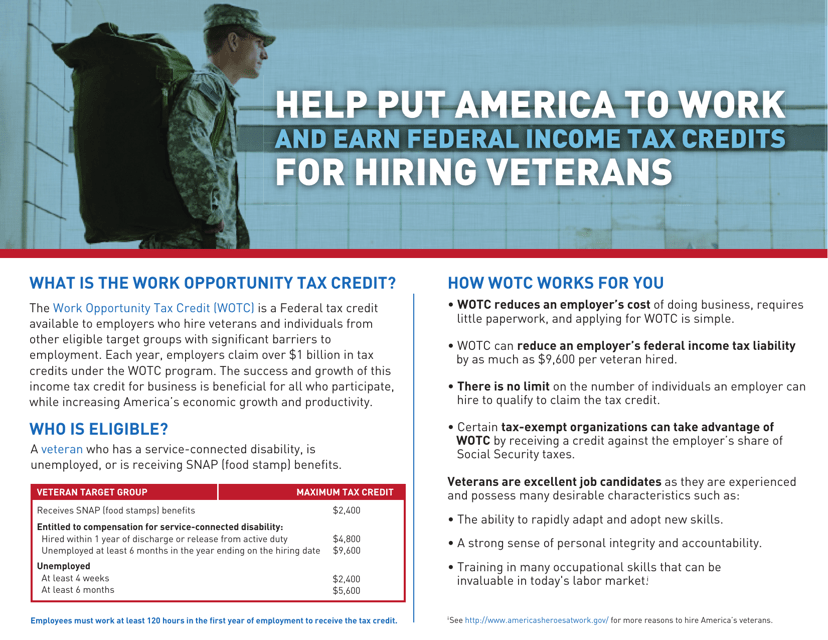

Help Put America to Work and Earn Federal Income Tax Credits for Hiring Veterans

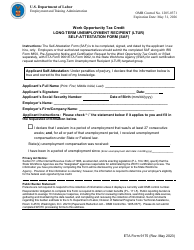

Help Put America to Work and Earn Federal Income Tax Credits for Hiring Veterans is a 2-page legal document that was released by the U.S. Department of Labor on April 1, 2013 and used nation-wide.

FAQ

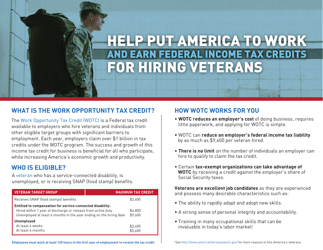

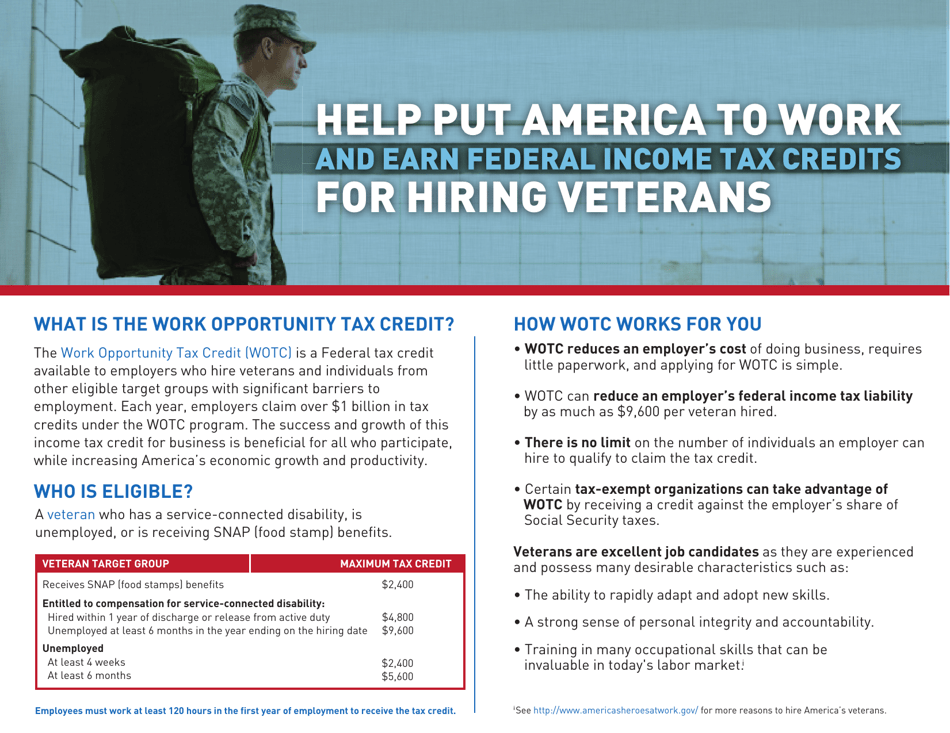

Q: What is the purpose of the program?

A: The program aims to help put America to work and provide federal incometax credits for hiring veterans.

Q: What is the benefit of hiring veterans under this program?

A: Employers can earn federal income tax credits by hiring veterans.

Q: Who qualifies as a veteran under this program?

A: Individuals who have served in the United States military and have been discharged or released under honorable conditions.

Q: How do employers earn federal income tax credits?

A: Employers earn federal income tax credits by hiring qualifying veterans.

Q: Are there specific criteria for employers to qualify for tax credits?

A: Yes, employers must meet certain criteria to qualify for tax credits.

Form Details:

- The latest edition currently provided by the U.S. Department of Labor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.