Accounts Payable Template

What Is Accounts Payable?

Accounts Payable refers to a general ledger account that combines the current financial obligations of the company - debts the business owes to its partners, suppliers, and creditors. Its purpose is to provide administrative and financial support to the organization - accountants are able to finalize payments and monitor expenses by processing and reconciling multiple invoices. Use Accounts Payable to manage payments of your business efficiently since this accounting instrument deals with all monetary operations of the entity outside of payroll.

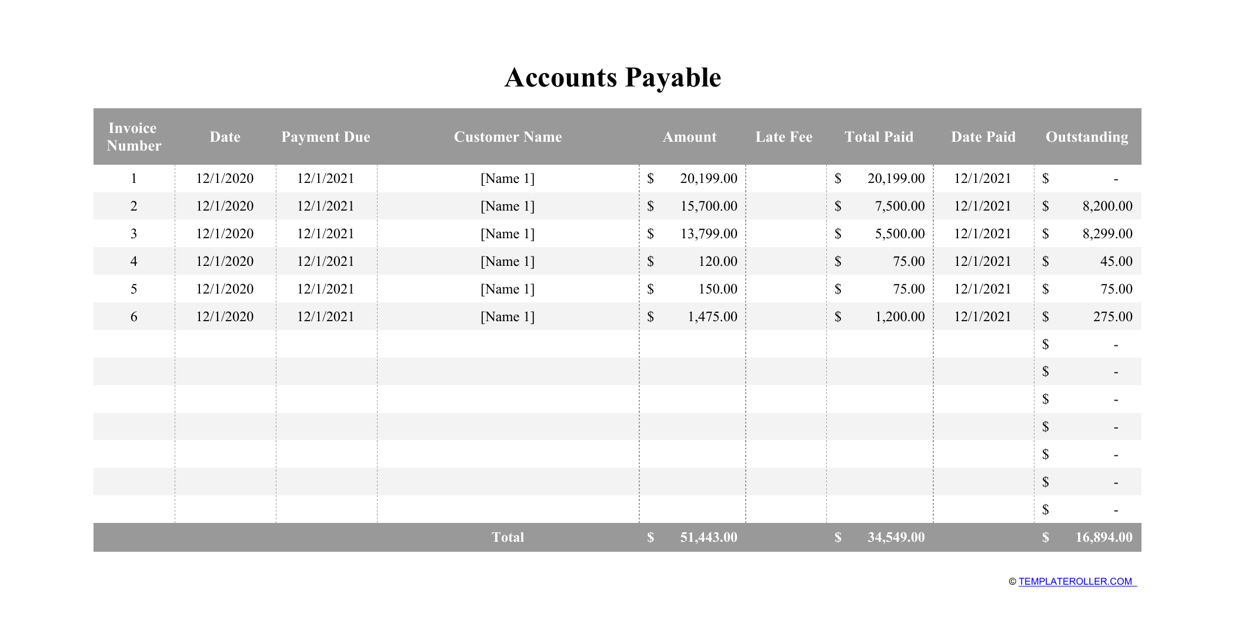

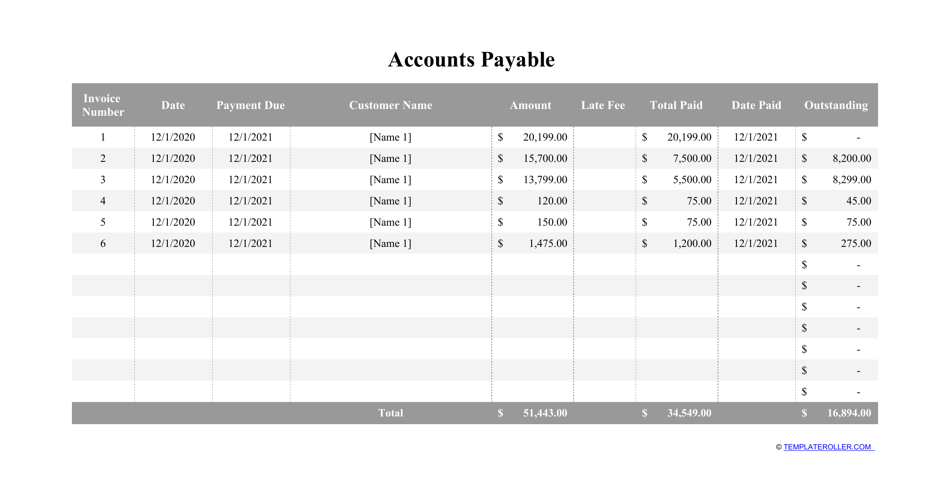

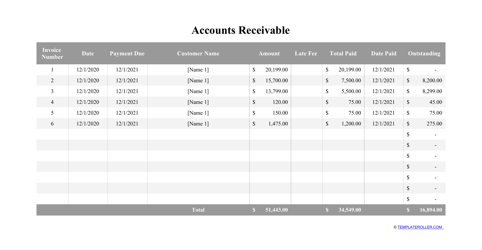

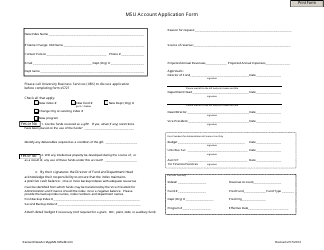

You can download an XLS Accounts Payable template through the link below. To handle future payments your company will receive from its customers and partners, you can use an Accounts Receivable template - another useful accounting tool that allows you to keep track of the money you collect days or weeks after you provide goods and services.

What Is the Difference Between Notes Payable and Accounts Payable?

Both Accounts Payable and Notes Payable refer to financial obligations any organization must manage to run their day-to-day business smoothly. These terms are often used interchangeably; however, there are major differences between them:

- "Accounts" always refer to short-term obligations, while "Notes" can mean both short-term and long-term obligations.

- You can convert Accounts Payable to Notes Payable - the latter represent written promises to pay a sum of money at a certain future date.

- Accounts Payable usually exist in the form of debts to suppliers and vendors - Notes Payable are due to various credit institutions.

- There can be no specific terms under Accounts Payable. Notes Payable always indicate payment conditions - interest rate, penalties for failure to pay, etc.

How to Do Accounts Payable?

Whether you have to pay external advisors, freelancers, or long-term vendors, it is important to keep track of payments and invoices due. Here is how you can handle your Accounts Payable without the assistance of an accounts payable specialist:

- Only pay invoices after making sure they are correct and legitimate. Confirm that they accurately reflect the order of the customer and make sure the other party received the goods indicated in the invoice.

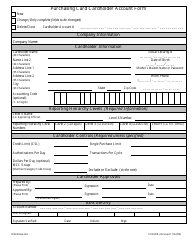

- Streamline the invoice payments. If they are all connected to the same banking account, it will be easier for you to see them all and not miss an important transaction.

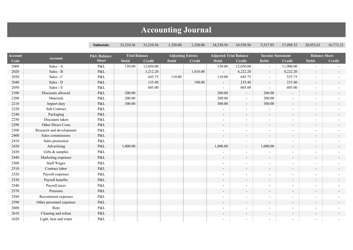

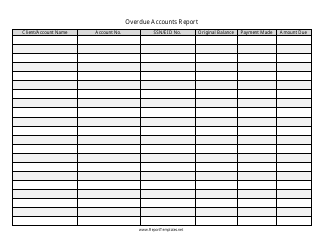

- Monitor every payment. Create an Accounts Payable journal entry as soon as you learn about the upcoming payment. You must know the exact amount of money you owe, the party you owe it to, and the due date of payment. Certain payments are recurring - you can set reminders so that you do not ever miss a weekly or monthly payment.

- Know who is in charge of payments. There must be a single individual who manages payments and signs off on all the operations. Once you know who is responsible for these financial matters, you will decrease the risk of unpaid invoices.

- Reconcile all the total amount of Accounts Payable. You can mark or tag paid invoices with letters or stickers if you have printed records to be able to see quickly which payments are still due.

- Be on good terms with clients and companies you owe money - cultivate rapport with vendors, suppliers, and customers who may forgive you for late payments or give you discounts.

Traditionally, a business hires or appoints an accounts payable clerk - an employee responsible for compiling and maintaining records. Additionally, this staff member verifies expense reports, schedules and prepares paychecks for all salaried employees, analyzes Accounts Payable in order to compose weekly or monthly reports for the business owner, and improves the payment process.

What Happens When Accounts Payable Increases?

If you notice an increase in the Accounts Payable normal balance, that means your business purchases more goods and services on credit with an intention to pay later and possibly in installments instead of dealing with payments promptly with cash or online money transfer. It is a common issue that often occurs when you buy new equipment or inventory or make an expensive purchase - this new entry is added to existing liabilities in your records but you forget to save an invoice or choose to postpone the payment.

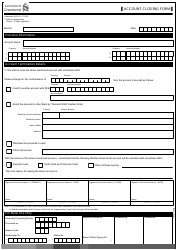

You have to manage your cash flow from operating activities better, pay all outstanding debts, and avoid new purchases on credit. To decrease Accounts Payable, you also can create digital invoices to document all operations and only make electronic payments instead of issuing traditional checks or dealing with cash.

Related Templates and Topics: