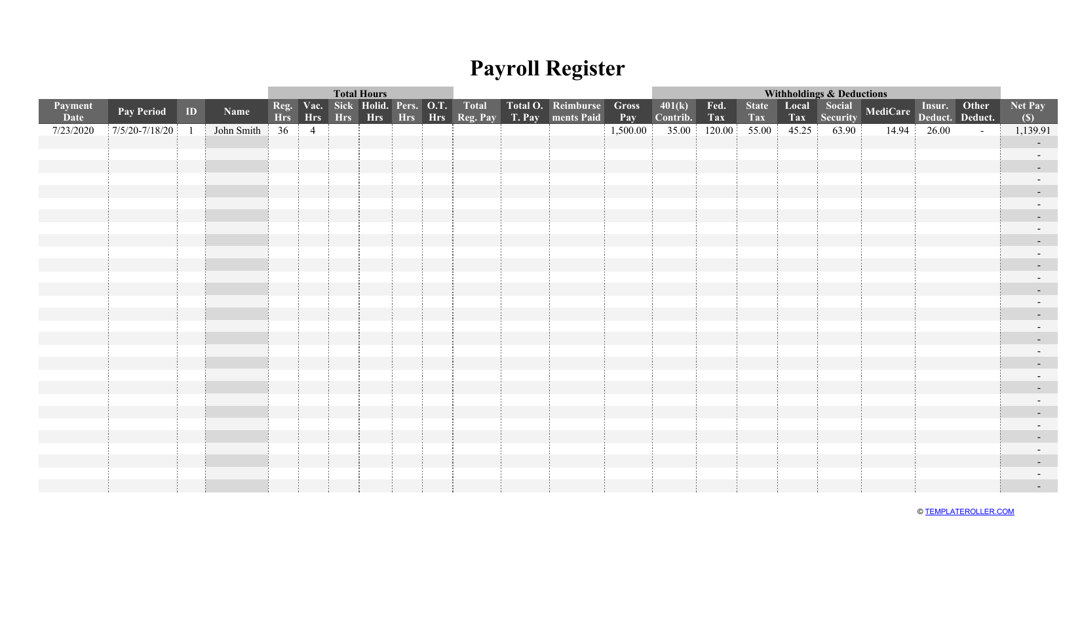

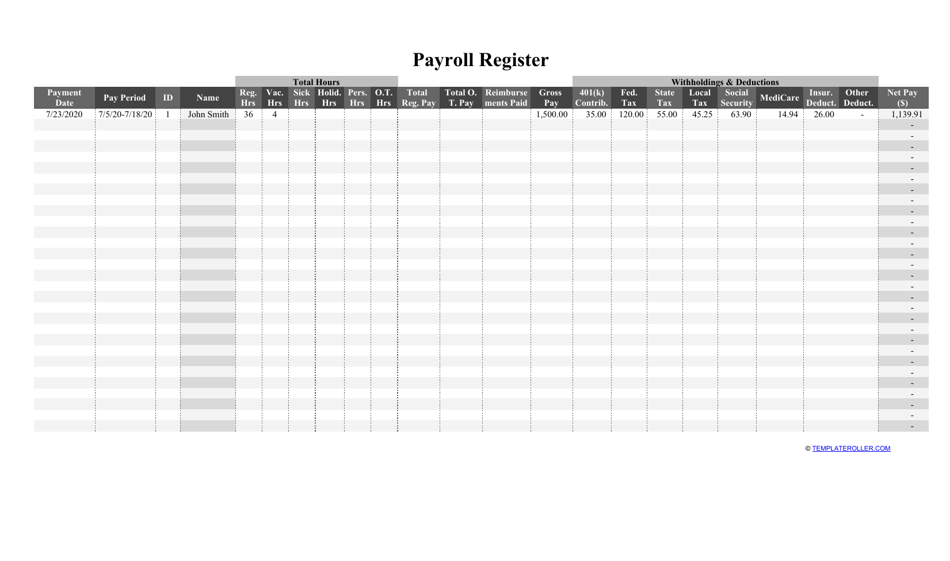

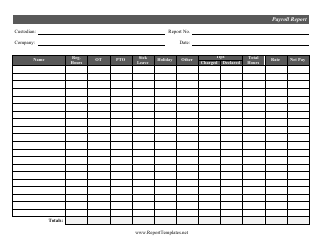

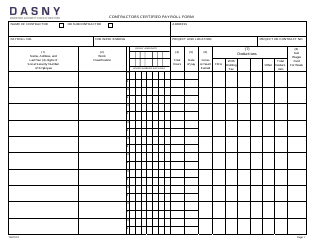

Payroll Register Template

What Is a Payroll Register?

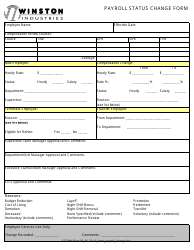

A Payroll Register is a document that must be completed by an accountant of an organization, and it describes the payroll information of employees. This document indicates the total gross pay of the worker, withholding and deduction amounts, and the net pay.

Alternate Name:

- Payroll Register Report.

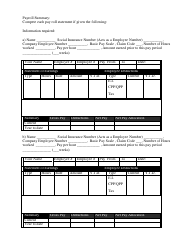

This report is usually represented as an electronic spreadsheet or online application, indicating the worker's payroll information for a certain period. Accountants also complete year-to-date totals based on worker's reports, which allows them to track gross wages and deductions throughout the year. A Payroll Register Report is necessary for creating payroll checks, filing the quarterly payroll tax reports with the Internal Revenue Service (IRS), providing annual wage and tax reports to the Social Security Administration (SSA), and transferring the payment of state and federal taxes.

A Payroll Register template available in Excel can be downloaded through the link below.

How to Do a Payroll Register?

A Register for Payroll must be filled in as follows:

-

The filer should enter the dates of the payment period.

-

Enter the name of the worker. Specify the total number of hours worked by this individual during this period.

-

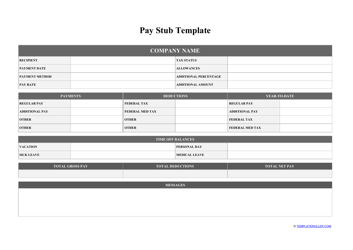

The filer should complete the following information about the earnings of the employee:

- Regular (enter the wages this person is entitled to regularly);

- Overtime (specify the sum of money that the worker has to obtain according to the total overtime hours worked during the payment period);

- Current gross (provide the current gross amount entitled to this person; gross income is the sum of money a worker earns before the withdrawal of taxes and deductions);

- YTD gross (enter the year-to-date income of this individual, which is the amount of gross income that the worker has obtained from the beginning of the year to the current payment date).

-

Indicate the acts the current gross is taxable for:

- Federal Unemployment Tax (FUTA) and State Unemployment Tax (SUTA) (according to FUTA and the SUTA laws, an entity is obliged to retain taxes intended for unemployment insurance and benefits);

- Federal Insurance Contributions Act (FICA) (according to the FICA, the entity is obliged to retain social security and Medicare taxes).

-

Specify the amount of withdrawal taxes and deductions:

- Indicate the amount of Federal income tax that an organization withholds from their current gross;

- Enter the amount of State and local income tax that the company withholds from the current gross;

- Old-Age Survivors and Disability Insurance (OASDI) and Medicare (indicate the amount of FICA taxes intended for Social Security or OASDI and hospital insurance for senior citizens and the disabled);

- Indicate the full deduction amount.

-

Indicate the payments due to the employee:

- The filer has to enter the net pay for this individual during the payroll period. For this purpose, subtract all of the indicated deductions from the current gross;

- Enter the payroll check number.

Still looking for a particular template? Take a look at the related template below: