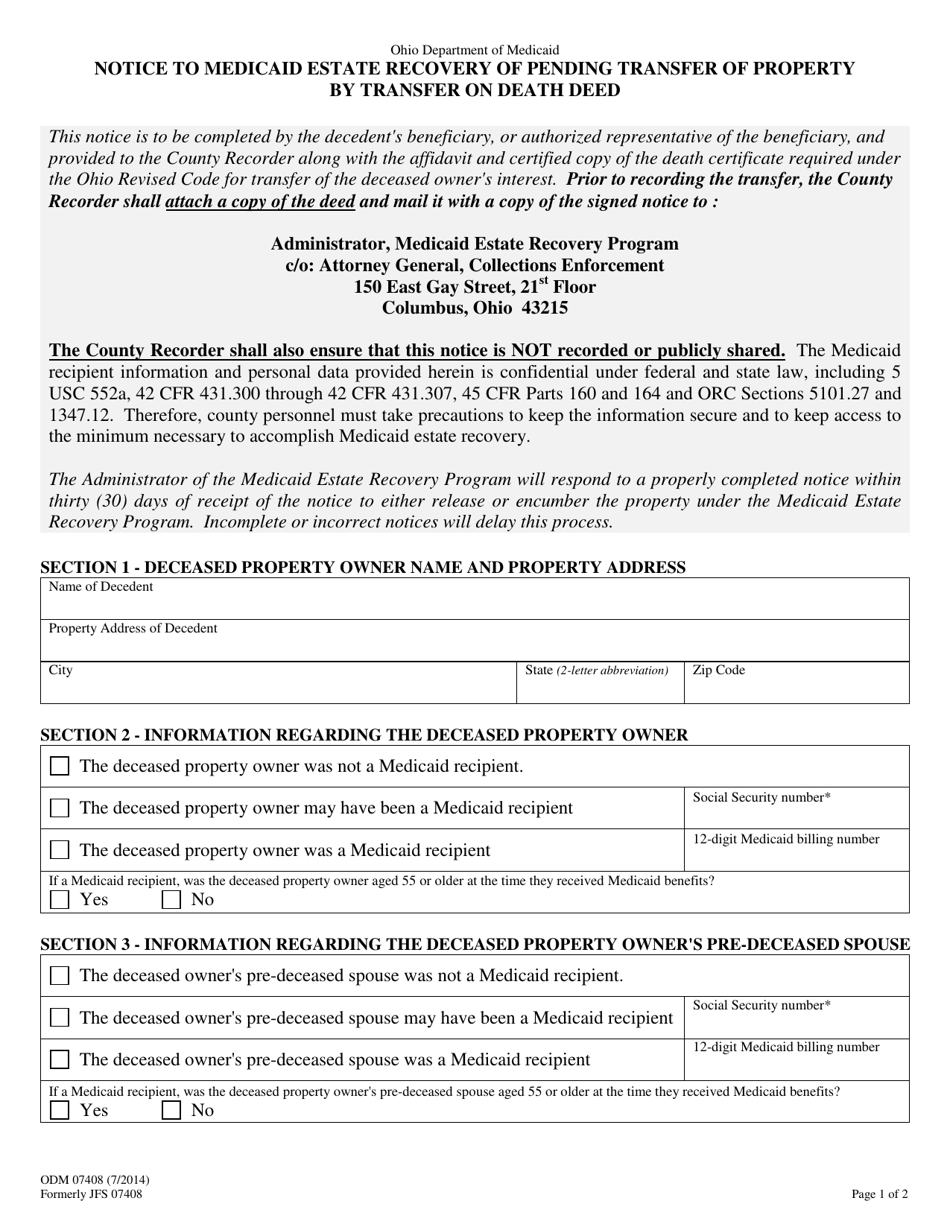

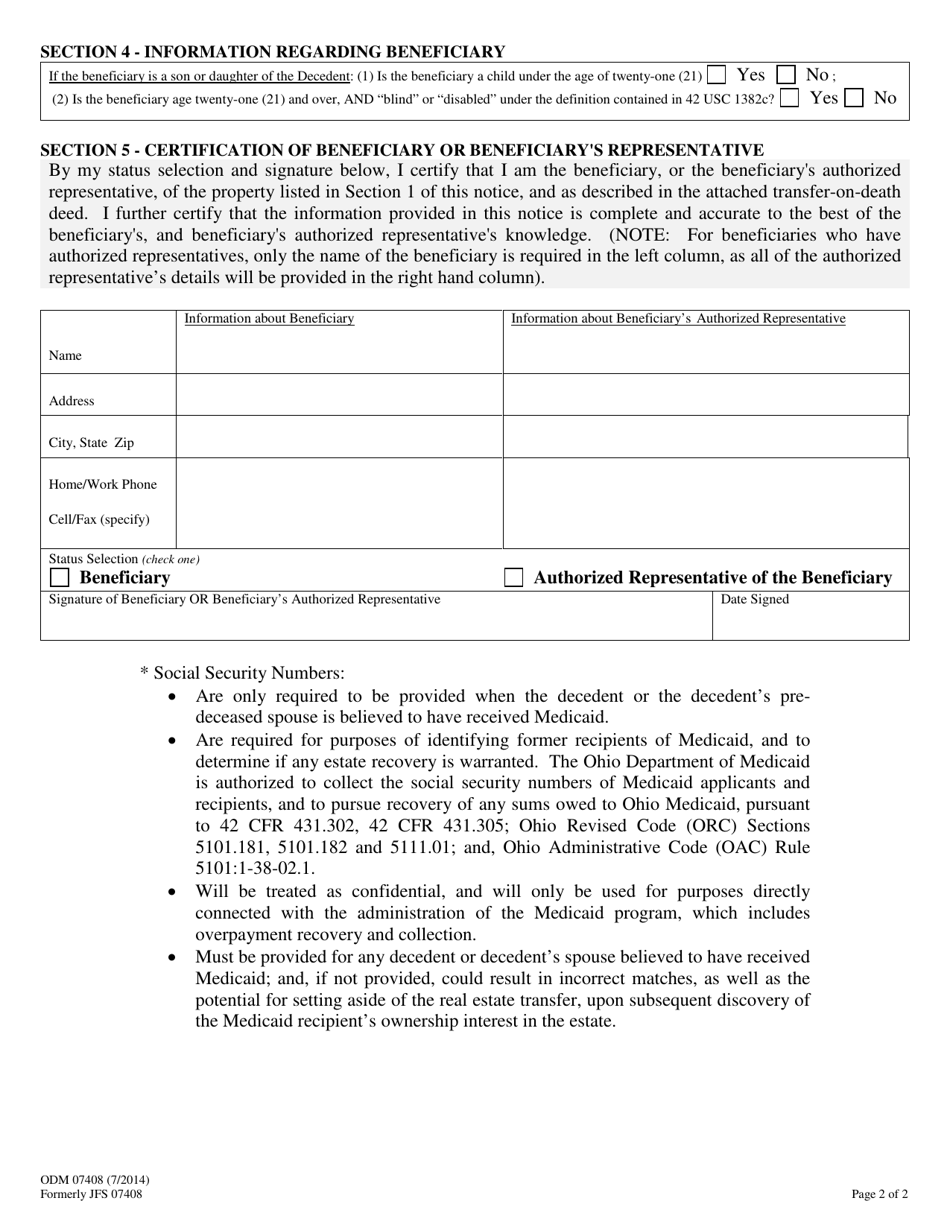

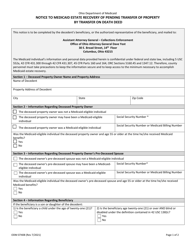

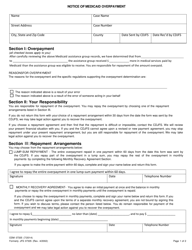

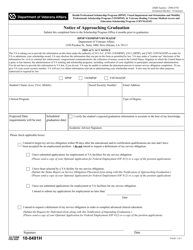

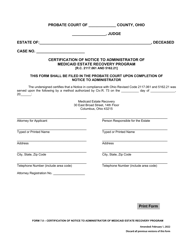

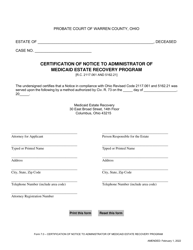

Form ODM07408 (JFS07408) Notice to Medicaid Estate Recovery of Pending Transfer of Property by Transfer on Death Deed - Ohio

What Is Form ODM07408 (JFS07408)?

This is a legal form that was released by the Ohio Department of Medicaid - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ODM07408 (JFS07408)?

A: Form ODM07408 (JFS07408) is a notice used in Ohio to inform Medicaid Estate Recovery of a pending transfer of property by Transfer on Death Deed.

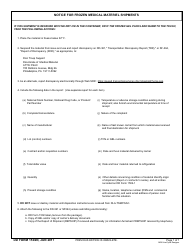

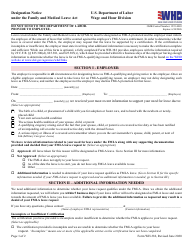

Q: What is Medicaid Estate Recovery?

A: Medicaid Estate Recovery is a program that recovers funds from the estates of deceased Medicaid recipients to reimburse for the costs of their Medicaid benefits.

Q: What is a Transfer on Death Deed?

A: A Transfer on Death Deed is a legal document used to transfer ownership of real property upon the death of the owner, without the need for probate.

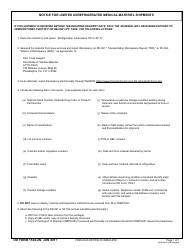

Q: Why would someone use a Transfer on Death Deed?

A: Someone may use a Transfer on Death Deed to ensure that their real property is transferred to a specific individual or individuals without the need for probate.

Q: When should Form ODM07408 (JFS07408) be used?

A: Form ODM07408 (JFS07408) should be used when there is a pending transfer of property by Transfer on Death Deed and the owner of the property was a Medicaid recipient.

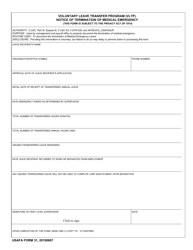

Q: What information is required on Form ODM07408 (JFS07408)?

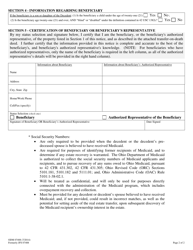

A: Form ODM07408 (JFS07408) requires information about the deceased Medicaid recipient, the property being transferred, and the person or entity receiving the property.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Ohio Department of Medicaid;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ODM07408 (JFS07408) by clicking the link below or browse more documents and templates provided by the Ohio Department of Medicaid.